Self Employed Loans Cares Act, 2

Self employed loans cares act Indeed lately is being sought by users around us, maybe one of you personally. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of the post I will discuss about Self Employed Loans Cares Act.

- Cares Act For Self Employed Unemployment Benefits

- Https Www Clarkhill Com Uploads Medium Resource 4617 Cares Act Summary3 Pdf

- Kpmg Spark Cares For Small Business Clients

- Covid 19 Frequently Asked Questions Congressman Conor Lamb

- Cares Act For Small Businesses Loans And Grants Now Available For Small Business Self Employed And Gig Workers Signals Az

- How To Apply For Ppp Small Business Loans In The Cares Act Vox

Find, Read, And Discover Self Employed Loans Cares Act, Such Us:

- 2

- Mfc Financial Planners The Cares Act It S Impact On Businesses

- Ksm Blog Katz Sapper Miller Cpa Ksm Cpa Insights

- Coronavirus Relief For Small Businesses And The Self Employed Considerable

- 2

If you are looking for Government Monopoly Graph you've reached the ideal place. We have 100 graphics about government monopoly graph including images, photos, photographs, wallpapers, and more. In these webpage, we additionally have number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Https Www Seattle Gov Documents Departments Economicdevelopment Covid19 Resources 20for 20businesses 06 23 20 20 20sba 20cares 20act 20fact 20sheet Pdf Government Monopoly Graph

This deferral is only available if no part of a ppp loan is forgiven.

Government monopoly graph. Economic injury disaster loan eidl and paycheck protection program ppp. 62 of the total 124 for 2020 with 50 of their 2020 liability due on december 31 2021 and the remaining 50 due on december 31 2022. The recently enacted coronavirus aid relief and economic security act cares act provides more than 2 trillion of economic stimulus for the us.

Benefits are boosted by 600 over regular state benefits and can be claimed for up to 39 weeks. The cares act allows self employed individuals to defer one half of their social security taxes ie. Under the ppp initiative.

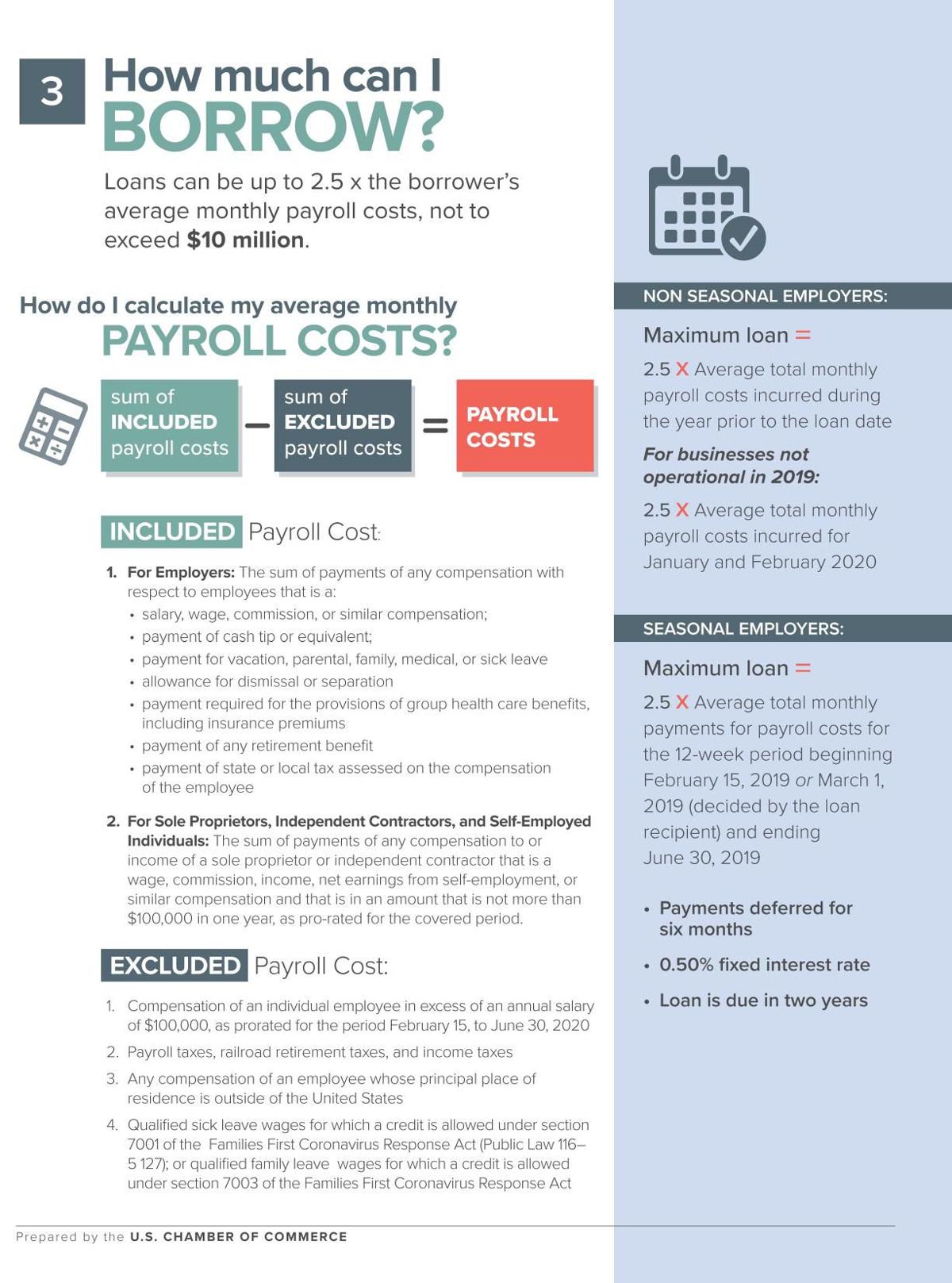

The cares act established the ppp as a loan initiative designed to provide much needed cash to small businesses and self employed taxpayers during the coronavirus crisis. Cares act created two loan programs for small businesses and the self employed. The cares act makes state unemployment benefits available to self employed freelance independent contractor and other gig workers unemployed or underemployed by the covid 19 pandemic.

Economy establishes small business loan programs to help keep workers employed and covers other business losses related to coronavirus. Tips for handling joblessness. Because the two programs are so new detailed rules and procedures are still being created and published.

The new guidance also clarifies how ppp loans may be used by self employed persons and how loan forgiveness will be calculated. The ppp provides forgiveness for small business loans for keeping employees. It also provides additional funding for sbas resource partners to provide advice and training to help small businesses respond to the unprecedented challenges in communities throughout the country.

Small business owners sole proprietorships independent contractors and other self employed individuals are eligible to apply for economic injury disaster loans eidl a longstanding us. Assistance program that was enhanced by the cares act. The cares act includes provisions for 350 billion of federally guaranteed loans that would be offered through the small business administration.

The cares act tasks the small business administration with overseeing the distribution of millions of dollars in loans and grants to help small businesses survive the pandemic. Its a program for small employers self employed individuals and gig economy workers with 350 billion to help prevent workers from losing their jobs and small businesses from going under due to economic losses caused by the covid 19 pandemic. The ppp provides 8 weeks of cash flow assistance through 100 percent federally guaranteed loans to small employers who maintain their payroll during this emergency.

More From Government Monopoly Graph

- Federal Government Legislative Branch Canada

- Branches Of Government Quizlet

- Government University In Islamabad

- Drawing 3 Branches Government

- Self Employed Furlough Till October

Incoming Search Terms:

- Icymi Congressman Allen Holds Coronavirus Telephone Town Hall Self Employed Furlough Till October,

- Covid 19 Frequently Asked Questions Congressman Conor Lamb Self Employed Furlough Till October,

- Sba Loans Under The Cares Act Updated As Of May 20 2020 Blogs Coronavirus Resource Center Back To Business Foley Lardner Llp Self Employed Furlough Till October,

- Ksm Blog Katz Sapper Miller Cpa Ksm Cpa Insights Self Employed Furlough Till October,

- Cares Act Grants And Loans Johnson Block Cpas Madison Wi Self Employed Furlough Till October,

- Navigating Local State And Federal Resources For Employers And Self Employed Nawbovc Self Employed Furlough Till October,