Self Employed Tax Calculator Nyc, Collective Responses For Independent Contractors During Covid 19

Self employed tax calculator nyc Indeed recently is being sought by consumers around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of the post I will discuss about Self Employed Tax Calculator Nyc.

- Solved De Beth Parts し Calculate 2018 Adjusted Gre Inco Chegg Com

- State Income Tax Wikipedia

- 1099 Taxes Calculator Estimate Your Self Employment Taxes

- 2020 Tax Changes For 1099 Independent Contractors Updated For 2020

- Tax Services For Foreigners 212 Tax Services New York City

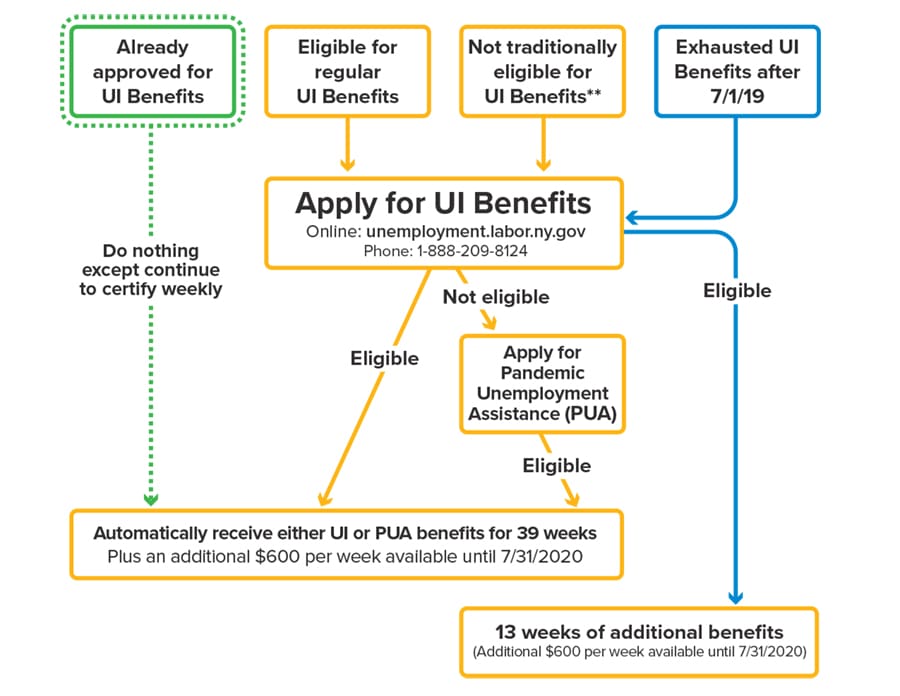

- Cares Act What You Need To Know Neighborhood Trust Financial Partners

Find, Read, And Discover Self Employed Tax Calculator Nyc, Such Us:

- 2020 2021 Tax Brackets Bankrate

- How Much Should You Budget For Taxes As A Freelancer

- Federal Income Tax Calculator 2020 Credit Karma

- Estimate And Export Your Freelance Taxes Nyc Bonsai

- The Top 10 Best Self Employed Jobs Smartasset

If you are searching for Government Finance Statistics Yearbook 2018 Pdf you've come to the right location. We have 104 graphics about government finance statistics yearbook 2018 pdf adding pictures, pictures, photos, backgrounds, and much more. In such web page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctv24mwuumn6b2qqelqobcf3lqwlzqf6foowsqmd Smzy309ws Usqp Cau Government Finance Statistics Yearbook 2018 Pdf

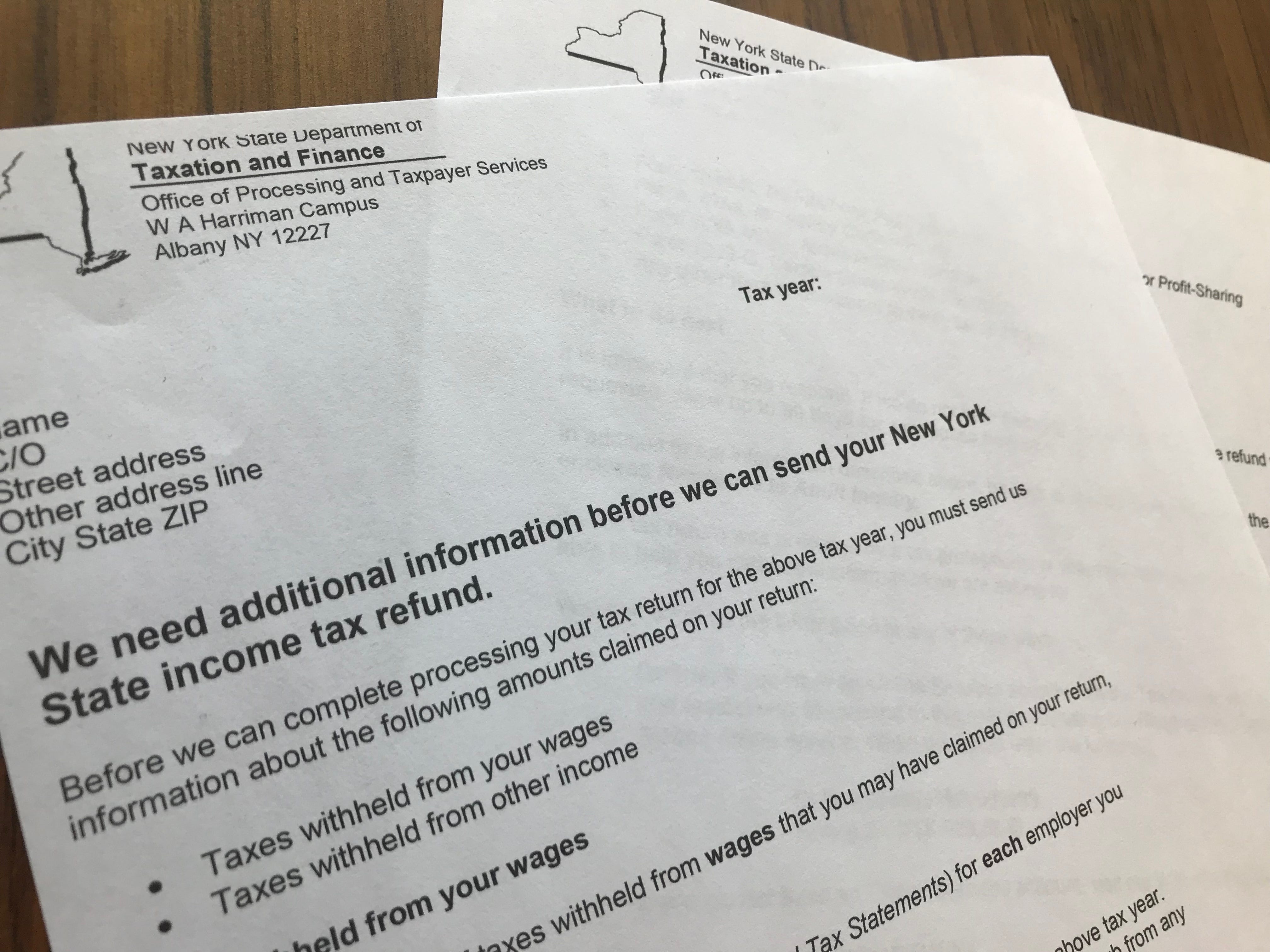

New York State Taxes Tax Rates A Guide To Ny State Taxation Government Finance Statistics Yearbook 2018 Pdf

If youre a church worker your church employee income should be at least 10828 before you are required to file self employed tax.

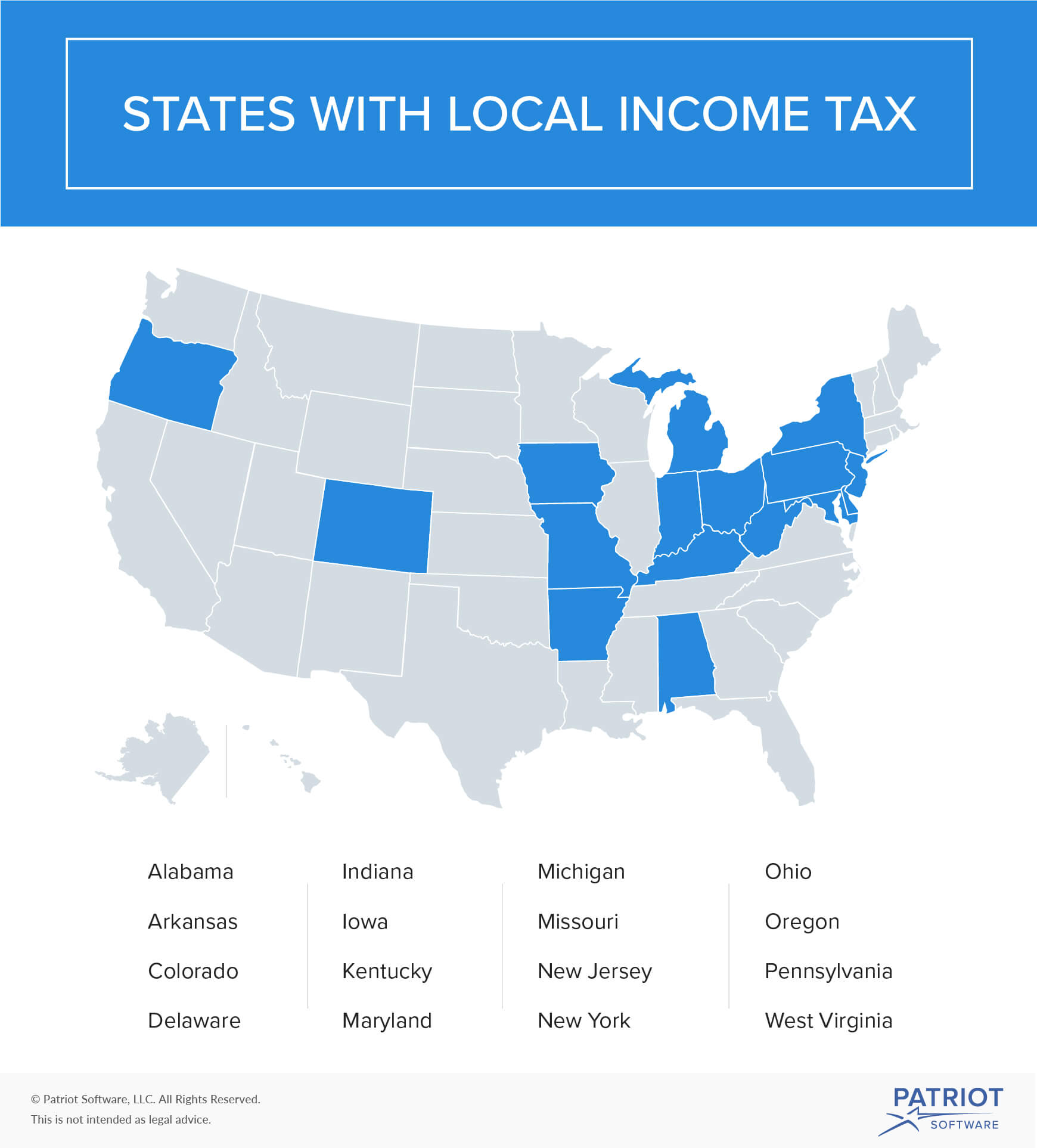

Government finance statistics yearbook 2018 pdf. Another thing worth noting is that certain self employed taxpayers in new york city as well as rockland nassau suffolk orange putnam dutchess and westchester counties have to pay a metropolitan commuter transportation mobility tax mctmt of 034 of net earnings to the metropolitan transportation authority mta. New york tobacco tax. The self employment tax applies evenly to everyone regardless of your income bracket.

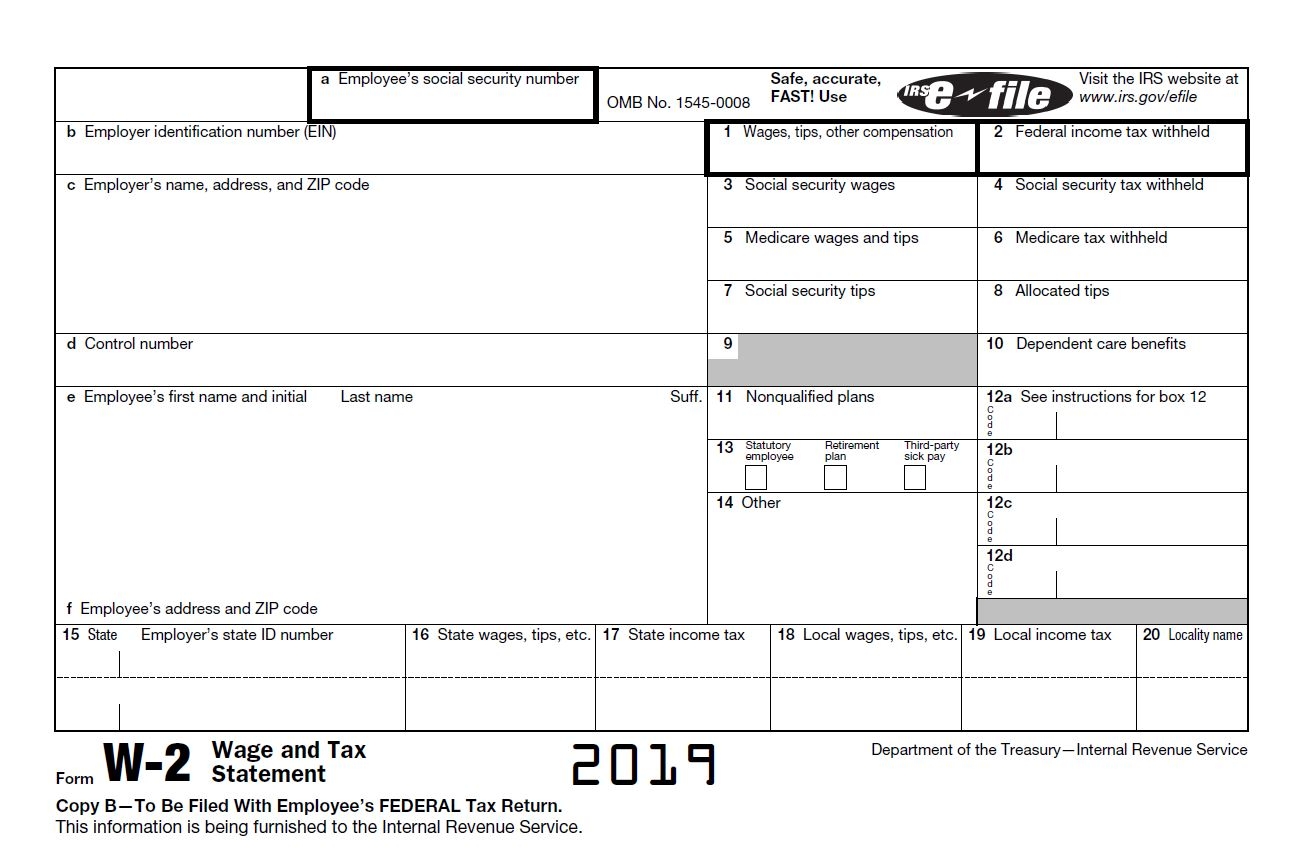

This rate is derived from the fact that self employed taxpayers can deduct the employers portion of the tax which is 765. Use this calculator to estimate your self employment taxes. To pay self employed taxes you are required to have a social security number and an individual taxpayer identification number.

More information about the calculations performed is available on the details page. Use this calculator to estimate your self employment taxes. 124 for social security tax and 29 for medicare.

On the other hand many products face higher rates or additional charges. However if you are self employed operate a farm or are a church employee you may owe self employment taxes. Normally these taxes are withheld by your employer.

New york property tax. Normally these taxes are withheld by your employer. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability.

Please note that the self employment tax is 124 for the federal insurance contributions. The calculator uses tax information from the tax year 2020 2021 to show you take home pay. Paying taxes on your self employment income.

You will pay an additional 09 medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly. 2020 self employed tax calculator. Please note that the self employment tax is 124 for the fica portion and 29 for medicare.

The calculations provided should not be considered financial legal or tax advice. The 1099 tax rate consists of two parts. This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income.

In new york city there is an additional 150 excise tax per pack of cigarettes. The biggest reason why filing a 1099 misc can catch people off guard is because of the 153 self employment tax. However if you are self employed operate a farm or are a church employee you may owe self employment taxes.

You are required to pay self employed tax if you earned 400 and above. Cigarettes are subject to an excise tax of 435 per pack of 20 and other tobacco products have a tax equaling 75 of the wholesale price. The tax rate is currently 153 of your income with 124 going to social security and 29 going to medicare.

More From Government Finance Statistics Yearbook 2018 Pdf

- Government Debt To Gdp By Oecd Country

- Self Employed Furlough November

- Government Yoga And Naturopathy Medical College

- Self Employed Furlough Help

- Government Regulation Definition Us History Quizlet

Incoming Search Terms:

- New York City Income Tax Rates And Credits Government Regulation Definition Us History Quizlet,

- Tax Services For Foreigners 212 Tax Services New York City Government Regulation Definition Us History Quizlet,

- Filing Taxes In Two States Working In Ny Living In Nj Priortax Government Regulation Definition Us History Quizlet,

- How To Deduct Parking Expenses On Your Taxes Government Regulation Definition Us History Quizlet,

- New York State Taxes Tax Rates A Guide To Ny State Taxation Government Regulation Definition Us History Quizlet,

- Self Employed In The Big Apple Nyc Unincorporated Business Tax Government Regulation Definition Us History Quizlet,

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)