Self Employed Furlough August Payment, The Coronavirus Job Retention Scheme Qandas For Employers Ashurst

Self employed furlough august payment Indeed recently is being hunted by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the title of the post I will talk about about Self Employed Furlough August Payment.

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- Furlough Scheme Changes Firms Must Start Paying In August Stump Up 20 In October

- Uk Coronavirus Businesses Must Pay Part Of Furlough Costs From August As It Happened Uk News The Guardian

- Furlough Timeline Explained What You Need To Know Gc Business Growth Hub

- Coronavirus Job Retention Scheme How To Furlough Workers The Legal Partners

- More Than One In Four Uk Workers Now Furloughed Bbc News

Find, Read, And Discover Self Employed Furlough August Payment, Such Us:

- Your Income And Coronavirus Covid 19 Policy In Practice

- Number Of Furloughed Workers Stands At 9 6 Million Your Money

- Support For Self Employed Extended And Furlough Scheme Changes Confirmed Your Money

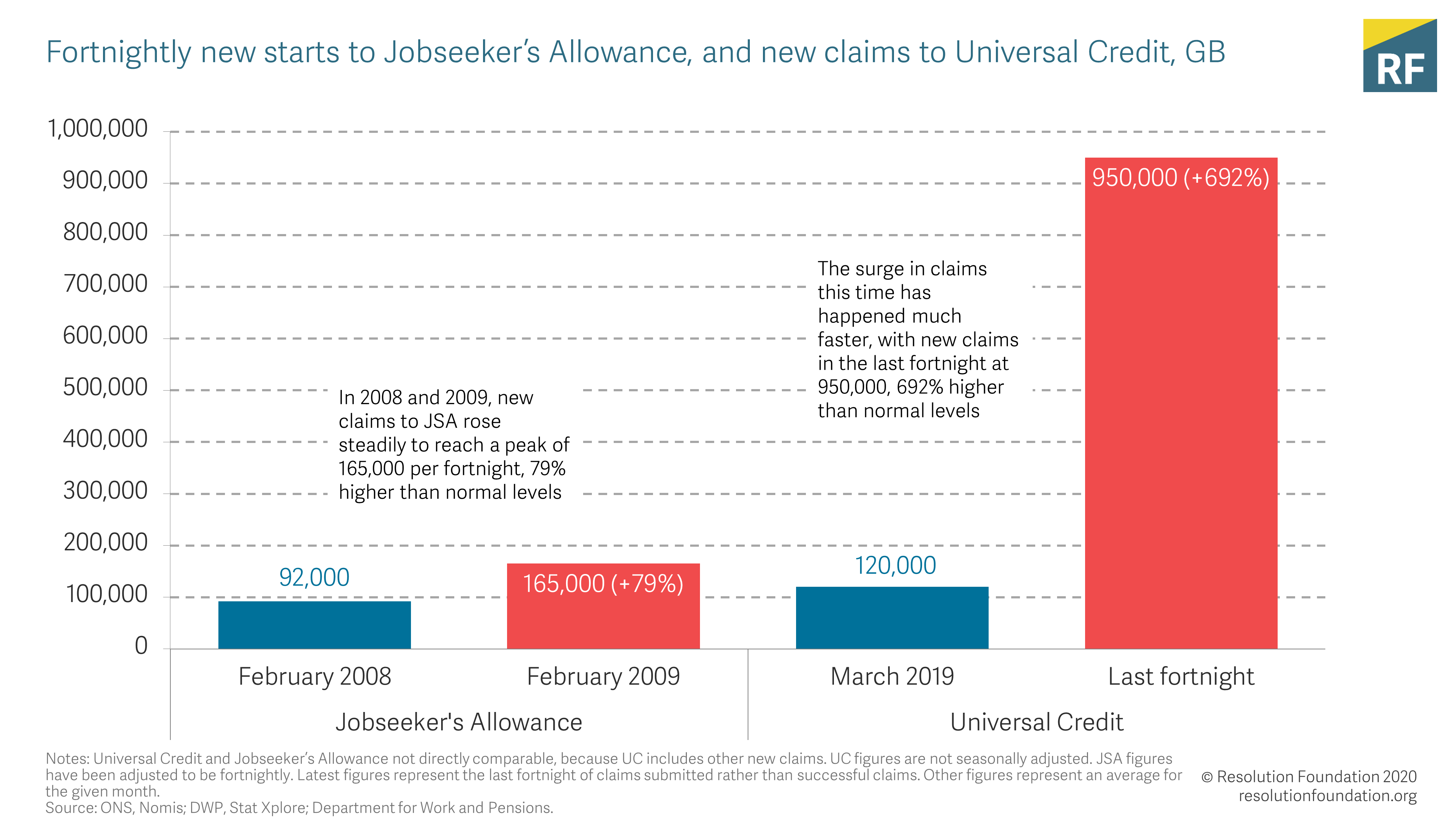

- No Work No Pay Resolution Foundation

- Coronavirus Businesses Must Pay Towards Furlough Scheme From August Chancellor Announces Business News Sky News

If you re searching for Government Gateway User Id Meaning you've reached the right place. We ve got 100 images about government gateway user id meaning including images, photos, pictures, wallpapers, and more. In these webpage, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Last month it was confirmed that self employed workers whose businesses have been negatively hit by coronavirus would be able to claim a second and final grant in august.

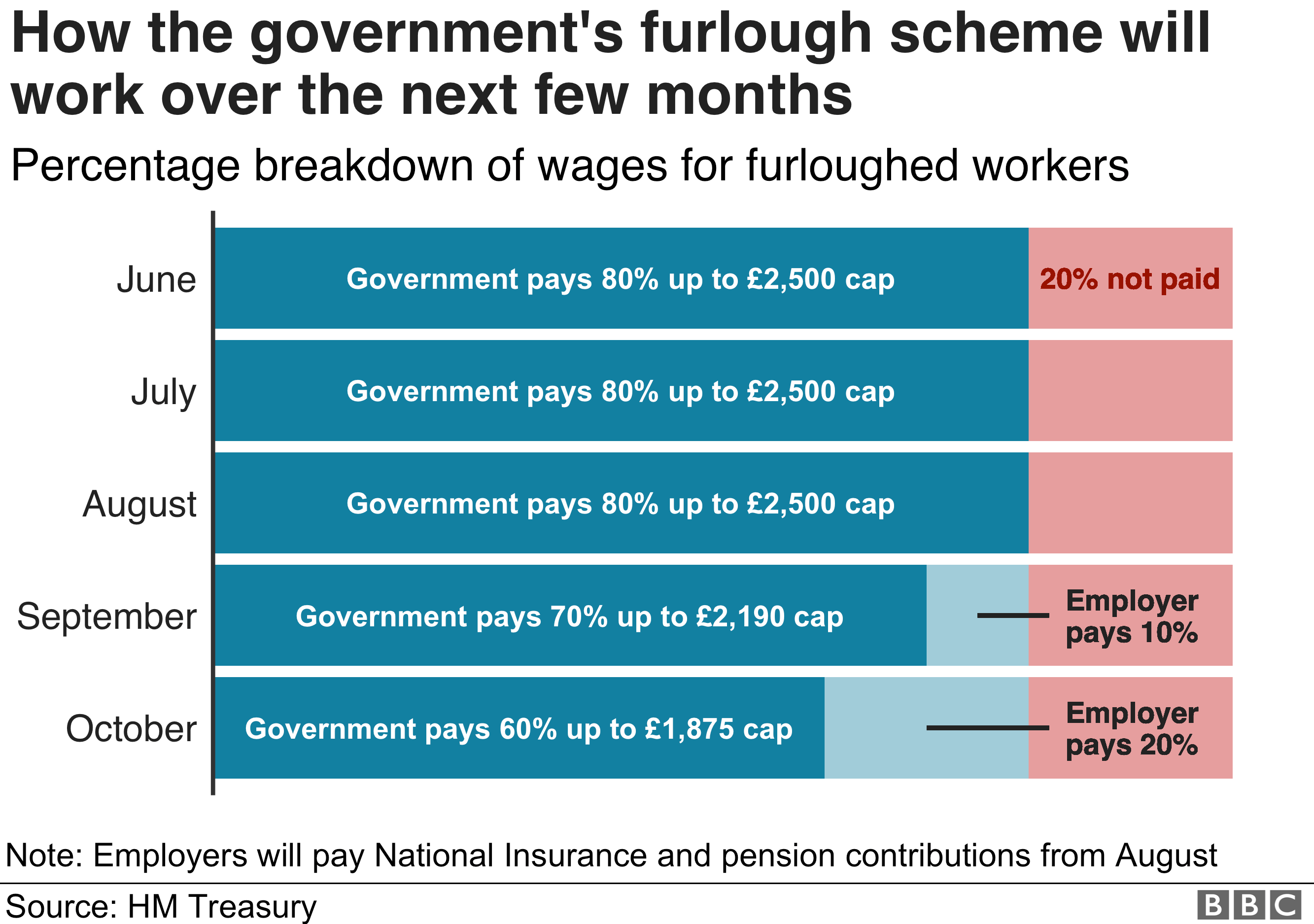

Government gateway user id meaning. In august the employer will have to pay the employers ni and pension contributions but will still be able to receive 80 of the employees pay to a maximum of 2500 per month so no contribution to their actual wages is needed. Furlough pay is based on what was earned during the last paid period before 19 march 2020. What the august furlough and self employed grant changes mean for you.

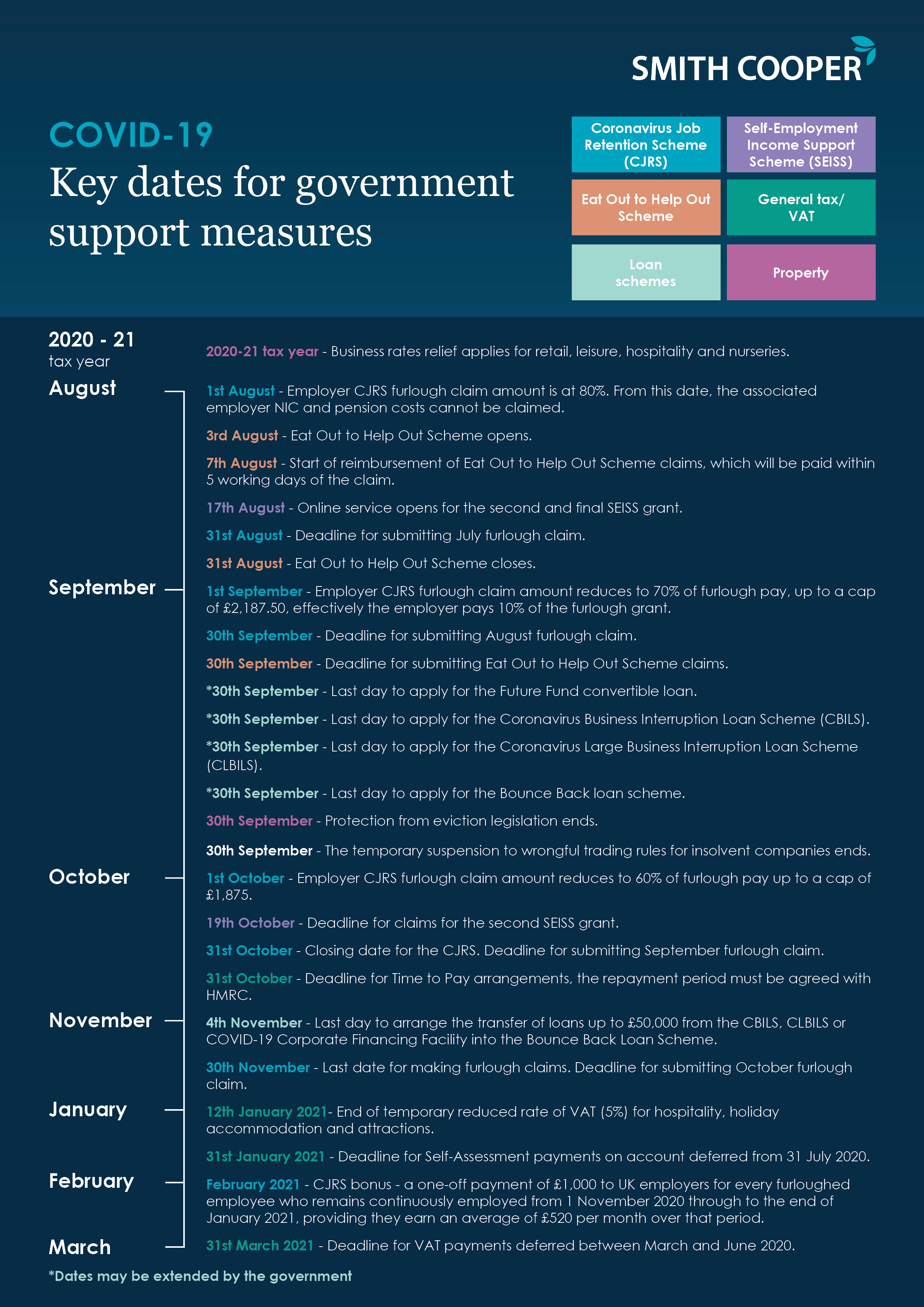

Those eligible under the self employment income support scheme seiss which has so far seen 23 million claims worth 68 billion will be able to claim a second and final grant in august. From august employers had to pay employers national insurance contributions and pension contributions for furloughed workers with the government continuing to pay 80 of the employees salaries. Tax help for self employed and businesses.

Businesses will start picking up the furlough bill in august when they have to pay national insurance ni and pension contributions. These workers can apply for the first grant 80 of average monthly profits up to 2500 a month for three months until 13 july. Mr sunak later announced self employed people will be able to claim for a second and final grant from august.

The self employed and others who do self assessment tax returns had already been given more time to pay on account taxes due with those struggling to pay their 31 july 2020 on account payment able to defer this until 31 january 2021. The grant paid in a lump sum in june covering march april and may was capped at 2500 a month or 7500 in total. August the government will pay 80 of wages up to a cap of 2500.

The scheme has been extended to accept applications for the second grant until october. The money will again be paid out in a single instalment covering june july and august. The last opportunity to furlough new employees is 10 june three weeks before the scheme closes to new entrants on 30 june.

Those eligible for the self employment income support scheme seiss will be able to claim the additional grant in august which will be worth up to 70 of their average monthly trading profits though its capped at 6570 overall.

More From Government Gateway User Id Meaning

- Self Employed Job Support Scheme Wales

- Self Employed Working From Home Business Rates

- Government Housing

- Furlough Rules England

- Self Employed Or Employed Hmrc

Incoming Search Terms:

- Coronavirus Job Retention Scheme How To Furlough Workers The Legal Partners Self Employed Or Employed Hmrc,

- Architects Warned Over Misuse Of Covid 19 Furlough And Income Support Schemes Self Employed Or Employed Hmrc,

- Y S6hendcie7gm Self Employed Or Employed Hmrc,

- The Government Is Not Paying Nine Million People S Wages Resolution Foundation Self Employed Or Employed Hmrc,

- How Long Will Self Employed Support Be Extended For Self Employed Or Employed Hmrc,

- Sick Pay And Debt Tuc Self Employed Or Employed Hmrc,