Self Employed Vat Ireland, Taxworld Ireland Irish Tax Law Legislation Online Intelligent Tax Technology

Self employed vat ireland Indeed recently has been sought by users around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of this article I will discuss about Self Employed Vat Ireland.

- How To Stop Being Self Employed In Ireland Accountant Pages

- Qlf9qt6kmkkq0m

- Covid 19 Financial Supports Announced For The Self Employed Contracting Plus Blog

- Self Employed In Ireland A Guide To Your Taxes Part 2

- When Do I Need To Register For Vat And Tax In Ireland

- How To Stop Being Self Employed In Ireland Accountant Pages

Find, Read, And Discover Self Employed Vat Ireland, Such Us:

- What S Included In Each Website Package Bizweb365 Ireland Websites For The Self Employed In Ireland

- Https Www Localenterprise Ie Sligo Files Business 20publications Vat For Small Business Pdf

- Free Small Business Ie And Expenses Excel Spreadsheet Tracker To Make Your Self Employed Tax Return Easier M In 2020 Free Spreadsheets Excel Spreadsheets Spreadsheet

- 5 Things You Must Do When You Go Self Employed Bytestart

- Revenue Form 11 The Ultimate Guide To Your Tax Returns

If you are looking for Government Canada Logo Png you've arrived at the ideal place. We have 102 graphics about government canada logo png including pictures, pictures, photos, wallpapers, and more. In such web page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Https Www Localenterprise Ie Sligo Files Business 20publications Vat For Small Business Pdf Government Canada Logo Png

Everyone is liable to pay the universal social charge usc if their gross income is over 13000 in a year.

Government canada logo png. If youre self employed in ireland then youre obliged to file a self assessed tax return usually by the deadline of october 31 or by the pay and file deadline of nov 10. Certain items are charged at lower rates for example childrens clothing is charged at the rate of 0 whereas household fuel for example gas and electricity is charged at the reduced rate of 5. Filing returns and making payments.

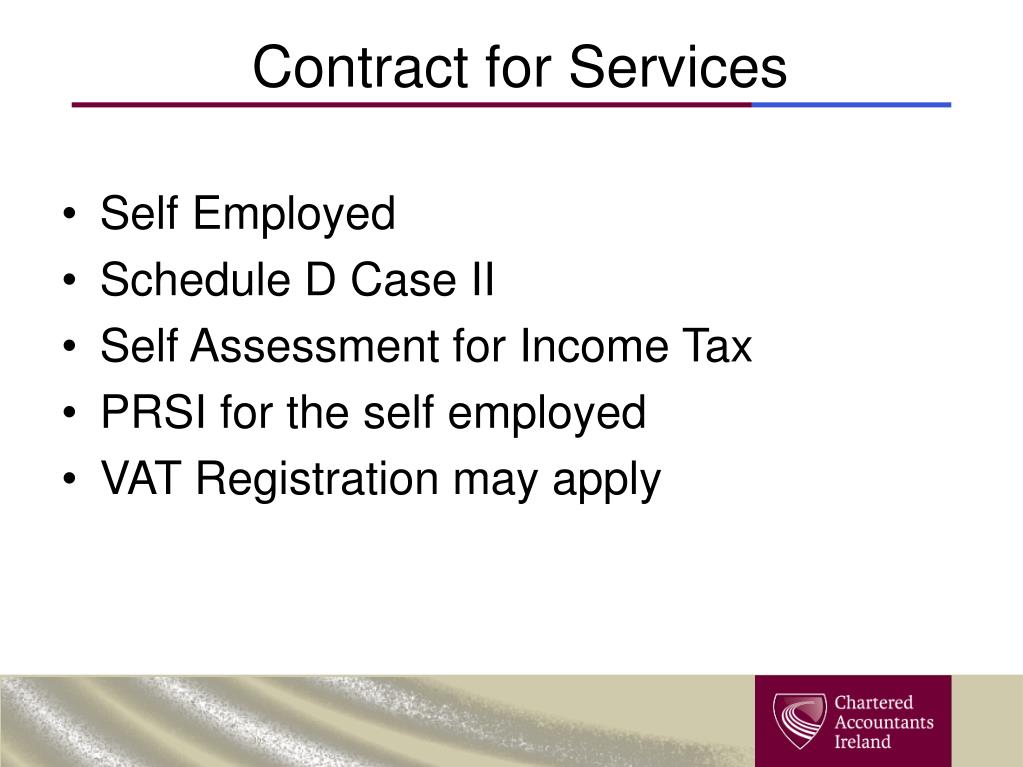

This form can be also be used to register for vat. If you sell goods then the limit is 75000. As a self employed individual you pay tax under the self assessment system.

There are also low rates for flat rate farmers. You will receive a notice of registration confirming that you are registered for income tax and if applicable for vat. The number of people who now file a self assessed tax return has shot up by 112000 in the last five years.

You need to register for vat if your company sells services and your sales are over 37500 in a year. Before you can use the system you must register with revenue as self employed for which youll need your personal public service number ppsn. Vat or value added tax sales tax.

The standard rate of vat is 20. Your tax return is used to declare income you earn and also to claim any tax allowances that can be offset against your tax bill. Universal social charge prsi and vat usc.

Some 730000 were expected to file a tax return last year according to taxback. You pay preliminary tax an estimate of tax due on or before 31 october each year and make a tax return not later than 31 october following the end of the tax year. An extra charge of 3 applies to any self employed income over 100000 regardless of age.

Business owners are obliged to register for vat if their turnover exceeds or is likely to exceed the following thresholds in any 12 month period. Value added tax vat registration is obligatory when your turnover exceeds or is likely to exceed the vat thresholds. Once you are registered as a sole trader you must use ros to both file returns and make payments.

The thresholds depend on your turnover in any continuous 12 month period. This means that self employed people pay a total of 11 usc on any income over 100000. The threshold for distance selling relies on your turnover in a calendar year.

Value added tax vat relevant contracts tax rct. When do i need to register for vat as self employed. How do i pay my taxes working as self employed in ireland.

The rates of vat are the standard rate 23 or reduced rates 9 and 135 and zero rated 0.

Taxworld Ireland Irish Tax Law Legislation Online Intelligent Tax Technology Government Canada Logo Png

More From Government Canada Logo Png

- Branches Of Government Vocabulary List

- Self Employed Benefits California

- News About Furlough Scheme

- Self Employed Courier Jobs Manchester

- Local Government Bodies

Incoming Search Terms:

- How To Stop Being Self Employed In Ireland Accountant Pages Local Government Bodies,

- 2 Local Government Bodies,

- Questions Raised As Hmrc Site Crashes On Vat Deadline Financial Times Local Government Bodies,

- Are You In Low Paid Self Employment And Considering Becoming Vat Registered Low Incomes Tax Reform Group Local Government Bodies,

- Registering For Self Employed Taxes In Ireland Including Vat Accountsireland Local Government Bodies,

- Tax Guide For Self Employed Sole Traders Lawyer Ie Local Government Bodies,