Government Bonds Are Issued By Which Of The Following Financial Institutions, A Brief Introduction To China S Bond Market

Government bonds are issued by which of the following financial institutions Indeed recently is being sought by consumers around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of the article I will talk about about Government Bonds Are Issued By Which Of The Following Financial Institutions.

- Https Www Banking Senate Gov Download 73114 Anginer Testimony

- Http Www Bis Org Publ Qtrpdf R Qt0312h Pdf

- Chapter 5 Developing A Primary Market For Government Securities Developing Government Bond Markets A Handbook

- Bank Qualified Debt

- Where Can I Buy Government Bonds

- Http Documents1 Worldbank Org Curated En 129961580334830825 Pdf Staff Note For The G20 International Financial Architecture Working Group Ifawg Recent Developments On Local Currency Bond Markets In Emerging Economies Pdf

Find, Read, And Discover Government Bonds Are Issued By Which Of The Following Financial Institutions, Such Us:

- Government Bond Definition

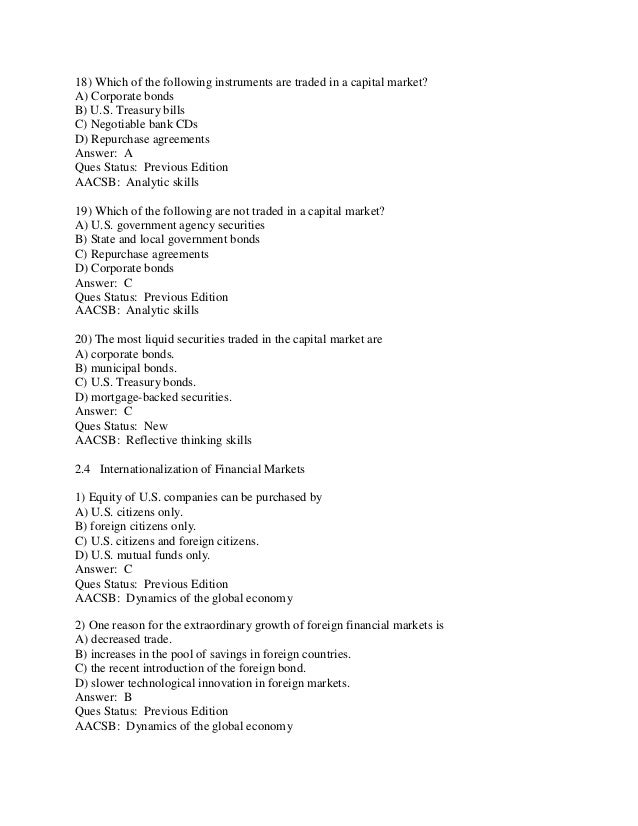

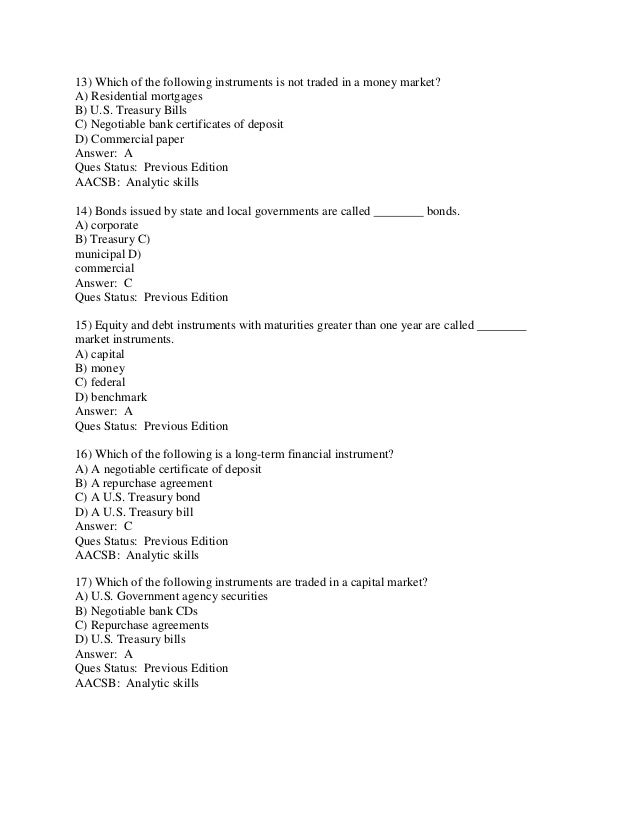

- Test Bank For Economics Of Money Banking And Financial Markets 10th E

- Chapter 1 China S Bond Market Characteristics Prospects And Reforms Excerpt The Future Of China S Bond Market

- Banks As Buyers Of Last Resort For Government Bonds Vox Cepr Policy Portal

- Market Value Of U S Government Debt Dallasfed Org

If you re searching for Government Quarantine Facilities Kerala you've reached the perfect place. We have 102 graphics about government quarantine facilities kerala adding images, photos, photographs, backgrounds, and more. In these page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Test Bank For Economics Of Money Banking And Financial Markets 10th E Government Quarantine Facilities Kerala

It is popular because it does not.

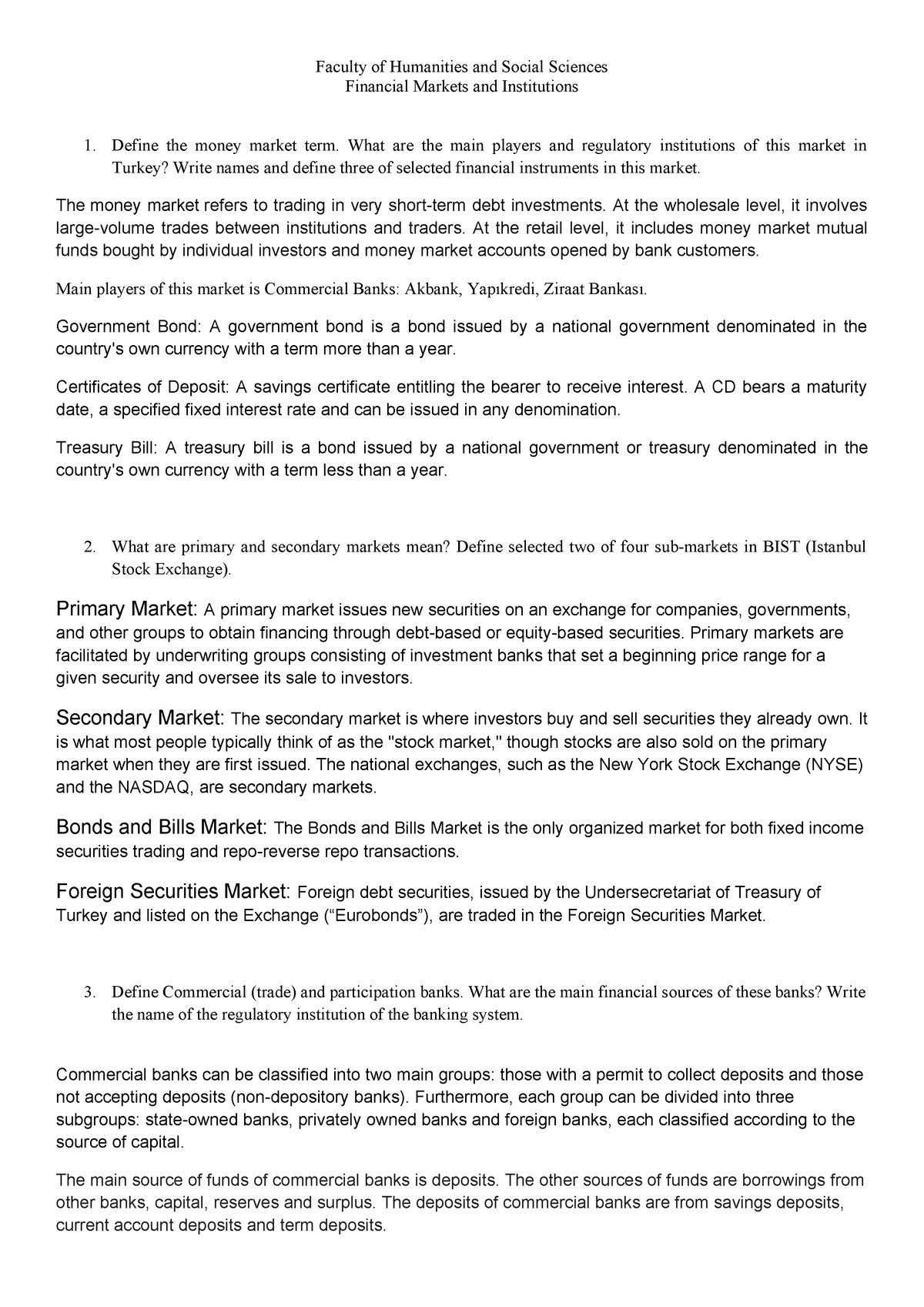

Government quarantine facilities kerala. The sale of bonds to raise money. Which of the following financial institutions would typically invest the largest portions of its funds in home mortgage loans. Government began monitoring lending practices of financial institutions making it more difficult to issue mortgages.

Government debt also known as public interest public debt national debt and sovereign debt contrasts to the annual government budget deficit which is a flow variable that equals the difference between government receipts and spending in a single year. A government bond is a debt security issued by a government to support government spending. The reduced yield is attributed to the federal governments ability to print money and collect tax revenue which significantly lowers their chance of default.

This is precisely the purpose of bonds issued by the central government. Institutions are where the financial advisers work. Treasury bonds politicians like raising money by selling bonds as opposed to raising taxes because voters hate taxes.

Before the beginning of every financial year the central government announces its financial budget its anticipated expenditures and sources of revenue. Investment bonds are issued by thousands of different governments government agencies municipalities financial institutions and corporations. Institutions that sell shares to the public and use the procceds to buy portfolios of stocks and bonds.

Interest rate risk is the risk financial institutions face due to changes in market interest rates. They all pay interest. Of course when the.

This is an example of funds being transferred from a saver to a user. Following are some important considerations about each of the major kinds of bonds. One investment maturity strategy popular among smaller institutions is the ladder or spaced maturity policy.

Financial institutions invest heavily in treasury securities and therefore are exposed to the possibility that the government will default on its debts. Treasury notes and bonds are issued by the federal government and are coupon instruments. Which of the following statements are correct.

The is perhaps the most international of all stock markets. The following are examples of government issued bonds which typically offer a lower interest rate compared to corporate bonds. The debt is a stock variable measured at a specific point in time and it is the accumulation of all prior deficits.

Edison could invest by purchasing bonds issued by the us. Zachary buys a bond issued by the city of atlanta. Which of the following supply and demand models for home mortgages represents what would happen if the us.

More From Government Quarantine Facilities Kerala

- Government News

- Self Employed Second Grant Proof

- Self Employed Claim Furlough

- 3 Branches Of State Government And Their Functions

- Is The Furlough Scheme Reducing

Incoming Search Terms:

- Where Can I Buy Government Bonds Is The Furlough Scheme Reducing,

- Market Value Of U S Government Debt Dallasfed Org Is The Furlough Scheme Reducing,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctbyhmlkq3olkpzfmbbpjaccerwifyqkgzhbi8 Xqahovi Owoa Usqp Cau Is The Furlough Scheme Reducing,

- 4 Survey Of Public Debt Management Frameworks In Selected Countries Coordinating Public Debt And Monetary Management Is The Furlough Scheme Reducing,

- Pdf The Impact Of The Financial Crisis On The Bond Market Is The Furlough Scheme Reducing,

- Are Chinese Credit Ratings Relevant A Study Of The Chinese Bond Market And Credit Rating Industry Sciencedirect Is The Furlough Scheme Reducing,

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png)