Self Employed Income Tax Calculator Nz, Your Bullsh T Free Guide To New Zealand Tax For Working Holidaymakers

Self employed income tax calculator nz Indeed lately is being sought by consumers around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this article I will talk about about Self Employed Income Tax Calculator Nz.

- Calculating Your Levies

- Ka 03867 Customer Self Service

- Your Bullsh T Free Guide To New Zealand Tax For Working Holidaymakers

- How Taxes Work When You Re Working Abroad Go Overseas

- Switching To Self Employed There S Lots To Consider Sorted

- Paying Personal Income Tax In Indonesia Gapura Bali

Find, Read, And Discover Self Employed Income Tax Calculator Nz, Such Us:

- Employment Exchange Online Registration Up Employment Yojana Magazine Nc Employment Security Commissi Snapchat Hacks Snapchat Marketing Snapchat Questions

- Self Employed Income Tax Calculator 2020 21 Transferwise

- National S 16 Month Income Tax Cut Could Do More To Boost High Income Earners Bank Balances Than Get People Out Spending Jenee Tibshraeny Suggests Interest Co Nz

- Your Bullsh T Free Guide To New Zealand Tax For Working Holidaymakers

- Taxation Our World In Data

If you are looking for Government Budget 2020 India you've reached the perfect location. We ve got 103 images about government budget 2020 india including images, photos, pictures, backgrounds, and much more. In such web page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Top calculators and tools.

Government budget 2020 india. Other income is not taxed before you get paid. The calculator uses tax information from the tax year 2020 2021 to show you take home pay. Self employment includes contracting working as a sole trader and small business owners.

S there are count results there are count results. Income tax take moni whiwhi mo nga pakihi. Business and organisations nga pakihi me nga whakahaere.

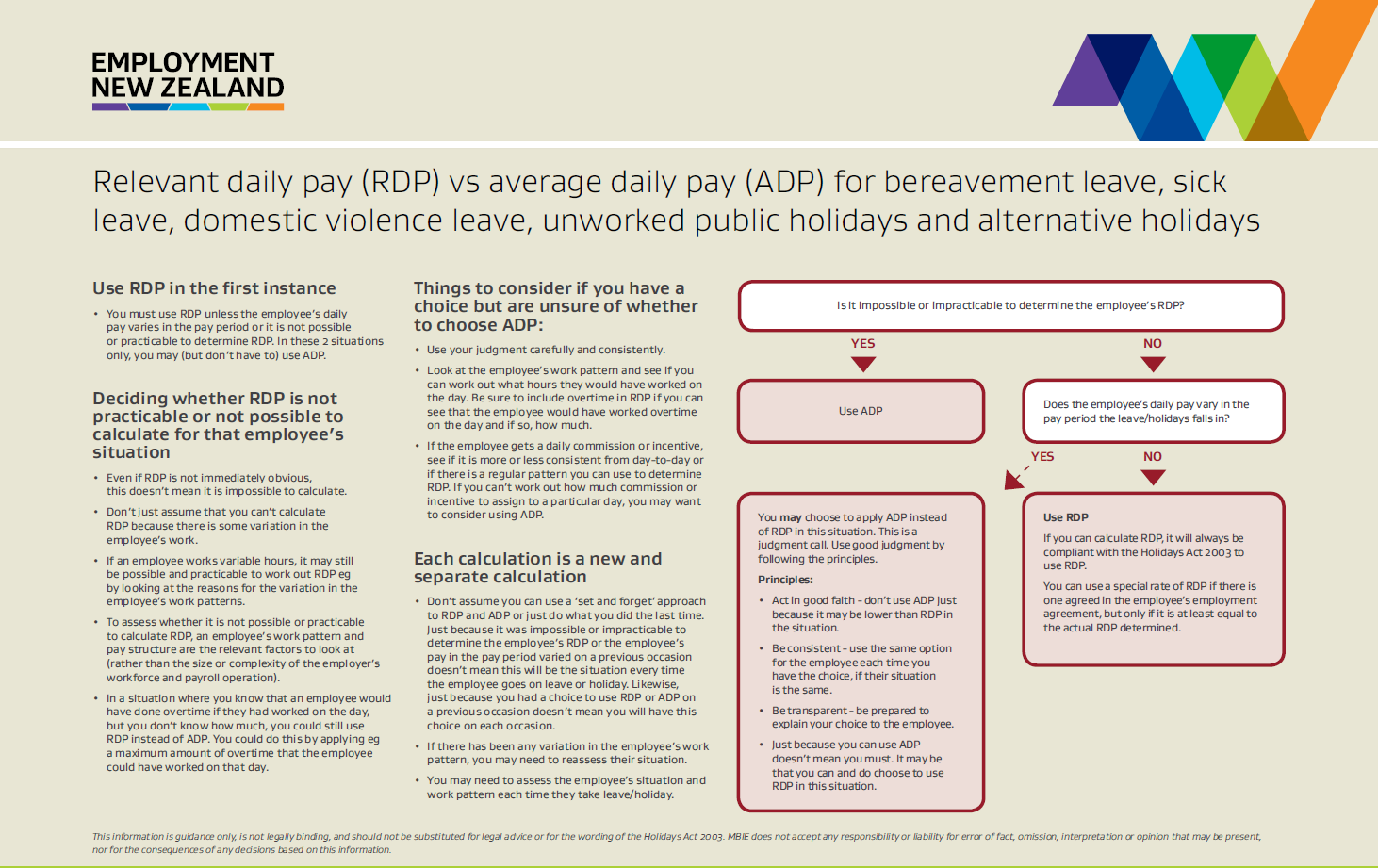

If youre self employed you use your individual ird number to pay tax. Calculate employee actual hourly cost. New zealand has progressive or gradual tax rates.

If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability. Property tax decision tool. You pay tax on this income at the end of the tax year.

Calculate gst correctly with this super easy gst calculator for new zealand 15 gst. Ird numbers nga tau ird. Usually a self employed person can start in business without following any formal or legal set up tasks.

Estimate your annual income tax for self employed people salary and wage earners. More information about the calculations performed is available on the details page. Self employment profits are subject to the same income taxes as those taken from employed people.

Tax on annual income calculator. The amount of tax you pay depends on your total income for the tax year. Which tax rate applies to me.

The key difference is in two areas national insurance contributions and the ability to deduct expenses and costs before calculating any deductions. This includes income from self employment or renting out property and some overseas income. New zealands best paye calculator.

Goods and services tax gst take mo nga rawa me nga ratonga non profits and charities nga umanga kore huamoni me nga umanga aroha. Its a smart move to set aside around 15 20 of your income during the year to pay your income tax with more if expecting over 70000 profit. This calculator assumes youre employed as being self employed means hourly weekly fortnightly and monthly income payments will be different depending on when you make tax payments and how much you pay.

Each year youre required to file income tax returns with inland revenue. Calculate your take home pay from hourly wage or salary. Income tax is then worked out on the profit.

For employers and people going to contracting. You pay tax on net profit by filing an individual income return. Kiwisaver for employers.

Kiwisaver student loan secondary tax tax code acc paye.

More From Government Budget 2020 India

- Self Employed Job Retention Scheme Gov

- What Is The British Furlough Scheme

- Free Self Employed Contract Template Uk

- Self Employed Furlough Latest

- Philhealth Payment Form For Self Employed

Incoming Search Terms:

- Median Weekly Incomes Down 8 In June Quarter Year On Year As Covid 19 Bites Statistics New Zealand Says Interest Co Nz Philhealth Payment Form For Self Employed,

- Rental Expenses Spreadsheet Income And Nz Expense For Self Employed Rty Free Template Small Business Trucking Download Schedule Sample Mac Excel Large Property Tax House Sarahdrydenpeterson Philhealth Payment Form For Self Employed,

- Coronavirus Self Employment Income Support Scheme What You Need To Know Sage Advice United Kingdom Philhealth Payment Form For Self Employed,

- Tax Calculator And Other Useful Calculators And Tools Kiwitax Philhealth Payment Form For Self Employed,

- Income Tax Wikipedia Philhealth Payment Form For Self Employed,

- How Do I Become Self Employed Kiwitax Philhealth Payment Form For Self Employed,