Self Employed Unemployment Ny Calculator, New York State Unemployment Rate Is At Highest Level Since The Great Depression

Self employed unemployment ny calculator Indeed lately is being sought by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this post I will discuss about Self Employed Unemployment Ny Calculator.

- Nys Dcss Income Withholding Worksheet

- New York State Unemployment Rate Is At Highest Level Since The Great Depression

- Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

- A Record 3 3 Million Americans Filed For Jobless Claims As Coronavirus Puts Economy Into Recession The Washington Post

- File Your First Claim For Benefits Department Of Labor

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctcwc1v1pinoqmfboi751pctsu5oyhwnx4vs9vzcaa6huom1rve Usqp Cau

Find, Read, And Discover Self Employed Unemployment Ny Calculator, Such Us:

- Https Eligibility Com Unemployment

- Gdol Bares More Details About Unemployment Assistance

- Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsouxlj14lwz9wv5mvkyjdfal05xrem9he0ryrpt5owtinuotcn Usqp Cau

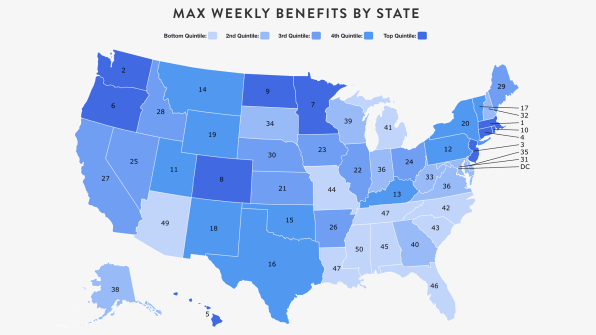

- The 600 Unemployment Booster Shot State By State The New York Times

If you re looking for Government Jobs Names List you've come to the ideal location. We have 104 images about government jobs names list including pictures, photos, photographs, wallpapers, and much more. In these page, we also provide number of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Self sufficiency employment estimator.

Government jobs names list. You dont need to pay self employment tax on income under 400 the calculations provided should not be considered financial legal or tax advice. If you are collecting unemployment based on a job you had working freelance can impact the benefits you are receiving. If you are self employed an independent contractor or a farmer you may now be eligible and can file for benefits online.

These basic needs include housing food health care transportation childcare and taxes. Pandemic unemployment assistance is a new federal program that is part of the coronavirus aid relief and economic security cares act that provides extended eligibility for individuals who have traditionally been ineligible for unemployment insurance benefits eg self. Self employed folks can access unemployment and other benefits during the coronavirus pandemic.

This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income. The estimated income does not include public or private assistance. For the social security portion of self employment taxes the 150000 in regular job income counts against the 137700 limit leaving you with no self employment tax for the social security portion.

You must include documentation that supports the basis for your calculations. Many self employed workers freelancers and others not covered by regular unemployment are now eligible to receive unemployment benefits under the pandemic unemployment act pua. See form dtf 215 recordkeeping suggestions for self employed persons for examples of the documentation the tax department will and will not accept in support of your claim.

By susannah snider senior editor personal finance june 16 2020. This estimator calculates the income required by an individual or family to meet its basic needs for a given family size and geographic location. If you are eligible for regular unemployment insurance benefits or pandemic emergency unemployment compensation 13 additional weeks an additional 600 per week will be added to your benefit rate until the week ending 7262020.

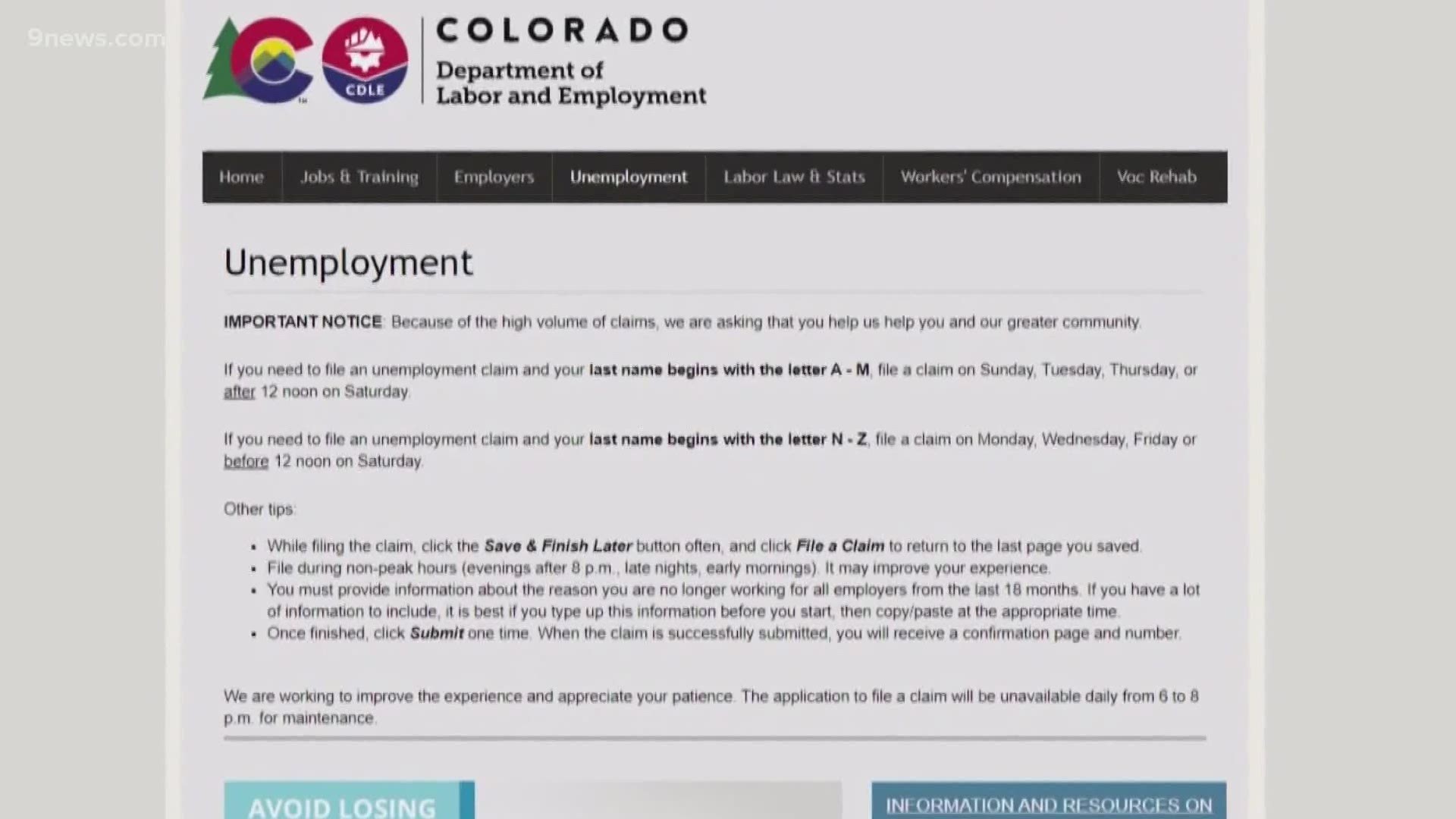

Form 8829 if you are claiming business use of your home. Guidance for self employed individuals how to file an unemployment insurance claim on new york state department of labors website personal information part i how many employers have you worked for in the past 18 months in answering this question count yourself as an employer if you were self employed.

More From Government Jobs Names List

- Government Institution Icon Png

- Examples Of Federalismgovernment Intervention

- Government Relations Officer Job Description Uae

- Us Government Publishing Office Police

- Self Employed Furlough Gov

Incoming Search Terms:

- Nys Unemployment Claims Continue To Stall Especially For Self Employed Workers Wrgb Self Employed Furlough Gov,

- How To Apply For Unemployment In New York Self Employed Furlough Gov,

- Https Labor Ny Gov Ui Pdfs Self Employed Ui Guide Pdf Self Employed Furlough Gov,

- What Is Self Employment Tax Rate Calculations More Self Employed Furlough Gov,

- New York State Unemployment Rate Is At Highest Level Since The Great Depression Self Employed Furlough Gov,

- New York State Unemployment Rate Is At Highest Level Since The Great Depression Self Employed Furlough Gov,

/GettyImages-174622133-56b0942a5f9b58b7d0242a36.jpg)

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png)