Self Employed Bounce Back Loan Natwest, Hundreds Of Thousands Of Small Businesses Blocked From Coronavirus Loans As Banks Close Doors To New Customers

Self employed bounce back loan natwest Indeed lately has been hunted by users around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of the post I will discuss about Self Employed Bounce Back Loan Natwest.

- Support With Bounce Back Loans

- A Guide To Bounce Back Loans Help For Small Businesses And Self Employed Compare Uk Quotes

- Natwest The Four Main Accounts Available To British Businesses Personal Finance Finance Express Co Uk

- Bounce Back Loan Uber Drivers Forum

- Bounce Back Loan Fraud Hotline But No Helpline For Applicants Mr Bounce Back Bounce Back Loan Complaints

- Natwest Is Offering 175 To New And Current Customers To Switch Bank Account Personal Finance Finance Express Co Uk

Find, Read, And Discover Self Employed Bounce Back Loan Natwest, Such Us:

- Natwest The Four Main Accounts Available To British Businesses Personal Finance Finance Express Co Uk

- July 21st Bounce Back Loans Update Mr Bounce Back Bounce Back Loan Complaints

- Coronavirus Update 4 May Bounce Back Loans Launched Latest Covid 19 News

- Bounce Back Loan Help Desk Home Facebook

- Mse To Refer Starling Bounce Back Loan Complaints To Regulator

If you are looking for Self Employed Covid Grant Ireland you've reached the right place. We ve got 100 graphics about self employed covid grant ireland adding pictures, photos, photographs, wallpapers, and more. In such web page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

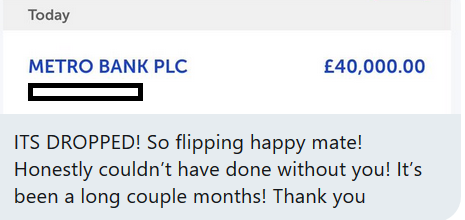

The bounce back loan scheme is open to applications until 30 november 2020.

Self employed covid grant ireland. With unprecedented demand were currently prioritising existing customers. Lloyds and natwest are offering loans to their business customers but they must already be. Bounce back loans dont affect your eligibility for other government personal support.

The government provides lenders like natwest with a guarantee for 100 of the loan. If you opened a natwest business bank account after this date you will not be able to apply for a bounce back loan with us. Bounce back loans are available to existing natwest customers on or before 4 may 2020.

Weve confirmed this with a number of individual lenders. The bounce back loan scheme was launched in may 2020 amid fears that the previous coronavirus funding would not be provided quickly enough for self employed workers and small businesses to get back to work as restrictions eased. Theres no need to contact us at this time.

The bounce back loan scheme is a government initiative to support small and medium sized businesses. Here are all the facts you need to know about bounce back loans and how they. A loan under the scheme is a business loan.

Bounce back loans can be used to repay existing finance. A lender may consider paying the funds into a personal current account if no business bank account is held if the business has been satisfactorily evidenced. Were working through the details and will be in touch when we have more information.

The terms of the loan are covered by the scheme. 8 bounce back loan need to knows. The deadline for new government loan scheme applications has been extended to 31 january 2021.

The government has also announced top ups for existing bounce back loans. Martin lewis explains how self employed and company directors can apply for bounce back loan help. Is the loan available under the bounce back loan scheme a personal loan or a business loan.

The government has also announced top ups for existing bounce back loans. You can still apply for a bounce back loan and get the self employment income support grants and you may still be eligible for universal credit. To access a bounce back loan please contact your current bank.

4 may 2020 businesses that were undertakings in difficulty on 31 december 2019 can apply.

Business Bounce Back Loan Bbbl Update And How To Apply Pma Accountants Self Employed Covid Grant Ireland

More From Self Employed Covid Grant Ireland

- Furlough Scheme Rules For Self Employed

- Government Bonds India 2020

- Government Vouchers Malta Validity

- Local Government Taxes Philippines

- Qld Government Logo Transparent

Incoming Search Terms:

- Coronavirus Natwest Qld Government Logo Transparent,

- Support With Bounce Back Loans Qld Government Logo Transparent,

- Natwest How Savers Can Access 3 Percent Interest Rate As Uk Savings Account Rates Slashed Personal Finance Finance Express Co Uk Qld Government Logo Transparent,

- Natwest Closes Small Business Accounts After Covid Loan Applications Qld Government Logo Transparent,

- Bounce Back Loan Help Desk Home Facebook Qld Government Logo Transparent,

- Natwest Launches App Only Bank Account Bo But Is It Any Good Qld Government Logo Transparent,