Indian Government Bonds Etf, Nseindia On Twitter Bharat Bond Etf Open For Subscription The Etf Includes Portfolio Of Aaa Rated Bonds Issued By Government Of India For More Details Contact Your Sebi Authorized Broker Https T Co Mu8shjwtjy

Indian government bonds etf Indeed lately has been hunted by consumers around us, maybe one of you personally. People now are accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the name of the post I will discuss about Indian Government Bonds Etf.

- Investing In India What Are Government Bonds

- Gold S Relevance In Multi Asset Allocation Funds My Gold Guide

- Nippon India Etf Nifty Cpse Bond Plus Sdl 2024 Maturity Nfo Should You Invest

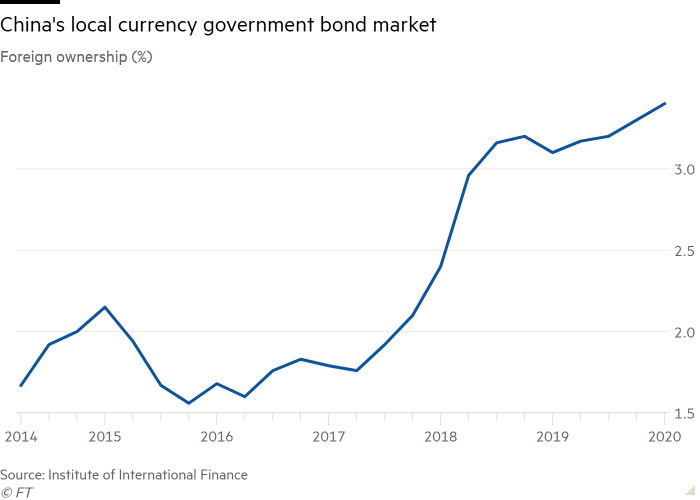

- Csop Aims To Scoop Huge Foreign Investment With China Bond Etf Financial Times

- How To Buy Government Bonds In India Getmoneyrich

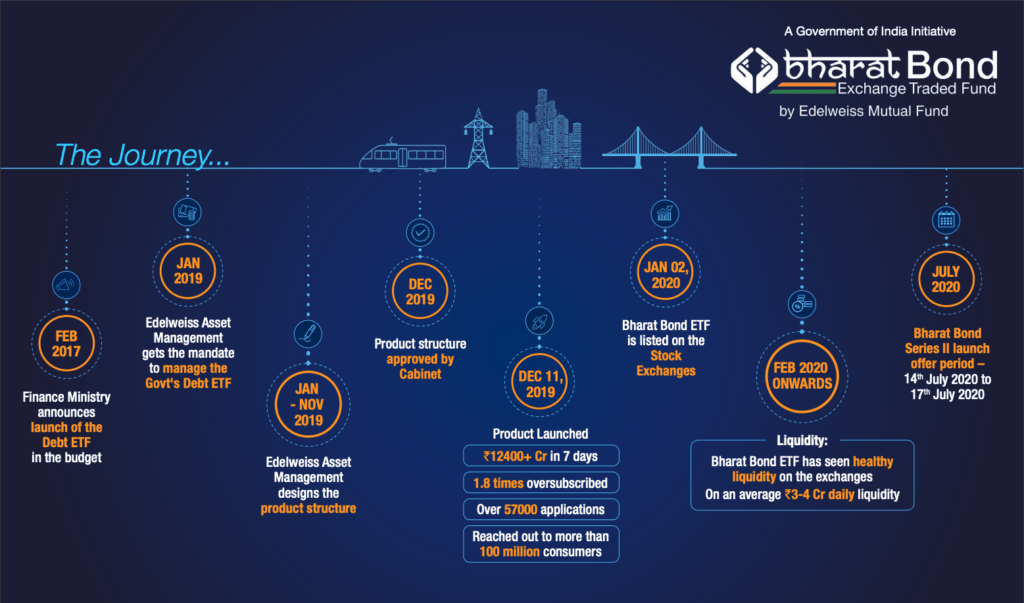

- Bharat Bond Etf Second Tranche Of Bharat Bond Etf Opens On July 14 2020

Find, Read, And Discover Indian Government Bonds Etf, Such Us:

- Acquisory Consulting On Twitter Bond Etf A New Tool Of Investment Bond Exchange Traded Funds Etf Similar In Structure And Intent To Stock Etf Could Debut Soon In India Where Government Is

- Bond Exchange Traded Funds Etfs Manifest Ias

- How To Buy Government Bonds In India Getmoneyrich

- Bharat Bond Etf Nfo Closes Today 10 Things To Know About India S First Corporate Bond Etf

- Mauritius Commercial Bank To Launch Etf For Indian Government Securities African Markets

If you re searching for What Is Furlough Uk Law you've reached the perfect location. We have 101 images about what is furlough uk law adding images, photos, pictures, backgrounds, and more. In these webpage, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Bonds included in these funds may be government quasi government or corporate debt.

What is furlough uk law. The fund will provide institutional and retail investors regular income through the payment of half yearly. India exchange traded funds. As of october 29 2020 the msci india index a benchmark for this group of funds had a 1 year.

After the introduction of mutual funds exchange traded funds etfs have become the most innovative and popular securities amongst investors in india. This move will allow retail investors to buy government debt. Look on your bond etfs factsheet for average credit ratings of aa and above.

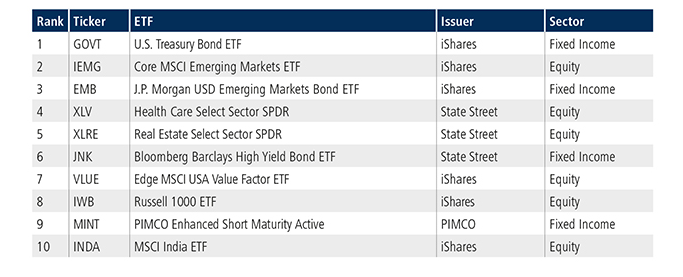

The etfdb ratings are transparent quant based scores designed to assess the relative merits of potential investments. Overseas funds have sold 146 billion of indian corporate and government bonds this year the most among emerging asian nations according to data compiled by bloomberg. The following table includes etfdb ratings for all etfs in the government bonds.

Etf instruments have created a valuable space amongst investors who find difficulties to master the trick of the trade of analyzing and. India aims to raise rs150bn us21bn from the first tranche of the umbrella bond etf that will launch on december 12 and close on december 20. Historically the india government bond 10y reached an all time high of 1476 in april of 1996.

Etfs are ranked on up to six metrics as well as an overall rating. India government bond 10y data forecasts historical chart was last updated on october of 2020. You can minimise this by investing in government bonds of high quality.

Emerging markets bonds tend to have lower credit quality than those of developed nations and thus generally offer much higher yields. Mcb india sovereign bond etf is an exchange traded fund incorporated in mauritius. The final thing to think about is currency risk.

Government bonds are meant to be a source of stability but foreign bonds add currency market volatility into the mix. Emerging markets bonds etfs invest in debt issued in emerging market countries. It will provide retail investors easy and low cost access to bond markets with smaller amount as low as 1000.

India 10y bond yield was 588 percent on thursday october 29 according to over the counter interbank yield quotes for this government bond maturity. Best etfs in india invest in best performing etfs 2020 updated on november 1 2020 159317 views. This can swing both ways.

More From What Is Furlough Uk Law

- Self Employed Unemployment Florida Covid 19

- Self Employed Tax Deductions 2019

- What Is Being Furloughed Mean

- Government Spending Pie Chart Uk

- Government Systems Of North Korea

Incoming Search Terms:

- Bond Etfs What S In It For You 10 Things To Know About Bond Etfs The Economic Times Government Systems Of North Korea,

- Funding Cpses Bharat Bond Etf To Attract Rs 10 000 Crore The Financial Express Government Systems Of North Korea,

- Debt Funds No Credit Risk Please Unovest Government Systems Of North Korea,

- Indian Debt Foreigners Flee India S Bond Market Just When It Needs Them Most The Economic Times Government Systems Of North Korea,

- Should You Invest In Bharat Bond Etf Advisorkhoj Government Systems Of North Korea,

- Acquisory Consulting On Twitter Bond Etf A New Tool Of Investment Bond Exchange Traded Funds Etf Similar In Structure And Intent To Stock Etf Could Debut Soon In India Where Government Is Government Systems Of North Korea,