What Is Furlough Payment In August, New Furlough Rules From Saturday Including How Your Pay Will Change On August 1 Mirror Online

What is furlough payment in august Indeed lately is being sought by consumers around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of the article I will talk about about What Is Furlough Payment In August.

- Rishi Sunak Announces Employers Must Pay Some Furlough Costs For Staff From August Heart

- Coople Extends Furlough Scheme Into August Coople Uk

- More Than One In Four Uk Workers Now Furloughed Bbc News

- Employers Will Have To Pay A Quarter Of The Wages Of Furloughed Staff From August Daily Mail Online

- Covid 19 Furlough And The New Rules August 2020

- Cjrs Brightpay Pay Periods Crossing August September Brightpay Documentation

Find, Read, And Discover What Is Furlough Payment In August, Such Us:

- Coronavirus Furlough Scheme To Finish At End Of October Says Chancellor Bbc News

- Coronavirus Furlough Scheme Extended For Another Four Months But Workers Allowed To Return Part Time From August

- New Furlough Rules From Saturday Including How Your Pay Will Change On August 1 Mirror Online

- Mann Abbott Job Support Scheme 1k Job Retention Bonus

- New Furlough Rules From Saturday Including How Your Pay Will Change On August 1 Mirror Online

If you re looking for Government Accounting Millan Solution Manual Chapter 5 you've reached the right place. We ve got 101 graphics about government accounting millan solution manual chapter 5 adding pictures, photos, photographs, backgrounds, and much more. In such web page, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

What Are The August Changes To The Furlough Scheme Government Accounting Millan Solution Manual Chapter 5

How Furlough Changes In August The New Rules For The Hmrc Job Retention Scheme Explained And When It Ends Government Accounting Millan Solution Manual Chapter 5

For periods starting on or after 1 september you will need to calculate the.

Government accounting millan solution manual chapter 5. For periods ending on or before 31 august 2020 you can claim a grant for the full amount of the minimum furlough pay. Furlough claims are changing from august as you can no longer claim for employers national insurance contributions or pension payments so the amount that can be claimed is reducing. Furlough claim changes from august.

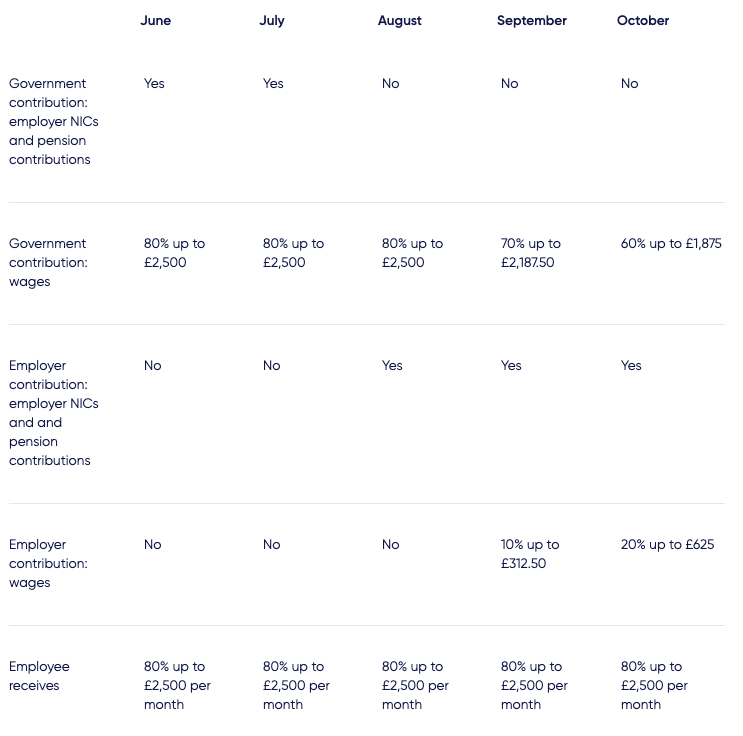

Since august the government has scaled back support with a view to closing the scheme at the end of october. Changes from august 1. The government will continue to pay 80 per cent of staff wages up to the 2500 a month cap.

Changes in august will mean firms will have to pay 25 of furlough wages firms will also be permitted to bring furloughed workers back as part time staff employers have warned they will have to. Employers will be required to resume payments of the 3 minimum auto enrolment pension contribution to furloughed workers from 1 august. However businesses will need to start picking up the furlough bill on august 1.

Businesses will start picking up the furlough bill in august when they have to pay national insurance ni and pension contributions. This represents about 5 per cent of employment costs for. It will start slowly withdrawing support and asking employers to pay more.

The employer continues to pay the nics and pension contributions as well as the 80 furlough pay which is still subject to the 2500 cap per month but the amount of. The government is making changes to the coronavirus furlough scheme from august. In march the government agreed to cover the cost for defined contribution dc members.

Employers had to start chipping in by paying employers ni and pension contributions in august. By september bosses had to pay 10 of furloughed staffs wages while the government put in 70.

All You Need To Know About The Flexible Furlough Scheme Paris Smith Government Accounting Millan Solution Manual Chapter 5

More From Government Accounting Millan Solution Manual Chapter 5

- Best Government Jobs In India With High Salary In Hindi

- Self Employed Maternity Pay

- Government Watchlist Search Covid

- Government Macroeconomic Objectives

- Furlough Extended For Travel Industry

Incoming Search Terms:

- How The Furlough Scheme Will Change From August 1st Business Leader News Furlough Extended For Travel Industry,

- Pressure Builds On Sunak As Shielding Guidance Eases And Government Reduces Furlough Support On 1 August The Canary Furlough Extended For Travel Industry,

- Coronavirus Businesses Must Pay Towards Furlough Scheme From August Chancellor Announces Business News Sky News Furlough Extended For Travel Industry,

- What Are The August Changes To The Furlough Scheme Furlough Extended For Travel Industry,

- Companies Will Not Pay 20 Of Furlough Costs Until October Personnel Today Furlough Extended For Travel Industry,

- Furlough Scheme Changes Starting In August What You Should Know Daily Record Furlough Extended For Travel Industry,

/cdn.vox-cdn.com/uploads/chorus_image/image/66870642/1212829574.jpg.0.jpg)