Self Employed Income Tax Percentage, Employed Self Employed And Rental Income Jf Financial

Self employed income tax percentage Indeed recently is being hunted by users around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of this post I will discuss about Self Employed Income Tax Percentage.

- Taxes Applicable To Sole Proprietors Freelancers Self Employed And Professionals

- Your Bullsh T Free Guide To Taxes In Germany

- Working Paper 96 3r

- Self Employed In Ireland A Guide To Your Taxes Part 2

- What Is The Self Employment Tax In 2020 Thestreet

- Federal Insurance Contributions Act Tax Wikipedia

Find, Read, And Discover Self Employed Income Tax Percentage, Such Us:

- Payroll Tax What It Is How To Calculate It Bench Accounting

- 14 Tax Tips For The Self Employed Taxact Blog

- Working Paper 96 3r

- A Penny Saved Is Nearly Two Pennies Earned Provident Planning

- Your Bullsh T Free Guide To Taxes In Germany

If you re looking for Government Meaning In Urdu you've reached the ideal location. We ve got 104 graphics about government meaning in urdu adding pictures, photos, photographs, wallpapers, and much more. In such webpage, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

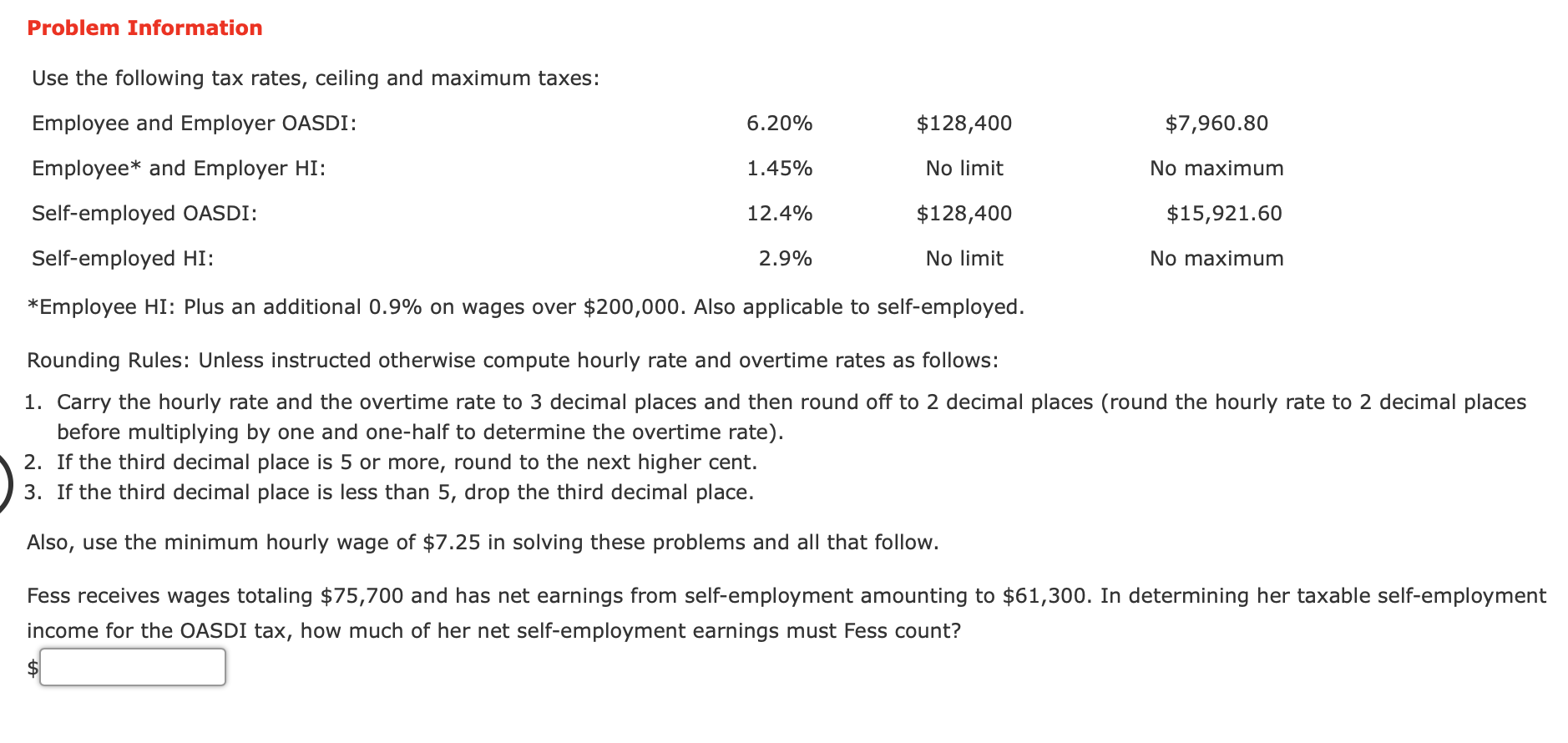

As an independent contractor if you made more than 400 you need to pay income tax and self employment tax.

Government meaning in urdu. If you are self employed you need to make these tax payments yourself since you dont have an employer to send it in for you. That rate is the sum of a 124 social security tax and a 29 medicare tax on net. The self employment tax is calculated on 9235 of your total income.

Income tax rates range anywhere from 10 to 37 depending on which tax bracket youre in. The self employment tax rate is 153. Brackets are assigned based on taxable income and applied at each bracket.

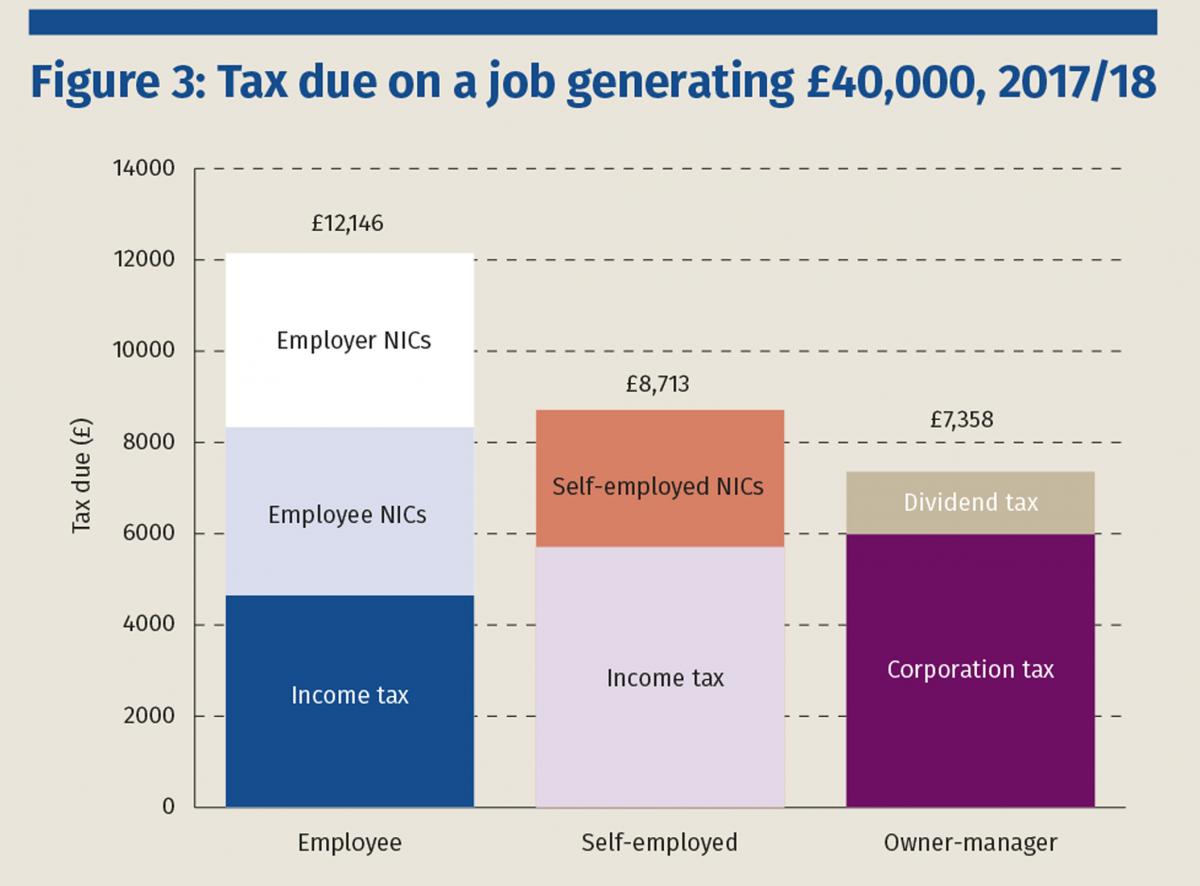

Self employment tax is 153 of the first 137700 of income you receive plus 29 of anything you earn over this threshold. 15 on the first 48535 of taxable income plus 205 on the next 48534 of taxable income on the portion of taxable income over 48535 up to 97069 plus. For earnings above 150000 the rate is 45 per cent for both the 2018 19 and 2019 20 tax years.

If you save 30 of your earnings youll cover your small business and income taxes each quarter. The employer portion of the self employment tax is deductible as a business expense. The self employment tax rate for 2019 and 2020 as noted the self employment tax rate is 153 of net earnings.

If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. As of 2019 the tax year for which youll file in 2020 these limits are 321400 if youre married and filing a joint return 160700 if youre single or 160725 if youre married filing separately or a married nonresident alien. For 2020 employees pay 765 percent of their income in social security and medicare taxes with their employers making an additional payment of 765 percent.

The tax rate is currently 153 of your income with 124 going to social security and 29 going to medicare. The rate is made up of 29 for medicare or hospital insurance and 124 for social security or survivors old age and disability insurance. This means that they can reduce their taxable income by deducting certain expenses from it.

However self employed people can also offset some of their expenditure against tax.

More From Government Meaning In Urdu

- Government Of India Act 1919 Pdf

- Self Employed Government Help

- Government Notes Aesthetic

- Types Of Government Worksheet Middle School

- Self Employed Courier Jobs Liverpool

Incoming Search Terms:

- 2020 Tax Changes For 1099 Independent Contractors Updated For 2020 Self Employed Courier Jobs Liverpool,

- Singapore Personal Income Tax Guide Guidemesingapore By Hawksford Self Employed Courier Jobs Liverpool,

- Taxes For The Self Employed And Independent Contractors Self Employed Courier Jobs Liverpool,

- 8 Optional Flat Rate Vs Graduated Tax Rates Which Is Better For Self Employed Doctors My Finance Md Self Employed Courier Jobs Liverpool,

- Solved Problem 6 16 Algorithmic Self Employment Tax Lo Chegg Com Self Employed Courier Jobs Liverpool,

- Https Www Cumortgagedirect Com Globalresources Mortappdocs Selfemployedincome Pdf Self Employed Courier Jobs Liverpool,