Local Government Revenue Sources Philippines, Top 10 Major Sources Of Revenue For Local Government In Nigeria

Local government revenue sources philippines Indeed recently has been sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the article I will talk about about Local Government Revenue Sources Philippines.

- Pandemic State Budget Shortfalls Deloitte Insights

- The Territorial Impact Of Covid 19 Managing The Crisis Across Levels Of Government

- Pdf Systematic Land Information Management Slim Jukka Nieminen Academia Edu

- 2

- Https 103 5 4 84 Wp Content Uploads Issuances 2019 Local Budget Memorandum Local Budget Memorandum No 78 Pdf

- Fiscal Policy Of The Philippines Wikipedia

Find, Read, And Discover Local Government Revenue Sources Philippines, Such Us:

- Money Matters The Golden Rule The Philippines 2007 In Million Pesos China 2004 100m Yuan Central Local Centrallocal Revenue1 096 Ppt Download

- Lgu Tagum Feted For Excellent Collection Efficiency

- Local Taxation Taxes Payments

- The Sources Of State And Local Tax Revenues Tax Foundation

- The Condition Of Education Preprimary Elementary And Secondary Education Finances Public School Revenue Sources Indicator April 2020

If you re searching for Honda Furlough Extended you've reached the right place. We ve got 104 graphics about honda furlough extended adding images, pictures, photos, backgrounds, and more. In such web page, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

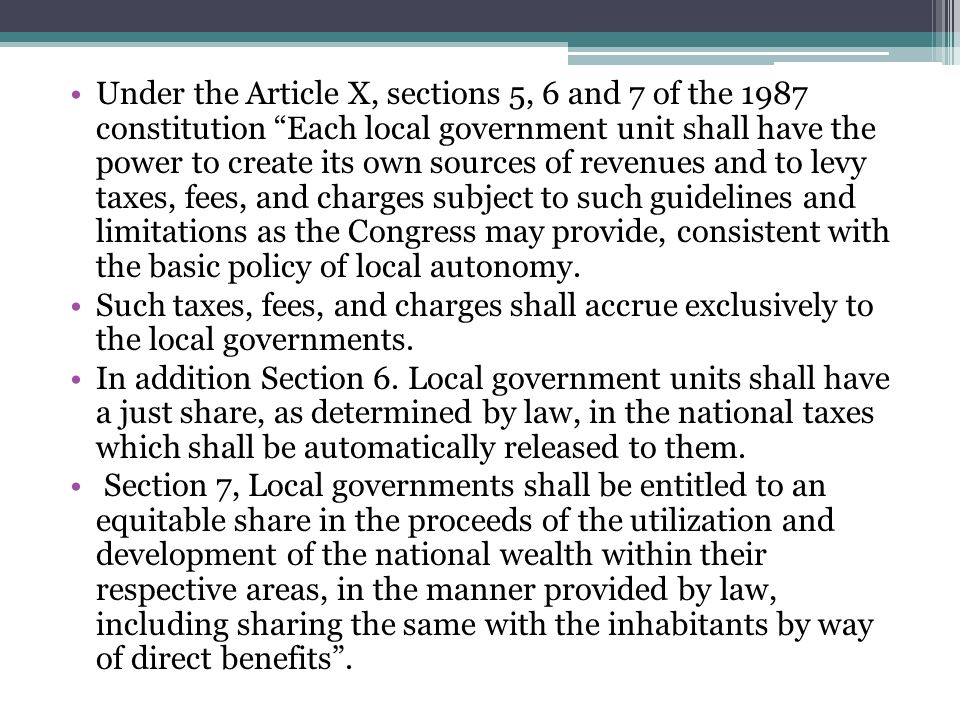

At present local governments are entitled to 40 of internal revenue taxes section 284 of the local government code.

Honda furlough extended. 9485 or the anti red tape act of 2007. Gfoa has prepared this interactive dashboard to help promote a better understanding of local government revenue sources. So it is actually one good source of revenue for the local government.

Section 6 article vi of the philippine constitution provides that local governments shall be entitled to a just share in national taxes. Taxes are governments biggest source of revenuewithout the collection of taxes no country can be run. This page provides philippines government revenues actual values historical data forecast chart statistics economic calendar and news.

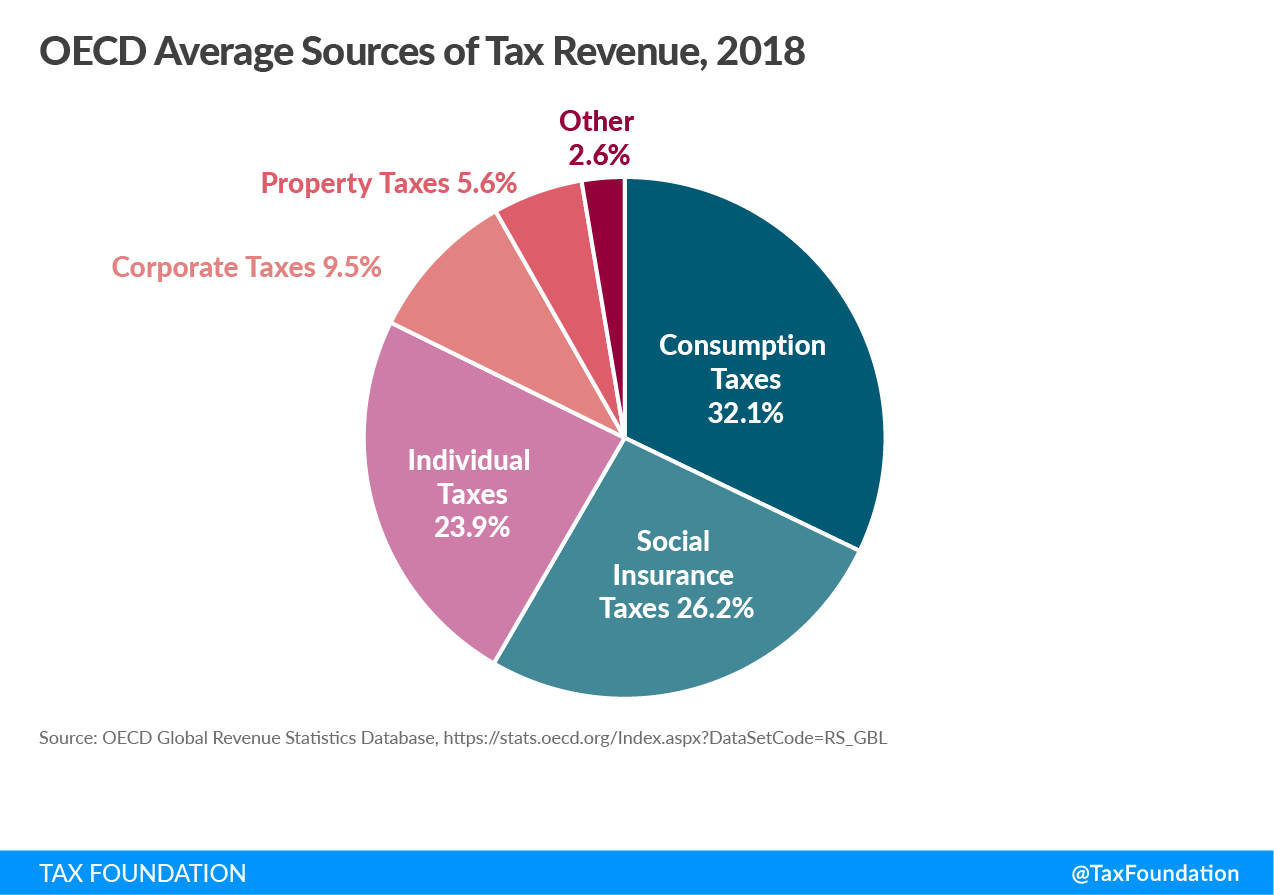

Sales taxes general and selective provided local governments 124 billion 7 percent of general revenue and individual income taxes accounted for 33 billion 2. Government revenues in philippines averaged 4753338 php million from 1959 until 2020 reaching an all time high of 350977 php million in june of 2020 and a record low of 81 php million in november of 1959. Chapter 3 table 315 tax revenues of subsectors of general government as of total tax revenue chapter 3 table 32 total tax revenue in us dollars at market exchange rate chapter 3 tables 37 to 314 taxes as of gdp and as of total tax revenue.

The blgf citizens charter the bureau of local government finance since its inception is geared towards the compliance with regulatory requirements and provision of quality service delivery to its employees the local government units lgus key stakeholders and the general publicthe blgf consistently complied with the republic act no. The government also earns revenue from the production of commodities like steel oil life saving drugs etc. Wikipedia defines a local government as a form of public administration which in a majority of contexts exists as the lowest tier of administration within a given state.

While most local governments rely on common revenue sources property tax sales tax intergovernmental assistance utility charges the specific sources for any one city can vary significantly. The government acts like a business person and the public acts like its customers. The government may either sell goods or render services like train city bus electricity transport posts and telegraphs water supply etc.

Rates are also one of the significant sources of local government revenue in nigeria. A rate is like tax levied on property owned by the local government. This was localities largest single source of tax revenue.

Local governments collected 509 billion from property taxes in 2017 or 30 percent of local government general revenue. Taxes are the monies that you are required by law to pay to the government according to the amount of income money you receive the property you have etc. In this post we shall reveal major sources of revenue.

More From Honda Furlough Extended

- Self Employed Covid

- Self Employed Cerb Transition

- Anti Government Corruption Quotes

- Functions Of Local Government In Zambia Pdf

- Housekeeping Self Employed Cleaner Invoice Template

Incoming Search Terms:

- Why It Matters In Paying Taxes Doing Business World Bank Group Housekeeping Self Employed Cleaner Invoice Template,

- Sources Of Government Revenue In The Oecd 2019 Tax Foundation Housekeeping Self Employed Cleaner Invoice Template,

- Money Matters The Golden Rule The Philippines 2007 In Million Pesos China 2004 100m Yuan Central Local Centrallocal Revenue1 096 Ppt Download Housekeeping Self Employed Cleaner Invoice Template,

- Figure B1 Own Source Revenue Of Local Government Units Download Scientific Diagram Housekeeping Self Employed Cleaner Invoice Template,

- Five Phase Icm Planning Process Adapted For Philippine Local Governments Download Scientific Diagram Housekeeping Self Employed Cleaner Invoice Template,

- The Territorial Impact Of Covid 19 Managing The Crisis Across Levels Of Government Housekeeping Self Employed Cleaner Invoice Template,