Self Employed Sss Monthly Pension Table, 2019 New And Updated Sss Contribution Table For Ofw S And Other Sss Member

Self employed sss monthly pension table Indeed lately has been hunted by users around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the name of the article I will talk about about Self Employed Sss Monthly Pension Table.

- How To Claim Your Sss Retirement Benefits Moneymax Ph

- How To Compute Your Sss Contribution Coins Ph

- E Pinoyguide July 2014

- Sss Contribution Table 2017 Sss Answers

- How Much Is The Sss Contribution For Employees

- Sss Monthly Contribution Table Schedule Of Payment 2020 The Pinoy Ofw

Find, Read, And Discover Self Employed Sss Monthly Pension Table, Such Us:

- How To Compute Your Sss Contribution Coins Ph

- Sss Contribution Pinay Investor

- How To Compute Sss Contributions In The Philippines Business Tips Philippines

- Sss Contribution Table 2017 Sss Answers

- New Sss Contribution Table 2020

If you are looking for Self Employed Income Tax Rate you've come to the ideal place. We ve got 104 graphics about self employed income tax rate adding images, photos, photographs, wallpapers, and much more. In these web page, we additionally provide number of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

19 03 05 the policy on expanding the coverage of the employees compensation program ecp to the.

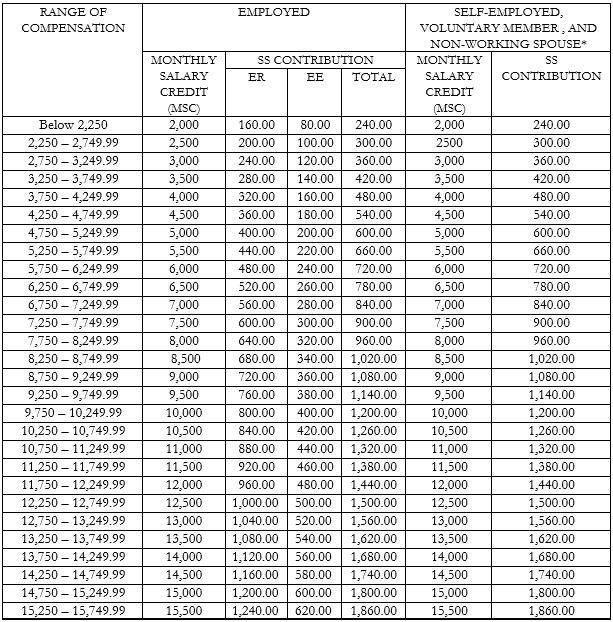

Self employed income tax rate. For employed members the minimum monthly salary credit is php 2000 with a total contribution of php 250 while the maximum monthly salary credit is php 20000 with a total contribution of php 2430. You can use this new sss contribution table if you are an employed self employed voluntary member or a non working spouse. Here is the new sss contribution table.

You are an sss member are aged 60 have separated from employment or stopped being self employed and have made at least 120 monthly sss contributions prior to the semester of retirement. Employees compensation benefits for self employed the employees compensation commission ecc issued on march 6 2019 board resolution no. For sss members who are self employed or overseas filipino workers kindly check this contribution table for reference.

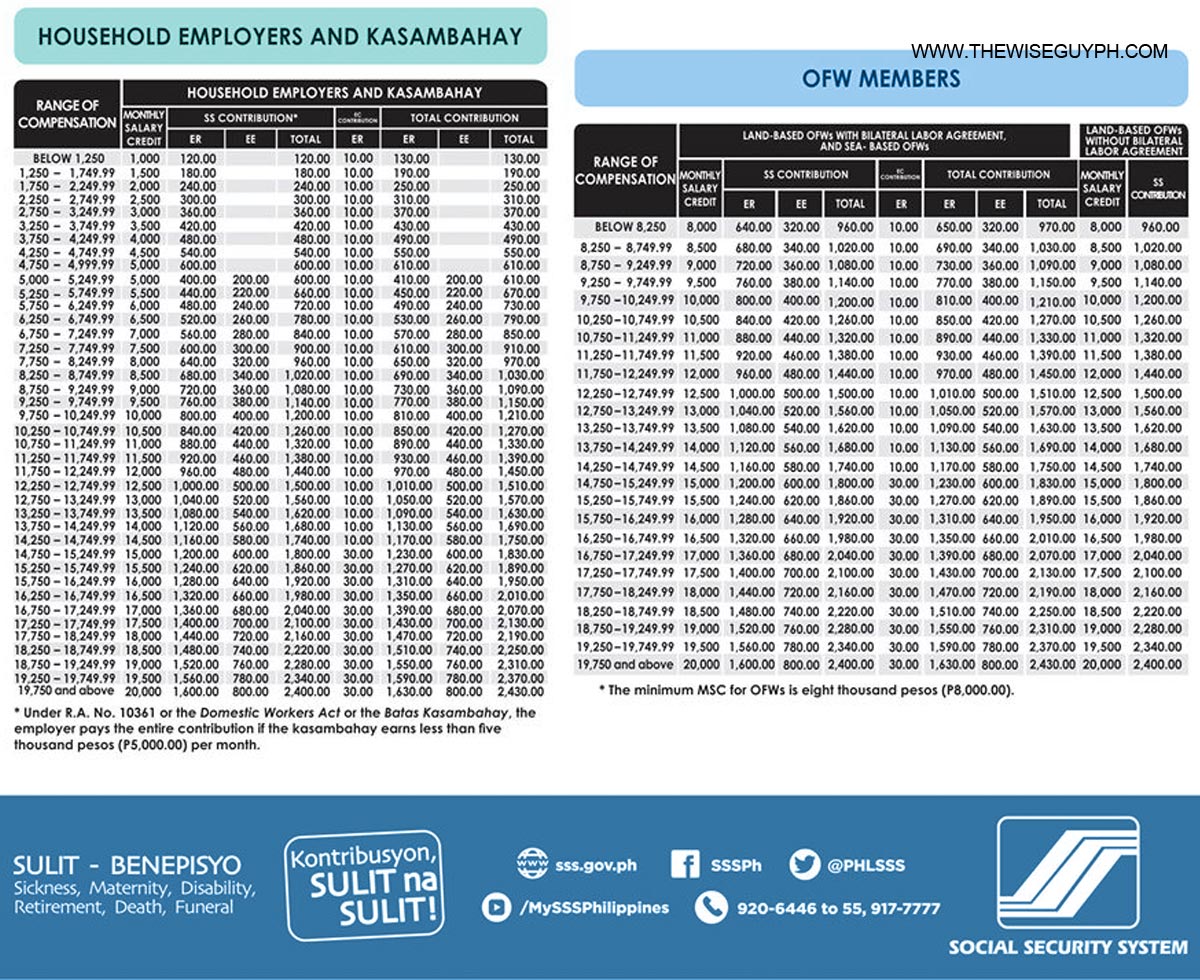

Non working spouses contribution is 50 of the their working spouses last posted monthly salary credit which should not be lower than p2000. Here is the new sss contributions table for employed self employed voluntary and non working spouse sss members for ofw members. For ofws the minimum monthly salary credit is p5000.

Employed self employed voluntary member and non working spouse. It is equal to the total contributions paid by the member and by the employer including interest. The sss contribution table below is for self employed individuals voluntary members and overseas filipino workers.

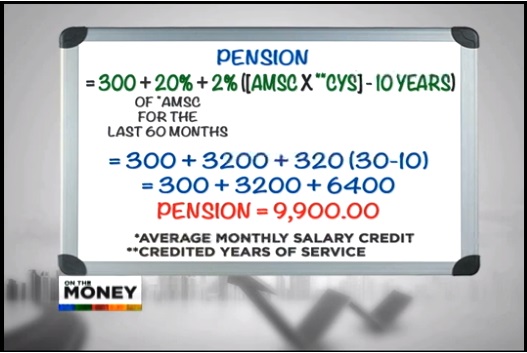

Sadly this is needed in order for you to compute your monthly pension. Lumpsum amount granted to a retiree who has not paid the required 120 monthly contributions. Sss new pension schedule 2020.

For comments concerns and inquiries contact. For household employers and kasambahay if you want here is the new sss contributions table for employed sss members. You are an sss member are aged 65 years old are employed or not and have made at least 120 monthly sss contributions prior to the semester of retirement.

Hello i was a member of sss but just start paying as self employed year 2010. Cash benefit either in monthly pension or lump sum paid to the beneficiaries of a deceased member. There are two types of retirement benefit.

I was already 48 years old when i turned 65 and i want to have my pension how much will i get monthly. 2020 sss contribution table for self employed voluntary or overseas filipino workers. The contribution rate for overseas filipino workers ofws earning less than p8250 monthly is p960 and p2400 for those with more than p19.

Monthly pension a lifetime cash benefit paid to a retiree who has paid at least 120 monthly contributions to the sss prior to the semester of retirement.

More From Self Employed Income Tax Rate

- Self Employed Sick Pay Ireland

- Government Accounting Millan Solution Manual Chapter 14

- Government Expenditures Pie Chart

- Government And Public Administration Career Cluster

- What Is Furlough From Your Job

Incoming Search Terms:

- Sss Pension Computation Guide For Retirement Planning Moneymax What Is Furlough From Your Job,

- Sss Online Registration And Steps To Check Sss Your Contribution Online What Is Furlough From Your Job,

- 1 What Is Furlough From Your Job,

- How To Pay Sss Contributions For Freelancers And Self Employed What Is Furlough From Your Job,

- Understanding The Sss Contribution Table And Why You Should Not Depend Only On Sss For Your Retirement Lifestyle Income Experiments What Is Furlough From Your Job,

- Sss Contribution For 2019 Jsl Co What Is Furlough From Your Job,