Government Budget Surplus Loanable Funds, Review Of The Previous Lecture Shortcomings Of Gdp Factor Prices Are Determined By Supply And Demand In Factor Markets As A Factor Input Is Increased Ppt Download

Government budget surplus loanable funds Indeed recently has been hunted by consumers around us, maybe one of you. Individuals are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of this post I will talk about about Government Budget Surplus Loanable Funds.

- The Graph Illustrates The Private Supply Of Loanab Chegg Com

- Poucv 3 Government Budget Deficits And Surpluses Economics Assignment Help Economics Homework Economics Project Help

- Mn 1512 Week 4 Finance Saving And Investment Seminar Answer Studocu

- Saving Investment And The Financial System Ppt Video Online Download

- Theories Of Government Budget Deficits And Debt Principles Of Political Economy 3e

- Https Www Palmislandtraders Com Econ53 Chap3 Pdf

Find, Read, And Discover Government Budget Surplus Loanable Funds, Such Us:

- Ppt Chapter Powerpoint Presentation Free Download Id 5321331

- Https Asadpriyo Weebly Com Uploads 4 5 1 4 45143247 Ch11 Pdf

- The Market Of Loanable Funds With An Example Of Crowding Out Freeeconhelp Com Learning Economics Solved

- The Deficit Interest Rates And Growth Tax Foundation

- Case For Cutting The National Debt Revision Economics Tutor2u

If you are searching for Government Public Affairs you've reached the right place. We ve got 104 graphics about government public affairs adding pictures, pictures, photos, backgrounds, and more. In such web page, we additionally have number of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.

Therefore it has negative savings which reduces total savings.

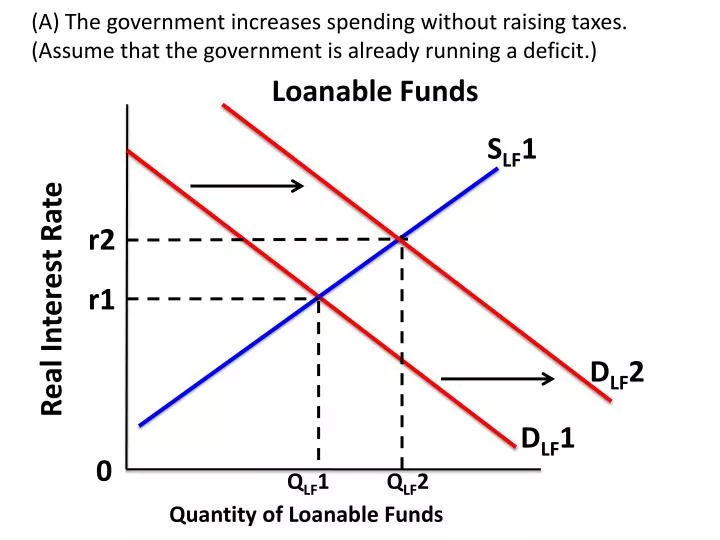

Government public affairs. Because revenue exceeds expenditure the government in this case acts as a supplier. Think of a simplistic society where there are 3 actors. A government budget surplus increases the supply of loanable funds lowers the real interest rate decreases savings and increases investment.

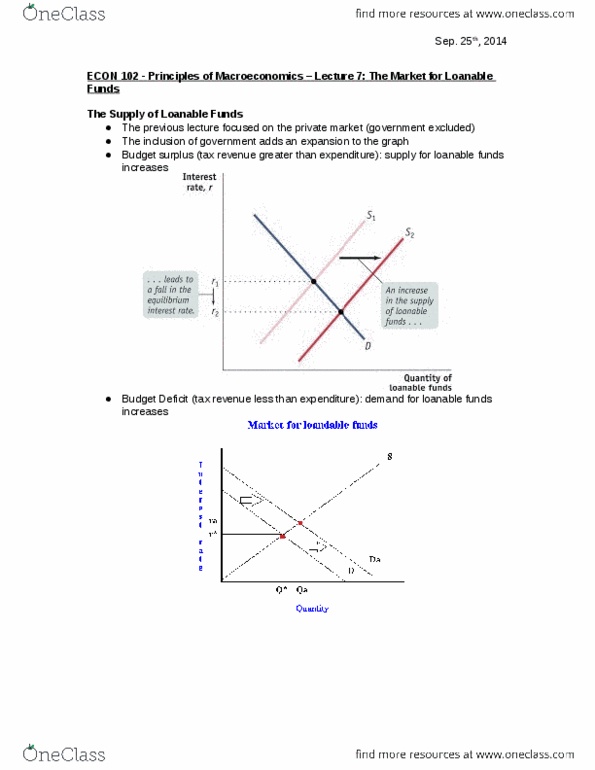

Government budget deficit. The supply of loanable funds curve slf shows the sum of private supply and government budget surplus government surplus horizontal distance between pslf and slf a government budget deficit increases the. Govt surplus increases supply of loanable funds and adds to private saving increase supply of loanable funds shift right real interest rate falls decrease household saving decrease quantity of private funds supplied new lower interest rate firms increase quantity demanded and investment government budget surplus pslf private supply of loanable funds curve slf supply of.

A government budget deficit affects the supply of loanable funds rather than the demand for loanable funds because in our model of the loanable funds market we define loanable funds as the flow of resources available to fund private investment. This happens because the governments expenses surpass its revenues. The demand for loanable funds for hoarding purpose is a decreasing function of the rate of interest.

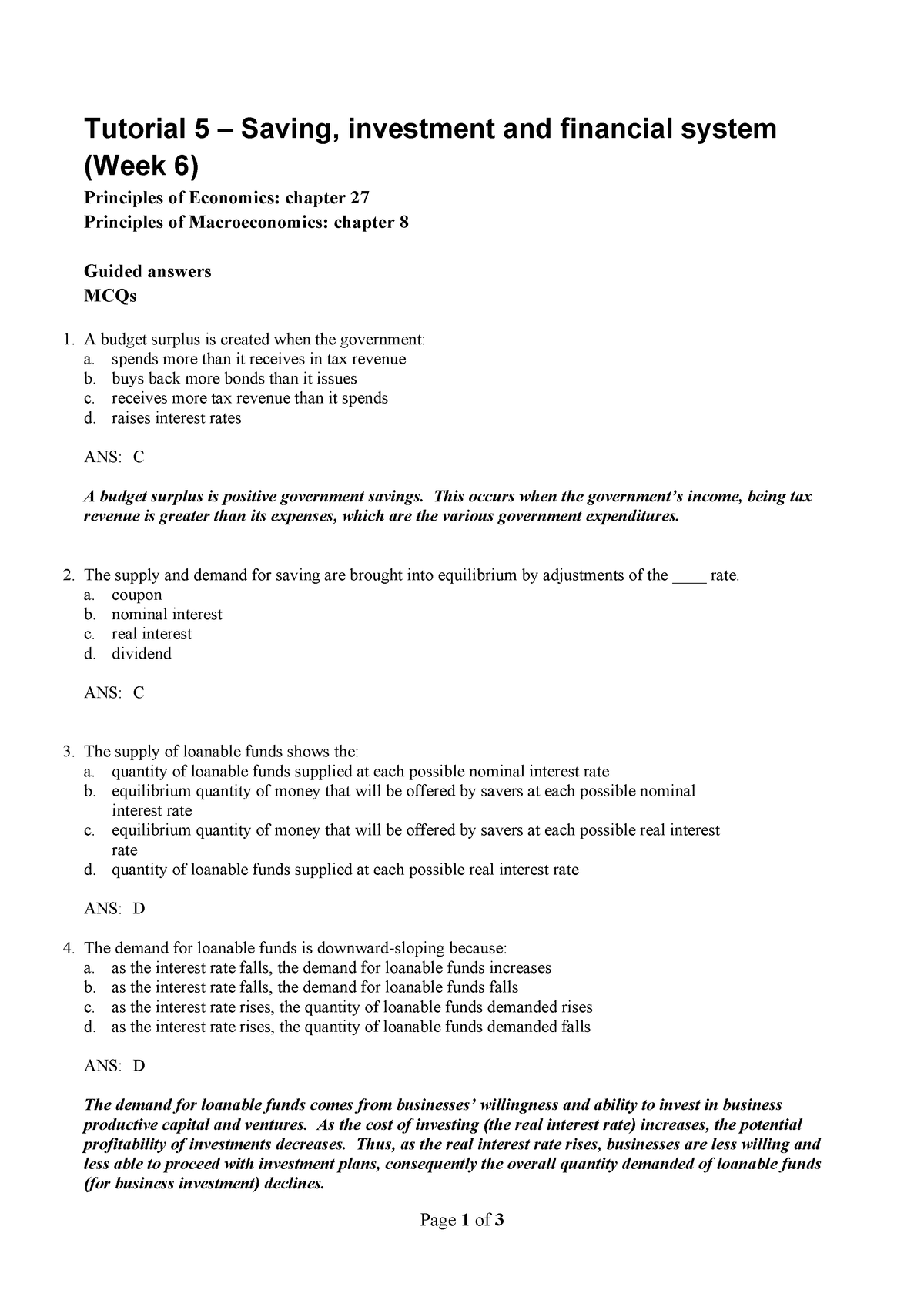

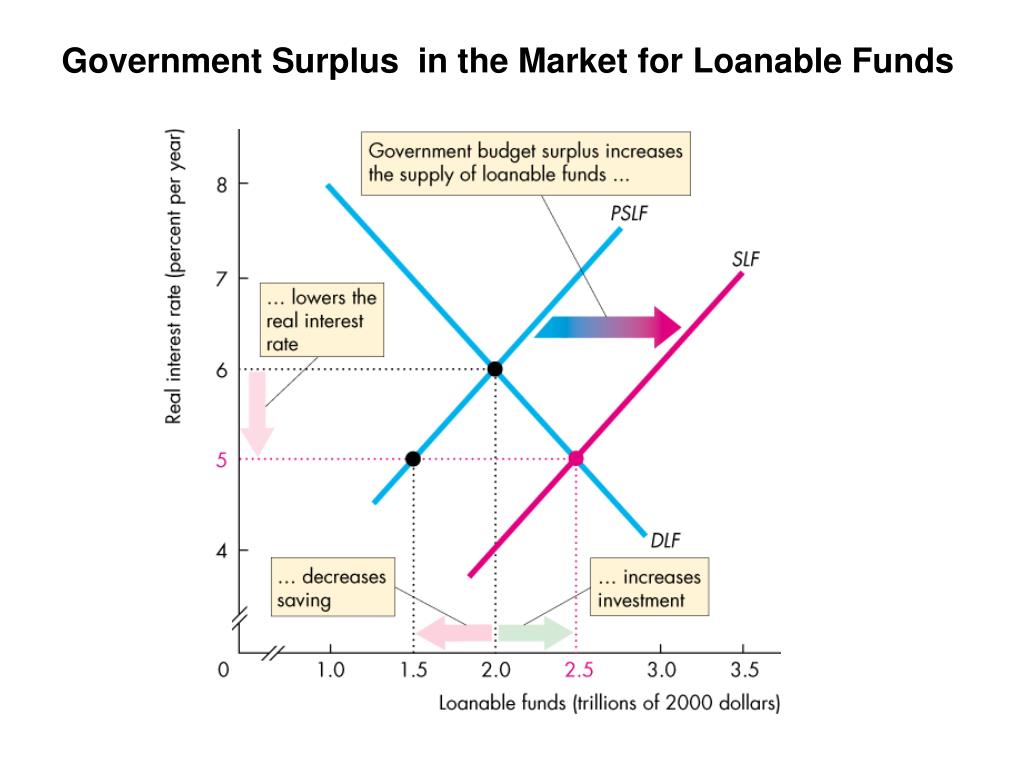

Especially for the government demand is zero when running a budget surplus. Government can spend more money than it receives in taxes and such creating a deficit or it can be frugal and spend le. When the government borrows money this results in an increase in the demand for loanable funds as shown in this graph.

At low rate of interest demand for loanable funds for hoarding will be more and vice versa. With a decrease in government spending your demand curve for the loan able funds market will shift inward and push the interest rate lower. When a fall in the interest rate leads to higher investment spending the resulting increase in real gdp generates exactly enough additional savings to match the rise in investment spending.

Government debtor and creditor and there is an active credit market. The government needs funds to finance the budget deficit. In macroeconomics we refer to the amount of loanable funds supplied by the government as public savings.

More From Government Public Affairs

- Furlough Scheme Extension Germany

- November Furlough Scheme Gov

- Government Furlough Scheme Helpline

- Government Exams India 2020

- Self Employed Sss Maternity Benefits Requirements

Incoming Search Terms:

- The Effects Of A Government Budget Deficit Economics Assignment Help Economics Homework Economics Project Help Self Employed Sss Maternity Benefits Requirements,

- The Market For Loanable Funds Self Employed Sss Maternity Benefits Requirements,

- Ppt Loanable Funds Powerpoint Presentation Free Download Id 2705626 Self Employed Sss Maternity Benefits Requirements,

- The Market Of Loanable Funds With An Example Of Crowding Out Freeeconhelp Com Learning Economics Solved Self Employed Sss Maternity Benefits Requirements,

- Exam 5 Economics 1051 With Milyo At University Of Missouri Columbia Studyblue Self Employed Sss Maternity Benefits Requirements,

- Review Of The Previous Lecture Shortcomings Of Gdp Factor Prices Are Determined By Supply And Demand In Factor Markets As A Factor Input Is Increased Ppt Download Self Employed Sss Maternity Benefits Requirements,