Self Employed Ei Canada, The Case For Progressive Employment Insurance Reform Broadbent Institute

Self employed ei canada Indeed lately has been sought by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of this article I will talk about about Self Employed Ei Canada.

- How To Use A My Service Canada Account And Report Ei Online 2020 Personal Finance Freedom

- Do I Qualify For The Canada Emergency Response Benefit Ei Exceedia

- How To Use A My Service Canada Account And Report Ei Online 2020 Personal Finance Freedom

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse

- Employment And Social Development Canada On Twitter If You Are Already Receiving Ei Regular Or Ei Sickness Benefits You Don T Need To Apply Or Re Apply To Receive The Canada Emergency Benefit Https T Co H4cq3mdg5z

- On Cerb And Concerned About The Move To Ei Next Month Here S What We Know So Far The Star

Find, Read, And Discover Self Employed Ei Canada, Such Us:

- The Case For Progressive Employment Insurance Reform Broadbent Institute

- Cerb Is Transitioning To Ei What Does That Mean Cbc News

- How To Use A My Service Canada Account And Report Ei Online 2020 Personal Finance Freedom

- What Is A Record Of Employment Ontario Employment Law

- Employment Insurance Monitoring And Assessment Report For The Fiscal Year Beginning April 1 2017 And Ending March 31 2018 Chapter 2 2 Employment Insurance Regular Benefits Canada Ca

If you are looking for What Is Furlough Cash you've reached the perfect location. We ve got 104 graphics about what is furlough cash including images, pictures, photos, wallpapers, and much more. In these page, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

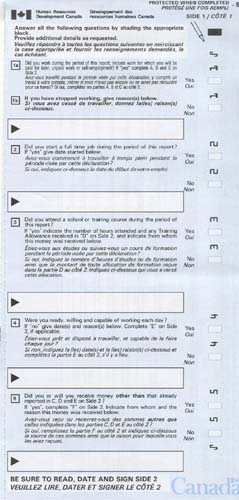

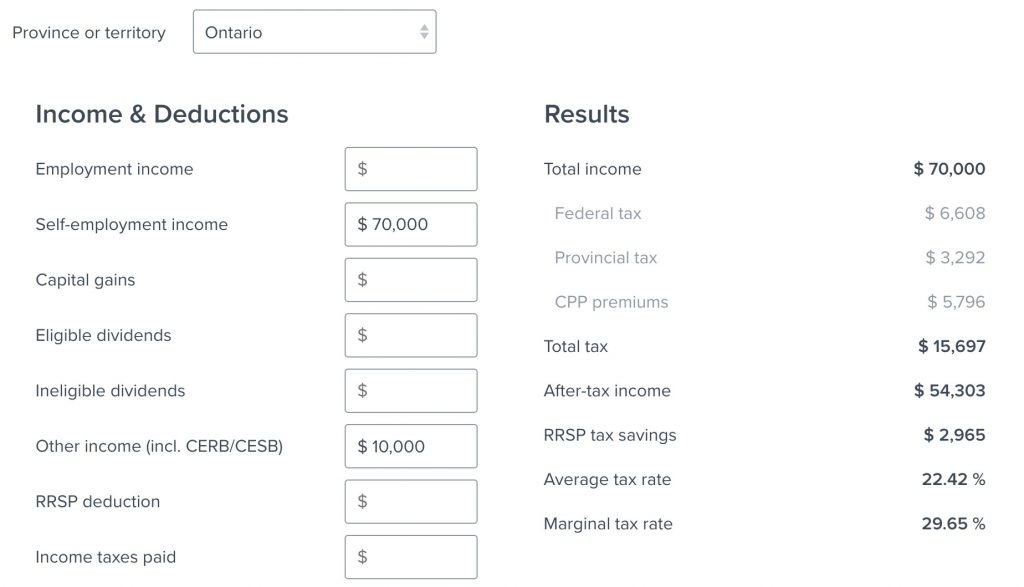

Ei premiums are paid when the self employed worker files their annual income tax and benefit return using schedule 13 employment insurance premiums on self employment and other eligible earnings.

What is furlough cash. When self employed persons opt into the ei program to access ei special benefits they pay the same ei premium rate as employees pay. On the main page in msca. By taking part in this ei program you are registering with the canada employment insurance commission and agreeing to pay premiums on your self employed income.

While this ei measure extends certain ei benefits to self employed individuals enrollment is completely voluntary. For extended parental benefits the minimum weekly amount youll receive is 300 before. Request a personal access code online or at a service canada centre.

If you choose to cancel your registration within those first 60 days you will not have to pay any premiums. Click the apply for tab. Follow the steps to enter into an agreement with the ei commission.

As of september 27 2020 there are some temporary changes to the ei program to help you access ei self employment benefits. Canada recovery sickness benefit. Here are a few instances when ei can help you with income replacement.

Employment insurance ei has a program designed for self employed people. The minimum weekly amount youll receive is 500 before taxes. Benefits for the self employed.

Register and apply for special benefits if you are self employed. Injury or illness precluding you from work. Apply for benefits if you are a self employed fisher who is actively seeking work.

The canada recovery benefit crb is for self employed workers and those who still need support. If youre self employed you can still access ei special benefits. Create an account using a sign in partner gckey or myalberta digital id.

The following changes will be in effect for 1 year and could apply to you. They will receive 500 per week for 26 weeks. If you work or live outside of canada get information on employment insurance pensions benefits and taxes.

As a self employed canadian or permanent resident you can have access to ei special benefits if you register with the canada employment insurance commission. Register for the self employed program. If you are not sure of your status as a self employed person or if you need more information you should contact your service canada centre or the cra.

Employment insurance reflects the respect for workers that is woven into canadas social fabric. Click register for ei for the self employed. If you run your own business or control more than 40 of your corporations voting shares this program can provide you with access to special benefits as early as 12 months after registering.

The benefit is for those who havent returned to work due to covid 19 or have had their income drop by at least 50 per cent. Ei for self employed in particular is an essential safety net to protect one from income fluctuations and unexpected events. Benefits for canadians living abroad.

More From What Is Furlough Cash

- Government Policy Development Process

- Us Government Expenditures Pie Chart

- Government Expenditure Definition Pdf

- Furlough Extension End Of June

- Self Employed Universal Credit Forum

Incoming Search Terms:

- A Guide To The New Ei And The Government S Three New Benefits For Workers Kamloops This Week Self Employed Universal Credit Forum,

- Self Employed You Can Still Get Access To Some Employment Insurance Ei Benefits Cpa Edmonton Com Dt Accounting Tax Services Chartered Professional Accountant Self Employed Universal Credit Forum,

- Is This The End Of Canada S Employment Insurance System As We Know It Ipolitics Self Employed Universal Credit Forum,

- How To Apply For Ei And Covid 19 Emergency Benefits Cbc News Self Employed Universal Credit Forum,

- Ottawa Receives 500 000 New Applications For Employment Insurance As Coronavirus Related Layoffs Increase The Globe And Mail Self Employed Universal Credit Forum,

- Covid 19 Employment Insurance And Benefits Gowling Wlg Self Employed Universal Credit Forum,