Government Tax Spending Breakdown, What Are The Sources Of Revenue For Local Governments Tax Policy Center

Government tax spending breakdown Indeed lately has been sought by consumers around us, maybe one of you. People are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of the article I will talk about about Government Tax Spending Breakdown.

- Government Spending In The United Kingdom Wikipedia

- How Does The Government Spend My Taxes

- Discretionary Spending Breakdown

- File Breakdown Of Tax Revenue By Country And By Main Tax Categories In 2017 Of Gdp Png Statistics Explained

- Uk Budget Surplus 2018 Maybe Not So Likely Economics From 2 Students

- Putting Federal Spending In Context Pew Research Center

Find, Read, And Discover Government Tax Spending Breakdown, Such Us:

- What Are The Sources Of Revenue For Local Governments Tax Policy Center

- Where Do Your Tax Dollars Go Tax Foundation

- Budget 2019 Summary Of All Spending Plans Interest Co Nz

- Budget 2020 Gov Uk

- File Breakdown Of Tax Revenue By Country And By Main Tax Categories In 2018 Of Gdp New Png Statistics Explained

If you re searching for Furlough Scheme Rules November you've come to the right location. We have 104 graphics about furlough scheme rules november adding pictures, photos, photographs, wallpapers, and more. In these web page, we also have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

This guide outlines how the public spending breakdown was calculated and shown in your tax summary and provides some general.

Furlough scheme rules november. Central government spending in the united kingdom also called public expenditure is the responsibility of the uk government the scottish government the welsh government and the northern ireland executivein the budget for financial year 201617 proposed total government spending was 772 billion. Spending per head is significantly higher in northern ireland wales and scotland than it. Figure d provides a historical picture of military spending over.

Paid out of the general fund. In 2018 mandatory spending accounted for the greatest portion of total spending at 62. This totalled 865 billion in the 201819 financial year.

National defense spending is any government spending attributable to the maintenance and strengthening of the united states armed forces including the army navy marines and the air force. Most are paid out of the general fund. Mandatory spending budgeted at 2966 trillion.

Payroll taxes fund 100 of the cost. The governments main sources of revenue come from tax levies fees investment income and from the sales of goods and services. Government spending is broken down into three categories.

Payroll taxes and premiums fund 57 of the cost. Governments three main spending categories for 2018 and 2019. Treasury and both reflect spending priorities laid out by congress in various pieces of legislation.

When the government issues a tax break it chooses to give up tax revenue for a specific purpose so both spending and tax breaks mean less money in the us. Payroll taxes partially fund unemployment compensation. As of the fiscal year 2019 budget approved by congress national defense is the largest discretionary expenditure in the federal budget.

Below is a breakdown of the us. Discretionary spending forecasted to be 1485 trillion. Government spending in indonesia averaged 11149473 idr billion from 2000 until 2020 reaching an all time high of 28472974 idr billion in the fourth quarter of 2019 and a record low of 2171330 idr billion in the third quarter of 2000.

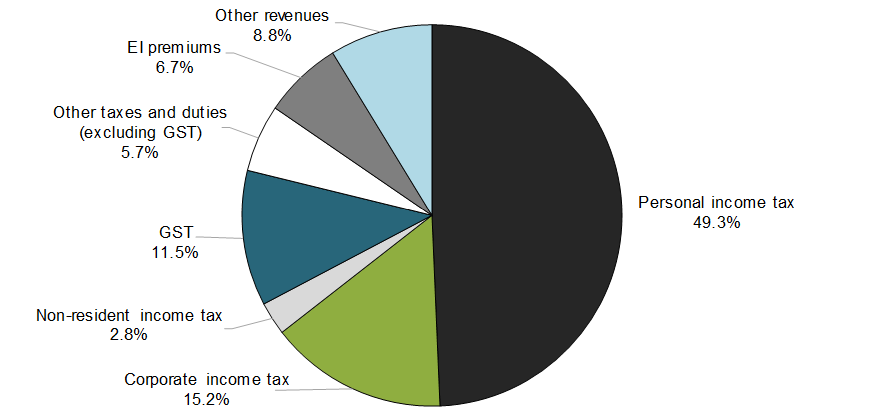

Each category of spending has different subcategories. Tax revenue is the major source of core crown revenue. Corporate taxes add 265 billion contributing just 7.

Government spending in indonesia increased to 19500477 idr billion in the second quarter of 2020 from 15939805 idr billion in the first quarter of 2020. President donald trumps tax plan lowered that from 9 in fy 2016. In fact tax breaks function as a type of government spending and they are officially called tax expenditures within the federal government.

Total core crown revenue for the 201819 financial year was 1193 billion. Government spending can be broken down and understood in different ways. Income taxes at 18 trillion contribute 49 of fy 2020 government revenue.

More From Furlough Scheme Rules November

- Government Covid 19 Signs To Print Out

- Government Qr Code

- Government Bsc Nursing Colleges In Kerala

- Government Organization In Russia

- Government Agency Icon Png

Incoming Search Terms:

- The History Of U S Government Spending Revenue And Debt 1790 2015 Metrocosm Government Agency Icon Png,

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsggoetp9 12ffrdp8vvyeyxrxihpkhnrkput5qnzre5qeo72bs Usqp Cau Government Agency Icon Png,

- United States Federal Budget Wikipedia Government Agency Icon Png,

- Putting Federal Spending In Context Pew Research Center Government Agency Icon Png,

- Uk Budget Surplus 2018 Maybe Not So Likely Economics From 2 Students Government Agency Icon Png,

- Taxation Our World In Data Government Agency Icon Png,