Self Employed Jobkeeper Eligibility, The Federal Government Of Australia Wage Subsidy Scheme Job Keeper Allowance 30 March 2020 Rostron Carlyle Rojas Lawyers

Self employed jobkeeper eligibility Indeed lately has been hunted by users around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of the post I will discuss about Self Employed Jobkeeper Eligibility.

- Covid 19 Stimulus 3 Jobkeeper Payment Cruz And Co

- 2

- Uber Driver S Guide To Jobkeeper Jobseeker Coronavirus Payments

- Our Step By Step Guide To Applying For Jobkeeper Payment Businessdepot

- Simon Jones Co Jobkeeper Programme

- The Federal Government Of Australia Wage Subsidy Scheme Job Keeper Allowance 30 March 2020 Rostron Carlyle Rojas Lawyers

Find, Read, And Discover Self Employed Jobkeeper Eligibility, Such Us:

- Adjustments To Employee Eligibility For Jobkeeper Account Able Accountants Pty Ltd

- 130 Billion Jobkeeper Payment Official Website Of Dan Tehan Member For Wannon

- Gartly Advisory Accountants August 2020 Newsletter Jobkeeper Updates Rental Property Covid19 By Gartly Advisory Issuu

- Jobkeeper Enrolment Form

- 2

If you are looking for Government Whip Definition you've come to the perfect location. We ve got 100 images about government whip definition including images, pictures, photos, backgrounds, and more. In such webpage, we also have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

This summary is for self employed individuals that run a business.

Government whip definition. My company has had its income reduced by about 90 and fits all other eligibility requirements. Speaking exclusively at mybusiness week ato deputy commissioner for small business kirsten fish said that like businesses with employees self employed workers also have an. The jobkeeper payment is a scheme to support businesses and not for profit organisations significantly affected by covid 19 to help keep more australians in jobs.

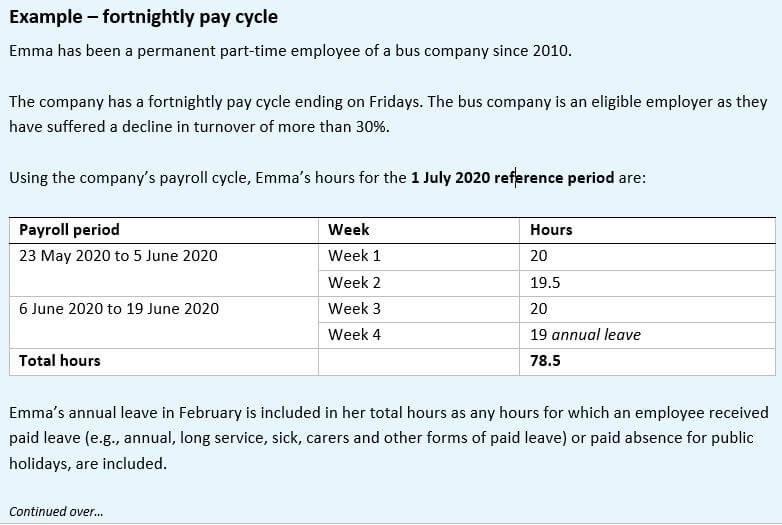

The system is designed around jobkeeper fortnights. If there are additional checks required or any errors made on your form it may take some additional time for us to resolve. From 30 march 2020 eligible sole traders and self employed people that operate via a partnership trust or company can claim 1500 per fortnight for 6 months ending 27 september 2020 with the first payments being made in the first week of may.

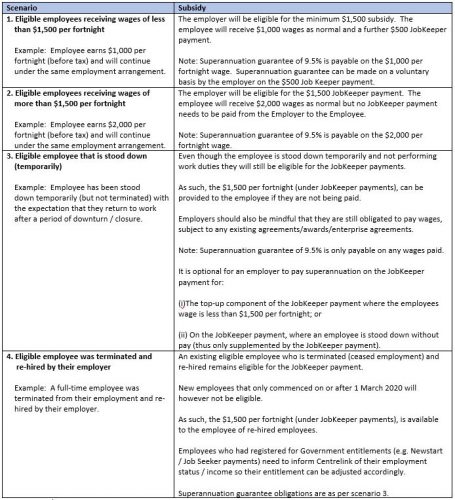

Employers may be eligible for the jobkeeper payment scheme if all the following apply. The first fortnight starts on 30 march 2020 with the final fortnight ending on 27 september 2020. Our part 1 summary was for employees of business entities.

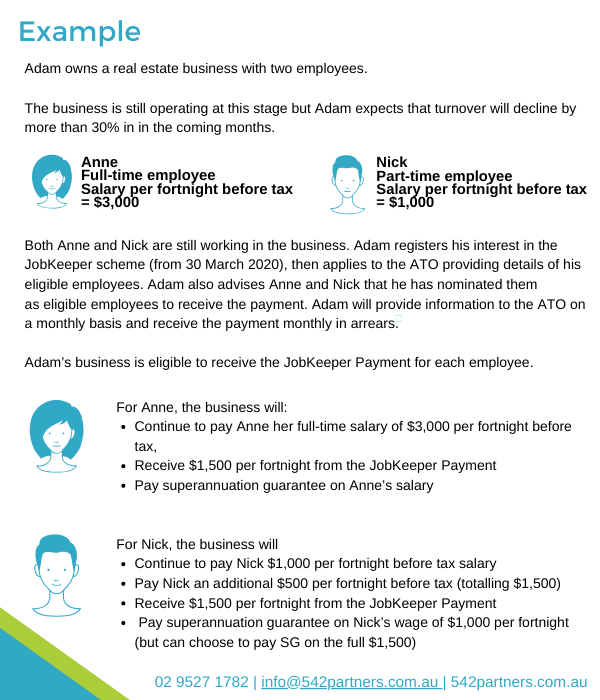

The jobkeeper payment is administered by the australian taxation office ato. Determine the payment rate you are eligible to claim for each of your eligible employees. The australian government has introduced the jobkeeper subsidy to enable coronavirus effected businesses to bounce back after the crisis.

You employed at least one eligible employee during the jobkeeper fortnight you are applying for. The jobkeeper payment will be available to eligible businesses including the self employed and not for profits until 28 march 2021. Self employed persons who meet the income test.

There are 5 key steps for this aspect of jobkeeper. To be eligible to receive the payment you need to be between the age of 22 and pension age meet residence rules and pass the income test. Provided they meet the eligibility criteria see below sole traders will receive 1500 per fortnight before tax per eligible employee which can also include themselves if they are self employed.

You must pay your eligible employees at least the jobkeeper amount in the jobkeeper fortnight to claim the jobkeeper payment for that fortnight. This includes employees who are stood down or re hired. I am self employed director but only pay myself a small fortnightly wage through my company trust set up and i have a permanent part time job elsewhere where i currently claim the tax free threshold.

After this you should receive jobkeeper payments within five business days. Thinking about self managed super.

More From Government Whip Definition

- Australian Government Spending 2019

- Self Employed Income Support Scheme Login

- 2020 Calendar With Government Holidays In Tamilnadu

- Self Employed Quickbooks

- Self Employed Payment

Incoming Search Terms:

- Jobkeeper Payment Flowchart Eligible Employees Self Employed Payment,

- The Jobkeeper Subsidy Is Your Business Eligible Dfk Everalls Business Taxation Advice Canberra Self Employed Payment,

- Lozzdgmxarappm Self Employed Payment,

- 1500 Jobkeeper Subsidy To Keep Staff Employed Self Employed Payment,

- Jobkeeper Subsidies For Sole Traders How Do I Know If I M Eligible And How Much Money Will I Get Smartcompany Self Employed Payment,

- The Federal Government Of Australia Wage Subsidy Scheme Job Keeper Allowance 30 March 2020 Rostron Carlyle Rojas Lawyers Self Employed Payment,