Self Employed Or Sole Trader, Accountants For Freelancers And Self Employed Rs Accountancy

Self employed or sole trader Indeed recently is being sought by users around us, maybe one of you. People are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of the post I will talk about about Self Employed Or Sole Trader.

- 1

- Coronavirus Financial Help Self Employed Sole Trader Or Partner Lifetise

- 13 Things You Should Know About Being A Sole Trader Start Up Donut

- Registering For Self Employment And Self Assessment Hm Revenue Customs Hmrc

- An Update For Sole Traders And Self Employed People Cvgt Australia

- Read E Book Tax Year Diary 2019 2020 Busineb Log Book For Self Em

Find, Read, And Discover Self Employed Or Sole Trader, Such Us:

- Self Employed Sole Trader Accounts Positive Twists

- Should I Be Self Employed A Sole Trader Or Run A Limited Company

- Quickbooks Self Employed For Freelancer Quickbooks Australia

- Going Self Employed A Guide For Sole Traders Heelan Associates

- Self Employed Vs Sole Trader What S The Difference

If you are searching for Self Employed Help Scotland you've come to the ideal place. We have 104 graphics about self employed help scotland including images, photos, pictures, backgrounds, and more. In these web page, we additionally provide variety of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Set up as self employed a sole trader.

Self employed help scotland. A sole trader is a self employed individual who is the exclusive owner of their business. You just fill in an online form and the ball is rolling. Registering as a sole trader with hmrc is easy.

Sole traders do not have to have a director or register with companies house. A freelancer could be registered with hmrc as a sole trader but not all sole traders are confined to the definition of a freelancer. As a sole trader you the business owner and the business itself are considered one legal entity so you are entitled to all profits after tax.

A sole trader is basically a self employed person who is the sole owner of their business. Unlike a limited company a sole trader doesnt have to register with companies house or have a director. How to set up as a sole trader.

You need to prove youre self employed for example to claim tax free childcare. Sole traders known as sole proprietor ships it is a legal business entity operated by self employed and invested and owned by an individual personal property. Its quick easy and free to do.

For example im a freelance copywriter which means im self employed and im registered as a sole trader. You earned more than 1000 from self employment between 6 april 2019 and 5 april 2020. A sole trader is a self employed person who is the sole owner of their business.

The most important difference with llc limited liability company and llp limited liability partnership include structure only one individual can the the owner and take. Step by step what you need to do when you start working for yourself either as your only job or at the same time as working for an employer. The term is used to describe the type of business structure you use.

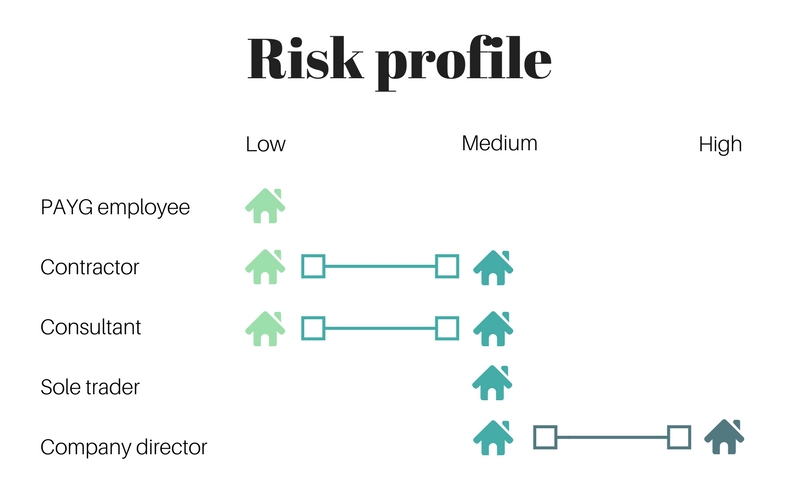

Sole trader as someone whos self employed or a sole trader youre the most valuable and indispensable asset of your business. Because sole traders are self employed they must pay tax through self assessment. The pros of setting up as a sole trader or self employed its easy to become a sole trader or self employed.

How to tell the difference between freelancers and sole traders. Neither work for another employer or pay tax through paye. Both freelancers and sole traders are likely to refer to themselves as self employed.

You want to make voluntary class 2 national insurance payments to help you qualify for benefits. Whether youre an architect a lawyer a doctor a hairdresser an estate agent a mechanic or a construction worker well sort out your communication needs so you can focus on keeping your business running smoothly. How to set.

A business consultant that works freelance is self employed and also registered as a sole trader. Examples of someone self employed. You need to set up as a sole trader if any of the following apply.

More From Self Employed Help Scotland

- Self Employed Ppp Loan Amount

- Part Time Furlough Scheme Uk Hmrc

- Government Id Adalah

- Hp 241 G1 Government Laptop Drivers For Windows 7 32 Bit

- Us Government Accountability Office Glassdoor

Incoming Search Terms:

- An Update For Sole Traders And Self Employed People Cvgt Australia Us Government Accountability Office Glassdoor,

- Watford Accountant For Self Employed Sole Trader Freelancers Us Government Accountability Office Glassdoor,

- Self Assessment For Self Employed People And Sole Traders Register Stock Photo Alamy Us Government Accountability Office Glassdoor,

- What S The Difference Between Self Employed And Sole Trader Us Government Accountability Office Glassdoor,

- Registering For Self Employment And Self Assessment Hm Revenue Customs Hmrc Us Government Accountability Office Glassdoor,

- How Do I Know If I M Self Employed Mileiq Uk Us Government Accountability Office Glassdoor,