Freelance Vs Self Employed Taxes, Freelance Target Income Calculator Calculate Your Ideal Income

Freelance vs self employed taxes Indeed recently has been sought by users around us, maybe one of you personally. Individuals now are accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of the article I will talk about about Freelance Vs Self Employed Taxes.

- Employee Vs Independent Contractor Difference And Comparison Diffen

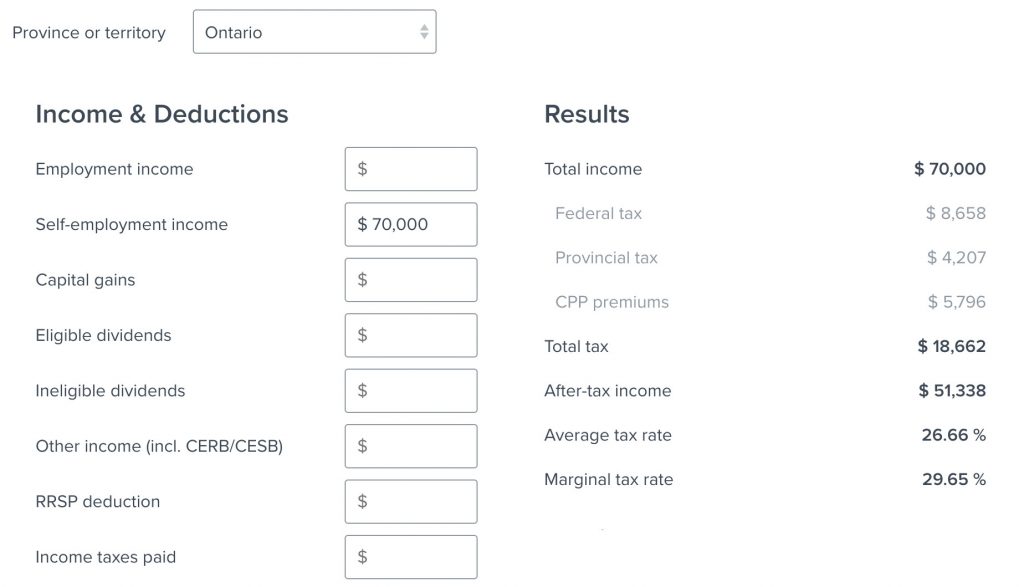

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse

- Kontist Banking For Freelancers Self Employed Sme Banking Club Magazine

- Quarterly Tax Guide For Freelancers And The Self Employed Tax Guide Quarterly Taxes Estimated Tax Payments

- Understanding Self Employment Taxes As A Freelancer Tax Queen Self Employment Tax Deductions List Tax Time

- How Self Employed Persons And Freelancers Can Effectively Reduce Tax Payment In Hong Kong Youtube

Find, Read, And Discover Freelance Vs Self Employed Taxes, Such Us:

- How To File Taxes As A Freelancer Chime

- The Epic Cheat Sheet To Deductions For Self Employed Rockstars

- How To Pay Tax As An Independent Contractor Or Freelancer

- Freshbooks Vs Quickbooks Self Employed Which Is Better For Freelancers Cleverleverage Com

- Read E Book Tax Year Diary 2019 2020 Busineb Log Book For Self Em

If you are searching for 3rd Self Employed Grant Claim Date you've arrived at the perfect location. We have 101 graphics about 3rd self employed grant claim date adding images, pictures, photos, backgrounds, and more. In such webpage, we additionally provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

The income tax has to be paid yearly before the 31st may to the finanzamt.

3rd self employed grant claim date. But as a freelancer youre considered both an employee and an employer. And some self employed people value having employees over the salary they may bring in today. 2 at a normal full time job your social security and medicare taxes are taken out of your paychecks automaticallyand your employer covers half of those taxes.

The main difference is that freelancers take on a variety of jobs from a variety of clients. Freelancers typically operate as their own business. While self employed you can typically focus on doing the same work and make money off products or services you sell freelancers may drift from client to client one day working on a webpage another day working on an ad.

The internal revenue service considers all freelancers to be self employed so heres a self employment tip. A freelancer is considered a self employed person who. Overall the tax rate is between 6 and 42.

Both freelancers and self employed individuals handle taxes the same way. Freelancers may be required to get numerous 1099 misc forms for each client they handle. Pays their own self employment taxes.

Theres no difference in taxes. Once you start earning income you are required to file your taxes as if you own your own business. If you are a freelance worker or a self employed individual you file your taxes as if you are a small business owner which means for that portion of self employed income you report that income subtract your business expenses related to earning that income and then report the remainder as your earned income for the year.

Quite often the term gets used interchangeably with independent contractor but there can be some differences. Whether youre self employed a freelancer a solopreneur or a business owner youll be required to pay self employment tax. Some independent freelancers can make way more money than a self employed individual even one with employees.

This difference only determines how youre treated in law and for tax purposes. The only tax difference you might face is if youre a business owner with things like employees and a storefront. For freelancers and self employed people the income tax will apply to everything they earn with their activities.

All that being said when it comes to money time theres no clear winner in defining yourself as freelance vs. While you can take additional deductions if you are self employed youll also face additional taxes in the form of the self employment tax. The income tax is calculated depending on the annual income the higher the income the higher the taxes.

You can be a sole trader or a limited company whether you see yourself as self employed or a freelancer and your choice will be based on how much profit you make and which one will let you pay less tax.

More From 3rd Self Employed Grant Claim Date

- Hp 246 Government Laptop Motherboard Price

- Uk Government Spending Pie Chart 2020

- Furlough Scheme Uk Replacement

- Furlough Scheme Uk Extension

- Self Employed Work Invoice Template

Incoming Search Terms:

- 5 Tips For Managing Money As A Freelance Writer The Quiet Type Self Employed Work Invoice Template,

- Tax Brackets For Self Employed Individuals In 2020 Shared Economy Cpa Self Employed Work Invoice Template,

- The Epic Cheat Sheet To Deductions For Self Employed Rockstars Self Employed Work Invoice Template,

- Set Freelance Rates By Starting With This Expense Formula Nation1099 Self Employed Work Invoice Template,

- Bir Tax Guide For Self Employed Professionals And Freelancers Self Employed Work Invoice Template,

- The Freelance Drone Pilot Guide To Success Self Employed Work Invoice Template,