Self Assessment Self Employed Accounts Template Uk, Balance Sheet Example Accountingcoach Simple Profit And Loss Statement Template For Self Employed Exam Golagoon

Self assessment self employed accounts template uk Indeed recently has been hunted by users around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the name of the article I will discuss about Self Assessment Self Employed Accounts Template Uk.

- Working From Home Allowances For The Self Employed News

- What Is The Difference Between Self Employed And Sole Trader

- Self Employed Accounts Template Goselfemployed Co

- Tax Benefits For Sole Traders Working From Home Freeagent

- Balance Sheet Example Accountingcoach Simple Profit And Loss Statement Template For Self Employed Exam Golagoon

- Self Assessment Tax Return And The Short Self Employed Tax Return Form

Find, Read, And Discover Self Assessment Self Employed Accounts Template Uk, Such Us:

- Uk Self Employed Tax Accounts Small Business Toolbox

- Self Employed Accounting Tax Software Quickbooks Uk

- P60 Form Explained Uk 2019 Goselfemployed Co

- Self Employment Wikipedia

- Information Guide For Unique Tax Reference Numbers

If you are searching for Self Employed Cerb Questions you've come to the right location. We ve got 104 images about self employed cerb questions adding images, photos, photographs, backgrounds, and more. In these page, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

If your accounting period is 6 th april to 5 th april the best advice is to add the end of the year april figures into march.

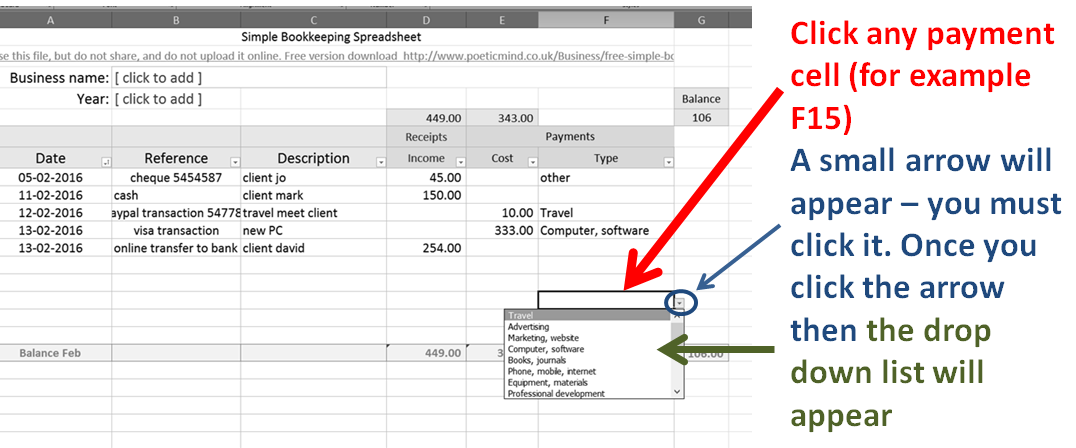

Self employed cerb questions. The self employment short form and notes have been added for tax year 2019 to 2020. You must keep records of your business income and expenses for your tax return if youre self employed as a. The self employment short form and notes have been added for tax year 2018 to 2019.

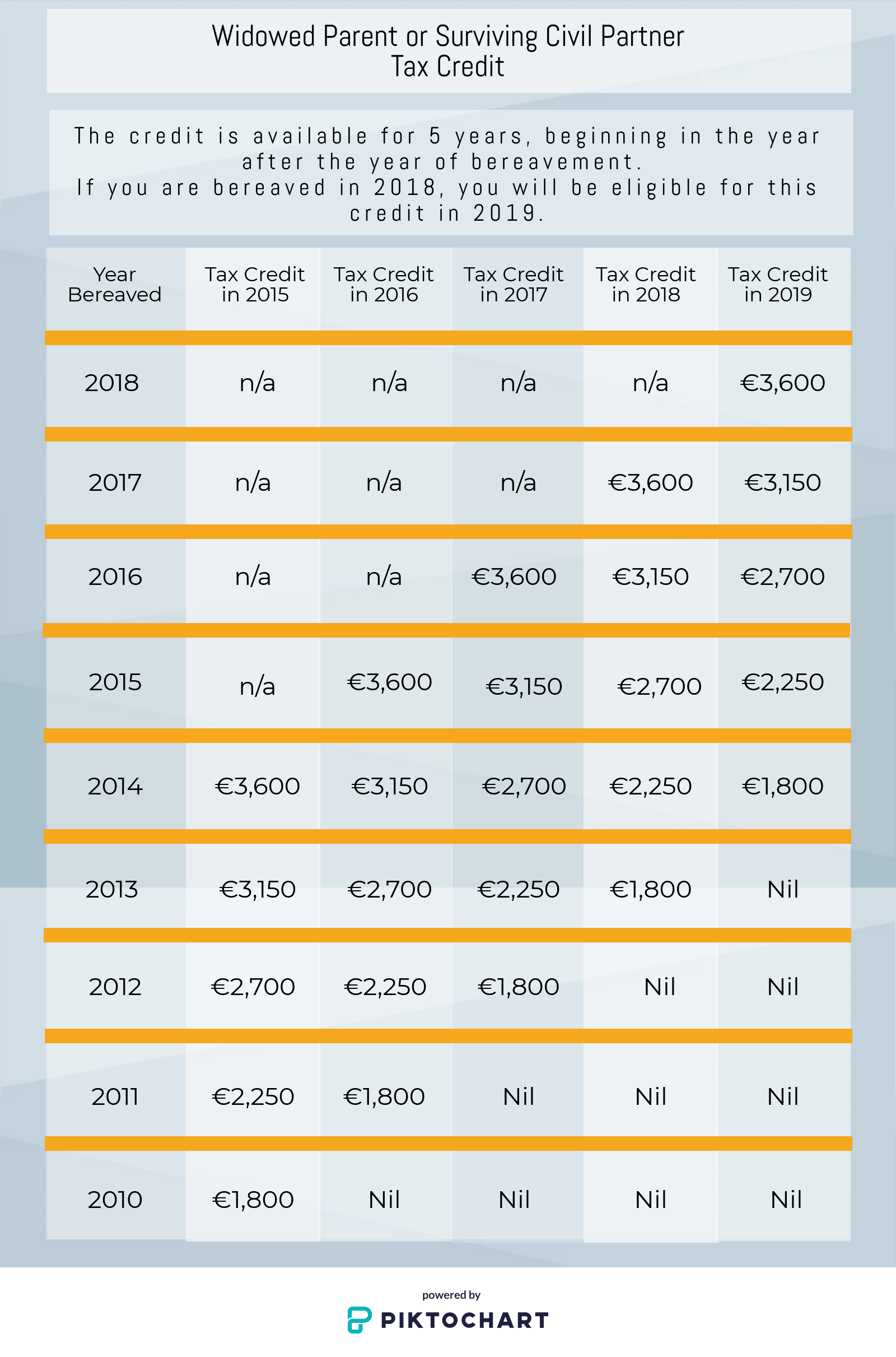

The self employed bookkeeping template runs from april to march. Youll need to register for self assessment. Full instructions on using the cash book template are available here.

Think about ways that you are able to spend less. It keeps checking the bank figure much easier. The self assessment provides hmrc with information on your income and expenses and makes sure you are taxed the correct.

The template comes with all the formulas you need so you can track your income and expenses estimate your taxes in real time a dashboard to quickly see key accounting information and more. All sole traders will have to complete an annual self assessment tax return and submit this to hmrc. Self employed bookkeeping template.

Now theres a huge range of accounting software thats been designed especially for small businesses and the self employed. Once your first years self assessment is processed a tax calculation is available from hmrc. How using simplified expenses can save you time if youre self employed.

Complete a self assessment tax return. All self employed businesses must keep records of the financial transactions and submit these accounts annually to hm revenue and customs in the format of the self assessment tax return which are supplementary pages included in the self employed annual tax return. Even for household cleaning goods and such you are able to do the specific same and save a significant amount of money.

You will spare a package if you maintain certain appliances. There is also a payment on account that is due 31st july. Hmrc will require you to complete a self assessment tax return.

Please note that these invoice templates are only suitable for uk self employed sole traders freelancers they are not suitable for limited companies. The tax year is from 6 th april to 5 th april and the tax return and payment are due 31 st january the following year. Invoice numbering ensure you use a consistent invoice numbering system and that you are sequential with the numbering eg.

This simple bookkeeping spreadsheet is designed for the unique accounting needs of the uk sole traders and self employed business owners.

More From Self Employed Cerb Questions

- Uk Government Furlough Scheme Cost

- Self Employed Voluntary Sss Table Of Contribution 2020

- Furlough Scheme Rules For Employees

- Government Decree Covid

- Self Employed Profit And Loss Statement Format

Incoming Search Terms:

- Information Guide For Unique Tax Reference Numbers Self Employed Profit And Loss Statement Format,

- Self Assessment Self Employment Short Sa103s Gov Uk Self Employed Profit And Loss Statement Format,

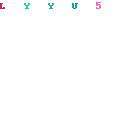

- Expenses You Can Claim If You Re Self Employed In Ireland Self Employed Profit And Loss Statement Format,

- Bookkeeping Templates For Self Employed Cash Book Template Self Employed Profit And Loss Statement Format,

- Tax Year 2018 19 All The Key Dates You Need To Know And Plan For Informi Small Business Support Self Employed Profit And Loss Statement Format,

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland Self Employed Profit And Loss Statement Format,