Self Employed Pension Tax Relief Ireland, Https Www Revenue Ie En Tax Professionals Tdm Pensions Chapter 26 Pdf

Self employed pension tax relief ireland Indeed lately is being hunted by consumers around us, perhaps one of you. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of this article I will discuss about Self Employed Pension Tax Relief Ireland.

- Tax Liability Introduction To Taxation Exam Docsity

- Topical Tax Issues For Reducing Your Irish Income Tax Liability

- Self Employed Pension Tax Relief Simple Guide To Pensions Jf Financial

- Ira Support And Contribution Limits For Us Expats

- Do Pension Contributions Still Make Sense Deloitte Ireland Deloitte Private

- Lowquotes Author At Lowquotes

Find, Read, And Discover Self Employed Pension Tax Relief Ireland, Such Us:

- Pensions Tax Relief And Contributions

- Https Web Actuaries Ie Sites Default Files 2018 11 181115 20private 20pension 20tax 20relief 20paper 0 Pdf

- Do Pension Contributions Still Make Sense Deloitte Ireland Deloitte Private

- Http Www Iopsweb Org Resources 39574324 Pdf

- Ad Have You Ever Considered Pension Alliance Insurance Brokers Facebook

If you are searching for Self Employed Insurance Plans Texas you've reached the perfect location. We ve got 100 images about self employed insurance plans texas adding images, pictures, photos, wallpapers, and more. In these web page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

One way to do this is to contribute to a pension.

Self employed insurance plans texas. If you are self employed you are probably looking at ways to reduce your tax. Find out how to choose your pension how much do you need to contribute to a pension and the things to look out for when setting up a pension or reviewing your existing pension. Self employed pensions tax relief.

If youre self employed you can apply for tax relief on contributions by using revenues online. This is 115000 and it is adjusted from time to time by the minister for finance. Taxation of deasp pensions.

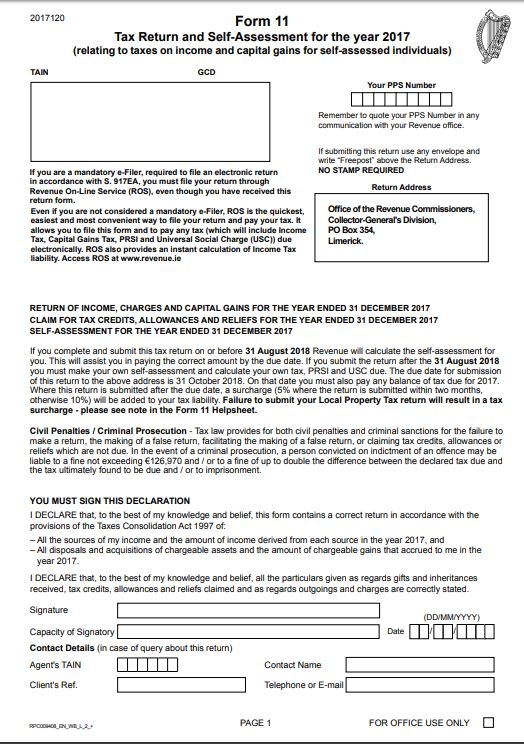

Also your farm land must be in ireland and the tax relief cannot operate to create a loss. For more information on how you can claim tax relief in your form 11 see help claiming a relief for pension contributions. If you are self employed.

Example 2 an individual aged 40 with self employed income net relevant earnings of 100000 in 2019 and paying premiums to a personal pension plan may claim tax relief on the lower of. In summary if you are self employed and making personal pension contributions you will usually get 20 tax relief in the form of this being added to your pension by the government and in addition to this you will get income tax relief through your personal tax return if your earnings are above the basic tax band. If your employer does not deduct the contributions use myaccount to complete and file an income tax return.

You may get tax relief on contributions to approved personal pension arrangements. Income tax loss relief for self employed. Filing a return.

You can claim back either 20 if you are on the standard rate tax band or 40 tax if you are on the higher rate tax band on the premiums. On 23 july 2020 the government announced the introduction of a new once off income tax relief measure. If you are self employed or a proprietary director you must include your pension contributions in your online self assessment tax return in order to obtain income tax relief.

Detailed information regarding tax relief on contributions and pensions in general can be found on citizensinformationie and revenueie both of those links are to. If youre a paye worker this relief is generally applied at source by your employer. If you make contributions but do not get tax relief on them because you exceed the tax relief limits you can apply for tax relief on these contributions in the future.

Self employment tax rates 2018. Sign in to ros to claim tax relief. For everyone there is a maximum annual amount of earnings for which tax relief is given.

Contributions of 17 of salary 34000 she could claim tax relief on the full amount as this is lower than 30 of 115000. It is intended to benefit self employed people who were profitable in 2019 but as a result of the covid 19 pandemic will make a loss in 2020. You can also apply for the relief online at revenues myaccount service.

More From Self Employed Insurance Plans Texas

- Self Employed Business Ideas Uk

- Self Employed Income Tax Rate 2020

- Furlough Scheme Uk

- Furlough Extension Scheme

- Types Of Government Worksheet 6th Grade Pdf

Incoming Search Terms:

- Taking Tax Free Cash From A Pension Fund Aj Bell Youinvest Types Of Government Worksheet 6th Grade Pdf,

- Estonian Taxes And Tax Structure As Of 1 July 2017 Types Of Government Worksheet 6th Grade Pdf,

- Https Web Actuaries Ie Sites Default Files 2018 11 181115 20private 20pension 20tax 20relief 20paper 0 Pdf Types Of Government Worksheet 6th Grade Pdf,

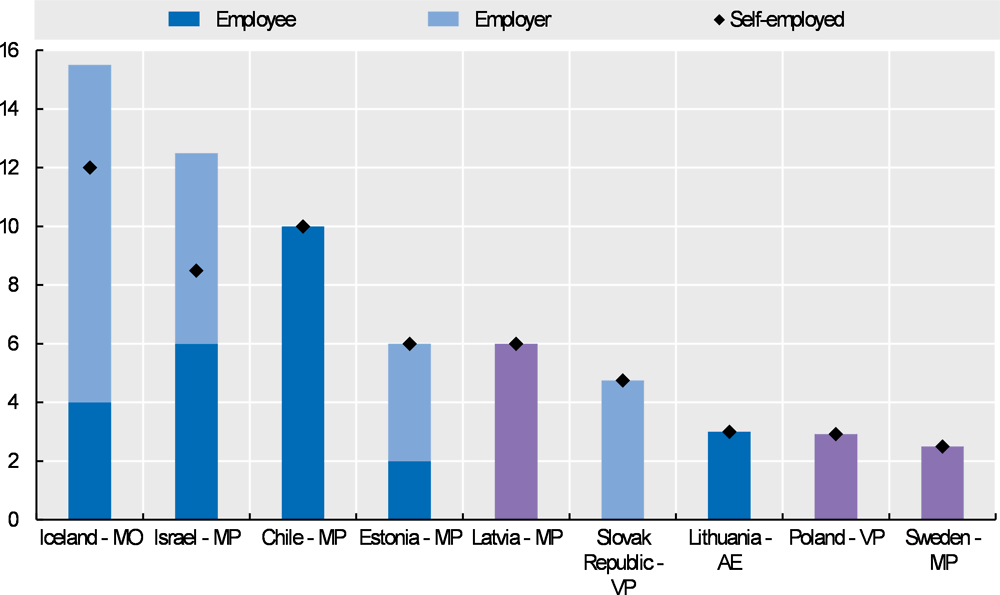

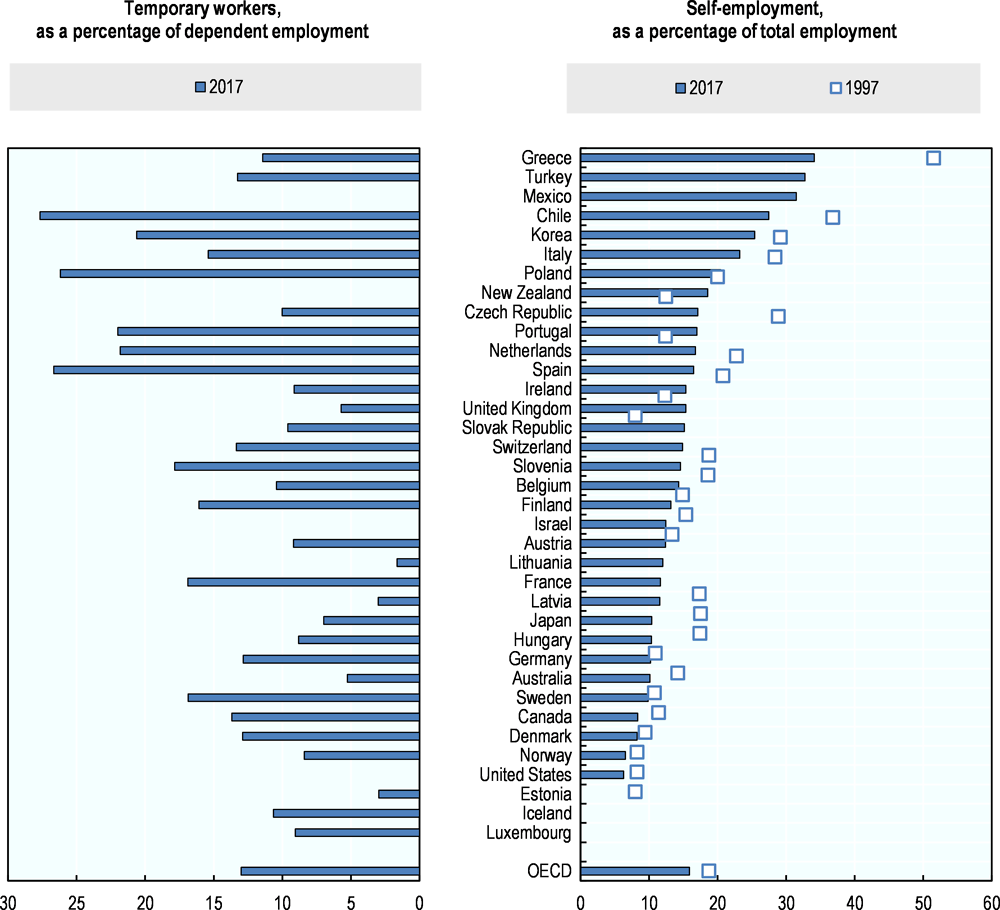

- Are Funded Pensions Well Designed To Adapt To Non Standard Forms Of Work Pensions At A Glance 2019 Oecd And G20 Indicators Oecd Ilibrary Types Of Government Worksheet 6th Grade Pdf,

- Top Up Your Pension Savings And Get Up To 40 Tax Back Irish Life Corporate Business Types Of Government Worksheet 6th Grade Pdf,

- Do Pension Contributions Still Make Sense Deloitte Ireland Deloitte Private Types Of Government Worksheet 6th Grade Pdf,