Rules Of Furlough Scheme For Employees, Faqs Furloughing Employees Job Retention Scheme Sa Law

Rules of furlough scheme for employees Indeed recently has been sought by users around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of this article I will discuss about Rules Of Furlough Scheme For Employees.

- What Is Furlough Definition Pros Cons More

- Furlough Rishi Sunak Reveals Replacement Support Scheme Bbc News

- Changes To The Coronavirus Job Retention Scheme From 1 July 2020 Charity Tax Group

- Employers Need Greater Clarity On Rules For Furloughed Employees Under Coronavirus Job Retention Scheme Hr News

- Covid 19 Rishi Sunak To Announce Help For Shut Down Businesses Bbc News

- Coronavirus Employees Help

Find, Read, And Discover Rules Of Furlough Scheme For Employees, Such Us:

- Six Million Furloughed Staff Continued To Work From Home Study Suggests

- Fretting About Flexible Furlough Low Incomes Tax Reform Group

- The Coronavirus Job Retention Scheme Qandas For Employers Ashurst

- The Deadline For Putting Employees On Furlough Is This Week Business Live

- The Uk S Coronavirus Furlough Scheme Explained Wired Uk

If you re searching for Self Employed Furlough you've come to the ideal place. We have 100 graphics about self employed furlough including pictures, pictures, photos, backgrounds, and much more. In these web page, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Furlough rules explained 15 things you need to know as 9million people join scheme.

Self employed furlough. There are rules about what your employees can do. Furlough rules have been dramatically altered in recent months as the government launched the coronavirus job retention scheme to keep the economy afloat. The scheme has helped thousands across.

Heres our summary of the furlough rules. Over the next few months the government will also reduce how much they cover under the scheme and the maximum someone on it can earn. They can keep employees on the pay roll who have been asked to stop working this is known as being on furlough.

Furlough rules explained for employers and employees. What is the furlough scheme. The government has extended the furlough job retention scheme until october 2020 although specific details of the scheme from august are yet to be clarified.

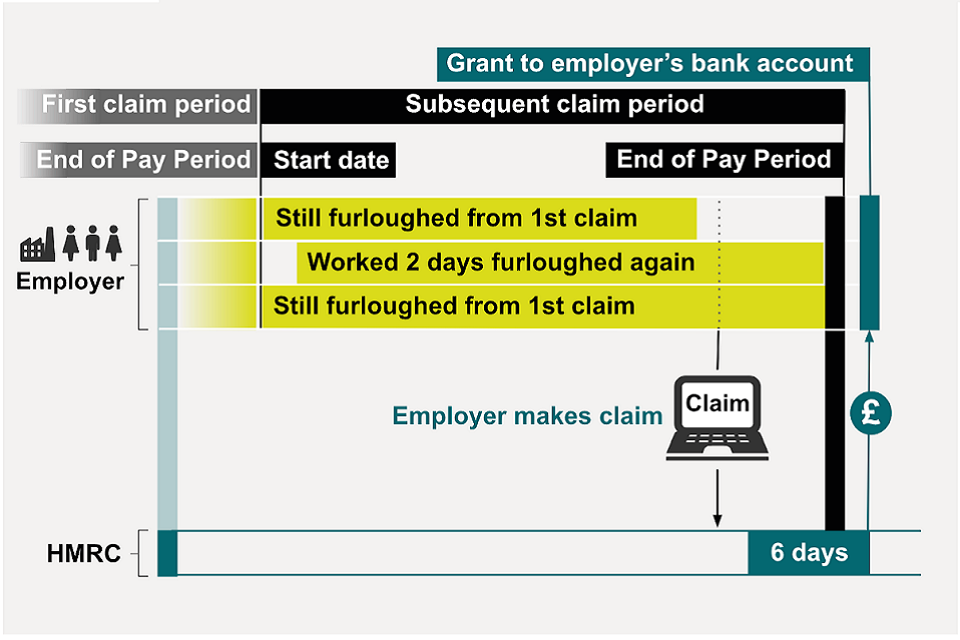

Under the coronavirus jobs retention scheme to give furlough its official title employees placed on leave receive 80 of their pay up to a maximum of 2500 a month. During hours which you record your employee as being on furlough employees who are pension scheme trustees or trustee directors of a corporate. The decision whether to furlough an employee is at the discretion of the employer.

While the scheme closes to new applicants on 30 june to be eligible to stay on furlough after this point an employee must have already been on furlough for at least three weeks prior to the closing date. In view of the two extensions to the furlough scheme the issue of what happens to holidays is important. Find out more including how you will be able to claim the coronavirus job retention scheme on govuk.

What continues with the furlough scheme. According to recent estimates 93 million employees in the uk have been placed on the governments furlough scheme since it was announced in march. Employees who have not been put on furlough by 10 june 2020.

Employees can be put on furlough a leave of absence and firms can keep paying them but 80 of their. Employees who are shielding or have difficulties because of childcare can continue to be furloughed. Employees could get paid 80 of wages up to a monthly cap of 2500.

Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk Self Employed Furlough

More From Self Employed Furlough

- Usa Federal Government Grant Logo

- Self Employed Ei Canada Covid

- Government Shutdown 2020 Update

- Martin Lewis Furlough Scheme Extended

- Government Relations Cover Letter Example

Incoming Search Terms:

- What Changes Are Being Made To The Furlough Scheme In October Metro News Government Relations Cover Letter Example,

- More Than One In Four Uk Workers Now Furloughed Bbc News Government Relations Cover Letter Example,

- Half Of Businesses Would Have To Lay Off Staff Within Three Months If Furlough Scheme Ended Yougov Government Relations Cover Letter Example,

- Furlough Extended During New Lockdown And Workers Will Get 80 Of Wages Paid Government Relations Cover Letter Example,

- Hmrc Confirms Compulsory Commission Can Be Paid To Furloughed Sales Staff Car Dealer Magazine Government Relations Cover Letter Example,

- Job Retention Scheme New Flexible Furlough Rules Kpmg Ireland Government Relations Cover Letter Example,