Self Employed Jobkeeper, Jobkeeper 2 0 Oct Update Victoria On The Road To Restarting

Self employed jobkeeper Indeed recently has been sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to see image and video information for inspiration, and according to the name of this article I will talk about about Self Employed Jobkeeper.

- Job Keeper Is Available To Uber Drivers Uber Drivers Forum

- Jobkeeper Extension What This Means To Business And Employees Chan Naylor Property Business Tax Accountants

- Covid 19 Explainer Jobkeeper 1500 Fortnightly Payment

- 1 500 Jobkeeper Subsidy To Keep Staff Employed

- Jobkeeper And Jobseeker Information For Photographers

- Jobkeeper Extension What You Need To Know Heal Thy Money Co

Find, Read, And Discover Self Employed Jobkeeper, Such Us:

- What The Jobkeeper Payment Scheme Means For Businesses Ldb Group

- Jobkeeper 2 0 Other Measures Juggernaut Advisory

- Jobkeeper Program Australian Government Wage Subsidies During Covid 19 Keypay

- Https Www Ioe Emp Org Index Php Eid Dumpfile T F F 147549 Token Eb3d2ebb5d4d7968642bfb1cef7170c592b5197e

- The Government S Jobkeeper Payment Explained Abacus Wealth Solutions

If you re looking for Self Employed Pension Plans you've arrived at the right location. We have 100 images about self employed pension plans adding images, photos, photographs, backgrounds, and more. In such webpage, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

Are sole traders and self employed people eligible for jobkeeper payments.

Self employed pension plans. This summary is for self employed individuals that run a business. After this you should receive jobkeeper payments within five business days. If the sole trader or the self employed business is receiving jobkeeper payments for eligible employees they will then need to use the payments to pay their employees wages.

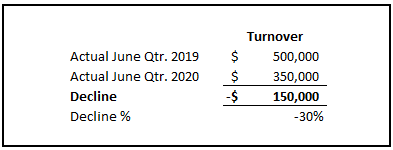

The system is designed around jobkeeper fortnights. The virtual mybusiness week 2020 continues on 1 october. Sole traders that have seen the revenue from their business affected by covid 19 are eligible to receive the.

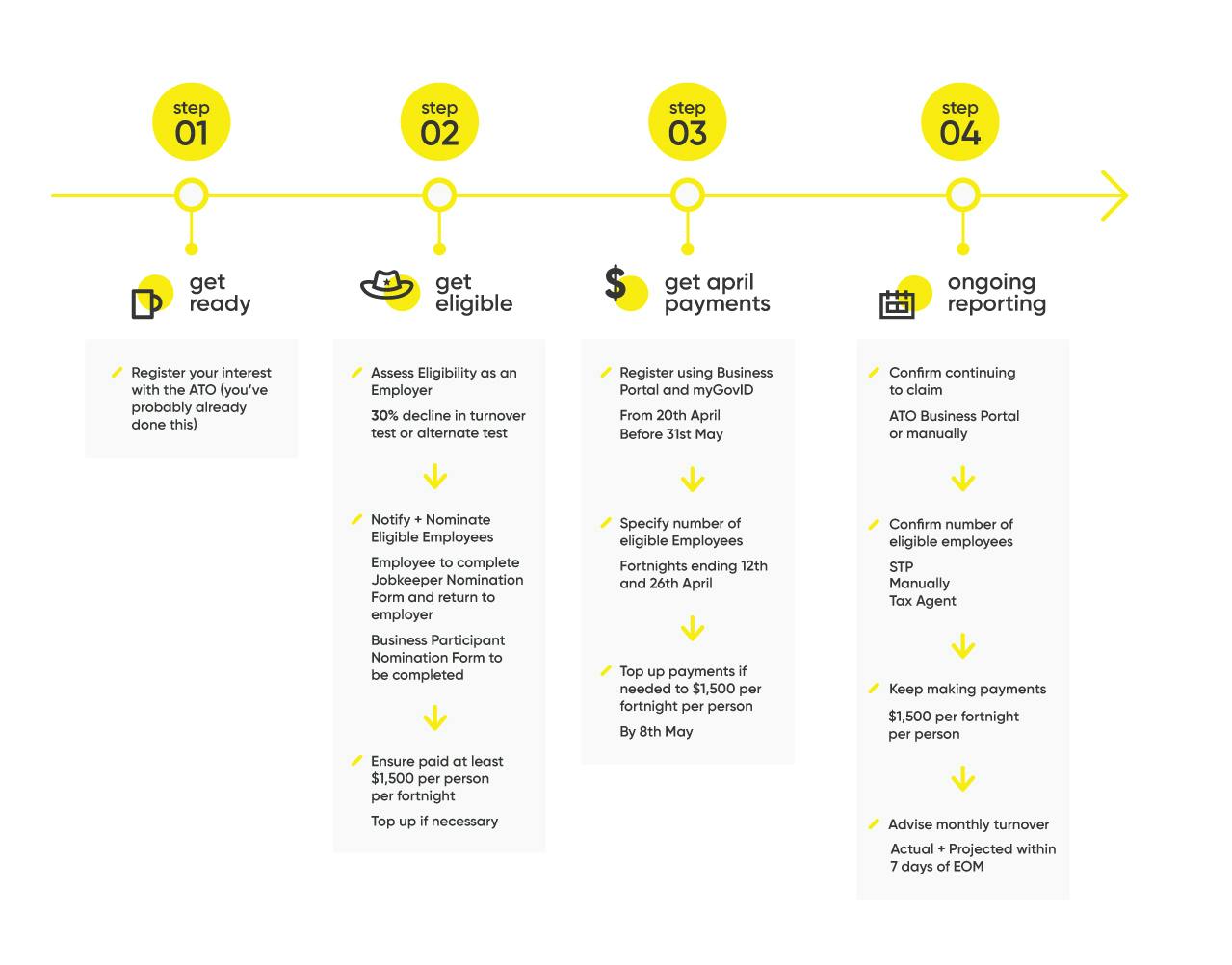

Ato jobkeeper guide for sole traders including jobkeeper 20 changes for other self employed entities. Employees do not need to complete another nomination notice. From 30 march 2020 eligible sole traders and self employed people that operate via a partnership trust or company can claim 1500 per fortnight for 6 months ending 27 september 2020 with the first payments being made in the first week of may.

Ms fish advised self employed workers to keep a reliable account of the records they have that could substantiate the 80 hours working on or in their business during the february period. I physically cant pay myself 1500fortnight. If you have already enrolled for jobkeeper you do not need to re enrol for the jobkeeper extension.

The australian government has introduced the jobkeeper subsidy to enable coronavirus effected businesses to bounce back after the crisis. Sole traders and self employed businesses will receive the jobkeeper payments monthly in arrears directly from the ato. The first fortnight starts on 30 march 2020 with the final fortnight ending on 27 september 2020.

You will need to check your actual decline in turnover for continuing eligibility from 1 october 2020 and again from 1 january 2021. The jobkeeper payment will be available to eligible businesses including the self employed and not for profits until 28 march 2021. If there are additional checks required or any errors made on your form it may take some additional time for us to resolve.

Partnerships companies and trusts see companion ato guide sole traders may be eligible for the jobkeeper payment under the business participation entitlement if their business has experienced a decline in turnover according to the eligibility criteria. The jobkeeper guide for sole traders will help you through steps 1 3 of your jobkeeper application. Hi i was just wondering how sole tradersself employed people go about applying for jobkeeper.

The jobkeeper payment is a scheme to support businesses and not for profit organisations significantly affected by covid 19 to help keep more australians in jobs. Our part 1 summary was for employees of business entities. There are 5 key steps for this aspect of jobkeeper.

More From Self Employed Pension Plans

- Government Job Retention Scheme Furlough Portal

- Self Employed Dbs Check Online

- Bangladesh Government Logo Png

- Self Employed Unemployment Benefits

- Furlough Scheme Extension After October

Incoming Search Terms:

- Https Www Ioe Emp Org Index Php Eid Dumpfile T F F 147549 Token Eb3d2ebb5d4d7968642bfb1cef7170c592b5197e Furlough Scheme Extension After October,

- 1 500 A Fortnight Jobkeeper Wage Subsidy In Massive 130 Billion Program Furlough Scheme Extension After October,

- Extension Of The Jobkeeper Payment Salisbury Accountants Furlough Scheme Extension After October,

- Https Www Highview Com Au Wp Wp Content Uploads 2020 04 Jobkeeper Payment Faq Self Employed Covid19 12apr2020 Pdf Furlough Scheme Extension After October,

- Covid 19 Jobkeeper Package Mbc Accountants Furlough Scheme Extension After October,

- 1 500 Jobkeeper Subsidy To Keep Staff Employed Quantum Advisory Furlough Scheme Extension After October,