Self Employed Australia Tax Calculator, Ato Reasonable Travel Allowances Atotaxrates Info

Self employed australia tax calculator Indeed lately has been hunted by users around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to see image and video data for inspiration, and according to the name of this post I will discuss about Self Employed Australia Tax Calculator.

- Freelancers Understanding The German Tax Year Kontist

- Foreign Income Tax Offset Atotaxrates Info

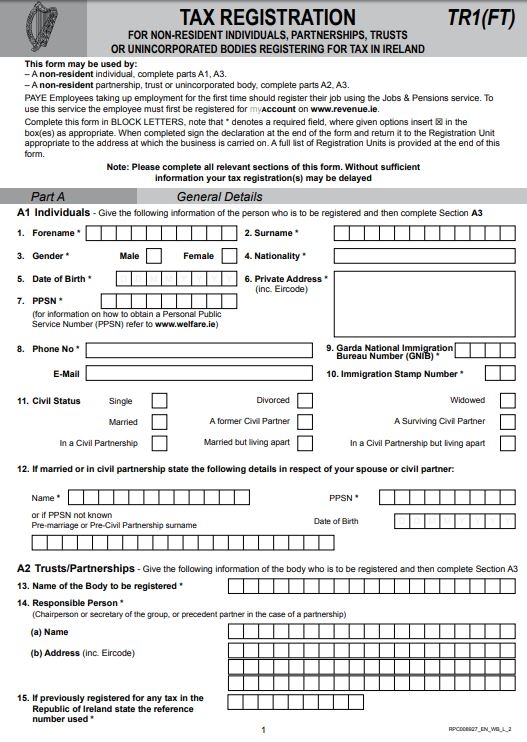

- Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

- Your Bullsh T Free Guide To Income Tax In The Uk

- How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

- How To Calculate Payroll Tax

Find, Read, And Discover Self Employed Australia Tax Calculator, Such Us:

- How To Calculate Payroll Tax

- Top Call Centre Questions Australian Taxation Office

- How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

- Payroll Tax Deductions Business Queensland

- How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

If you are searching for Top 10 Government Jobs In India you've reached the ideal place. We have 104 images about top 10 government jobs in india including images, photos, pictures, backgrounds, and more. In such webpage, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

We seek to understand members situations and make referrals to our partner outsourced self employed specialist lawyers accountants insurance brokers and other.

Top 10 government jobs in india. If youre a church worker your church employee income should be at least 10828 before you are required to file self employed tax. See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions. Simple tax calculatorthis calculator helps you to calculate the tax you owe on your taxable.

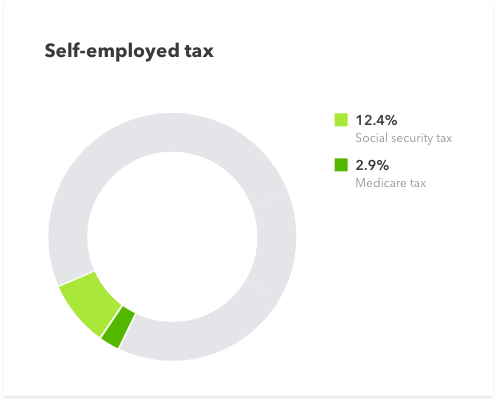

More information about the calculations performed is available on the details page. This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income. Employed and self employed uses tax information from the tax year 2020 2021 to show you take home pay.

To pay self employed taxes you are required to have a social security number and an individual taxpayer identification number. Nonetheless income tax is only payable if there is a taxable profit. You are required to pay self employed tax if you earned 400 and above.

Fica consists of your federal social security tax 124 and medicare tax 29 for a total of 153 of your net business income. Sea tax calculator how much extra tax will you personally pay under shorten compared to morrison. If youre self employed that is a sole trader or a partner in a partnership you dont have to make super contributions to a super fund for yourself.

With our employed and self employed tax calculator you can very quickly find out how much income tax and national insurance you should expect to pay as well as the impact this will have on your pension. When youre self employed you need to pay self employment tax which is 153 of your net business income as well as state and federal income tax. This calculator assesses the tax you will pay under a shorten labor government compared with a morrison coalition government.

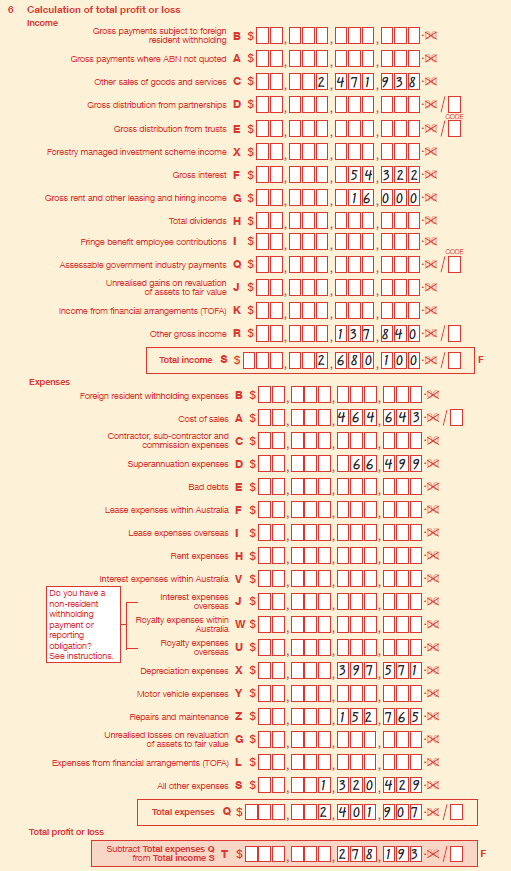

You dont need to pay self employment tax on income under 400 the calculations provided should not be considered financial legal or tax advice. It can be used for the 201314 to 201920 income years. The income tax return however applies to all self employed who earn income from self employment which are probably all.

Self employed australia does not provide tax financial legal or other professional advice. Low income tax offsetthis calculator has been decommissioned. However you may want to consider super as a way of saving for your retirement.

Who we are campaign successes current campaigns. Whether youre employed self employed or a combination of both working out your take home pay after tax can be tricky. Medicare levythis calculator will help you work out your medicare levy including exemptions and reductions based on family income.

More From Top 10 Government Jobs In India

- Self Employed Xmas Party

- Uk Furlough Scheme How Many

- Self Employed Home Loans Requirements

- Government Consulting Contracts

- Self Employed Zasilek Dla Bezrobotnych

Incoming Search Terms:

- Self Employment Tax Calculator 1099 Schedule C Estimated Taxes Self Employed Zasilek Dla Bezrobotnych,

- Employee Share Schemes Australian Taxation Office Self Employed Zasilek Dla Bezrobotnych,

- Tax Information For Driver Partners Self Employed Zasilek Dla Bezrobotnych,

- Top Call Centre Questions Australian Taxation Office Self Employed Zasilek Dla Bezrobotnych,

- Ytd Calculator Calculate Your Year To Date Income Self Employed Zasilek Dla Bezrobotnych,

- Online Australian Tax Return And Refund Calculator Self Employed Zasilek Dla Bezrobotnych,