Self Employed Delivery Driver Tax Calculator, Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

Self employed delivery driver tax calculator Indeed recently has been hunted by users around us, perhaps one of you. People are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the article I will discuss about Self Employed Delivery Driver Tax Calculator.

- Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Jessica Moorhouse

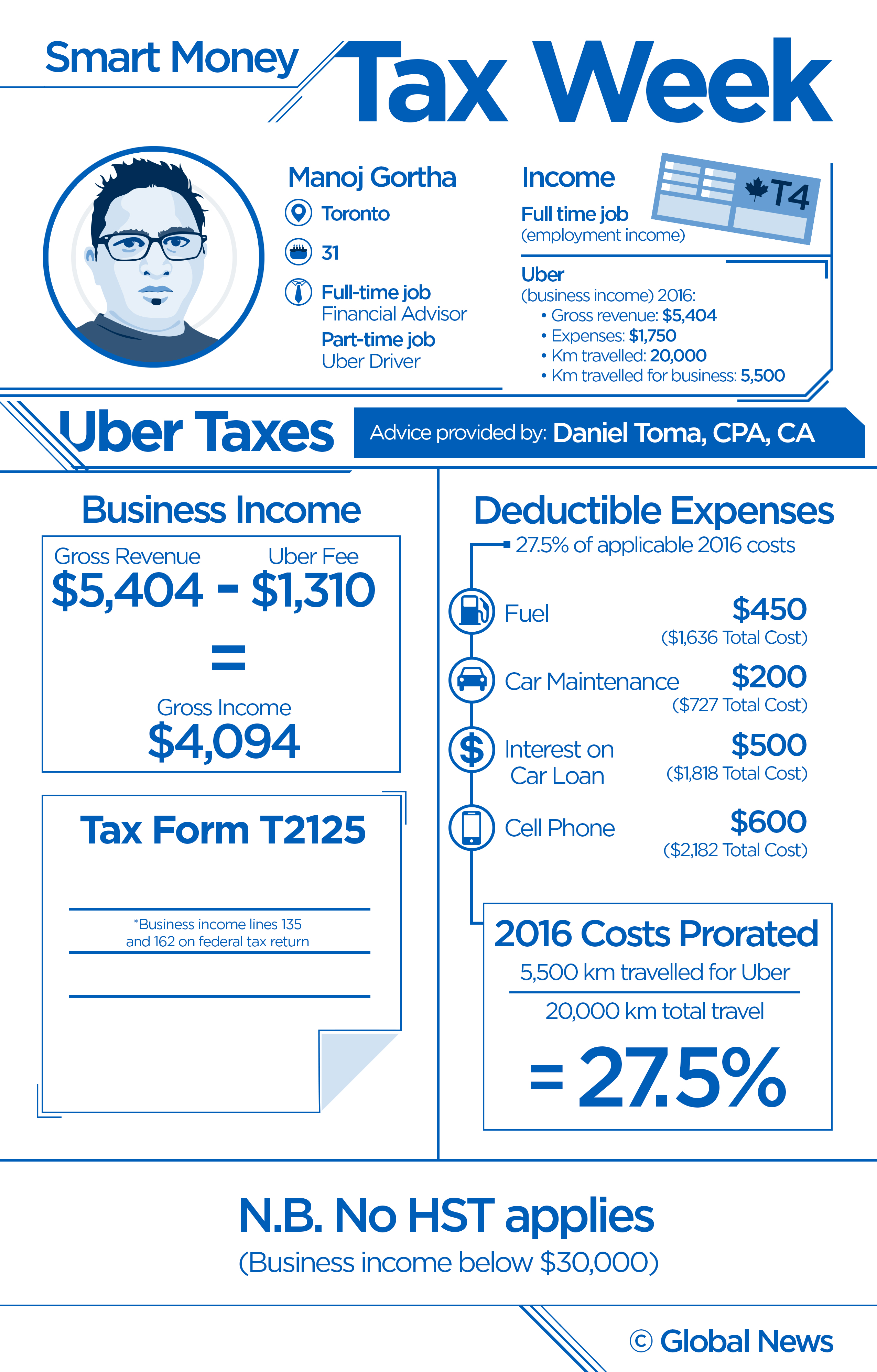

- Tax Tips For Uber Driver Partners Understanding Your Taxes Turbotax Tax Tips Videos

- 2020 Uber Driver Tax Deductions See Uber Taxes Hurdlr

- Axa Luxembourg My Taxes How Much Can I Deduct

- Freetaxusa Review 2020 Easy Tax Filing For Uber Drivers

- Employed And Self Employed Tax Calculator Taxscouts

Find, Read, And Discover Self Employed Delivery Driver Tax Calculator, Such Us:

- Publication 463 2019 Travel Gift And Car Expenses Internal Revenue Service

- Filing Tax Returns For Delivery Drivers Tips And Advice Turbotax Tax Tips Videos

- 2020 Uber Driver Tax Deductions See Uber Taxes Hurdlr

- Business Expenses For Grubhub Postmates Doordash Uber Eats Taxes

- Postmates 1099 Taxes And Write Offs Stride Blog

If you re searching for Government Artinya you've come to the ideal location. We ve got 100 images about government artinya including pictures, photos, photographs, wallpapers, and much more. In these webpage, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

The tax rate is currently 153 of your income with 124 going to social security and 29 going to medicare.

Government artinya. You dont need to pay self employment tax on income under 400 the calculations provided should not be considered financial legal or tax advice. Again if you use turbotax to prepare your return the software will ask you a series of questions and fill out the proper forms for you. If you are self employed use this simplified self employed tax calculator to work out your tax and national insurance liability.

See what happens when you are both employed and self employed at the same time with uk income tax national insurance student loan and pension deductions. This rate is derived from the fact that self employed taxpayers can deduct the employers portion of the tax which is 765. So if you started working as a deliveroo rider on the 1 december 2018 youll need to register as self employed with hmrc by 5th october 2019.

You will pay an additional 09 medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly. The calculator uses tax information from the tax year 2020 2021 to show you take home pay. The self employment tax is calculated on 9235 of your total income.

Youll typically use schedule c to report the income you earned as a delivery driver. Actual results will vary based on your tax situation. Estimates based on deductible business expenses calculated at the self employment tax income rate 153 for tax year 2019.

According to the national careers service couriers earn between 14500 and 40000 a year. Employed and self employed uses tax information from the tax year 2020 2021 to show you take home pay. More information about the calculations performed is available on the details page.

If you are self employed your social security tax rate is 124 percent and your medicare tax is 29 percent on those same amounts of earnings but you are able to deduct the employer portion. You need to register as self employed by the 5th of october following the tax year you started working for deliveroo. Pays for itself turbotax self employed.

More information about the calculations performed is available on the details page. Self employment tax consists of social security and medicare taxes for individuals who work for themselves. Youll use schedule se to calculate your self employment tax.

Glassdoorcouk lists a range of different courier jobs with different organisations and hourly rates of pay appear to range from 5 per hour to 11 pound per hour. This calculator provides an estimate of the self employment tax social security and medicare and does not include income tax on the profits that your business made and any other income. Employees who receive a w 2 only pay half of the total social security 62 and medicare 145 taxes while their employer is responsible for paying the other half.

More From Government Artinya

- Government Vouchers Malta Deadline

- What Is Furlough In September

- Reasons For Government Regulation Of Business

- Request Government Official Letter Format Pdf

- Government Furlough Scheme Govuk

Incoming Search Terms:

- Tax Returns Guide And Calculator For Self Employed Drivers Government Furlough Scheme Govuk,

- Business Expenses For Grubhub Postmates Doordash Uber Eats Taxes Government Furlough Scheme Govuk,

- Your Complete Guide To Self Employment Taxes In 2020 Ridester Com Government Furlough Scheme Govuk,

- Tax Deductions For Rideshare Uber And Lyft Drivers Get It Back Tax Credits For People Who Work Government Furlough Scheme Govuk,

- Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience Government Furlough Scheme Govuk,

- Free Self Employed Tax Calculator View Your Potential Tax Obligation Instantly Hurdlr Government Furlough Scheme Govuk,