Government Home Loans With No Down Payment, How Much Should I Save For A Down Payment Experian

Government home loans with no down payment Indeed recently has been hunted by consumers around us, maybe one of you. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the name of this article I will talk about about Government Home Loans With No Down Payment.

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqviwbblz6yud52bgd2uqwninmlbws4cotpnmgevqrdlfwcitmx Usqp Cau

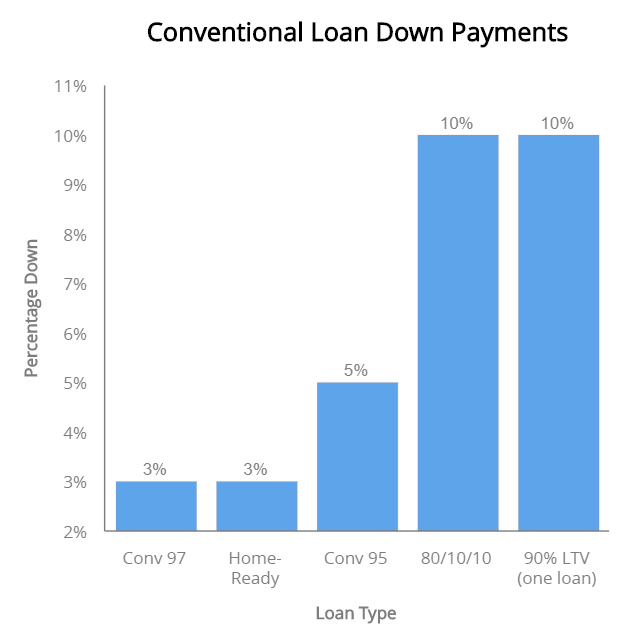

- 47 Low Down Payment Mortgages By State Including 30 States With An Option For No Mortgage Insurance

- Va Loan Programs For Veterans In Ocala Florida Ocala Real Estate Homes For Sale Your Ocala Real Estate Agent Expert Localrealtyservice Com

- Fha Vs Va Loan Comparing The Two Loan Programs In Detail

- Rhs Louisville Kentucky Mortgage Loans

- How To Get A No Down Payment Mortgage Zero Down Home Loan U S News

Find, Read, And Discover Government Home Loans With No Down Payment, Such Us:

- How To Get A Mortgage With Bad Credit In 4 Simple Steps

- Are You Qualified To Receive A Teacher Mortgage By Maurice Martinez Issuu

- How Much Is A Down Payment On A House Do You Need 20 Percent Thestreet

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqviwbblz6yud52bgd2uqwninmlbws4cotpnmgevqrdlfwcitmx Usqp Cau

- 10 Best Lenders For Low And No Down Payment Mortgages In 2020 Nerdwallet

If you re looking for Government Role In Market Economy Remains you've come to the right place. We ve got 104 graphics about government role in market economy remains adding pictures, photos, photographs, wallpapers, and much more. In these page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

While the federal government provides all the above programs loans and resources to help you buy a home many local cities and states offer special government home loans for first time buyers.

Government role in market economy remains. Government mortgage programs with no money down. Typically no down payment mortgages come in the form of government loans or special lender programs. Considering those with credit scores at the 580 mark it also has lower down payment options at 35.

Applicants will need to meet minimum income requirements to qualify and can only get loans for a primary residence. Local grants programs. If you meet this criteria this loan requires no down payment comes with a 30 year fixed rate mortgage and low closing costs.

A low or no down payment mortgage may sound appealing but theres a catch. But if you want a no down payment home loan keep in mind that the loan types available to you may be limited. Perhaps one of the most popular low down payment mortgage option in the market today is a government backed mortgage called the fha home loan.

These loans may come with additional fees at closing or require private mortgage insurance when you put less than 20 percent down which can inflate your monthly mortgage payment. In the guaranteed home program the usda provides a 90 loan guarantee to a qualifying lender to reduce the risk of the loan. As a result lenders will extend 100 loans to their borrowers meaning no down payment.

If coming up with a down payment is a struggle an alternative to buying a house with no money down is an fha loan. There are currently two types of government sponsored loans that allow you to buy a home without a down payment. Buyers can now purchase a home with very little or no money down at closing.

This results in flexible credit score requirements and a lower down payment. This means that government backed loans are less risky for the lender and they can expand their usual loan criteria to people with riskier financial profiles such as borrowers with no down payment. Lenders offing a fha loan are also restricted in the fees they are allowed to charge you.

Here are some of those home loans. The federal housing administration fha home loan is one option. The fha does not offer a no money down loan.

However they do allow for loans with a down payment as low as 35 of the homes purchase price. Usda loans and va loans. For a home that costs 200000 that would still require a down payment of 7000.

More From Government Role In Market Economy Remains

- Hermes Self Employed Courier Forum

- Self Employed Jobs From Home Ideas Uk

- Self Employed Vs Entrepreneur

- Government Tyranny Examples

- Furlough Rules October Uk

Incoming Search Terms:

- Covid 19 Down Payment Resource Furlough Rules October Uk,

- Refinancing Non Qm Loans To Government And Conventional Mortgage Youtube Furlough Rules October Uk,

- Fha Loan What To Know 2020 Guidelines Nerdwallet Furlough Rules October Uk,

- Zero Down Payment Mortgage Option Pete S Mini Storage Furlough Rules October Uk,

- How To Buy A House With No Money Down The Lenders Network Furlough Rules October Uk,

- Mortgages That Require No Down Payment Or A Small One Bankrate Furlough Rules October Uk,