Self Employed Furlough Tax, Millions Of Self Employed To Benefit From Second Stage Of Support Scheme Gov Uk

Self employed furlough tax Indeed recently is being hunted by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of the article I will discuss about Self Employed Furlough Tax.

- Millions Of Self Employed To Benefit From Second Stage Of Support Scheme Gov Uk

- Coronavirus Self Employment Income Support Scheme What You Need To Know Sage Advice United Kingdom

- Steps To Take Before Calculating Your Claim Using The Coronavirus Job Retention Scheme Gov Uk

- To Fight Covid 19 Only The Formal Economy Is Getting Tax Breaks The Informal Economy May Be Asked To Foot The Bill The International Centre For Tax And Development Ictd

- Second Self Employed Grant When And How To Claim Next Payment Under Hmrc Support Scheme And Who Is Eligible For Seiss

- Freelancers The Self Employed Community Community

Find, Read, And Discover Self Employed Furlough Tax, Such Us:

- Coronavirus Advice For The Self Employed And Freelancers Ipse

- 2nd Seiss Self Employment Income Support Scheme August 2020 Payment Youtube

- How Should The Chancellor Tackle Self Employed Tax Ftadviser Com

- Hmrc Receives 73 000 Tax Evasion Reports Ftadviser Com

- Coronavirus Job Retention Scheme Can Directors Furlough Themselves Insights Bishop Fleming

If you re searching for Ei For Self Employed Canada you've come to the perfect location. We have 100 graphics about ei for self employed canada including images, pictures, photos, wallpapers, and much more. In these webpage, we also have number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

The furlough scheme will be extended until the end of march chancellor rishi sunak has announced while the next three month self employed income support grant will now be worth up to 7500.

Ei for self employed canada. And the scheme was intended to mirror the governments support given to the employed under the furlough scheme. People need to have filed a tax return for 201819 and need to take more than half their total income from self employment for example. New firms dont qualify.

Call 0800 015 9559. The government has announced a five month extension of the furlough scheme while the self employed will be eligible for a third grant worth up to 7500. The government made several far reaching changes to its income support measures today as a national lockdown in england got underway.

The furlough scheme has protected over nine million jobs across the uk and self employed people have already received over 13 billion in support. 8am to 8pm monday to friday. This is in addition to billions of pounds in.

Furlough pay is the amount which has been promised to employers who have placed employees on furlough. The government has promised to cover 80 percent of furloughed employees wages up to a. Tax help for self employed and businesses hmrc has set up a dedicated coronavirus helpline for self employed workers and business owners who are concerned about making tax payments.

The original furlough scheme was due to end in october but it was extended to cover the second lockdown period in england through to 2 december. Furloughed staff can with their employers permission take work elsewhere and both furlough pay plus employment wages or self employed profits could take them into a higher tax bracket not necessarily reflected in the deduction made via the new employment. It could also alter eligibility for tax allowances.

The self employment income.

More From Ei For Self Employed Canada

- Lenovo B490 Government Laptop Ram

- Self Employed Excel Invoice Template Uk

- Self Employed 1099 Form 2020

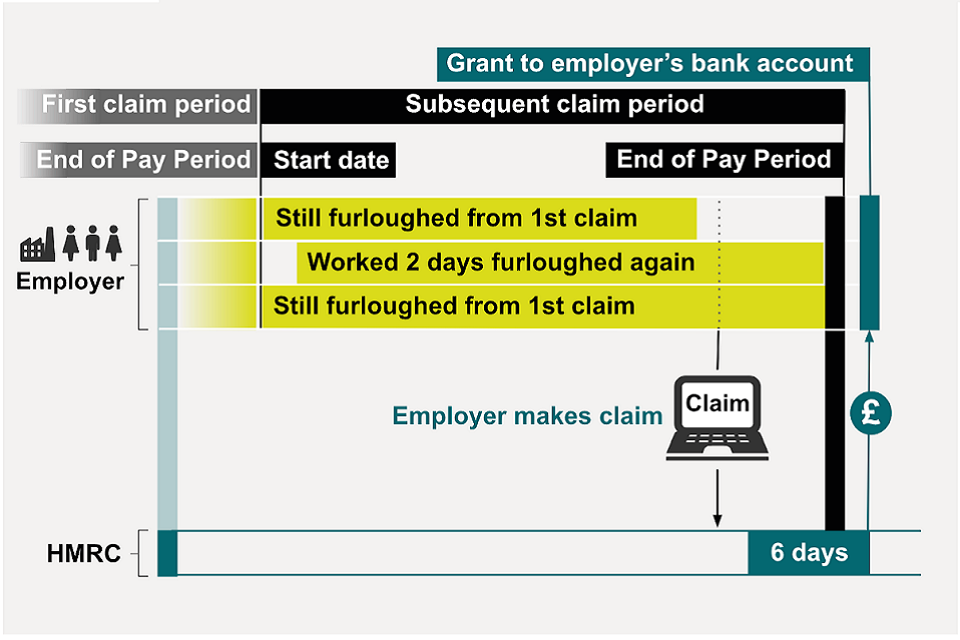

- Furlough Scheme Claim Rules

- What Is Furlough In Spanish

Incoming Search Terms:

- Your Income And Coronavirus Covid 19 Policy In Practice What Is Furlough In Spanish,

- Chancellor Extends Self Employment Support Scheme And Confirms Furlough Next Steps Gov Uk What Is Furlough In Spanish,

- Upequyab8r Ywm What Is Furlough In Spanish,

- The Income Tax Return Guide For Small Businesses And Self Employed What Is Furlough In Spanish,

- Coronavirus Self Employed Grant Claims Top One Million Bbc News What Is Furlough In Spanish,

- Coronavirus Help For Businesses And Self Employed Kirklees Council What Is Furlough In Spanish,