Self Employed Furlough Application Form, Ivislx9qp5bxom

Self employed furlough application form Indeed lately is being sought by consumers around us, maybe one of you personally. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of this post I will discuss about Self Employed Furlough Application Form.

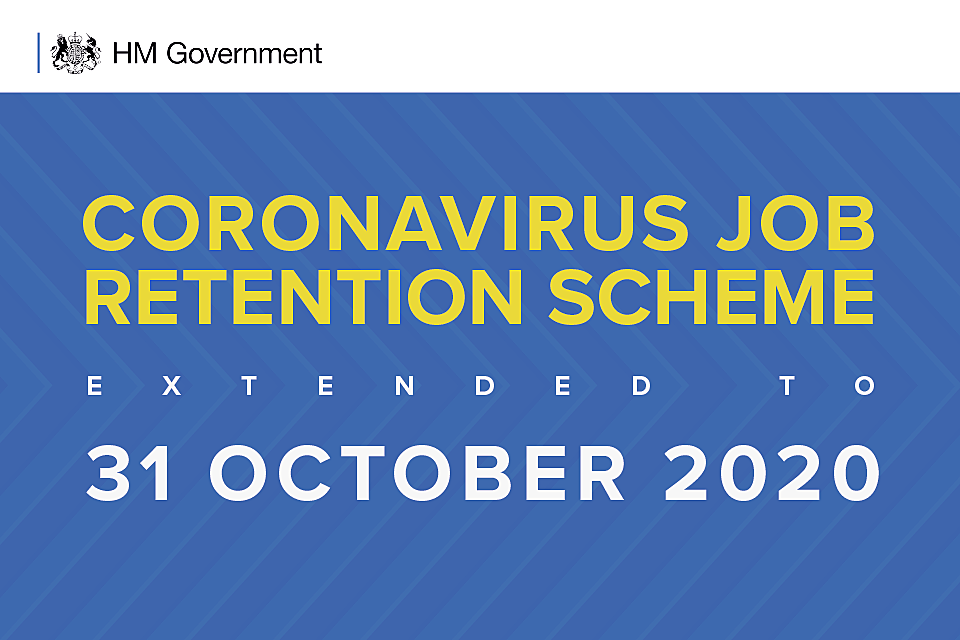

- Furlough And Self Employment Support Scheme Extended Until End Of March 2021

- Coronavirus Job Support Scheme The Details And What It Might Mean For Employers

- Furloughed Employees To Receive Full Redundancy As New Law Comes Into Force Thiis Magazine

- The Self Employment Support Scheme Will Be Extended Price Bailey

- Coronavirus Self Employed Grant Scheme Sees Big Rush Bbc News

- Coronavirus Help For Businesses And Self Employed Kirklees Council

Find, Read, And Discover Self Employed Furlough Application Form, Such Us:

- Coronavirus Covid 19 Practical Steps For Employers How To Claim Furlough Leave In Job Retention Scheme Uk Gov Lawson West Solicitors In Leicester

- West Lothian Council Coronavirus Financial Advice And Support

- Coronavirus Self Employment Income Support Scheme What You Need To Know Sage Advice United Kingdom

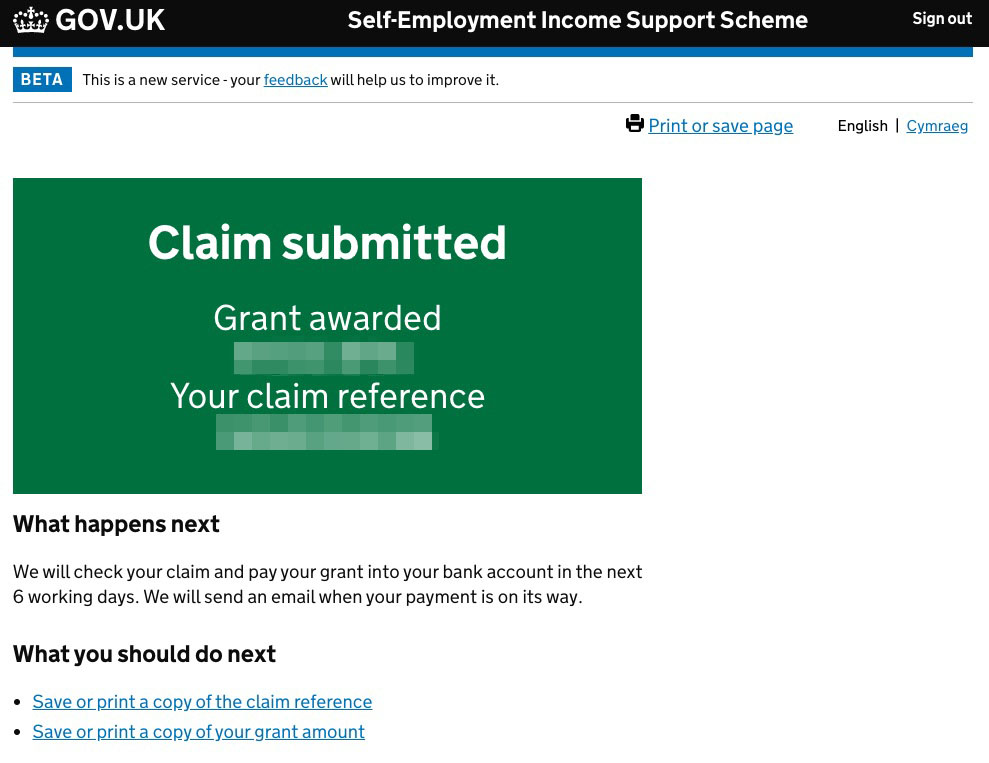

- How To Submit A Self Employment Income Support Scheme Seiss Claim

- What The August Furlough And Self Employed Grant Changes Mean For You Your Money

If you are looking for Self Employed Vs Entrepreneur you've arrived at the right place. We ve got 100 graphics about self employed vs entrepreneur including images, photos, pictures, wallpapers, and more. In these page, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Coronavirus Self Employment Income Support Scheme What You Need To Know Sage Advice United Kingdom Self Employed Vs Entrepreneur

Read on for more about your rights as a self employed person and what supports out there including help for limited company.

Self employed vs entrepreneur. Claim to reduce payments on account sa303 30 november 2015 form keeping records for your tax. A self employed individual or member of a partnership can claim and if they have. Intend to continue trading in the tax year 2020 to 2021.

Halifax has said self employed applications may be referred to underwriters for review. Heres how you can apply and claim payment from hmrc. Furlough applications can now be made to hmrc under the coronavirus job retention scheme.

The self employment income support scheme claim service is now open. Information about what to do if you were not eligible for the grant or have been overpaid has been added. A new scheme the covid 19 part time job incentive for the self employed is a further support available to self employed people who are in receipt of the covid 19 pandemic unemployment payment or a jobseekers payment and are resuming self employment part time.

Claim for some of your employees wages if you have put them on furlough or flexible furlough because of coronavirus covid 19. The first two are now closed and while the third covers november to january applications are not yet open. The lender will be looking for evidence of the long term history and stability of the business within the sector as well as funds to meet commitments and the likelihood of returning to normal profitability and trading in the future.

Meanwhile the self employed will get a grant worth 80 of past profits but only for the month of november. Furlough in more or less its original form has been extended until the lockdown ends. Claim for wages through the coronavirus job retention scheme govuk.

Traded in the tax year 2018 to 2019 and submitted a self assessment tax return on or before 23 april 2020 for that year.

More From Self Employed Vs Entrepreneur

- Government Contractor Jobs Entry Level

- Self Employed Furlough Scheme Rules

- Government Shutdown 2019 Reason

- Government Gateway Login Pension

- 2021 Calendar With Government Holidays India

Incoming Search Terms:

- Coronavirus Self Employed Scheme Get The Details Right Accountingweb 2021 Calendar With Government Holidays India,

- Second Self Employed Grant When And How To Claim Next Payment Under Hmrc Support Scheme And Who Is Eligible For Seiss 2021 Calendar With Government Holidays India,

- Kllsf53i7ni2fm 2021 Calendar With Government Holidays India,

- How To Claim The Self Employment Grant Patterson Hall Chartered Accountants 2021 Calendar With Government Holidays India,

- Self Employed Get Second Grant From Government Pma Accountants 2021 Calendar With Government Holidays India,

- Hmrc Emails 24 000 Self Employed In Covid Support Probe Ftadviser Com 2021 Calendar With Government Holidays India,