Self Employed Sick Pay Calculator, Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcswcqsgtam0mrtpbbrpkfsizkluiugtojjz2c20exqlh9fybh89 Usqp Cau

Self employed sick pay calculator Indeed recently has been sought by users around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of this post I will talk about about Self Employed Sick Pay Calculator.

- 3

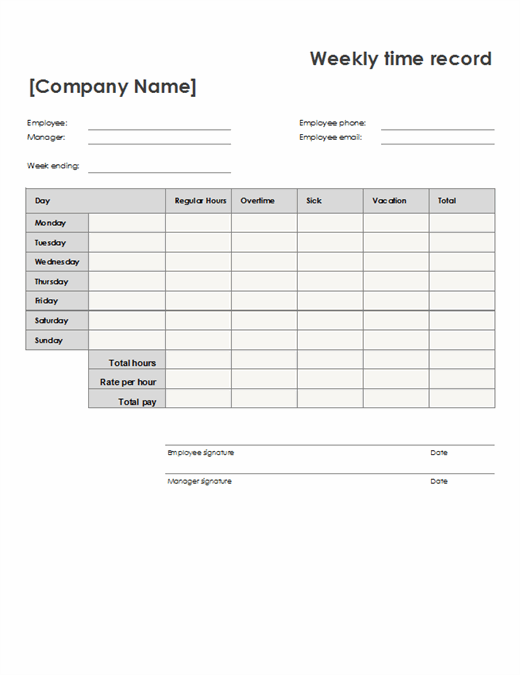

- Basic Paye Tools User Guide Gov Uk

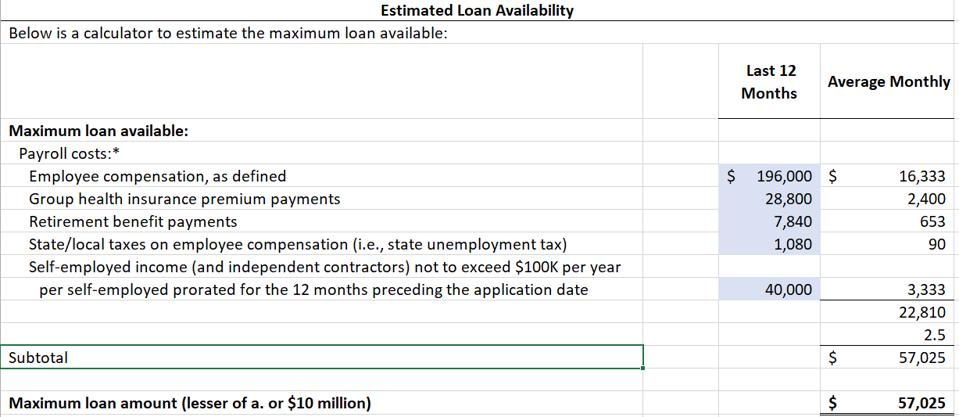

- Paycheck Protection Program Loans Three Things The Sba And Banks Need To Agree On Now

- Determining The Forgiveness Amount Of Your Paycheck Protection Program Ppp Loan Lexology

- Chapter 5 Dental Practice Management Dealing With Rights And Grievances By Professional Dentistry Issuu

- How To Calculate Your Unemployment Benefits

Find, Read, And Discover Self Employed Sick Pay Calculator, Such Us:

- Paycheck Protection Program Loans Three Things The Sba And Banks Need To Agree On Now

- The Sometimes Hidden Peril Of Self Employment

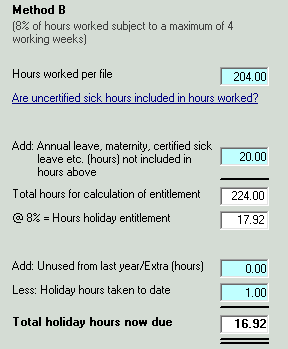

- Holiday Calculator Documentation Thesaurus Payroll Manager Ireland 2018

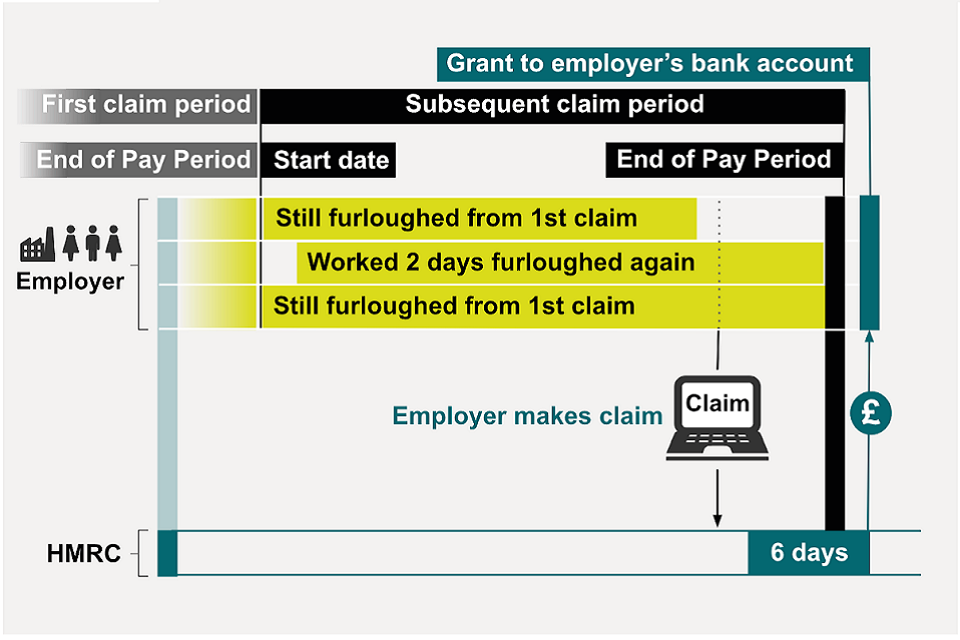

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- Your Income And Coronavirus Covid 19 Policy In Practice

If you are looking for Government Vacation Rewards Cancellation you've reached the right place. We have 104 graphics about government vacation rewards cancellation adding images, photos, photographs, wallpapers, and much more. In such page, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Paid Sick Leave To Protect Income Health And Jobs Through The Covid 19 Crisis Government Vacation Rewards Cancellation

More information about the calculations performed is available on the details page.

Government vacation rewards cancellation. This guide is also available in welsh cymraeg. Many employers have sick pay schemes which pay more than just ssp. Employed and self employed uses tax information from the tax year 2020 2021 to show you take home pay.

Adjustments are made for holiday and vacation days. Most full time employers will pay you for at least 5 days sick leave per year. Experiment with other financial calculators or explore hundreds of individual calculators covering other topics such as math fitness health and many more.

If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. Remember to include bank holidays in this if you want to. Youll need time off when youre self employed.

See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions. If you work and arent self employed youre legally entitled to get statutory sick pay ssp as long as you. Sick day allowance per year.

Holiday allowance per year. Look at your employment contract ssp is the minimum statutory requirement for employed people who are sick or self isolating. You will pay an additional 09 medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly.

Sick pay for the self employed while the government has promised to pay the first two weeks of any statutory sick pay ssp owed to employees affected by the coronavirus this is no good for self. Hopefully you wont get ill too often but it makes sense to allocate a few days each year. Have started work with your employer are sick for 4 full days or more in a row including non working days.

You can get 9585 per week statutory sick pay ssp if youre too ill to work. If youre self employed the chancellor announced that self employed workers will be able to access universal credit at a rate equivalent to statutory sick pay by removing the mif. Self employed are not eligible for statutory sick pay ssp therefore they must have an adequate self employed insurance policy in order to cover mandatory monthly payments such as mortgage energy expenses and other household bills.

Talk to your employer let your employer know that you are ill or self isolating or shielding and provide your nhs 111 isolation note or the letter.

More From Government Vacation Rewards Cancellation

- Government Agency Swot Analysis Examples

- Government Housing In England

- 5 Government Functions

- Uk Furlough Scheme After June

- Government Bonds Clipart

Incoming Search Terms:

- Self Employment Wikipedia Government Bonds Clipart,

- Http Www Ilo Org Dyn Travail Docs 1759 Social 20security 20programs 20throughout 20the 20world 20 20asia 20and 20the 20pacific 20 20myanmar 20 202010 2011 Pdf Government Bonds Clipart,

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk Government Bonds Clipart,

- Comparative Tables Missoc Government Bonds Clipart,

- Paycheck Protection Program Loans Three Things The Sba And Banks Need To Agree On Now Government Bonds Clipart,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctua04erzlafito6j6 Qaaqu2jzqtlalyjqodoj0jwcbgdeceky Usqp Cau Government Bonds Clipart,

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)