Furlough Scheme Rules For Directors, Potential Hmrc Penalties Directors And Furlough Scheme Fraud Hmrc Tax Disputes Solicitors Barristers

Furlough scheme rules for directors Indeed lately has been sought by users around us, maybe one of you. People are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of this post I will discuss about Furlough Scheme Rules For Directors.

- Chancellor Extends Self Employment Support Scheme And Confirms Furlough Next Steps Gov Uk

- What Is The Job Retention Scheme Patterson Hall Chartered Accountants

- Coronavirus Job Retention Scheme Get The Details Right Accountingweb

- 1 000 Bonus May Not Be Enough To Protect Jobs Bbc News

- Coronavirus Job Retention Scheme How To Furlough Workers The Legal Partners

- Iod Calls On Gov T To Include Director Dividends In 80 Furlough Scheme Citywire

Find, Read, And Discover Furlough Scheme Rules For Directors, Such Us:

- Cdc Director Says Coronavirus Vaccine Received T Be Extensively Accessible Till Late 2021 Spontac News

- Coronavirus Job Retention Scheme Can Directors Furlough Themselves Insights Bishop Fleming

- How Will Hmrc Deal With Furlough Fraud Davis Grant

- Iod Calls On Gov T To Include Director Dividends In 80 Furlough Scheme Citywire

- Bringing Employees Back To Work The Chancellor Announces Furlough Scheme Flexibility From 1 July Lexology

If you re searching for Government Expenditure Formula you've come to the right location. We ve got 102 images about government expenditure formula including images, photos, pictures, wallpapers, and much more. In such web page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

The iod said the new edict appeared to prevent a furloughed.

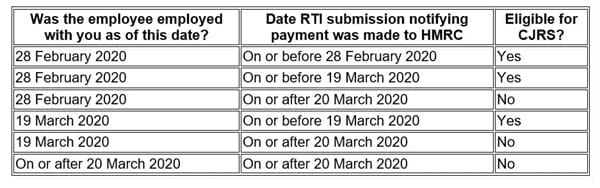

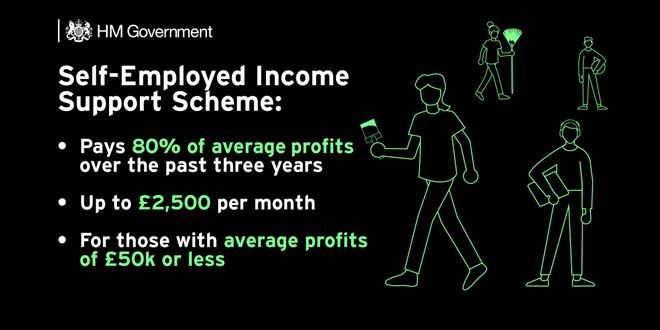

Government expenditure formula. Hmrc confirmed in early april that company directors would be eligible for the coronavirus job retention scheme cjrs. However while the principle is welcome there are a number of reasons why in practice the scheme may not suit all shareholder directors. Furthermore sole directors of their own companies would be able to furlough themselves.

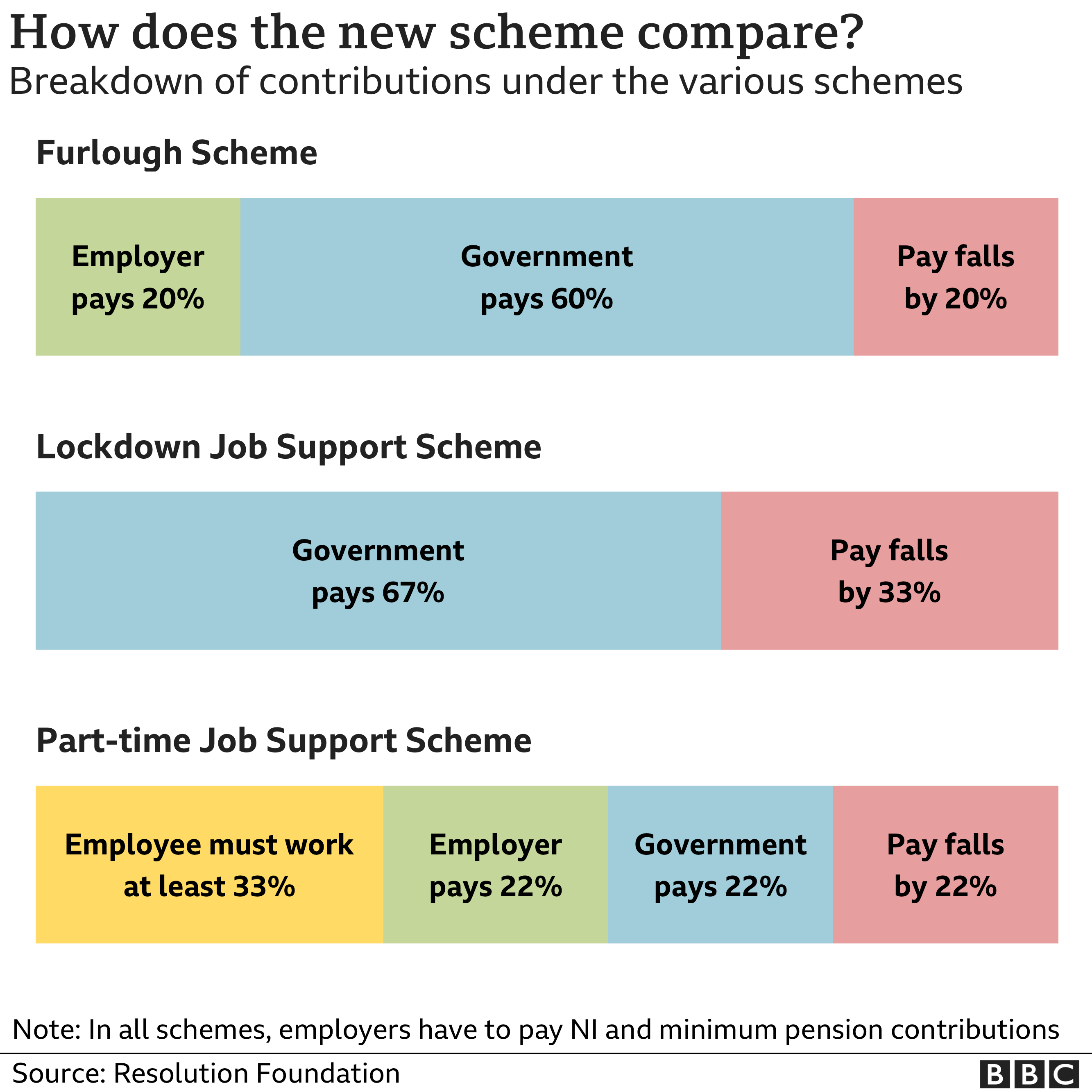

The coronavirus job retention scheme cjrs better known as the furlough scheme will be extended for another month following the announcement of a new national lockdown. Under the coronavirus jobs retention scheme. Non executive directors are not permanent employees so would not qualify.

Hm revenue customs has warned it will impose a penalty on directors who deliberately flout the rules of the governments coronavirus furlough scheme. Hours before the furlough scheme was due to end the government announced it would be extended until december to cover a further lockdown in england. Yesterday the treasury published new instructions that has been described by the institute of directors iod as more restrictive than hmrcs coronavirus job retention scheme guidance available online.

Between march and july the government paid for 80 of furloughed workers wages up to 2500 a month and it also covered employers national insurance ni and. No work unless statutor. Depending on the size and needs of the company it may be possible to furlough one or more directors.

During hours which you record your employee as being on furlough employees who are pension scheme trustees or trustee directors of a corporate trustee may undertake trustee duties in relation to. The att has requested guidance from hmrc on how directors should proceed under the flexible scheme. In the meantime any directors claiming under the mark two scheme for flexible furlough should keep good evidence of the work that they are doing the hours that they are actually working and how they determined their usual hours.

Directors can be furloughed after the first couple of versions of the guidance issued by hmrc it was subsequently clarified that directors can be furloughed and claim 80 of pay under the job retention scheme as long as the director is paid via the payroll paye system. The government has been accused of providing conflicting advice over what activities directors can carry out while furloughed.

Covid 19 Government Support Directors Duties And Responsibilities As An Employer Foot Anstey Government Expenditure Formula

More From Government Expenditure Formula

- Uk Government Spending 2019 Pie Chart

- Crown Uk Government Logo

- Government Clipart Png

- Us Government Publishing Office

- Government Guarantee Scheme 20

Incoming Search Terms:

- Manufacturers Call For Extensions To Furlough Scheme Government Guarantee Scheme 20,

- Architects Warned Over Misuse Of Covid 19 Furlough And Income Support Schemes Government Guarantee Scheme 20,

- Covid Redundancy Warning In Lockdown Appeal To Treasury Bbc News Government Guarantee Scheme 20,

- Coronavirus A Third Of Furloughed Employees Asked To Work While Firms Get Government Handouts Uk News Sky News Government Guarantee Scheme 20,

- Coronavirus Covid 19 Do The Furlough Provisions Apply To Company Directors And Members Of Llps Lexisnexis Blogs Government Guarantee Scheme 20,

- Changes To The Coronavirus Job Retention Scheme From 1 July 2020 Charity Tax Group Government Guarantee Scheme 20,