Furlough Scheme Rules For Employers, Coronavirus Job Retention Scheme Update Flexible Furloughing And Reducing Government Contributions Business West

Furlough scheme rules for employers Indeed recently has been sought by users around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the title of the post I will discuss about Furlough Scheme Rules For Employers.

- Many Firms Will Fall Between The Gaps Of Furlough Extension Say Experts

- Coronavirus Job Retention Scheme What Employers Should Do

- Job Retention Schemes During The Covid 19 Lockdown And Beyond

- Https Www Rec Uk Com Download File View 2783

- Furlough Scheme Still Shutting Out New Starters Not Paid Before 19 March Personnel Today

- Flexible Furloughing What Is It And Why Is 10 June Important Low Incomes Tax Reform Group

Find, Read, And Discover Furlough Scheme Rules For Employers, Such Us:

- Flexible Furlough Scheme Additional Update Dorset Chamber Of Commerce And Industry

- The Evolution Of The Furlough Scheme Employers Next Steps Personnel Today

- Hundreds Report Employers To Hmrc Over Furlough Fraud Personnel Today

- Updated Coronavirus Job Retention Scheme Mitchell Charlesworth

- Uk Furlough Scheme Faqs News Views

If you are searching for Government Unemployment Insurance Tends To you've reached the right place. We have 100 graphics about government unemployment insurance tends to including images, photos, pictures, wallpapers, and more. In these page, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Covid 19 Furlough Under Job Retention Scheme Faqs Make Uk Government Unemployment Insurance Tends To

This is the case regardless of whether the 3 consecutive week minimum.

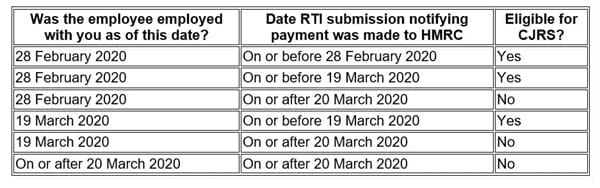

Government unemployment insurance tends to. It has been estimated that over 84 million workers have been furloughed in light of the coronavirus pandemic. Furlough rules explained for employers and employees. The same rules about working apply and employees are not allowed to undertake any work for their employer.

Between march and july the government paid for 80 of furloughed workers wages up to 2500 a month and it also covered employers national insurance ni and. Under the coronavirus jobs retention scheme to give furlough its official title employees placed on leave receive 80 of their pay up to a maximum of 2500 a month. This scheme started on march 1 2020 and is open to uk employers until june 2020 though the chancellor has said it could be extended.

The government has extended the furlough job retention scheme until october 2020 although specific details of the scheme from august are yet to be clarified. The minimum amount of time you can be furloughed for is. This means the extended furlough scheme is more generous.

What is the furlough scheme. With a quarter 75 million of the uk workforce on furlough both employers and employees must understand the rules of the scheme. Under the extended scheme the cost for employers of retaining workers will be reduced compared to the current scheme which ends today.

This demonstrates the significant impact it has had redundancy during or after furlough. Employers will be able to bring back furloughed employees part time from july 2020 and be responsible for paying this proportion of their wages. The coronavirus job retention scheme cjrs better known as the furlough scheme will be extended for another month following the announcement of a new national lockdown.

Where the employee starts a furlough period before 1 july this furlough period must be for a minimum of 3 consecutive weeks. The scheme remains as it currently is so employers can continue to furlough staff and receive 80 of their pay for the time they are furloughed. Whilst the governments job retention scheme was designed to avoid as many redundancies as possible it is inevitable that some employees will be made redundant during or following furlough.

Coronavirus Job Retention Scheme 10 June Cut Off And Flexible Furloughing From July Osborne Clarke Osborne Clarke Government Unemployment Insurance Tends To

More From Government Unemployment Insurance Tends To

- Furlough Retention Scheme 1000

- Government Jobs 2020 For 12th Pass Female In Delhi

- What Is Furlough Days

- Government Karnataka Logo

- Needs Of Government System Accounting

Incoming Search Terms:

- Coronavirus What Does Furlough Mean And How Will It Affect Workers Worldwide World Economic Forum Needs Of Government System Accounting,

- Covid 19 Furlough Under Job Retention Scheme Faqs Make Uk Needs Of Government System Accounting,

- The Winter Economy Plan Is Coming Resolution Foundation Needs Of Government System Accounting,

- Krv3ac9by0qqqm Needs Of Government System Accounting,

- Https Www Rec Uk Com Download File View 2783 Needs Of Government System Accounting,

- Covid Redundancy Warning In Lockdown Appeal To Treasury Bbc News Needs Of Government System Accounting,