Self Employed Courier Tax, Learn How To Start A Profitable Courier Service With Just A Few Hundred Dollars Profits On Wheels

Self employed courier tax Indeed recently has been hunted by users around us, maybe one of you. People are now accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of the article I will talk about about Self Employed Courier Tax.

- Self Employed Couriers Insurance Tradesman Saver

- Tax Deductions For Self Employed Not On Schedule C The Entrecourier

- The Drivers Tax App

- The Truth About The Freelance Courier And Self Employed Courier Driver Business Youtube

- Martinmcmahon On Twitter How Can A Deliveroo Delivery Rider Be Self Employed This Is The Section Of The Actual Illegal Agreement Between Revenue And Employers To Misclassify Delivery Riders As Self Employed Https T Co Lfeu82nqw0

- A Guide To Going Self Employed

Find, Read, And Discover Self Employed Courier Tax, Such Us:

- How Couriers File Their Taxes All Your Food Delivery Tax Questions Answered Courier Hacker

- Dpd Gives Drivers Paid Leave Pension And Sick Pay In New Worker Contract

- Courier Driver Tips Business Choice Direct

- Are Hermes Self Employed Plus Contracts Risky Larsen Howie

- Am I Employed Self Employed Both Or Neither Low Incomes Tax Reform Group

If you are looking for Government Furlough Scheme After October you've arrived at the ideal place. We ve got 104 images about government furlough scheme after october including images, pictures, photos, wallpapers, and much more. In such page, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Type vehicle expenses self employed business in the searchfind box and click search.

Government furlough scheme after october. Before you can determine if you are subject to self employment tax and income tax you must figure your net profit or net loss from your business. Aside from a clean driving licence you dont need any formal qualifications to become a self employed courier. Click on jump to vehicle expenses self employed business.

Completing annual tax return for a self emplyed courier driver. Se tax is a social security and medicare tax primarily for individuals who work for themselves. Mileage tracker expense tracker self employed taxes invoicing accounting self employed tax estimates financial reporting invoicing accounting.

What self employed expenses can i deduct. Glassdoorcouk lists a range of different courier jobs with different organisations and hourly rates of pay appear to range from 5 per hour to 11 pound per hour. This turbotax faq maybe helpful.

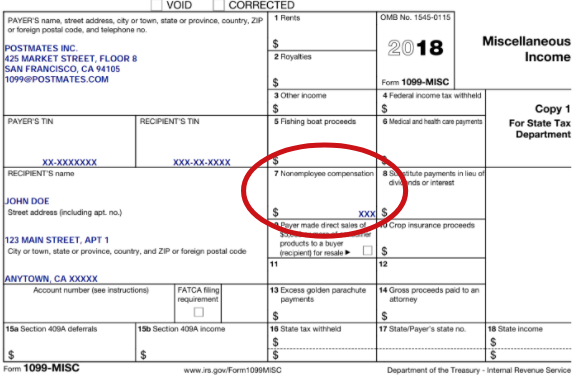

Self employed health insurance deduction. If you are a self employed courier you will need to complete a tax return so that you can declare your earnings to hmrc. You should keep records of all earnings and keep an organised record of all fares and tips.

Use these resources to learn more about what deductions you can claim if youre a courier. This article will help to highlight some key things to remember for your tax return and how to save tax. The self employment notes page offers details of allowable expenses but covers premises costs only but you advise that you raise invoices from home so you have three choices as to how you claim expenses from the home with how to claim with heating lighting and electricity 1 if you have a room just used for business then you count up habitable rooms within the home excluding bathroom and kitchen and say that amounts to 6 you can have initially 16th of those utility bills for.

Think about whether you want to get any courier qualifications. It is similar to the social security and medicare taxes withheld from the pay of most wage earners. For van expenses i am thinking of claiming the mileage expenses ie 45p25p rather than making a claim on his petrol receipts which give lower expense.

More From Government Furlough Scheme After October

- What Is The Furlough Scheme Called

- Is Government Singular Or Plural

- Self Employed Furlough Cut Off Date

- New Furlough Scheme Sun

- Furlough Rules Working Part Time

Incoming Search Terms:

- What Are Some Self Employed Tax Deductions In Canada Furlough Rules Working Part Time,

- What Can Independent Contractors Deduct Furlough Rules Working Part Time,

- Hermes And The Gmb The Taxman Cometh Rsa Furlough Rules Working Part Time,

- Am I Employed Self Employed Both Or Neither Low Incomes Tax Reform Group Furlough Rules Working Part Time,

- Tax And The Future Of Work Courier Furlough Rules Working Part Time,

- Blog Courier Exchange Furlough Rules Working Part Time,