Government Revenue And Deadweight Loss Graph, What Is Economic Surplus And Deadweight Loss Reviewecon Com

Government revenue and deadweight loss graph Indeed lately is being sought by users around us, maybe one of you personally. People are now accustomed to using the net in gadgets to view video and image information for inspiration, and according to the name of this post I will discuss about Government Revenue And Deadweight Loss Graph.

- Econport

- A Tax On Gasoline

- How To Determine The Deadweight Loss After A Tax Youtube

- Lesson Overview Taxation And Deadweight Loss Article Khan Academy

- Tax Revenue And Deadweight Loss Youtube

- Market Efficiency And Policy Trade Offs William Branch

Find, Read, And Discover Government Revenue And Deadweight Loss Graph, Such Us:

- Reading Monopolies And Deadweight Loss Microeconomics

- Solved Graphically Demonstrate Identify The Implementation Of A Tariff As Well As The Resulting Consumer Surplus Producer Surplus The Level Of Course Hero

- 1

- Https Www Ssc Wisc Edu Ekelly Econ101 Answerstohomework3spring2017 Pdf

- Calculating The Deadweight Loss From A Subsidy Freeeconhelp Com Learning Economics Solved

If you are searching for Government Quizlet you've reached the right location. We ve got 104 graphics about government quizlet including images, photos, photographs, wallpapers, and more. In these webpage, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Deadweight loss p2 p1 x q1 q2 heres what the graph and formula mean.

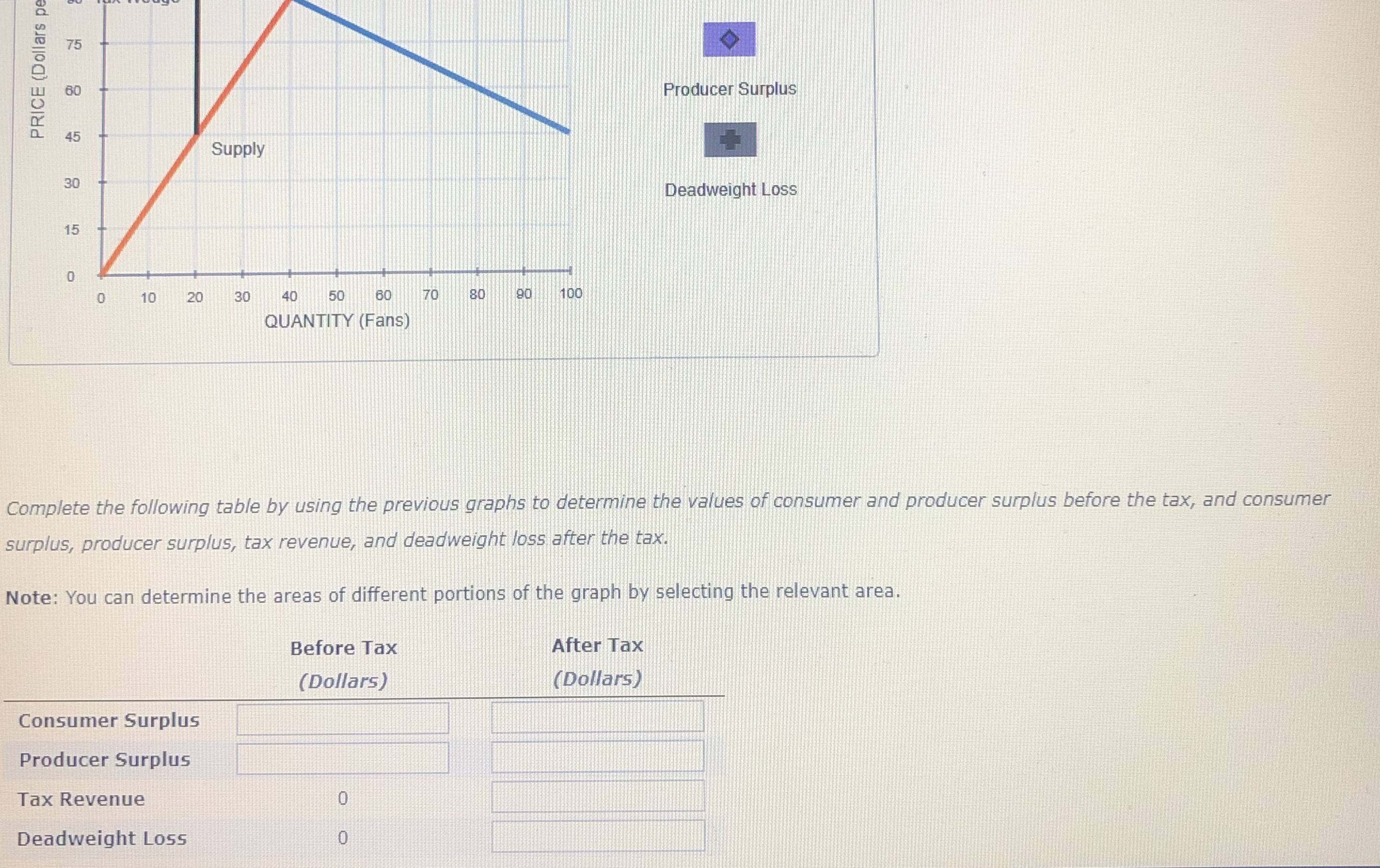

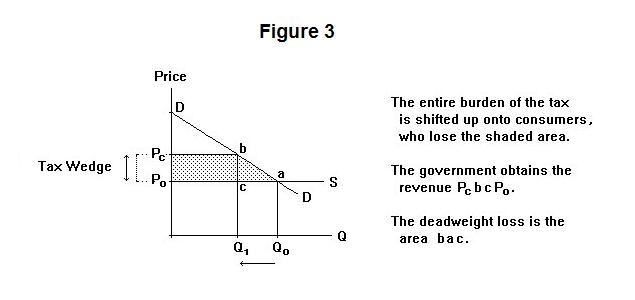

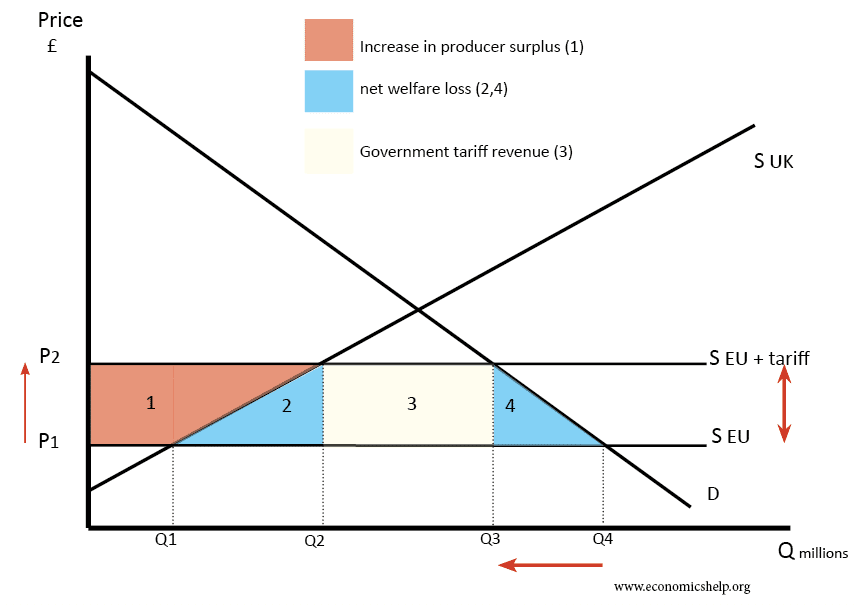

Government quizlet. Q1 and p1 are the equilibrium price as well as quantity before a tax is imposed. As illustrated in the graph deadweight loss is the value of the trades that are not made due to the tax. Relationship between tax revenues deadweight loss and demandelasticity the government is considering levying a tax of 120 per unit on suppliers of either leather jackets or smartphones.

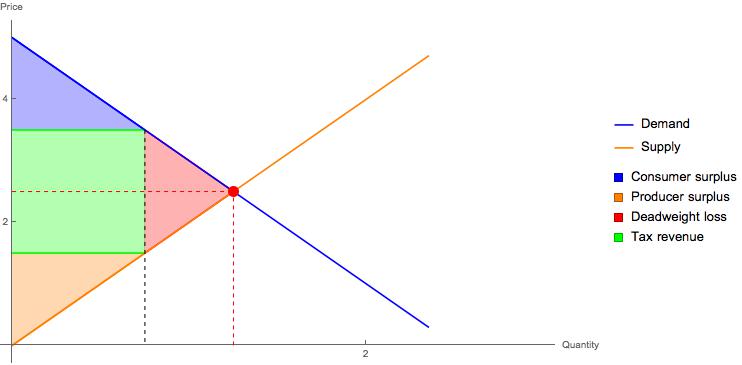

With this new tax price there would be a deadweight loss. In the case of a deadweight loss triangle found on the graph input tool the base is the amount of the tax and the height is the reduction in quantity caused by the tax 480 432 deadweight loss 384 se 336 480 432 384 deadweight loss 289 deadweight loss dollars 240 192 144 90 48 0 d 2 4 16 15 20 0 b 10 12 14 tax dollars per pack as the tax. This is the revenue collected by governments at the new tax price.

Deadweight loss 05 154 120500 450 05 3450 value of deadweight loss is 840. Relationship between tax revenues deadweight loss and demandelasticity the government is considering levying a tax of 60 per unit on suppliers of either concert tickets or bus passes. The supply curve for each of these two goods is identical as you can see on each of the following graphs.

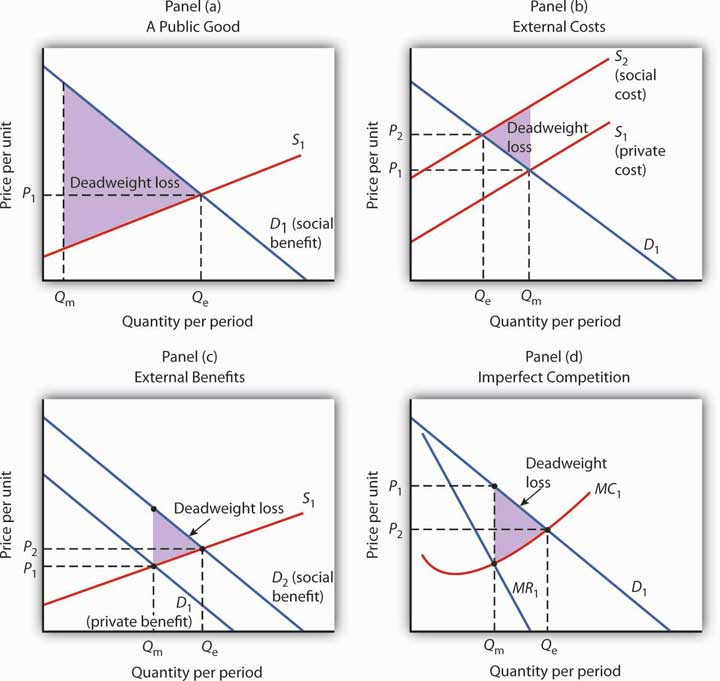

Therefore no exchanges take place in that region and. Harbergers triangle generally attributed to arnold harberger shows the deadweight loss as measured on a supply and demand graph associated with government intervention in a perfect marketmechanisms for this intervention include price floors caps taxes tariffs or quotasit also refers to the deadweight loss created by a governments failure to intervene in a market with externalities. A tax shifts the supply curve from s1 to s2.

Therefore the deadweight loss for the above scenario is 840. The blue area does not occur because of the new tax price.

More From Government Quizlet

- Self Employed Helpline

- Self Employed Covid Grant Scotland

- Sri Lanka Government Gazette 2020 October 09 Sinhala

- Self Employed Relief Fund

- Government Gateway Login Pension

Incoming Search Terms:

- Answers To Problem Set 8 Government Gateway Login Pension,

- Deadweight Loss Wikiwand Government Gateway Login Pension,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcs1mhswa6kd97crsigyjdxkb131a C56tokvpuvzlgmrmgxljvc Usqp Cau Government Gateway Login Pension,

- Laffer Curve Definition Government Gateway Login Pension,

- What Is Economic Surplus And Deadweight Loss Reviewecon Com Government Gateway Login Pension,

- Deadweight Loss Examples How To Calculate Deadweight Loss Government Gateway Login Pension,