Government Student Loans Vs Private, Addressing The 1 5 Trillion In Federal Student Loan Debt Center For American Progress

Government student loans vs private Indeed recently has been sought by consumers around us, maybe one of you. People are now accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of the post I will discuss about Government Student Loans Vs Private.

- U S Teachers Vs The U S Government The Battle Over Student Loan Forgiveness Sofi

- Government Report Reviews Private Student Loans And Recommends Statutory Changes Fastweb

- Federal Vs Private Student Loans What S The Difference Lendedu

- Addressing The 1 5 Trillion In Federal Student Loan Debt Center For American Progress

- Plr Articles Blog Posts Private Vs Federal Student Loans Plr Me

- Federal Loans Vs Private Loans For Students Comparison Sallie Mae

Find, Read, And Discover Government Student Loans Vs Private, Such Us:

- Student Loans Explained Wtfinance Mintlife Blog

- Lindsey Burke A Major Threat To Our Economy The Student Loan System Is Underwater Fox Business

- Federal Loans Vs Private Loans For Students Comparison Sallie Mae

- Private Loans Student Loan Borrowers Assistance

- Student Loan Interest Deduction Should Factor Into Debates On Student Debt Tax Code The Pew Charitable Trusts

If you re looking for Self Employed Income Tax Percentage you've come to the right place. We have 100 graphics about self employed income tax percentage including pictures, pictures, photos, backgrounds, and much more. In these page, we also have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

However if youre applying for a full year your lender may disburse the funds to your school each semester rather than all at once.

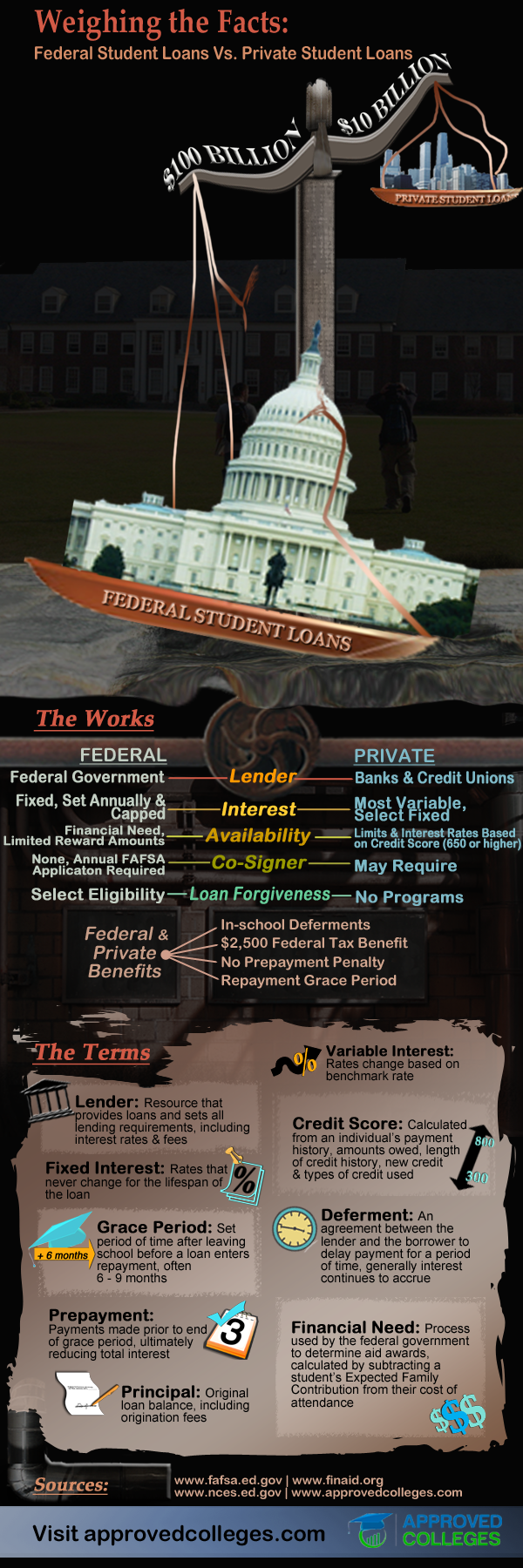

Self employed income tax percentage. With terms ranging from 5 15 years you can choose between having lower monthly. Federal loans generally have more favorable terms including flexible. Private student loans you can apply for private student loans when you need to as long as you plan enough time for the lender to process your loan and disburse send money to the school.

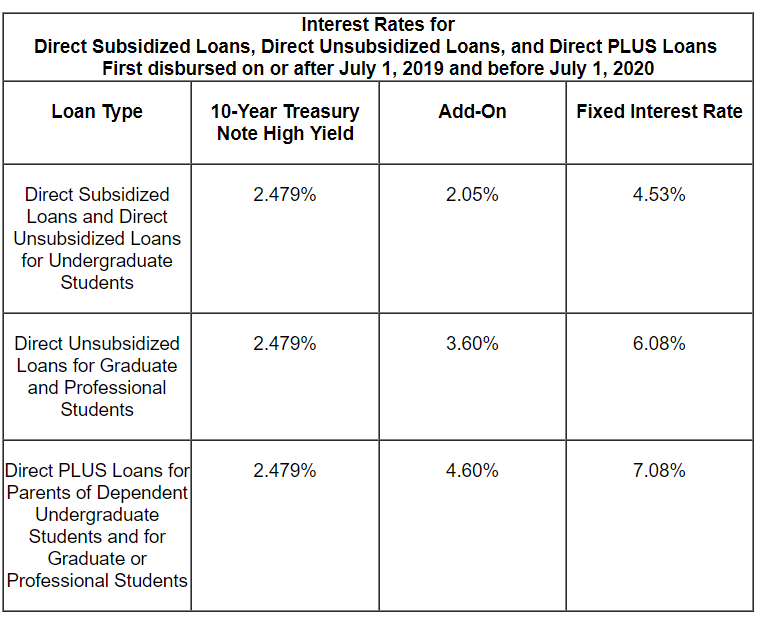

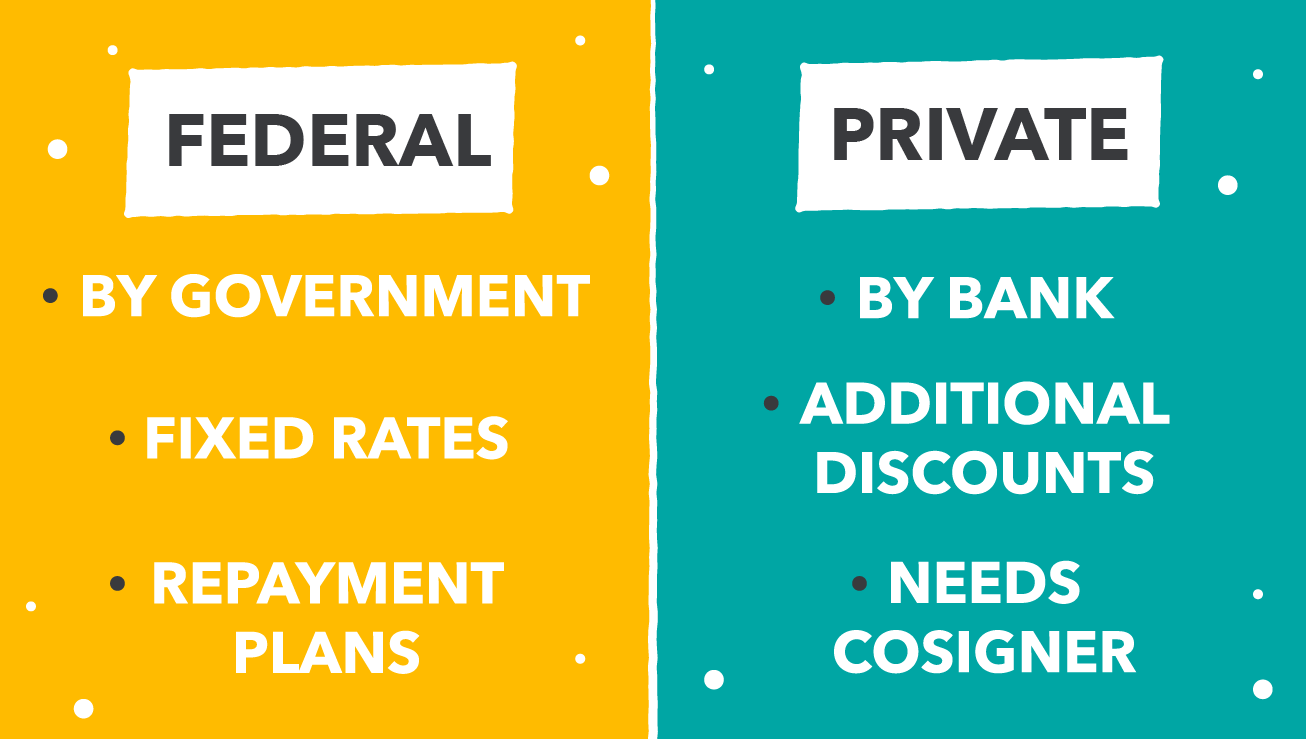

The basic difference between federal and private student loans is that federal student loans are offered by the government while private student loans are. You can obtain a student loan through the federal government or from private lenders such as banks and credit unions. Image by jessiejacobson flickr.

There are two forms of student loans. Student lines of credit offered by private financial institutions including the countrys big banks often offer interest rates that are considerably lower than those of government student loans. Since private student loans are not associated with the federal government their repayment terms and benefits vary from lender.

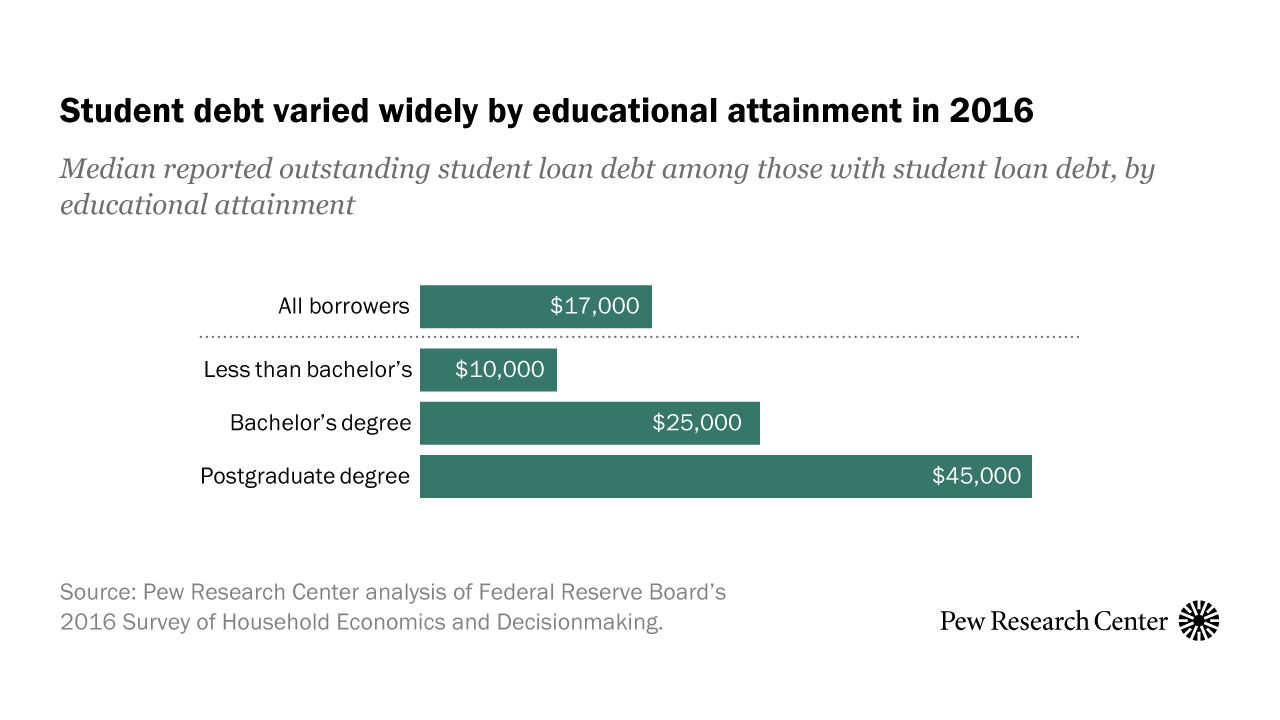

What type of loan youll be able to borrow will depend on several factors including your needs year in school income and how much youve already borrowed. On july 24 2013 in student loans. Luckily with student loans students can more easily pay for universitycollege.

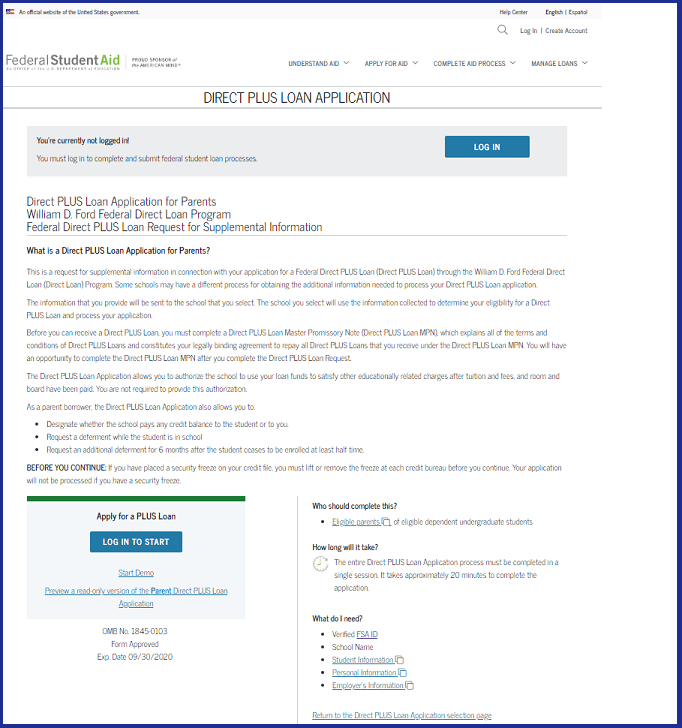

Both government and private student loans can be used to pay for schooling expenses like tuition books and supplies room and board and many other living expenses that come up during school. However there are a few primary differences that set these 2 funding. So when applying for private student loans its important to clearly understand annual percentage rates aprs and repayment terms before signing as well as the differences between private vs federal student loans.

A private student loan from elfi gives you a choice of several attractive repayment options including deferring repayment until six months after graduation. Private student loans private student loans come with different repayment plans depending on the lender. Both require you to borrow and pay back the money over a certain amount of time.

If youre planning to go to college one of the key things youll be researching into is financing options.

More From Self Employed Income Tax Percentage

- Government Cheese

- Government Shutdown 2019 Reason

- Government Tyranny Images

- Government Furlough Scheme How To Claim

- Government Uk Public Sector

Incoming Search Terms:

- Federal Vs Private Student Loans What S The Difference Daveramsey Com Government Uk Public Sector,

- Federal Vs Private Student Loans Government Uk Public Sector,

- The Debt Trap How The Student Loan Industry Betrays Young Americans Money The Guardian Government Uk Public Sector,

- Top 5 Questions About Subsidized And Unsubsidized Loans Ed Gov Blog Government Uk Public Sector,

- Lindsey Burke A Major Threat To Our Economy The Student Loan System Is Underwater Fox Business Government Uk Public Sector,

- Student Loans 101 It S A Money Thing Government Uk Public Sector,