Self Employed Courier Tax Returns, 5 Tax Hacks For New Courier Delivery Or Rideshare Drivers By Veronica Huerta Foster Medium

Self employed courier tax returns Indeed recently is being hunted by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of this article I will talk about about Self Employed Courier Tax Returns.

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gct0ieywjbsbu7xuahtzobjq1i01iiko3epgwevxgqny4c4hik0o Usqp Cau

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrtqqjzj7maqhlz9eppjs6hmpgbpdocsem0fbqfgd7fxjllq0qn Usqp Cau

- Doordash 1099 Taxes And Write Offs Stride Blog

- W 9 Form What Is It And How Do You Fill It Out Smartasset

- Self Assessment Tax Return For Couriers Tiler Plasterer

- Couriers The Untold Story Of The Biggest Heist In Irish Tax History Broadsheet Ie

Find, Read, And Discover Self Employed Courier Tax Returns, Such Us:

- Taxes For Self Employed Or Freelancers In Spain How To Pay

- 5 Tax Hacks For New Courier Delivery Or Rideshare Drivers By Veronica Huerta Foster Medium

- Https Www Revenue Ie En Tax Professionals Tdm Income Tax Capital Gains Tax Corporation Tax Part 04 04 01 07 Pdf

- How To Get The Biggest Tax Refund This Year My Money Us News

- Spreadsheet For Tax Deductions Eymir Mouldings Deduction Template Exc Golagoon

If you re searching for Furlough Scheme Extended Bbc News you've come to the ideal place. We have 104 images about furlough scheme extended bbc news adding pictures, photos, pictures, backgrounds, and much more. In these page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Im sure hmrc officer laughed hard when saw receipts for 2 cans of red bull and 3 pounds of cheddar cheese amongst other disallowed items that were claimed as allowable.

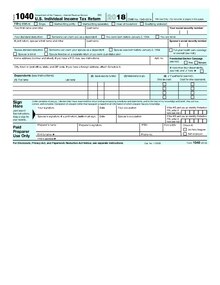

Furlough scheme extended bbc news. You cant write it off in schedule c but there are two places where this deduction happens. Also gas electric and insurance. Dental and medical expenses are deductible on your tax return.

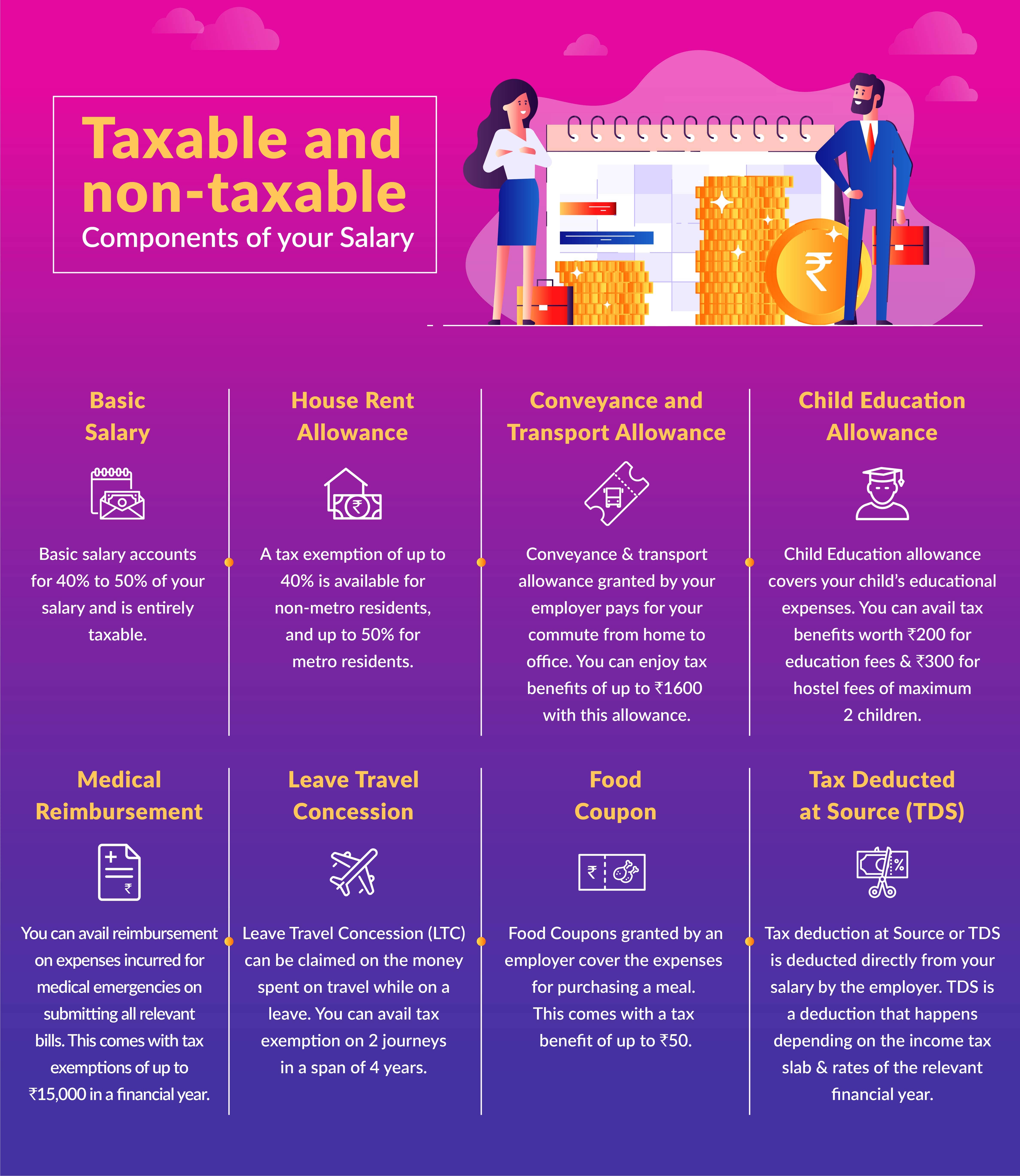

From our experience there are a number of people that end up paying more tax than necessary either because they havent recorded evidence of their costs or they dont realise what expenses and allowances they can claim. This article will help to highlight some key things to remember for your tax return and how to save tax. This is due to the fact that being self employed allows you to benefit from all profits made not only the salary that employees earn.

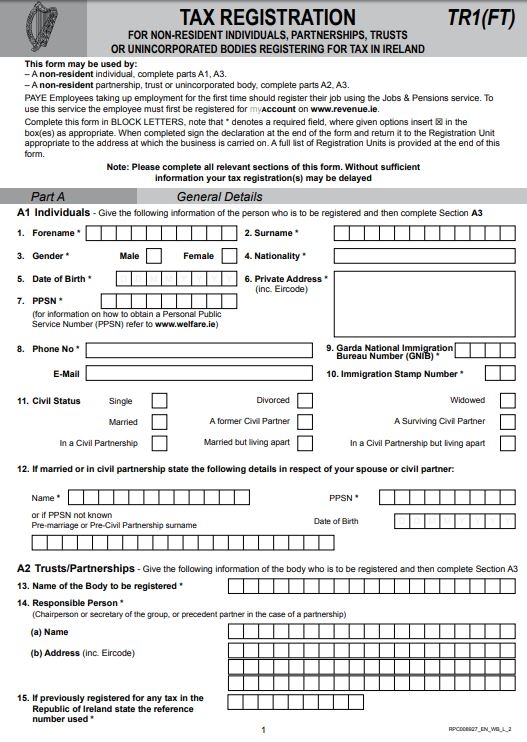

For van expenses i am thinking of claiming the mileage expenses ie 45p25p rather than making a claim on his petrol receipts which give lower expense. If you are a self employed courier you will need to complete a tax return so that you can declare your earnings to hmrc. All self employed couriers have to complete a tax return.

Read more to see what medical and dental expenses can be included in 2020. It is important that you are aware of what allowable expenses you can claim against your income. As a self employed courier i need what expenses are tax deductible.

Amendment and penalty as a result. You multiply your self employment income by 9235 giving it a 765 deduction. Eg is a proportion of council tax deductible and what percentage of my home can be allowed as a business expense.

This deduction was given as a way to level the playing field when you are self employed. Depreciation vehicle car depreciation tax deductions. Ive dealt with enquiry hmrc opened on self employed courier satr which his wife submitted with no tax knowledge.

Self employed health insurance deduction. You should keep records of all earnings and keep an organised record of all fares and tips. First it happens when figuring self employment tax.

More From Furlough Scheme Extended Bbc News

- New Furlough Scheme Announcement

- Self Employed Loans Bad Credit

- Self Employed Personal Loan Instant

- Extension Of Furlough Letter

- Self Employed Expenses Template Uk

Incoming Search Terms:

- 5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes Self Employed Expenses Template Uk,

- How Couriers File Their Taxes All Your Food Delivery Tax Questions Answered Courier Hacker Self Employed Expenses Template Uk,

- Hmrc Is Inundated With Claims From Employees Working From Home Daily Mail Online Self Employed Expenses Template Uk,

- Accounting Services And Tax Returns For Delivery Riders And Drivers Ugo Blog A Digital Lifestyle Magazine Self Employed Expenses Template Uk,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrtqqjzj7maqhlz9eppjs6hmpgbpdocsem0fbqfgd7fxjllq0qn Usqp Cau Self Employed Expenses Template Uk,

- How To Claim Expenses When You Re Self Employed Courier Self Employed Expenses Template Uk,