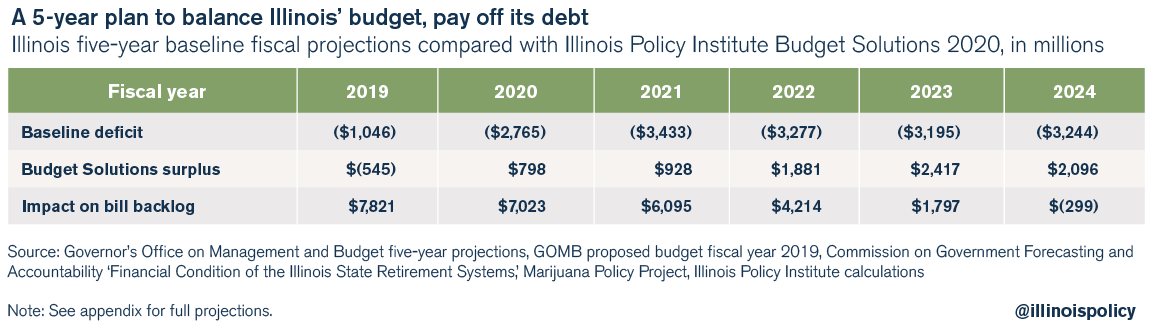

Government Budget Deficit Formula, Http Citeseerx Ist Psu Edu Viewdoc Download Doi 10 1 1 883 2662 Rep Rep1 Type Pdf

Government budget deficit formula Indeed recently is being sought by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of this post I will discuss about Government Budget Deficit Formula.

- Difference Between Fiscal Primary Revenue Deficit Yadnya Investment Academy

- National Debt Of The United States Wikipedia

- Http College Cengage Com Economics 0538797274 Mceachern Student Lecture 8574 Pdf

- Living Economics Crowding Out Effect Transcript

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqzec8htfra4efdhm Ztzwuirr5pds9714rpeftn7uecx17lh E Usqp Cau

- Fiscal Deficit Formula Calculator Example With Excel Template

Find, Read, And Discover Government Budget Deficit Formula, Such Us:

- Important Questions For Class 12 Economics Budgetary Deficiet And Its Measures

- What Is Current Account Deficit The Financial Express

- Solved In A More Realistic Model Taxes Are A Function Of Chegg Com

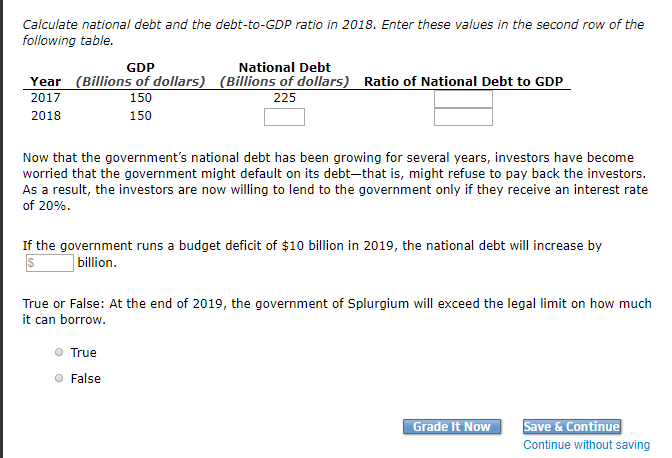

- Solved 2 Calculating The Debt To Gdp Ratio Suppose The F Chegg Com

- Reserve Bank Of India Publications

If you are searching for Government Employee Id Philippines you've arrived at the perfect location. We have 104 graphics about government employee id philippines adding pictures, photos, photographs, wallpapers, and more. In such webpage, we additionally provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Sandeep Garg Macroeconomics Class 12 Solutions Class 12 Macroeconomics Sandeep Garg Solutions Chapter 10 Government Budget And The Economy Government Employee Id Philippines

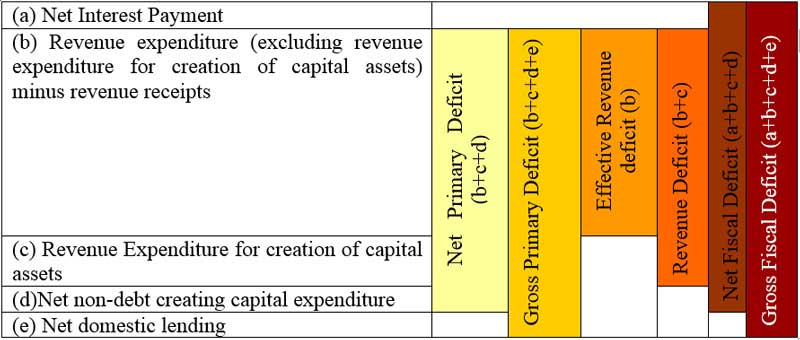

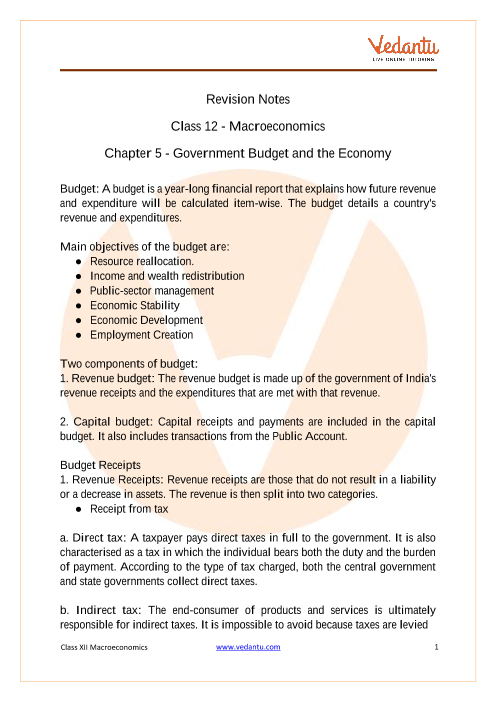

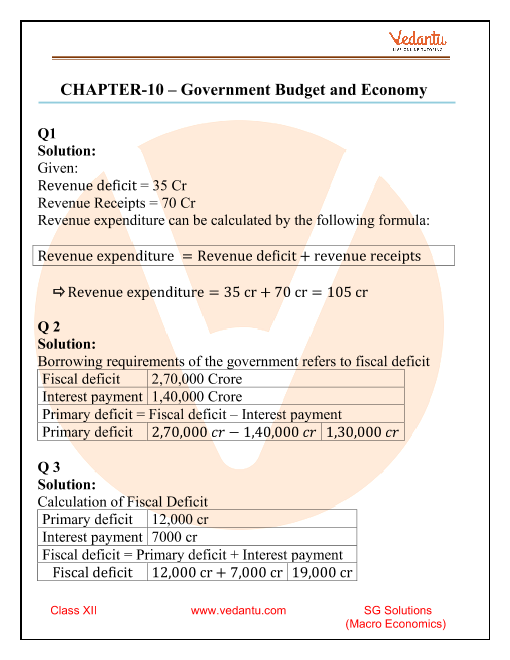

Fiscal deficit refers to a situation where the governments expenditure exceeds its revenues that it would generate.

Government employee id philippines. Impact of revenue deficit. What is budget deficit. In simple terms fiscal deficit is nothing but the difference between total revenue and total expenditure of the government.

What is the fiscal deficit. Where annual expenses of a budget exceeds the annual income of the budget then it is known as budget deficit indicating financial unhealthiness of a country which can be reduced by taking the attempts of different measures like reduction of revenue outflow and increasing revenue inflow. The formula for budget deficit budget deficit total expenditure total receipts.

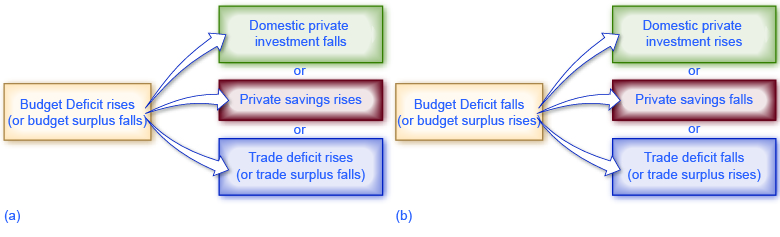

How to calculate fiscal deficit and budget deficit. It serves as an indication of the total borrowings that a government might require. A positive balance is called a government budget surplus and a negative balance is a government budget deficit.

We often refer to a government budget deficit as a fiscal deficit. How the fiscal deficit is calculated and its formula. For meeting the shortfall in the form of revenue deficit the government has to sell some assets.

To minimise the deficit or the gap between the expends and income the government may reduce a few expenditures and also rise. When an economy is in recession the government usually runs a budget deficit in order to boost the economy. Budget deficit total expenditures by the government.

Budget deficit definition the difference between the total receipts and total expenditure in both accounts revenue and capital account of the government. The government deficit is the amount of money in the budget set by which the government spending surpasses the revenue earned by the government. Revenue deficit has the following impacts on the economy.

Budget deficit is an important phenomena in fiscal policy. Revenue deficit total revenue expenditure total revenue receipts. The formula for revenue deficit can be expressed as.

This deficit presents a picture of the financial health of the economy. The term is typically used to refer to government spending and national debt. A budget deficit typically occurs when expenditures exceed revenue.

Exceed its total income which comes principally from taxes duties etc. A government deficit is when government spending exceeds revenue. When revenue receipts are lower than the expenditure is called a budget deficit.

The government budget balance also alternatively referred to as general government balance public budget balance or public fiscal balance is the overall difference between government revenues and spending. Budget deficit vs fiscal deficit. Since the primary source of government revenue is from taxes some might define a deficit as government spending that exceeds tax revenue.

Solved 2 Calculating The Debt To Gdp Ratio Suppose The F Chegg Com Government Employee Id Philippines

More From Government Employee Id Philippines

- Non Government Organization Meaning

- Self Employed Ka Hindi

- Self Employed Yodel Driver Reviews

- Irish Government Covid 19 Levels

- Self Employed Grant Apply August

Incoming Search Terms:

- Haver Analytics Self Employed Grant Apply August,

- Deficit Measurement In India Arthapedia Self Employed Grant Apply August,

- Fiscal Policy A Summing Up Ppt Video Online Download Self Employed Grant Apply August,

- What Is Fiscal Deficit The Financial Express Self Employed Grant Apply August,

- Economics 1 U C Berkeley Fall 2010 September 27 Government Deficits And Debts Lecture Self Employed Grant Apply August,

- Fiscal Deficit Formula Calculator Example With Excel Template Self Employed Grant Apply August,