Quickbooks Self Employed Invoices Not Showing Income, Intuit Quickbooks Self Employed Review 2020 Pcmag Australia

Quickbooks self employed invoices not showing income Indeed lately is being sought by users around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of this post I will talk about about Quickbooks Self Employed Invoices Not Showing Income.

- Quick Books Self Employed Can You Send Your Invo

- Quickbooks Self Employed Desktop Tutorials Quickbooks Self Employed

- Quickbooks Self Employed For Freelancer Quickbooks Australia

- Solved Report Showing Actual Income Not Invoices

- Matching Emailed Receipts In Quick Books Self Empl

- Quickbooks Online Self Employed Review Untangle Your Business And Personal Expenses Macworld

Find, Read, And Discover Quickbooks Self Employed Invoices Not Showing Income, Such Us:

- Quickbooks Self Employed Track Expenses Invoices Optimize Taxes

- 2020 Quickbooks Self Employed Review Pros And Cons Fundera

- What If I Want To Upload A Logo In Quickbooks Self Employed Insightfulaccountant Com

- Quickbooks Self Employed Mileage Tracker And Taxes Apps On Google Play

- Intuit Quickbooks Self Employed Review 2020 Pcmag Australia

If you re searching for Self Employed Tax Allowance 2020 you've arrived at the ideal location. We ve got 104 graphics about self employed tax allowance 2020 adding images, pictures, photos, backgrounds, and much more. In such webpage, we also have number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

Luckily showing proof of income as a self employed individual is a lot easier than most realize.

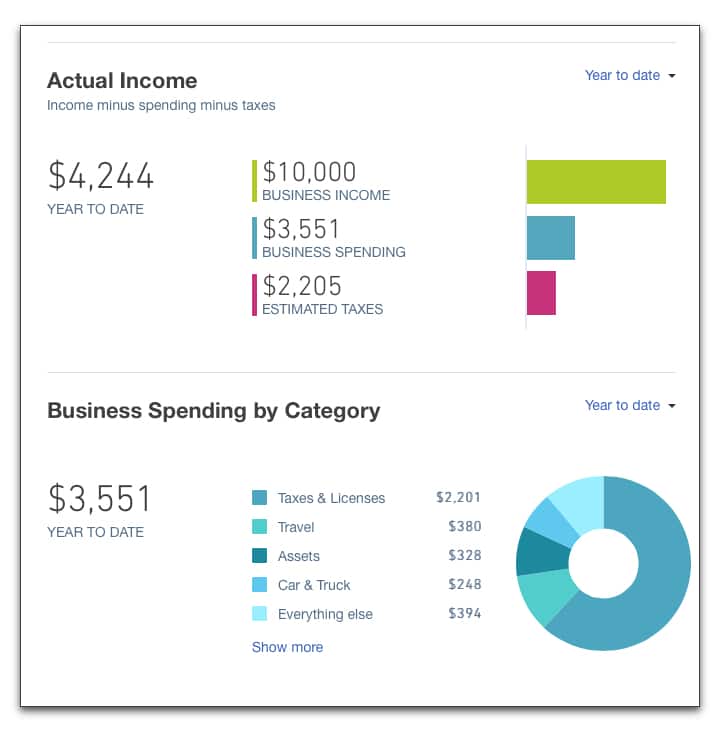

Self employed tax allowance 2020. Let me help you figure out why its not showing as income faze. Sales transactions reports are showing the total sales. If your bank account is connected where the payment is deposited all you need to do is to categorise the transaction as income.

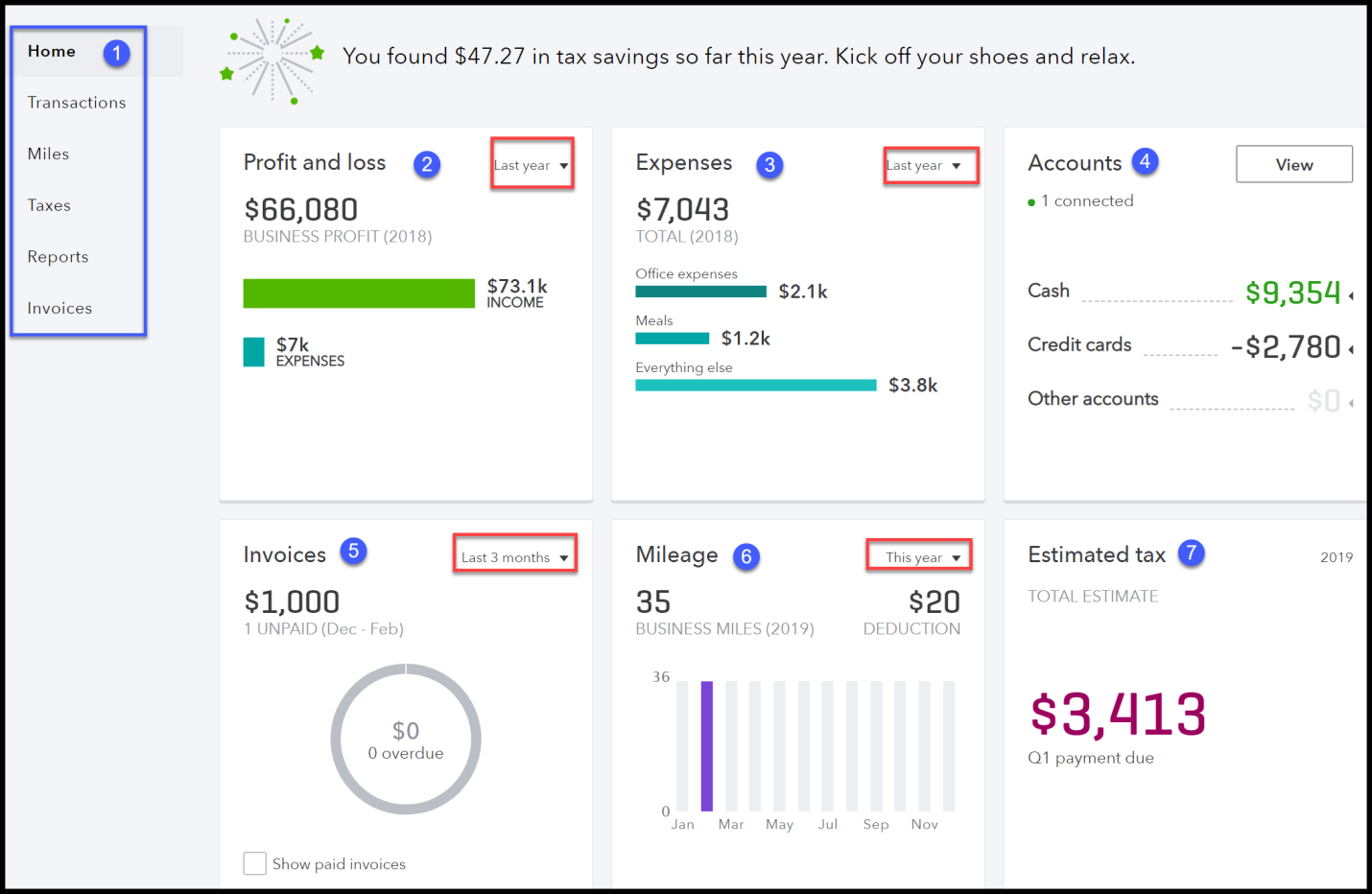

The tax bundle also comes with a 29 discount for the first three months when purchased 12 a month marked down from 17. When you create an invoice on self employed this will not post to your incomeexpenses as it is there so you can sent a copy to your customers. Am i not completing the receive payments correctly.

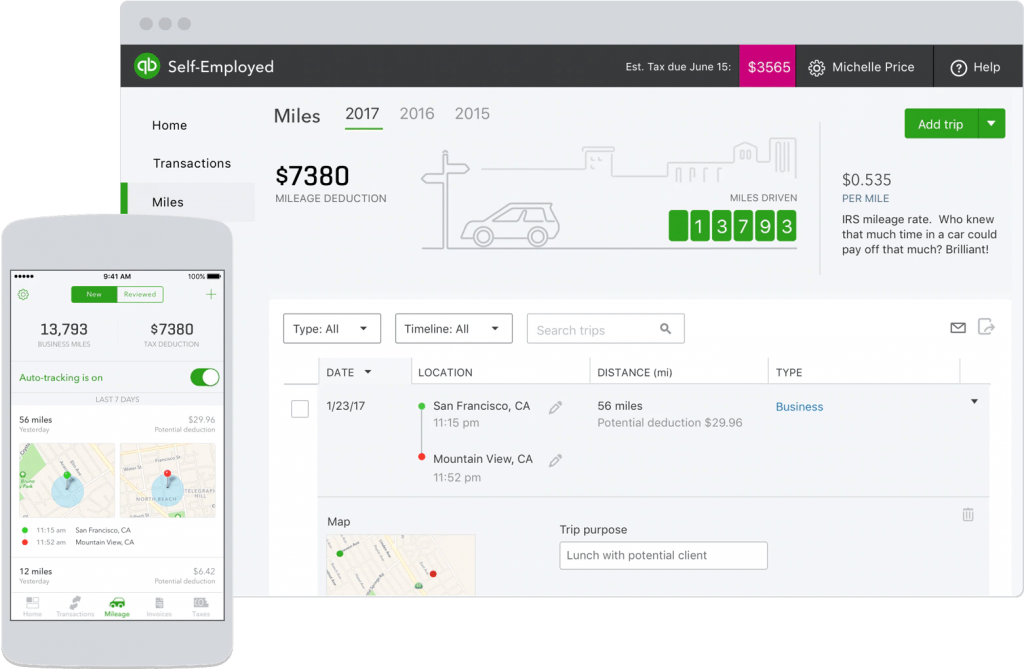

The most important thing to keep in mind when proving your income is to keep constant documentation. I would like to show the report using payments as there are many times that invoice is not fully paid or paid at all. A freelancers guide to quickbooks self employed.

These transactions should not be tied in asset liability or equity accounts. Quickbooks self employed tax bundle premium. Quickbooks self employed tax bundle live premium plus.

Showing results for. The invoices are paid. While you may review an itemized list of transactions and flag them as business personal or split you can also create rules for.

I am finding that for the transaction type being displayed for income that it is using invoice. Profit and loss is not showing income to expenses. You can also print a batch of invoices by clicking the arrow button below the print button choosing batch from the menu that quickbooks displays and then using the select invoices to print dialog box which quickbooks displays to select the to be printed invoices for printing.

Quickbooks self employed qbse is online software that makes accounting duties more manageable and organized for freelancers or those in the gig economy who are required to file a schedule c. This can be the reason why it didnt include in the total income amount. Quickbooks self employed is easy to connect to your bank account.

Search instead for. Please basic 101 answers. Keeping your tax returns profit and loss statements and bank statements all in the same place will make proving your income easier down the road.

Or am i setting up the invoices incorrectly. Select the project name then open the transaction. If you are using quickbooks self employed marking the invoice as paid will not automatically tag this as income since the invoices page is not connected on your transactions page.

You can print individual invoices by clicking the print button at the top of the create invoices window. I can see how an option to add invoices as income in your quickbooks self employed account is helpful to your business. Okay i am using qb premier 2016 and have been trying to use the profit and loss detail report.

Equipped with a 29 discount off your first three months with purchase 17a month.

More From Self Employed Tax Allowance 2020

- Government Guaranteed Bonds

- Government Administration Jobs Salary

- Self Employed Yodel Jobs

- Government Definition Of Federalism

- Government Home Loans Covid

Incoming Search Terms:

- Quickbooks Online Review 2020 Pricing Features Ratings Government Home Loans Covid,

- Quickbooks Self Employed For Freelancer Quickbooks Australia Government Home Loans Covid,

- Solved My Revenue Isn T Showing In Profit And Loss Government Home Loans Covid,

- Solved How Do I Attach Documents To Invoice Government Home Loans Covid,

- What If I Want To Upload A Logo In Quickbooks Self Employed Insightfulaccountant Com Government Home Loans Covid,

- Wave Vs Quickbooks Which Is Better If You Re Self Employed Traderscooter Government Home Loans Covid,