Self Employed Income Tax Rate, Singapore Personal Income Tax Guide How To File And Pay Your Personal Income Tax Ya 2020

Self employed income tax rate Indeed recently has been hunted by consumers around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of this post I will talk about about Self Employed Income Tax Rate.

- How Does The New Kansas Income Tax Bill Affect Individuals And Business Owners Longview Advisors

- Rate Structures Of The Payroll Programs Self Employed Paye Worker Download Scientific Diagram

- Tax Brackets For Self Employed Individuals In 2020 Shared Economy Cpa

- 2017 Irs Federal Income Tax Brackets Breakdown Example Single My Money Blog

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcs6jdkorlvbllexbusvqgstishqki8ryoaua0o4t9g33f8qnk0k Usqp Cau

- Chapter 15 Mongolia Opportunities For Simplicity In Tax Policy Design And Implementation Transition To Market Studies In Fiscal Reform

Find, Read, And Discover Self Employed Income Tax Rate, Such Us:

- Estimation Of Net Of Tax Rate Taxable Income Elasticity For Download Table

- Tax In A Changing World Of Work

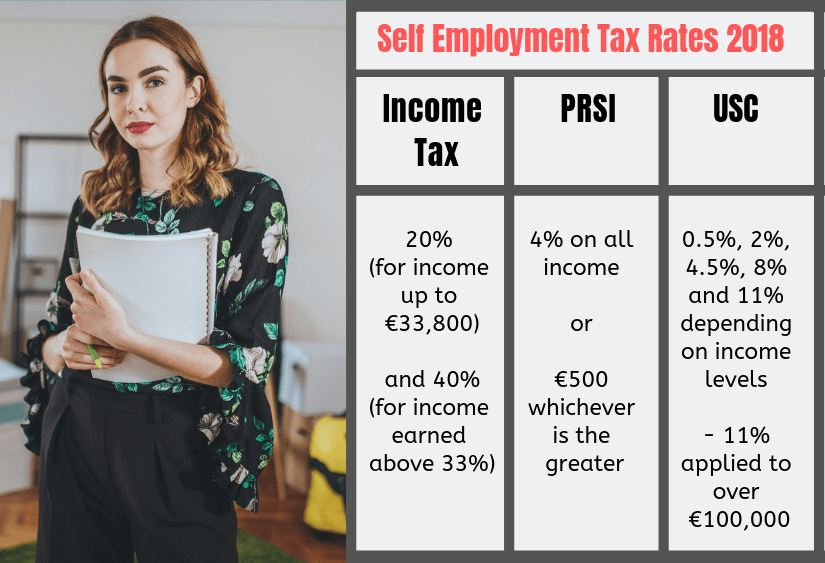

- Everything You Need To Know Before Going Self Employed Founder S Guide

- Rate Structures Of The Payroll Programs Self Employed Paye Worker Download Scientific Diagram

- Tax Schedule

If you re searching for Vile Charlie Hebdo Cartoon Government Building you've arrived at the perfect location. We have 104 images about vile charlie hebdo cartoon government building adding images, photos, photographs, backgrounds, and much more. In these page, we also have number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Finance Calculating Federal Income Taxes Social Security Medicare Self Employed Youtube Vile Charlie Hebdo Cartoon Government Building

What is the self employed income tax rate.

Vile charlie hebdo cartoon government building. 124 for social security old age survivors and disability insurance and 29 for medicare hospital insurance. For 2019 the first 132900 of your combined wages tips and net earnings is subject to any combination of the social security part of self employment tax. When it comes to paying income tax there arent any differences in the tax rates you pay compared to employees.

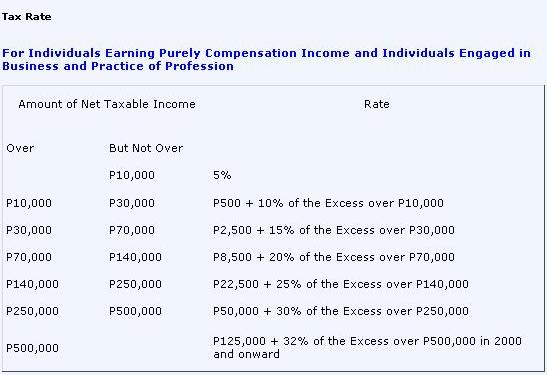

What this means is that the income tax rates for sole proprietors are the same as for individuals. The rate consists of two parts. Brackets are assigned based on taxable income and applied at.

That rate is the sum of a 124 social security tax and a 29 medicare tax on net. The maximum social security earnings are capped and are set each year. If you are self employed you need to make these tax payments yourself since you dont have an employer to send it in for you.

You can use our 2020 21 income tax calculator to find out how much youll pay. Income tax rates range anywhere from 10 to 37 depending on which tax bracket youre in. To be considered a trade or business an activity does not necessarily have to be profitable and you do not have to work at it full time but profit must be your motive.

All money you earn in the business goes towards your total income earned on line 15000. 0 on the first 12500 you earn. Tax rates for self employed canadians.

The self employment tax rate for 2019 and 2020 as noted the self employment tax rate is 153 of net earnings. Your adjusted gross income will include income from all sources including from your job self employed income side hustles and any passive sources dividends interest and capital gains. Every worker gets a personal allowance an amount that is taken tax free.

The tax rate for self employment income is 153 for social security and medicare based on the net earnings of the business. If your social security tax exceeds the maximum no social security tax is imposed on the amount over the maximummedicare tax is imposed on all net earnings with no maximum. The net amount of self employed income after all these allowable deductions is subject to federal state and sometimes local taxes.

For 2020 employees pay 765 percent of their income in social security and medicare taxes with their employers. When you are self employed as a sole proprietorship there is actually no difference between you and your business as far as the cra is concerned. In addition to income taxes everyone must pay social security and medicare taxes.

Self employment income is earned from carrying on a trade or business as a sole proprietor an independent contractor or some form of partnership. For the 2018 19 tax year the personal allowance was 11850. In the 2020 21 tax year self employed and employees pay.

What are the self employed income tax rates for 2020 21. The basic income tax rate is 20 per cent applying to income in the basic rate threshold.

Self Employment Information Leaflet Pages 1 7 Flip Pdf Download Fliphtml5 Vile Charlie Hebdo Cartoon Government Building

More From Vile Charlie Hebdo Cartoon Government Building

- Self Employed Meaning In Hindi

- Government Regulation Clipart

- Self Employed Nanny Contract Uk

- Government Accounting System In Bangladesh

- Local Government Administration Certificate Bc

Incoming Search Terms:

- Week 4 Taxation Of Employment Income Finance Minor Law Studocu Local Government Administration Certificate Bc,

- Ppt Taxes Powerpoint Presentation Free Download Id 5439768 Local Government Administration Certificate Bc,

- Pdf James Gray Example Prepare Financial Statements Balance Sheet And Income Statement For James Gray Business Jenath Rahana Academia Edu Local Government Administration Certificate Bc,

- How Much Should You Budget For Taxes As A Freelancer Local Government Administration Certificate Bc,

- Self Employment Information Leaflet Pages 1 7 Flip Pdf Download Fliphtml5 Local Government Administration Certificate Bc,

- Tax Rates And Other Payments Of The Self Employed By Country Download Scientific Diagram Local Government Administration Certificate Bc,

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)