Sources Of Government Revenue 2018, A Taxing Problem Taiwan S Comparatively High Personal Income Tax Rates Taiwan Business Topics

Sources of government revenue 2018 Indeed recently is being sought by consumers around us, maybe one of you personally. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the post I will talk about about Sources Of Government Revenue 2018.

- The 2018 Ontario Budget In Charts And Numbers Macleans Ca

- Local Government Office Of The New York State Comptroller

- The 2018 Ontario Budget In Charts And Numbers Macleans Ca

- Sources Of Government Revenue In The Oecd 2018 Tax Foundation

- Indian Strategic Studies China Opts For Tax Cuts To Jolt Its Economy Awake

- What Are The Sources Of Revenue For The Federal Government Tax Policy Center

Find, Read, And Discover Sources Of Government Revenue 2018, Such Us:

- Government Revenue Sources 2018 19 The Budgeted Figures For 2020 21 Are Very Similar And The Proportion Among The Heads Barely Changes Hence I Picked Up The Actual Figures Available All Figures In Crores Indiaspeaks

- Alberta Government Major Revenue Sources 1981 82 2017 2018 Millions Download Scientific Diagram

- A Taxing Problem Taiwan S Comparatively High Personal Income Tax Rates Taiwan Business Topics

- Soi Tax Stats Irs Data Book Internal Revenue Service

- Monthly Budget Review Summary For Fiscal Year 2019 Congressional Budget Office

If you are searching for Quickbooks Self Employed Invoice Payments you've arrived at the perfect location. We have 104 graphics about quickbooks self employed invoice payments including images, photos, pictures, wallpapers, and more. In these page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqmozhlncuymewt Qrblxnd N4zfdmzwqantsldxhln2oblkstj Usqp Cau Quickbooks Self Employed Invoice Payments

Gifts and grants 8.

Quickbooks self employed invoice payments. Fine and penalties 7. The following points highlight the nine main sources of government revenue. What are the sources of revenue for the federal government.

Federal government receipts in millions of dollars and as a percent of total from 1934 to 2018 estimated. Taxes are what the government uses to pay for public services. In 2018 roughly 4407 billion canadian dollars in.

About 50 percent of federal revenue comes from individual income taxes 7 percent from corporate income taxes and another 36 percent from payroll taxes that fund social insurance programs figure 1. Government also earns revenue from non tax sources. The fiji revenue and customs service frcs administers and receives all taxes duties and levies for the government.

These include fees paid for government services dividends from investments mostly from government owned entities grants in aid and money from fines and charges. Taxes are governments biggest source of revenue. Sources of government revenue in the oecd 2018 key findings in 2015 oecd countries relied heavily on consumption taxes such as the value added tax and social insurance taxes such as the payroll tax.

Land premium was the largest revenue item accounting for 266 of the total revenue. 2 the tax loaded portion of fees and charges is re classified under tax revenue. Published by erin duffin nov 29 2019 this statistic shows the revenue of the ontario provincial government in 2018 by source of revenue.

Figures for 2018 19 are subject to audit by the director of audit. The united states relied heavily on the individual income tax at 405 percent of total government tax revenue. Printing of paper money 9.

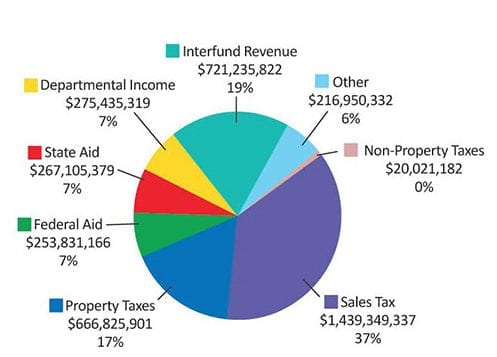

1 effective from 1 july 2008 the government waives the charge of hotel accommodation tax. Sources of government revenue. Federal government receipts by source millions of dollars 1934 2018.

Jump to receipts by source as a percent of total. What are the sources for 2018 government revenue. Taxes are the monies that you are required by law to pay to the government according to the amount of income money you receive the property you have etc.

Without the collection of taxes no country can be run. For the full fiscal year in 2017 2018 the government revenue increased by 8 to hk6198 billion after the 27 rise in the preceding year table 1. Without the collection of taxes no country can be run.

More From Quickbooks Self Employed Invoice Payments

- Furlough Calculator Scotland

- Furlough Rules Can You Work

- 10 Year Government Bond Yield India Ccil

- Self Employed Furlough Phone Number

- Government Unemployment Insurance Tends To Quizlet

Incoming Search Terms:

- Sources Of Government Revenue Ppt Download Government Unemployment Insurance Tends To Quizlet,

- Federal Fiscal Forecast Budget 2018 Was A Celebration Of Fiscal Cynicism Government Unemployment Insurance Tends To Quizlet,

- Saskatchewan Budget 2018 Government Unemployment Insurance Tends To Quizlet,

- Budget Overview Budget 2019 20 Government Unemployment Insurance Tends To Quizlet,

- Tax Revenues Where Does The Money Come From And What Are The Next Government S Challenges Institute For Fiscal Studies Ifs Government Unemployment Insurance Tends To Quizlet,

- Sources Of Government Revenue In The Oecd 2018 Tax Foundation Government Unemployment Insurance Tends To Quizlet,