Self Employed And Employed Tax Return, Customizing You To Your Market Home Business Business Tax Return

Self employed and employed tax return Indeed recently is being sought by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the title of the post I will talk about about Self Employed And Employed Tax Return.

- Printing Your Self Assessment Tax Return Freeagent

- How To Complete A Self Assessment Tax Return With Pictures

- Self Employment Tax The Benefit Bank Self

- Employed Self Employment Taxes

- Self Employment Tax For U S Citizens Abroad

- Ppt Priorities First Inc Business Self Employed Tax Preparation Checklist Powerpoint Presentation Id 1675536

Find, Read, And Discover Self Employed And Employed Tax Return, Such Us:

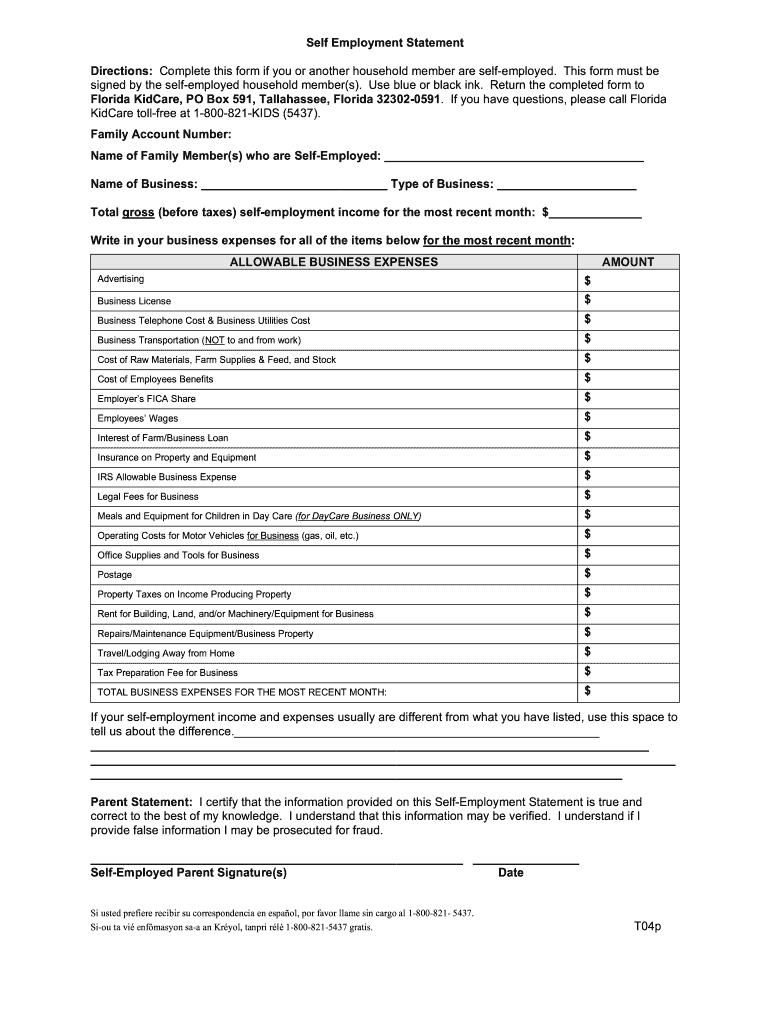

- Self Employment Form Fill Out And Sign Printable Pdf Template Signnow

- Printing Your Self Assessment Tax Return Freeagent

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctw7rwjhqvgpuzhoimbk04bp1 H 6gjv1nh Btkch8o6odh0gpz Usqp Cau

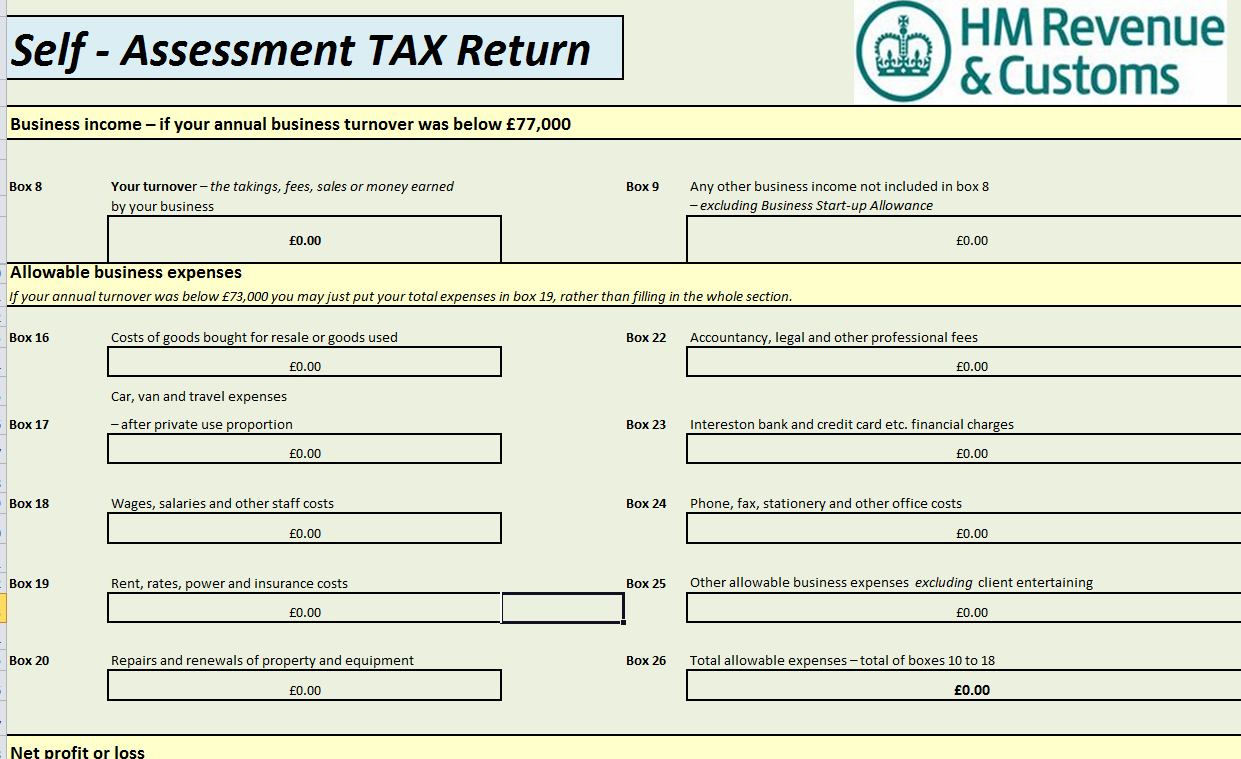

- Fillable Online Self Employment Short 2019 If You Re Self Employed Have Relatively Simple Tax Affairs And Your Annual Business Turnover Was Below 73 000 Use The Sa103s 2019 Short Version Of The Self Employment Supplementary Pages

- Free 7 Sample Self Employed Tax Forms In Ms Word Pdf

If you re searching for Market Failure And Government Intervention you've come to the right place. We ve got 104 graphics about market failure and government intervention adding pictures, photos, pictures, wallpapers, and much more. In such web page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

Registering a partner or partnership.

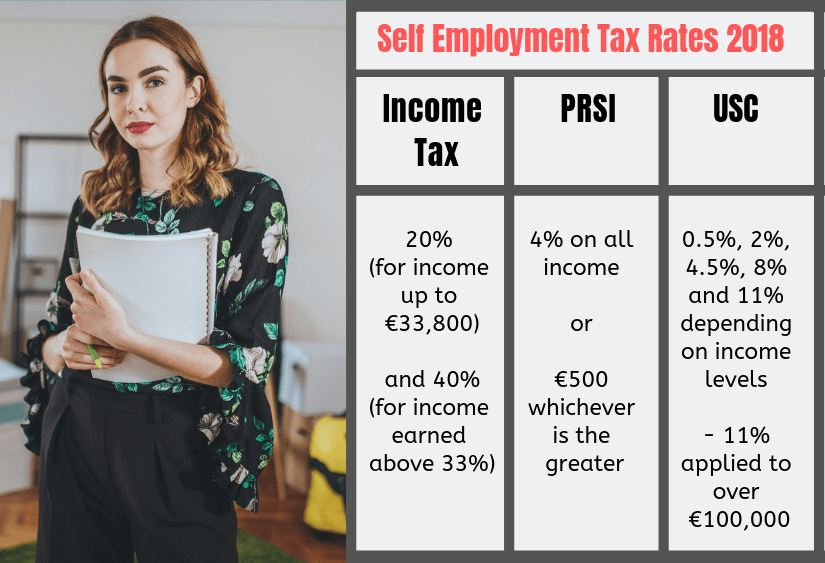

Market failure and government intervention. That rate is the sum of a 124 social security tax and a 29 medicare tax on net earnings. You need to keep records for example bank statements or receipts so you can fill in your tax return correctly. There are two sections to a self assessment tax return.

Filling in your return. Benefits including state pension child benefit and blind persons allowance. Taxed and untaxed income in the form of dividends and interest.

How to fill in a self assessment tax return. As noted the self employment tax rate is 153 of net earnings. Information about schedule se form 1040 or 1040 sr self employment tax including recent updates related forms and instructions on how to file.

The self employed usually need to file a self assessment tax return each year. Schedule se form 1040 is used by self employed persons to figure the self employment tax due on net earnings. The main section is the sa100 which deals with.

More From Market Failure And Government Intervention

- What Date Was Furlough Scheme Announced

- Government Notes Aesthetic

- Government Office

- Government Covid Testing Sites Near Me

- Uk Government Covid Furlough Scheme

Incoming Search Terms:

- Understanding Tax Returns Innovative Tax Relief Uk Government Covid Furlough Scheme,

- Self Employed Tax Returns Nlp Financial Uk Government Covid Furlough Scheme,

- Irs Shutters Some Operations Self Employed Get Unemployment And Track Your Stimulus Check Advisors To The Ultra Affluent Groco Uk Government Covid Furlough Scheme,

- Ppt Priorities First Inc Business Self Employed Tax Preparation Checklist Powerpoint Presentation Id 1675536 Uk Government Covid Furlough Scheme,

- What Is Self Employment Tax And Schedule Se Stride Blog Uk Government Covid Furlough Scheme,

- Self Employment Deadlines Authorstream Uk Government Covid Furlough Scheme,