Government Furlough Scheme Guidance For Employers, Covid 19 Job Retention Scheme Faqs

Government furlough scheme guidance for employers Indeed recently is being sought by users around us, maybe one of you personally. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of this post I will discuss about Government Furlough Scheme Guidance For Employers.

- Government Confirms That Furlough Rules Do Not Leave Employers At Risk Of Breaching Minimum Wage Rules Knights Lowe

- Coronavirus Guidance To Employers And Businesses Invest Plymouth

- Https Www Rec Uk Com Download File View 2627 6404

- Y S6hendcie7gm

- National Housing Federation Government Furlough Scheme Guidance For Housing Associations

- Job Retention Scheme Will Remain Open Until The End Of October Southport Bid

Find, Read, And Discover Government Furlough Scheme Guidance For Employers, Such Us:

- Y S6hendcie7gm

- Seven Things Employers Need To Know About Flexible Furlough Personnel Today

- Chancellor Extends Furlough Scheme Until October Gov Uk

- Updated Coronavirus Job Retention Scheme Mitchell Charlesworth

- United Kingdom Archives Coronavirus In A Flash

If you are searching for Self Employed Utr Number you've come to the right location. We ve got 100 graphics about self employed utr number including images, photos, photographs, backgrounds, and more. In these webpage, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

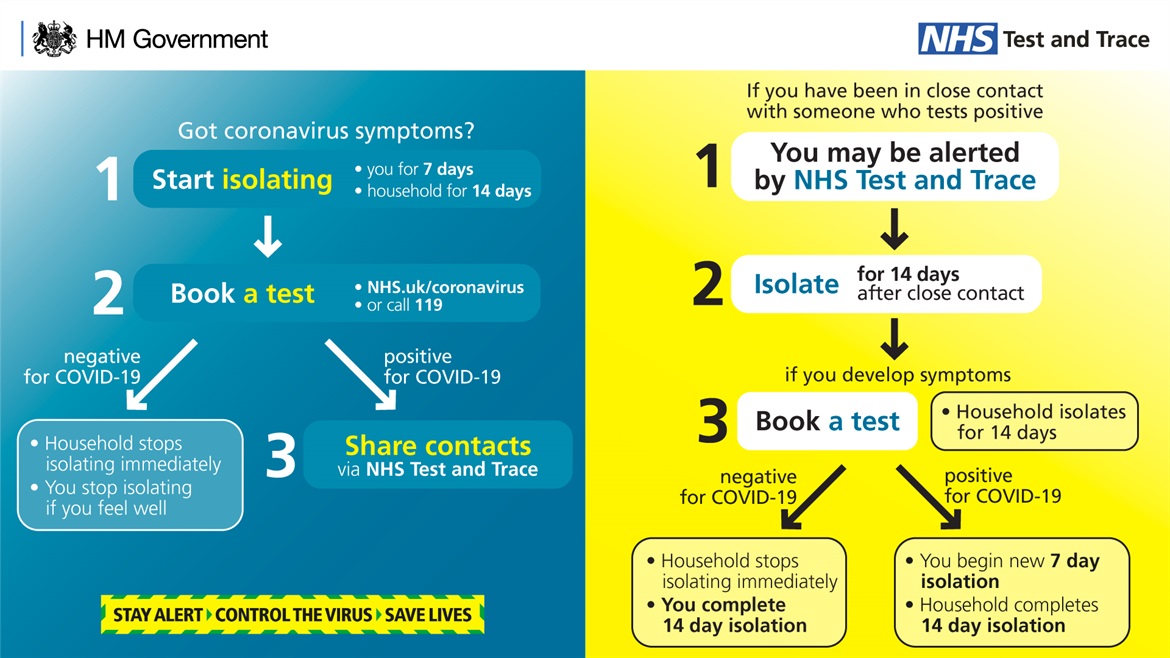

Coronavirus job retention scheme update.

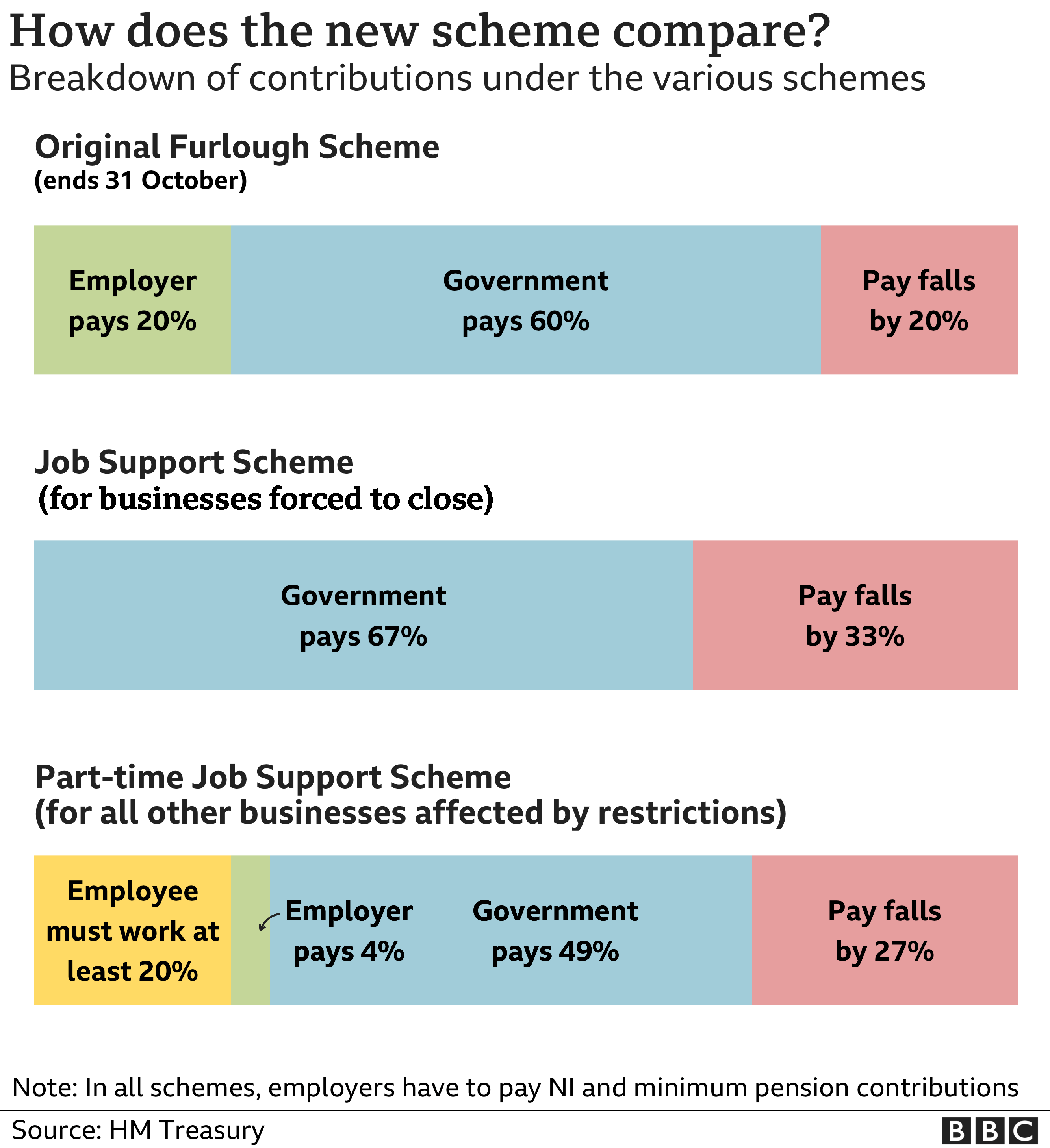

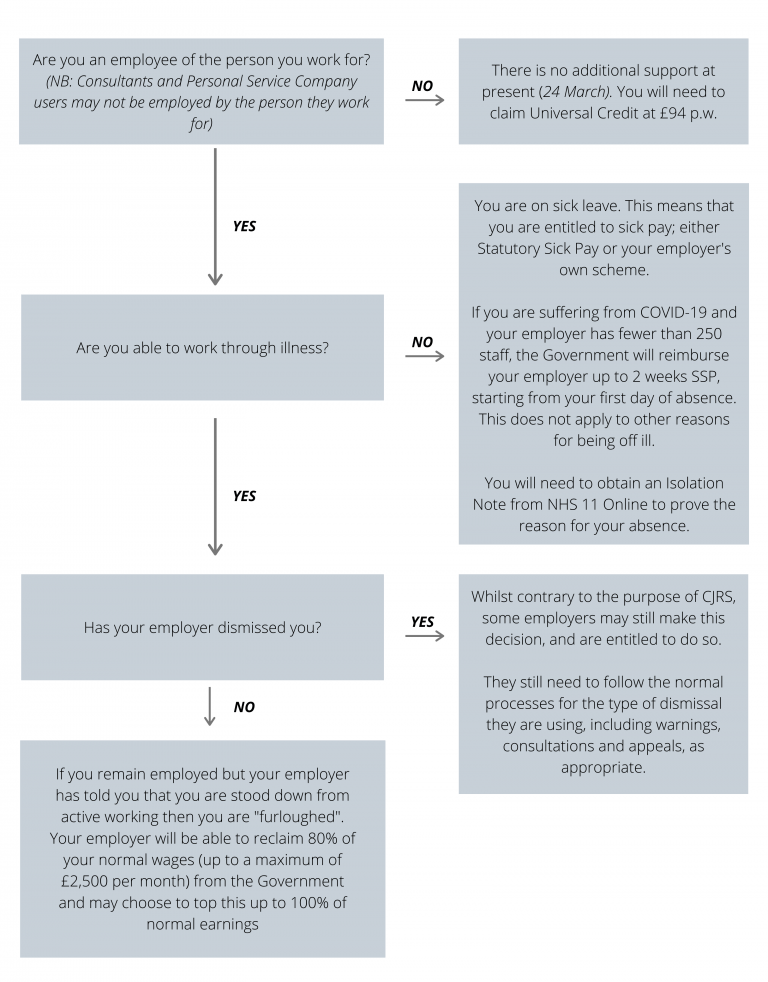

Self employed utr number. Its a good idea to make sure staff have a way to communicate with the employer and other people they work with. Hours before the furlough scheme was due to end the government announced it would be extended until december to cover a further lockdown in england. Where the employee starts a furlough period before 1 july this furlough period must be for a minimum of 3 consecutive weeks.

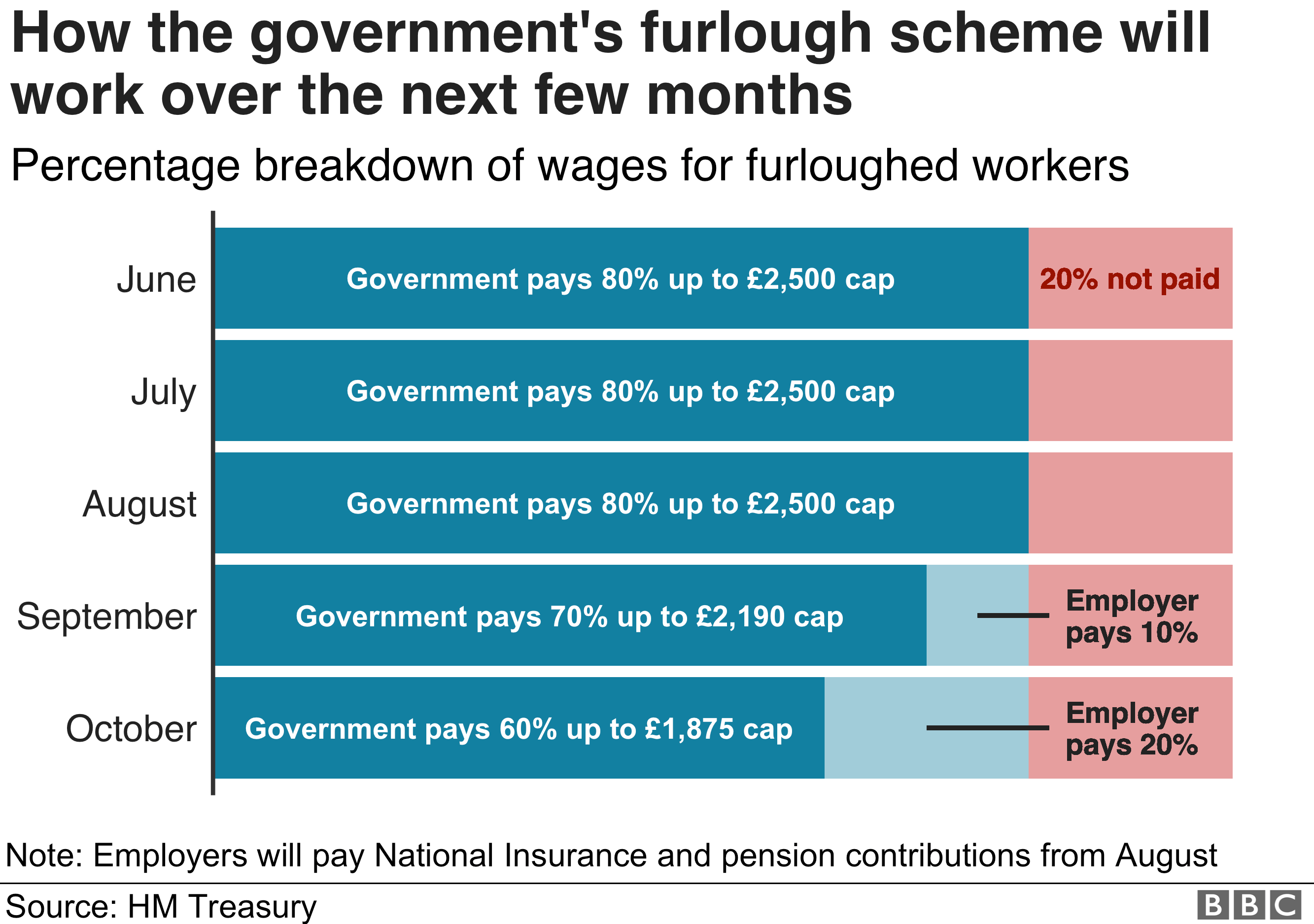

Under the extended scheme the cost for employers of retaining workers will be reduced compared to the current scheme which ends today. Government updates employer guidance to reflect winding down of furlough scheme posted 15th june 2020 following the recent announcement by the chancellor that the coronavirus job retention scheme cjrs will be wound down from july through to its complete closure on 31 october 2020 the government has updated the official guidance to provide. So what are the key details you need to know.

This means the extended furlough scheme is more generous. There are five guidance documents employers will need to read to get up to speed. We know that coronavirus is a worrying period for you as employers and your staff.

The furlough scheme coronavirus job retention scheme was due to end on 31 october 2020. Phase 2 will take the scheme to a total of 8 months with the government subsidising wages for employers. The government last night published further details of the furlough scheme.

Extension of the furlough scheme. Check if you can claim for your employees wages through the cjrs. The guidance is also published in the news section of the skills for care website.

It has now been extended until december 2020. Details of the new flexible furlough scheme available from 1 july 2020 have now been published via updates to existing guides. Employers will need to read the guidance but it is summarised below.

Government guidance is available on its job retention scheme alongside hm treasury directions which set out the legal framework for the schemethe original direction was made on 15 april 2020 but on 22 may 2020 a further direction was made which is the one people should refer to in respect of the framework prior to 1 july. 10 th june 2020 cut off for furloughing an employee. This can be a difficult time for both employers and staff.

The full details and guidance is here. The uk governments department of health and social care has approved the following guidance for social care employers on the use of the coronavirus job retention scheme furlough. We urge employers to read the guidance and to act in accordance with it.

Check which employees you can put on furlough to use the cjrs.

More From Self Employed Utr Number

- Korean Government Scholarship 2021 Undergraduate

- Government Singular Or Plural

- Government Building Cartoon Images

- Self Employed Tax Rates Uk

- Government Law College Kozhikode Kozhikode Kerala

Incoming Search Terms:

- Latest Guidance From Hmrc On Furloughing Through The Job Retention Scheme Dafferns Government Law College Kozhikode Kozhikode Kerala,

- Https Www Eca Co Uk Cmspages Getfile Aspx Guid 820bb725 5e5b 4703 88d6 Fc26c4d707cf Government Law College Kozhikode Kozhikode Kerala,

- Employer Guides Changes To The Coronavirus Job Retention Scheme Furlough Leave Government Law College Kozhikode Kozhikode Kerala,

- Coronavirus Job Support Scheme The Details And What It Might Mean For Employers Government Law College Kozhikode Kozhikode Kerala,

- Https Uk Markel Com Insurance Getmedia D0e14c7d 8f33 463c Afba D5c6777d6288 Furlough The Coronavirus Job Retention Scheme 20 04 20 Government Law College Kozhikode Kozhikode Kerala,

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk Government Law College Kozhikode Kozhikode Kerala,