Local Government Taxes In India, Types Of Tax In India Excise Value Added Tax

Local government taxes in india Indeed lately has been sought by users around us, perhaps one of you. People now are accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of the article I will talk about about Local Government Taxes In India.

- Taxation In South Africa Wikipedia

- Economic Survey Draws Attention To 10 New Economic Facts On Indian Economy

- Municipal Corporation Budgets Budget Basics Beta Documentation

- Taxation In New Zealand Wikipedia

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctznmmluq9dg0bg5nrorrwhbvyiziyx6whoxs8tsogjhdeudmgi Usqp Cau

- Economic Survey 2018 Low Tax Collection At Panchayats A Challenge To Fiscal Federalism Survey The Economic Times

Find, Read, And Discover Local Government Taxes In India, Such Us:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctznmmluq9dg0bg5nrorrwhbvyiziyx6whoxs8tsogjhdeudmgi Usqp Cau

- Section 193 Of Income Tax Act Tds Section Arinjay Academy

- Buy The Property Tax In North Carolina Local Government Board Builders Book Online At Low Prices In India The Property Tax In North Carolina Local Government Board Builders Reviews Ratings

- Google India Finds A New Way To Tax Google Facebook

- Do You Use A Form Filler In A Municipal Office In India To Complete The Payment Of Your Property Tax We Wou Revenue Management Financial Management Corruption

If you are looking for Self Employed Artinya you've reached the ideal location. We have 104 graphics about self employed artinya adding images, photos, photographs, backgrounds, and much more. In these page, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

An important restriction on this power is article 265 of the constitution which states that no tax shall be levied or collected except by the authority of law.

Self employed artinya. For example vat of 1 percent is levied on gold silver and other precious metals. The three bodies which collect the taxes in india have clearly defined the rules on what type of taxes they are permitted to collect. The effective rate of swachh bharat cess is 05.

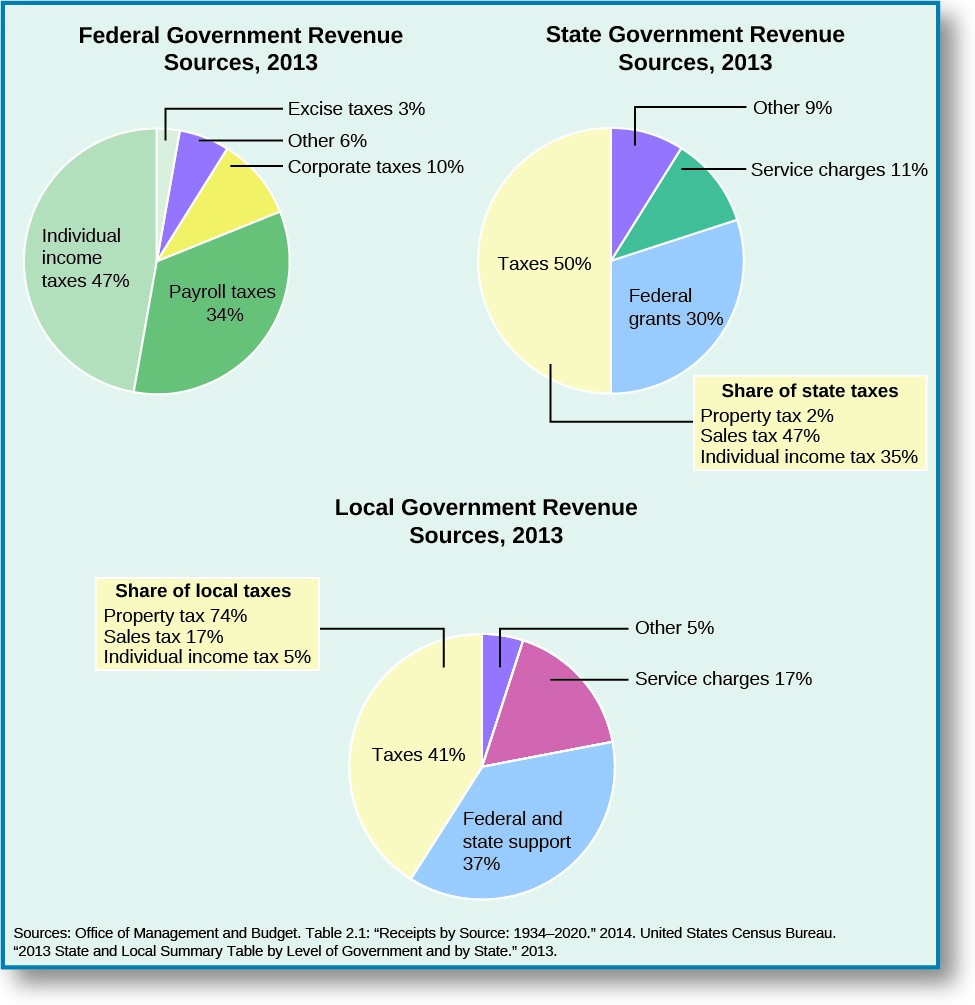

The authority to levy a tax is derived from the constitution of india which allocates the power to levy various taxes between the central and the state. After this tax we need to pay 145 service tax. In india taxes fall under three jurisdictions central government state government and local government.

Unlike the countries like uk where the occupier is liable to pay the property tax it is the liability of the property owner to pay the property tax in india to the concerned municipalities. A company incorporated in india is treated as a tax resident of india and is taxed at 30 on its global income. Taxes in india are levied by the central government and the state governments.

Therefore each tax le. Karnataka 135 percent there are also reduced vat rates of 1 percent and 4 percent for specific goods and services throughout india. However if its turnover is up to inr 4000 mn in fy 2017 18 then the applicable rate of tax is 25.

Some minor taxes are also levied by the local authorities such as the municipality. For drugs and medicines the rate is 4 percent. This tax is applicable on all taxable services from 15thnovemeber 2015.

Amendment of the income tax rules 1962 to prescribe manner relating to option under section 115bac and 115bad and that of determination of depreciation under section 115baa to 115bad of the income tax act 1961. The state governmentstax on agricultural income professional tax value added tax state excise duty stamp duty. Government revenues in india increased to 565417 inr billion in september from 377306 inr billion in august of 2020.

Central government taxes income tax excise duty gst customs state government taxes gst entertainment tax toll tax professional tax octroi duty stamp duty luxury tax and capital gains tax. Government revenues in india averaged 322964 inr billion from 1997 until 2020 reaching an all time high of 1750727 inr billion in march of 2020 and a record low of 082 inr billion in april of 1999. The central governmentincome tax custom duties central excise duty.

It is required to obtain a pan and tan and file an annual return of income. Whats new instructions to the income tax return forms itr 1 to itr 7 for ay.

More From Self Employed Artinya

- Ei For Self Employed Hairdresser

- Government Guidelines Coronavirus Uk

- Self Employed Grant August Eligibility

- Self Employed Sole Trader Invoice Template Australia

- Types Of Government Quiz Edgenuity

Incoming Search Terms:

- Aequitajuris Law Firm Income Tax Lawyers In India Corporate Law Types Of Government Quiz Edgenuity,

- How Does Local Government Work In India Explained Types Of Government Quiz Edgenuity,

- How Does The Corporate Income Tax Work Tax Policy Center Types Of Government Quiz Edgenuity,

- History Of Taxation In India Tax Structure In India Types Of Government Quiz Edgenuity,

- Tax Evasion Black Market Tax Evasion Types Of Government Quiz Edgenuity,

- Understanding The Budget Revenue Types Of Government Quiz Edgenuity,