Self Employed Income Tax Rate Ireland, Https Www Oecd Org Ctp Tax Policy Personal Income Tax Rates Explanatory Annex Pdf

Self employed income tax rate ireland Indeed lately has been hunted by users around us, maybe one of you. People are now accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the article I will talk about about Self Employed Income Tax Rate Ireland.

- Income Tax Deadline For Self Employed Accountant S Notes

- The Terrible Debate That Is In Store For Us In 2014 Notes On The Front

- Self Employed In Ireland A Guide To Your Taxes Part 2

- Packges Tax Services

- Https Pdf4pro Com Cdn Sme Tax Compliance And Simplification Oecd Org Eb7d0 Pdf

- Oecd Tax Database Oecd

Find, Read, And Discover Self Employed Income Tax Rate Ireland, Such Us:

- Income Tax Calculator Calculate Taxes Online Fy 2019 20

- The Terrible Debate That Is In Store For Us In 2014 Notes On The Front

- Personal Income Tax In Indonesia For Expatriate Workers Explained

- Taxation In The Republic Of Ireland Wikipedia

- Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

If you are looking for What Is Furlough Pay Now you've reached the ideal place. We ve got 103 images about what is furlough pay now adding pictures, photos, photographs, wallpapers, and much more. In these webpage, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Https Pdf4pro Com Cdn Sme Tax Compliance And Simplification Oecd Org Eb7d0 Pdf What Is Furlough Pay Now

The earned income tax credit for the self employed will increase from 1500 to 1650.

What is furlough pay now. Useful links about us. Members of chartered accountants ireland. It was announced in budget 2021 that the tax debt warehousing scheme will be extended to taxpayers who self assess for income tax that are adversely impacted by covid 19.

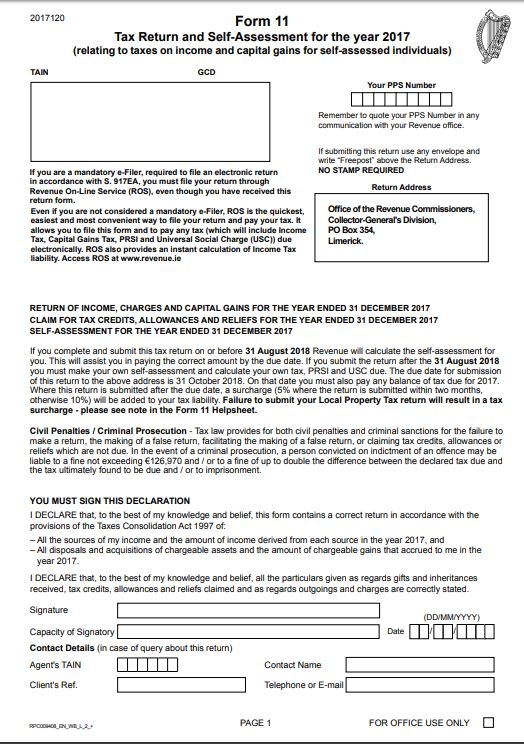

Self employed income tax calculator. Some 730000 were expected to file a tax return last year according to taxback. If youre self employed or receive income from non paye sources you must register for self assessmentself assessment is where you calculate the income tax you owe for the tax year yourself and it needs to be done every year when you file your tax returns.

It is brought to you by liam burns a chartered tax adviser with the irish taxation institute and principal of liam burns and co accountants. Your tax return is used to declare income you earn and also to claim any tax allowances that can be offset against your tax bill. If youre self employed in ireland then youre obliged to file a self assessed tax return usually by the deadline of october 31 or by the pay and file deadline of nov 10.

Winners of eircom golden spider award for best financial website. Income universal social charge usc pay related social insurance prsi value added tax vat and about tax credits. Tax rates bands and reliefs the following tables show the tax rates rate bands and tax reliefs for the tax year 2020 and the previous tax years.

For starters the earned income tax credit applies to most self employed people. Earned income credit cannot be transferred to your spouse or civil partner. The number of people who now file a self assessed tax return has shot up by 112000 in the last five years.

Members of irish tax institute. Income tax 20 up to 32800 and 41. To redress this revenue attempt to tax a self employed persons income in the year they earn it by way of preliminary tax.

So preliminary tax for 2017 is due by 31 october 2017 and it a full credit for the amount of preliminary tax paid is allowed against the final tax liability agreed on filing the following year. This measure will also be applied for the 2020 tax year. Assuming the 40 tax rate applies income tax 40.

Calculating your income tax gives more information on how these work. This tax credit is worth 1150 for 2018 950 for 2017 and you can subtract this figure from your tax liability. This one page guide guide covers the tax codes and legislation which affect how self employed are taxed in ireland.

More From What Is Furlough Pay Now

- What Is The Furlough Scheme Bbc

- Upcoming Government Exams 2020

- Government Grants For Homeowners 2020

- Hp 241 G1 Government Laptop Drivers For Windows 7 32 Bit

- Government Cheese 80s

Incoming Search Terms:

- Government Highly Likely To Widen 20 Tax Band In 2019 Budget Government Cheese 80s,

- Taxation In The Republic Of Ireland Wikipedia Government Cheese 80s,

- Tax Relief Flat Rate Employment Expenses Accountant S Notes Government Cheese 80s,

- Ireland V The Rest Of The World Do We Pay Too Much Tax Government Cheese 80s,

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Government Cheese 80s,

- Tax Institute Calls For Income Tax Cut Timeline Government Cheese 80s,