Government Bond Funds Risk, Dynamic Bond Fund Income Fund Vs Dynamic Bond Fund

Government bond funds risk Indeed recently is being hunted by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the title of this article I will discuss about Government Bond Funds Risk.

- Reading Bond Fund Fact Sheets 1 Common Categories Of Bond Funds Bond Duration Bonds Finance

- What Are Government Bonds Learn About Bonds

- 2

- Top 10 Best Government Bond Mutual Funds 2012 Mepb Financial

- Short Duration Bond Funds Icdportal

- 2

Find, Read, And Discover Government Bond Funds Risk, Such Us:

- Why Mutual Funds Are Running Away From Risk Free Government Bonds

- 9 Best Municipal Bond Funds To Buy And Hold Buy And Hold Strategy Us News

- A Guide To Investing In Bond Funds Smartasset

- The Problem With Eurozone Government Bonds And What To Do About It February 2019 Index Fund European Investor

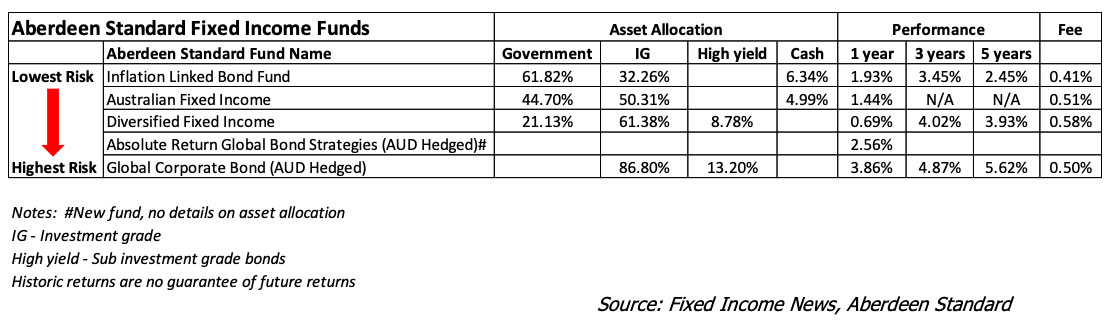

- Selecting Funds For Your Orso

If you are looking for Government Icon White Background you've reached the ideal place. We ve got 104 graphics about government icon white background adding images, photos, photographs, backgrounds, and much more. In these page, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

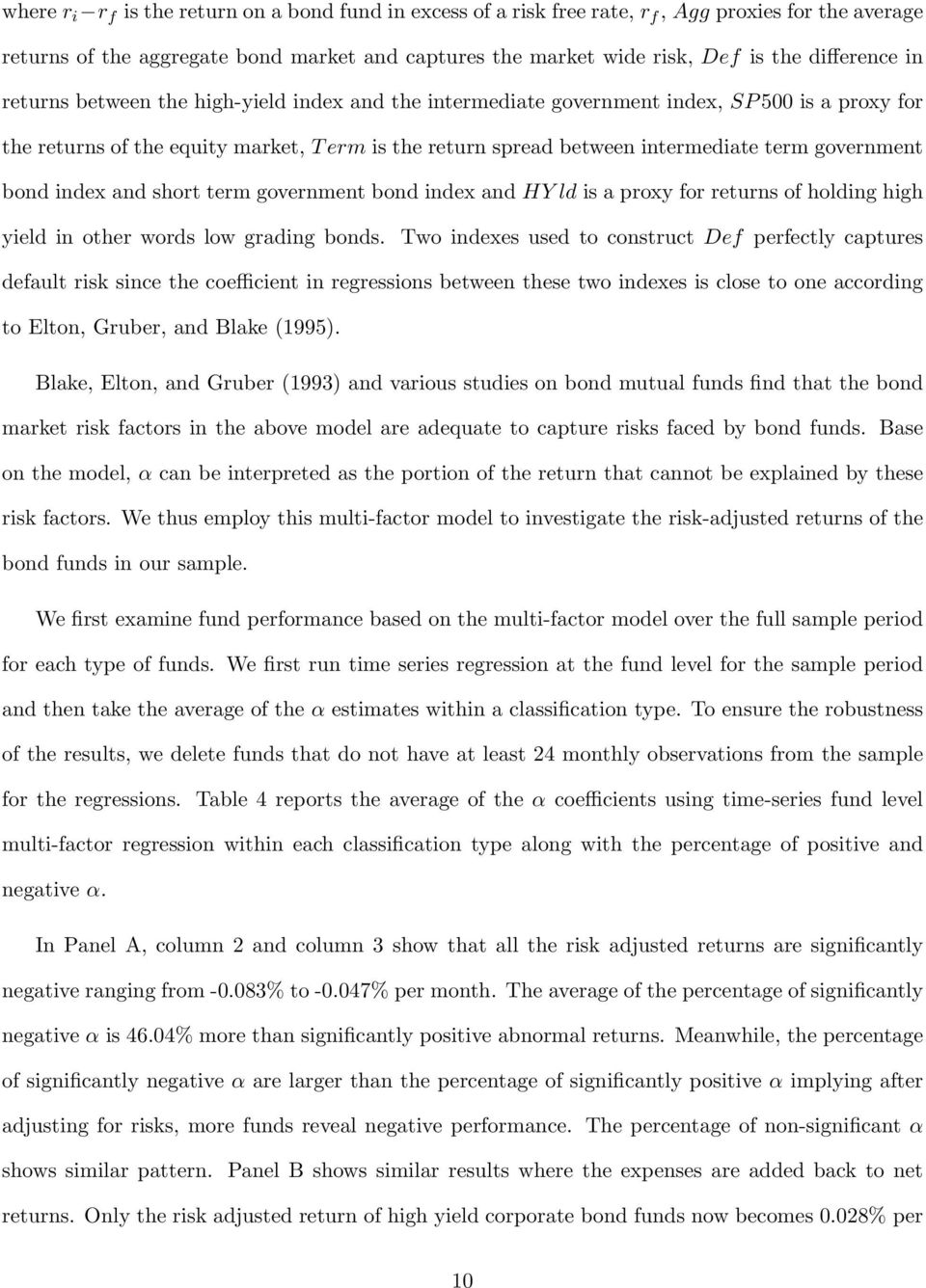

Fixed rate government bonds can have interest rate risk which occurs when interest rates are rising and investors are holding lower paying fixed rate bonds as compared to the market.

Government icon white background. Individual investors buying bonds can generally expect risk to trend downward as bonds age and approach. Although bonds are considered safe there are pitfalls like interest rate riskone of the primary risks associated with the bond market. For instance the yield on the indian 10 year note is over 7 these days while quality corporate bonds of a similar length average about half of this amount.

This isnt an issue if you plan to hold an individual bond until maturity but if you sell a bond before its maturity dateor if you own a mutual fund or etf that focuses on higher rated bondsyou are still taking on the risk of principal loss no matter how highly rated the investments. Bond funds are particularly sensitive to interest rate risk since unlike individual bonds they dont have a maturity date. See risk data for jpmorgan government bond fund hlgax.

Treasury bonds t bonds as risk free investments. However as with treasury notes even high rated bonds are at risk of short term principal loss if interest rates rise. While there is almost always a ready market for government bonds corporate bonds are sometimes entirely different animals.

Reinvestment risk means a bond or future cash flows will. In this way funds can lose value and investors dont have the certainty of receiving all of their principal back at some point in the future. Risk can fluctuate with bond funds because the fund is constantly buying and selling bonds.

The united states government has never defaulted on a debt or. This narrows the risk factors but it also means that government bonds and bond funds are acutely sensitive to interest rates mckeon says. An analogy often used is a teeter totter he says.

Research information including volatility and modern portfolio theory statistics beta r squared etc for jpmorgan government bond fund.

More From Government Icon White Background

- Traditional Government Office Interior

- Government Office Clipart

- New Furlough Rules From November Hmrc

- Self Employed Person Income Relief Scheme Extended

- Federal Government Forms W 9

Incoming Search Terms:

- Short Duration Bond Funds Icdportal Federal Government Forms W 9,

- 2 Federal Government Forms W 9,

- Corporate Bonds Or Government Bonds Lysander Funds Ltd Federal Government Forms W 9,

- Investor S Guide To U S Treasury Securities Project Invested Federal Government Forms W 9,

- Duration Pages 1 2 Flip Pdf Download Fliphtml5 Federal Government Forms W 9,

- 9 Bond Fund Risks To Evaluate Michael D Hakerem Cfa Federal Government Forms W 9,