Self Employed Health Insurance Deduction 2019 Limit, Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

Self employed health insurance deduction 2019 limit Indeed lately has been hunted by users around us, maybe one of you. People now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the title of the post I will discuss about Self Employed Health Insurance Deduction 2019 Limit.

- Self Employed Health Insurance Deductions 101 Decent

- What Is The Self Employed Health Insurance Deduction Ask Gusto

- The Qbi Deduction Reduction On Small Business Retirement Plans

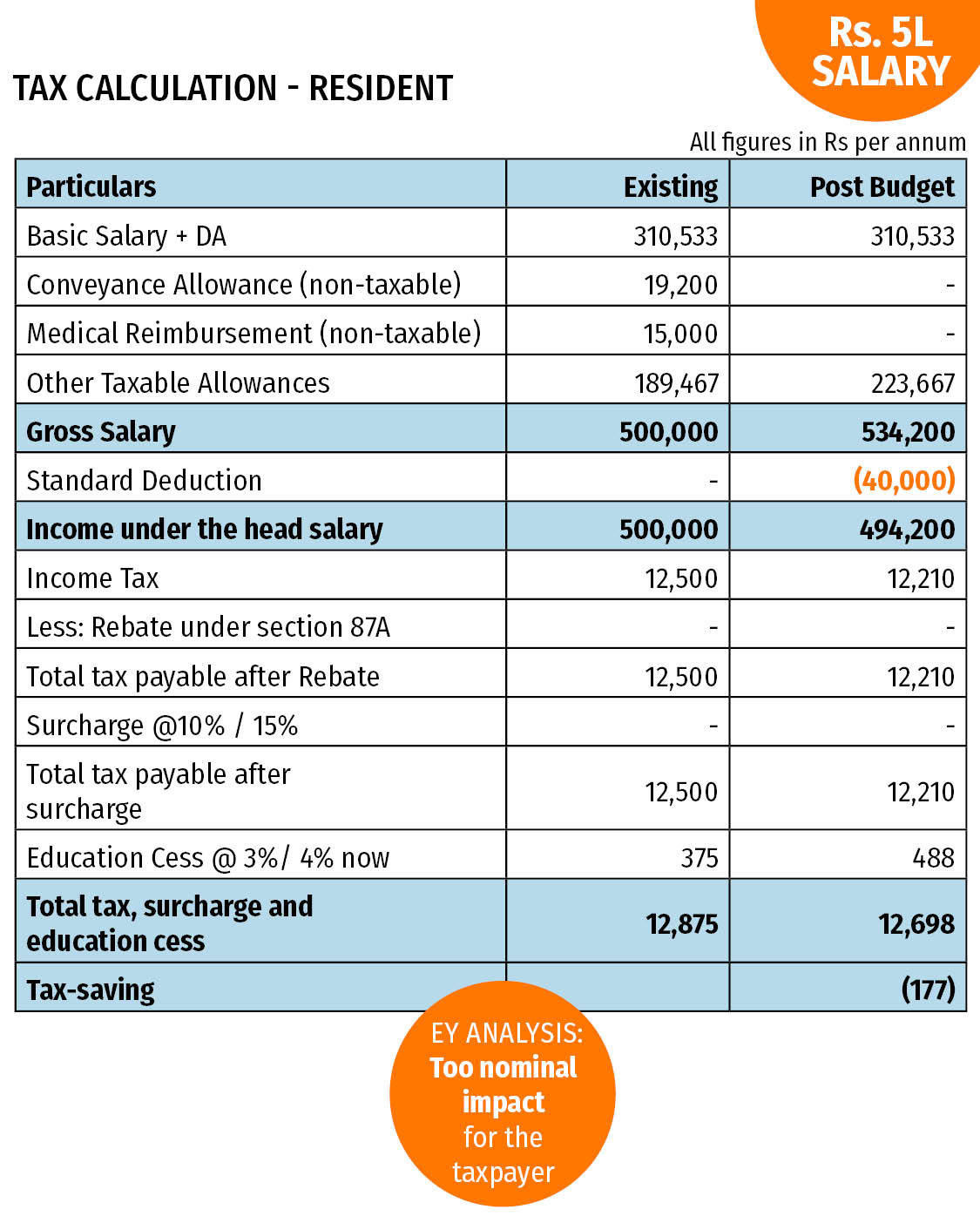

- Section 80d Deduction For Medical Insurance Health Checkups 2019

- Maximizing Premium Tax Credits For Self Employed Individuals

- Deducting Health Insurance Premiums Health Care Expenses On Your Taxes

Find, Read, And Discover Self Employed Health Insurance Deduction 2019 Limit, Such Us:

- Rules For Tax Deductibility Of Long Term Care Insurance

- Section 80d Deduction For Medical Insurance Health Checkups 2019

- Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

- 2021 Tax Benefit Amounts For Long Term Care Insurance Announced By Irs Ltc News

- Irs Instructions 1040 Schedule A 2019 Fill And Sign Printable Template Online Us Legal Forms

If you re searching for Upcoming Government Exams 2020 Full List In Tamil Nadu Pdf you've come to the perfect place. We ve got 104 images about upcoming government exams 2020 full list in tamil nadu pdf adding images, photos, photographs, backgrounds, and more. In these web page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Federal Insurance Contributions Act Tax Wikipedia Upcoming Government Exams 2020 Full List In Tamil Nadu Pdf

Deducting health insurance premiums if youre self employed accessed dec.

Upcoming government exams 2020 full list in tamil nadu pdf. Its written to ensure that self employed individuals get a break on their healthcare costs. A child includes your son daughter stepchild adopted child or. Self employed health insurance deduction.

Beginning in 2019 you can deduct 150 each year for 10 years. And that will help to keep you healthyand happyin 2020 and beyond. This includes dental and long term care coverage.

When both the self employed health insurance deduction and the premium tax credit are involved in a return there situations where the circular calculation that this involves does not converge to amount that is within 1. This insurance can also cover your children up to age 27 26 or younger as of the end of a tax year whether they are your dependents or not. Publication 554 page 2.

The self employed health insurance deduction applies to health insurance premiums for yourself your spouse and your dependents. Because its an adjustment to income you claim it on schedule 1 attached to your form 1040 federal income tax return. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent.

Deduction limit on meals. Self employed people are allowed to deduct health insurance premiums including dental and long term care coverage for themselves their spouses and their dependents. Unlike other tax deductions for self employed people the self employed health insurance deduction isnt taken on schedule c or on a business return.

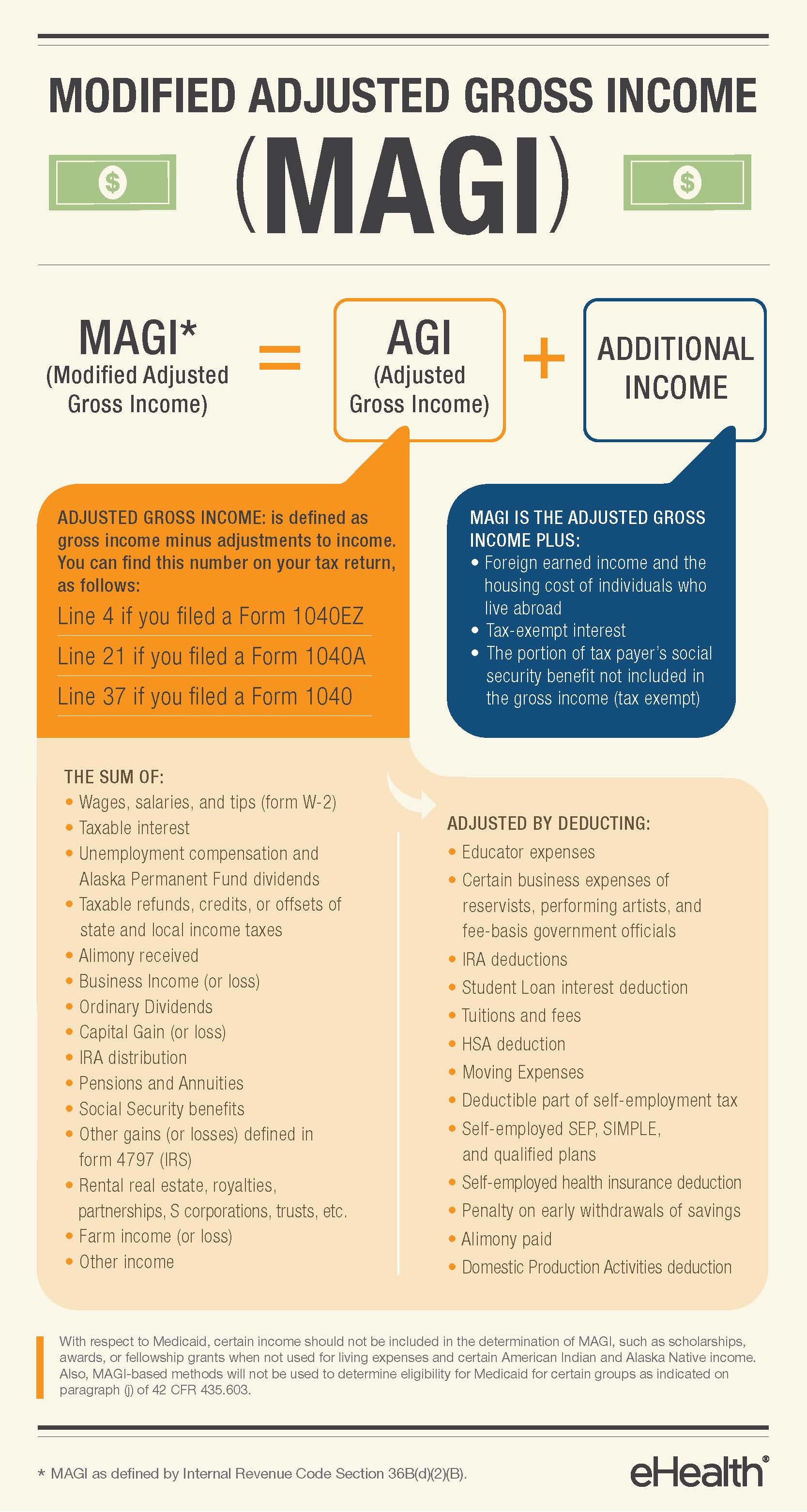

The self employed health insurance deduction has been around for a whilesince 1987 to be exact. If you qualify this deduction will reduce your adjusted gross income agi. Its available if you.

You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. Drive for uber full time have a business profit profit business income business expenses. Self employed health insurance deduction worksheet.

With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost. When youre an s corporation owner with more than 2 of the company stock youre treated the same as a self employed person when it comes to deducting health insurance. If you qualify the deduction for self employed health insurance premiums is a valuable tax break.

Deductions Modifying Your Adjusted Gross Income Can Save You Money Healthcare Counts Upcoming Government Exams 2020 Full List In Tamil Nadu Pdf

More From Upcoming Government Exams 2020 Full List In Tamil Nadu Pdf

- Self Employed Support Scheme Apply

- Lenovo E41 25 Government Laptop Specifications

- Local Self Government Meaning In Hindi

- Self Employed Hairdresser Furlough

- Government Zoom Meeting

Incoming Search Terms:

- Section 80d Deduction Of Health Insurance Ay 2019 20 Meteorio Government Zoom Meeting,

- Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2 Government Zoom Meeting,

- What Are The Self Employed Tax Deductions For 2020 Benzinga Government Zoom Meeting,

- Self Employment Tax Deductions Taxes Us News Government Zoom Meeting,

- Maximizing Premium Tax Credits For Self Employed Individuals Government Zoom Meeting,

- Self Employed Health Insurance Deductions 101 Decent Government Zoom Meeting,