Self Employed Or Sole Trader Uk, Should You Set Up Your Company As A Sole Trader Or Limited Company

Self employed or sole trader uk Indeed lately has been sought by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to view video and image information for inspiration, and according to the title of this post I will talk about about Self Employed Or Sole Trader Uk.

- Stewart Accounting

- How To Get A Mortgage If You Are Self Employed This Is Money

- False Self Employment Legislation Explained

- Ultimate Guide To Registering As A Sole Trader Thecompanywarehouse Co Uk

- Self Assessment For Self Employed People And Sole Traders Register Stock Photo Alamy

- Self Employed In The Uk Here Are The Chancellor S New Measures To Help Money The Guardian

Find, Read, And Discover Self Employed Or Sole Trader Uk, Such Us:

- Sole Traders Self Employed Accountants In London Rauf Accountants

- What Is The Difference Between Self Employed And Sole Trader

- How To Register As Self Employed Uk Startups Co Uk

- Help For Sole Traders The Self Employed And Micro Businesses Throughout The Uk Sme Business Solutions Business Executive Coachingsme Business Solutions Business Executive Coaching

- How And When To Register As A Sole Trader Uk Accidental Hipster Mum

If you are searching for Self Employed Tax Id Number you've arrived at the perfect location. We ve got 104 images about self employed tax id number adding pictures, pictures, photos, wallpapers, and more. In such webpage, we also have number of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

However it is not easy to claim most of your expenses.

Self employed tax id number. A business consultant that works freelance is self employed and also registered as a sole trader. Its the simplest business structure out there which is probably why its the most popular and you can set up as one via the govuk website youll need to do this for tax purposes. Set up as a sole trader.

You can keep all your businesss profits after youve paid tax on them. Sole trader businesses do not have directors and do not need to register with companies house. If youre self employed then youre basically running a business as a sole trader whether you think of yourself as a business owner or not.

Examples of someone self employed. Or you freelance but its more as a long term contractor for the same company than as a sole trader with a small business of your own. At tax care we offer a free initial consultation for self employed people.

A freelancer could be registered with hmrc as a sole trader but not all sole traders are confined to the definition of a freelancer. This means youre self employed even if you havent yet told hm revenue and customs hmrc. Sole trader describes your business structure while self employed is a way of saying that you dont work for an employer or pay tax through paye.

When it comes to self assessment tax return it easy to assess your total income. A sole trader is essentially a self employed person who is the sole owner of their business. Both terms are usually applicable.

What is the meaning of self employed. A sole trader is a self employed person who is the sole owner of their business. Either way whether youre an employee or self employed this guide is designed to run through the five main types of employment status according to govuk and how to work out where you fit in.

If you start working for yourself youre classed as a sole trader. If youre a sole trader you run your own business as an individual and are self employed. Neither work for another employer or pay tax through paye.

Because sole traders are self employed they must pay tax through self assessment. Sole traders do not have to have a director or register with companies house. We encourage you to prepare and submit your tax return and tell you how you are.

Self employed expense or sole trader guide. A sole trader is a self employed individual who is the exclusive owner of their business.

More From Self Employed Tax Id Number

- Furlough Rules New York

- Government To Government Services Online

- Self Employed Vs Employed Test

- Tamil Nadu Government Employee Id Card Template

- Self Employed Grant Apply August

Incoming Search Terms:

- How To Invoice As A Sole Trader Invoicing Guide For Beginners Self Employed Grant Apply August,

- Samozatrudnienie Anglii Self Employed W Uk Sole Trader Brytanii Self Employed Grant Apply August,

- Self Employed Vs Sole Trader What S The Difference Self Employed Grant Apply August,

- Using Self Employment To Meet The Settlement Uk Spouse Visa Income Threshold Cross Border Legal Solicitors Self Employed Grant Apply August,

- How Do I Know If I M Self Employed Mileiq Uk Self Employed Grant Apply August,

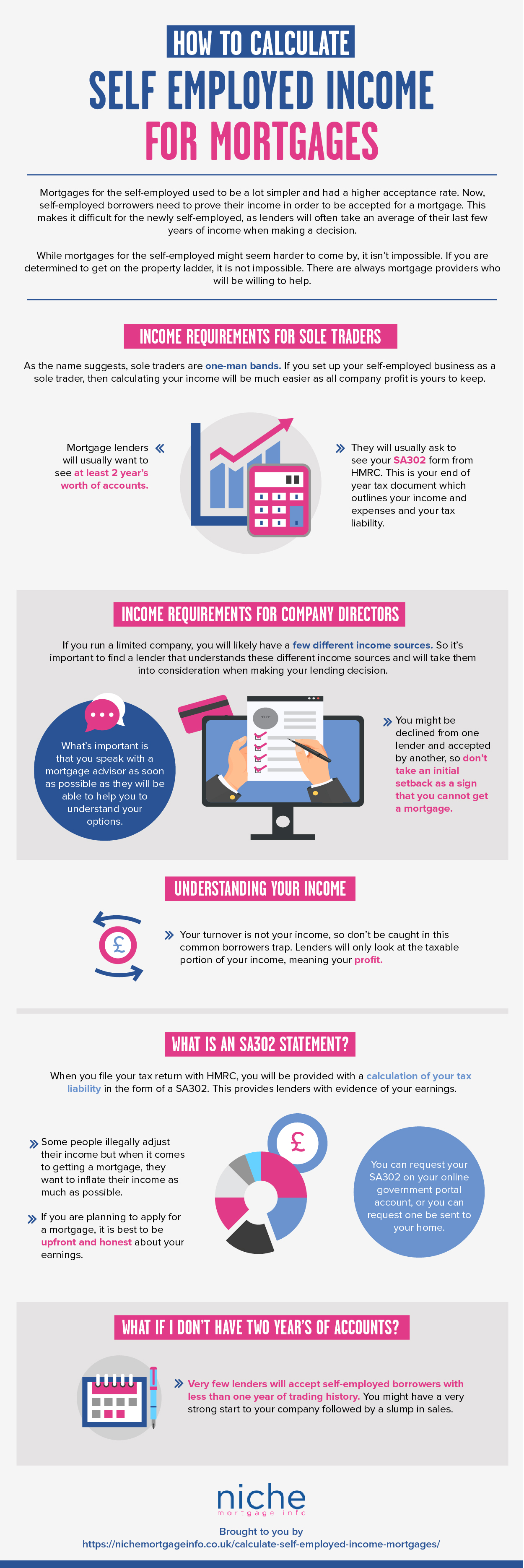

- Mortgage Lenders Income Requirements For The Self Employed Niche Self Employed Grant Apply August,