Self Employed Mortgage Lenders Uk, Best Mortgage Lenders For Self Employed In The Uk

Self employed mortgage lenders uk Indeed lately is being sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of this post I will talk about about Self Employed Mortgage Lenders Uk.

- Self Employed Mortgage How Does It Work Mortgage Light

- Key Documents Freelancers Need To Secure A Self Employed Mortgage Freelance Uk

- Mortgage Lenders Archives Active Mortgage Gary Das Mortgage Advisors For The Self Employed

- How Freelancers Can Get More From Mortgage Lenders With A Good Credit Score Freelance Uk

- Mortgage Application Proofs Guide Nationwide

- Alien Skin

Find, Read, And Discover Self Employed Mortgage Lenders Uk, Such Us:

- Self Employed Client With One Year S Accounts Wanting To Remortgage And Release Equity Aws Mortgages Financial Services

- Easystart Mortgages Finance Posts Facebook

- Mortgage Guide Articus Finance

- Self Employed Mortgage Niche Mortgage Broker

- Recently Self Employed Mortgage Options Niche Mortgage Broker

If you are looking for Self Employed Tax Form 2019 you've come to the right place. We have 100 images about self employed tax form 2019 adding pictures, pictures, photos, backgrounds, and more. In these webpage, we additionally have variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

You could be a sole trader a partner or director or a contractor who has set up a limited company.

Self employed tax form 2019. Self employed mortgages weve got a mortgage with your name on it email us. Lenders will view you as self employed if you own more than 20 to 25 of a business from which you earn your main income. Most lenders are happy to give mortgages for self employed people if.

There are many fha lenders that provide home loans for the self employed. 1 guaranteed rate. As a general rule well need to see proof of your income for the past two complete tax.

This means those who are self employed now need to apply for a mortgage in the same way as everyone else. When you apply for a mortgage well consider you to be self employed if you have more than a 20 share of the business from which you get your main income. If youre looking for a new mortgage please contact a mortgage broker wholl be able to discuss your personal circumstances to find the right mortgage for you.

You can compare the ltvs and interest rates on all mortgages from the self employed mortgage lenders that will not automatically refuse you because you are self employed. While mortgages for the self employed might seem harder to come by it isnt impossible. Self employed mortgage affordability its now a legal obligation for lenders to check if you can afford a mortgage repayment if interest rates were to increase by 6 7 and to multiply your income by 4 5 times to assess your maximum borrowing amount.

Lenders assess affordability by looking at an applicants outgoings and incomings which they must be able to corroborate. We work with many of the best fha approved lenders around the nation and can connect you with the best fha lender for your location. You could be a sole trader company director or contractor.

This makes it difficult for the newly self employed as lenders will often take an average of their last few years of income when making a decision. You can find a mortgage broker by searching online or by asking friends or family. Best fha lenders for the self employed.

You have been trading for at least three years you have two years of accounts or self assessment tax returns available there may be some discretion around the deposit thats required or your credit rating. What counts as self employed. Now self employed borrowers need to prove their income in order to be accepted for a mortgage.

Applying for a mortgage if youre self employed. Before lenders will consider offering you a mortgage they require proof that a mortgage is affordable and not just affordable now but in the future too. A few of the best national lenders that you may want to consider are.

More From Self Employed Tax Form 2019

- Government Logo Clipart

- Furlough Rules Oct

- Furlough Scheme Uk March

- Self Employed Bank Account Lloyds

- What Is Furlough Scheme In Uk

Incoming Search Terms:

- Self Employed You Can Still Get A Mortgage What Is Furlough Scheme In Uk,

- Self Employed Mortgages Let A Broker Navigate The Options What Mortgage What Is Furlough Scheme In Uk,

- Trust Your Broker What Is Furlough Scheme In Uk,

- How Can I Get A Mortgage If I M Self Employed Expert Advice What Is Furlough Scheme In Uk,

- Bowman Offshore Bank Transfers On Top Tips On Securing An Overseas Mortgage Pages 1 4 Text Version Anyflip What Is Furlough Scheme In Uk,

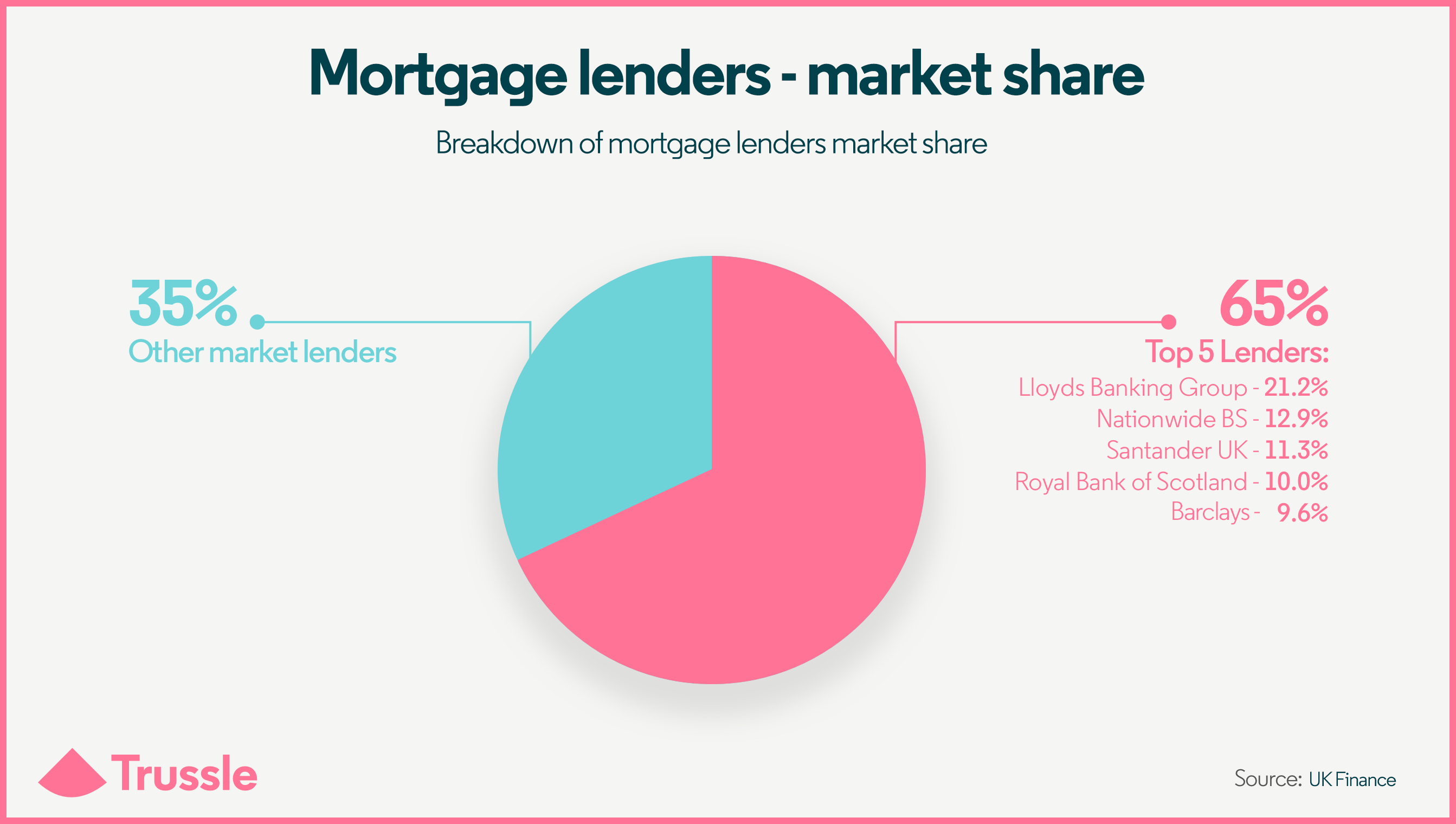

- Mortgage Market Dominated By Big Six Ftadviser Com What Is Furlough Scheme In Uk,