Self Employed Income Tax Deductions, Income Tax Lessons July 2019 0 Pdf Tax Deduction Taxation In The United States

Self employed income tax deductions Indeed recently has been sought by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the post I will discuss about Self Employed Income Tax Deductions.

- 2017 Self Employment Tax Form Brilliant Self Employed Tax Deductions Worksheet Fresh Free Forms 2018 Self Models Form Ideas

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctxyx5clwjinfpbsa Hyjnb4vxhneo Tsk Kz528hxay Gkwfek Usqp Cau

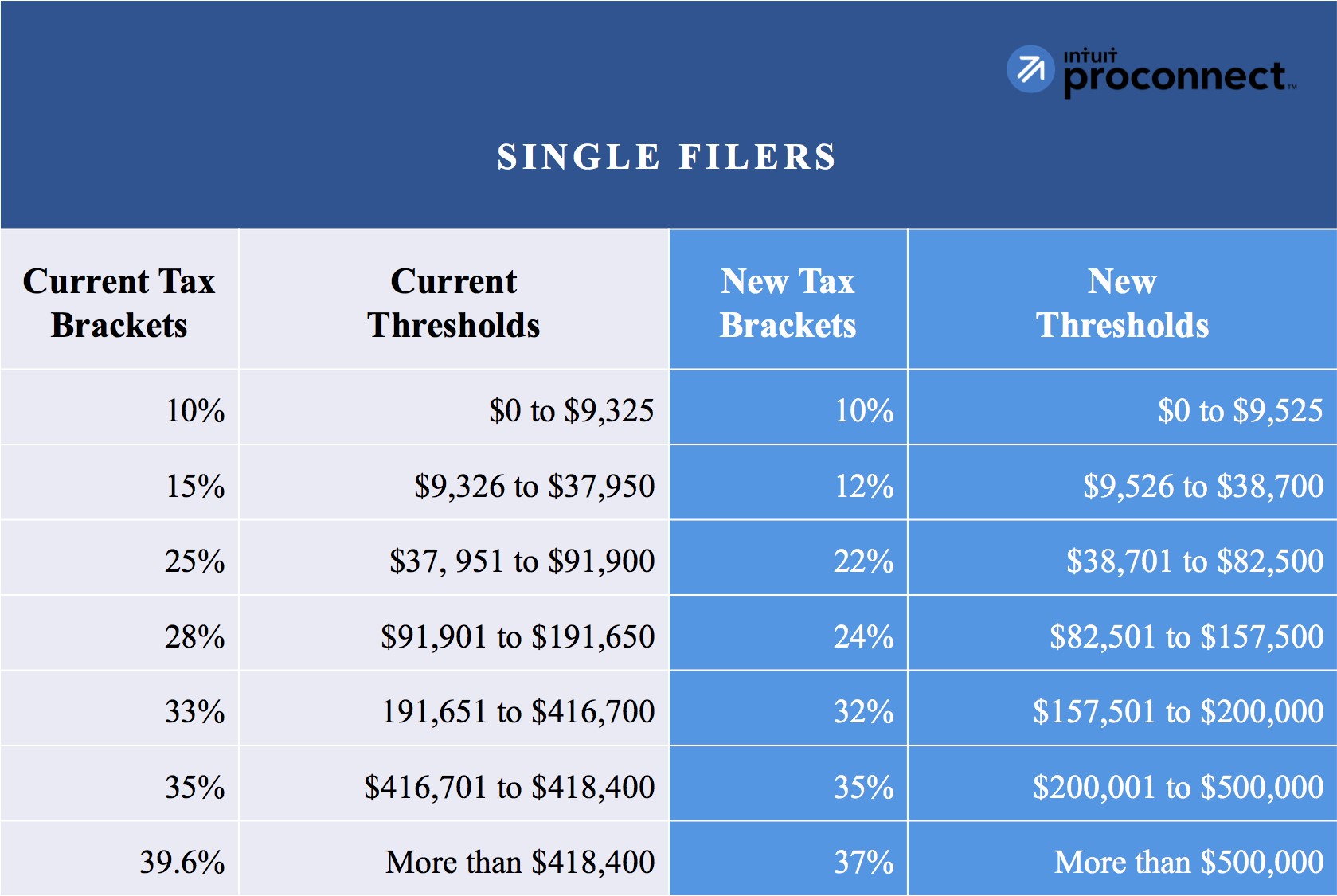

- Tax Reform How Physicians And The Self Employed Are Affected Physician On Fire

- Structure Of The Spanish Personal Income Tax 2015 Download Scientific Diagram

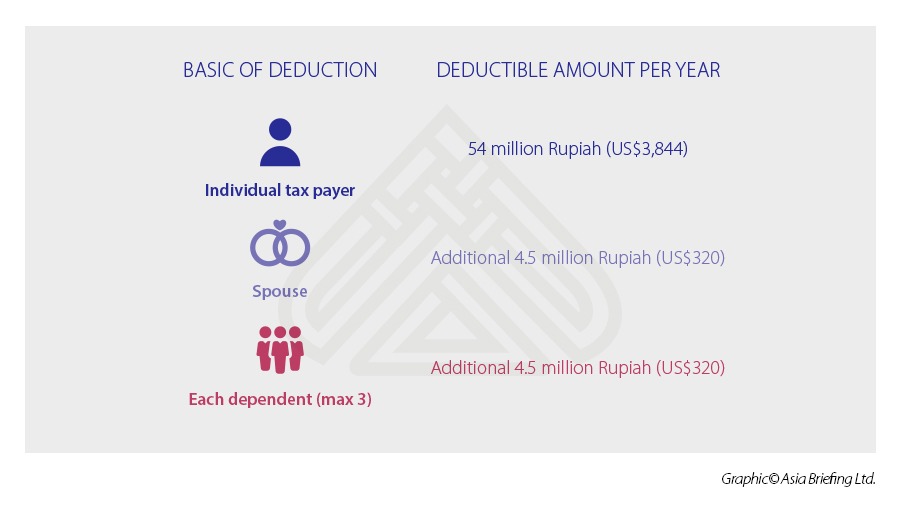

- Advante Management Services Pte Ltd Posts Facebook

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcs6jdkorlvbllexbusvqgstishqki8ryoaua0o4t9g33f8qnk0k Usqp Cau

Find, Read, And Discover Self Employed Income Tax Deductions, Such Us:

- Turbotax Self Employed Review 2020 Features Pricing The Blueprint

- The Definitive Guide To Common Business Deductions

- Self Employment Information Leaflet Pages 1 7 Flip Pdf Download Fliphtml5

- How To Reduce Your Income Tax In Singapore Make Use Of These Tax Reliefs And Deductions

- Structure Of The Spanish Personal Income Tax 2015 Download Scientific Diagram

If you are looking for Belgium Government Scholarships you've arrived at the right location. We ve got 104 images about belgium government scholarships including images, photos, pictures, backgrounds, and more. In these web page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

If the assessee is a self employed professional the presumptive taxation scheme would apply to himher under section 44da of the income tax act if the gross receipts are below inr 50 lakhs in a financial year.

Belgium government scholarships. But before you can reap the benefits of tax write offs you need to know what expenses are tax deductible if you work from home. Your self employment tax deduction would be 7500 15000 seca tax liability x 50 deduction. These expenses offset your income lowering your profits on paper and reducing your tax burden.

The scheme of presumptive tax is applicable for self employed assessees. Its one of few above the line tax deductions reducing your adjusted gross income agi. When you are self employed you must pay all of it as self employment tax.

That rate is the sum of a 124 social security. Self employed workers need to pay this entire tax 153 on their own but the irs does consider the employer portion of the self employment tax to be a deductible expense. They swoop in lower your tax bill and save your wallet from some serious destruction.

Self employed tax deductions are the superheroes of your business taxes. You have to file an income tax return if your net earnings from self employment were 400 or more. Weirdly one of the most common self employment tax deductions is self employment tax itself.

However as your own employer you are entitled to deduct half of those taxes. That deduction which youll calculate on form se reduces your total taxable income for both self employment tax and income taxes. If you are self employed the canada revenue agency allows you to deduct a range of business expenses.

Here is a look at the main deductions you can claim. Start running payroll and benefits with gusto. Business operating expenses any money you spend running your business is considered.

If your net earnings from self employment were less than 400 you still have to file an income tax return if you meet any other filing requirement listed in the form 1040 and 1040 sr instructions pdf. If youre self employed your business will have various running costs. Normally employees and their employers each pay half of fica taxes which cover medicare and social security.

More From Belgium Government Scholarships

- Government Bsc Nursing Colleges In Kerala

- Government Forms Pdf

- What Is Happening With Furlough Scheme

- Easy Minecraft Government Building

- Government Marketplace Reviews

Incoming Search Terms:

- Tax Guide For Independent Contractors Government Marketplace Reviews,

- Who S Required To Fill Out A Schedule C Irs Form Government Marketplace Reviews,

- Riley Associates Self Employment Taxation The Basics Government Marketplace Reviews,

- 9 Self Employment Tax Deductions To Optimize Your Tax Return Tax Deductions Savings Planner Deduction Government Marketplace Reviews,

- 2 Government Marketplace Reviews,

- The Be All End All List Of Small Business Tax Deductions Government Marketplace Reviews,