Self Employed Health Insurance Deduction 2019 Phase Out, Everything You Need To Know About Filing Your 2019 Taxes For Filing In 2020

Self employed health insurance deduction 2019 phase out Indeed lately is being hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the article I will talk about about Self Employed Health Insurance Deduction 2019 Phase Out.

- 1

- Sole Proprietorship Taxes A Simple Guide Bench Accounting

- Irs Releases Draft 2019 Forms For Section 199a Deduction Expands 199a Faq

- 1040 2019 Internal Revenue Service

- Breaking Down The Self Employed Health Insurance Deduction Eric Nisall

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gctiq D 6ex4ga2gzbusdq1vkj Ojahafxx7hxke1ffklhwm3ufl Usqp Cau

Find, Read, And Discover Self Employed Health Insurance Deduction 2019 Phase Out, Such Us:

- How The Tcja Tax Law Affects Your Personal Finances

- Taxation Of Individuals And Business Entities 2018 Edition 9th Editio

- Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000 Standard Deduction Removes Other Allowances Salaried May Be Left Poorer

- Instructions For Form 8995 2019 Internal Revenue Service

- Understanding The Self Employed Health Insurance Deduction Healthsherpa Blog

If you are searching for Self Employed Vs Employed National Insurance you've reached the right place. We have 104 images about self employed vs employed national insurance adding images, photos, pictures, wallpapers, and more. In these page, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsdlnpak5 Qq4ohxcmjq5paokpzilrr39bdahhheusgnujxz0wv Usqp Cau Self Employed Vs Employed National Insurance

Its written to ensure that self employed individuals get a break on their healthcare costs.

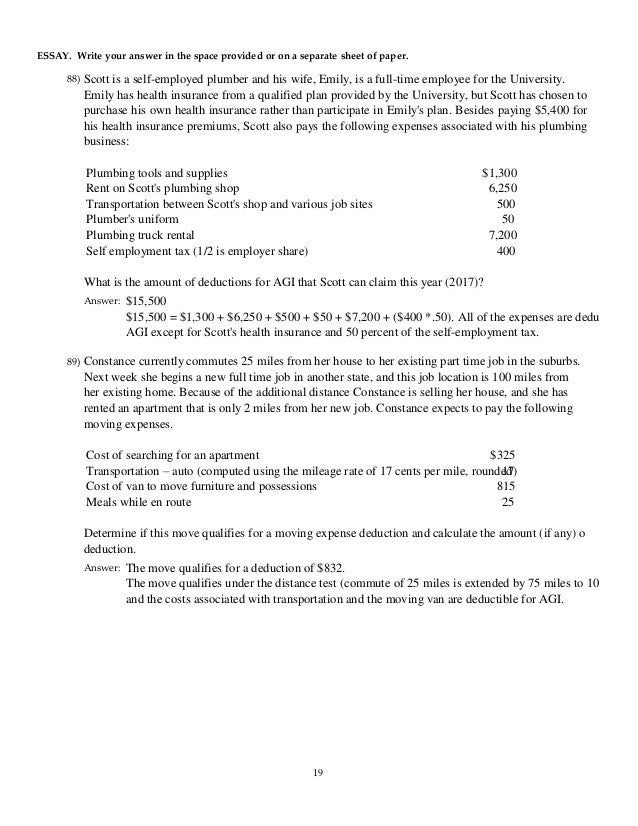

Self employed vs employed national insurance. Luckily there are numerous tax write offs that self employed professionals can claim to save thousands of dollars. The insurance also can cover your child who was under age 27 at the end of 2019 even if the child wasnt your dependent. In a nutshell the self employed health insurance deduction allows eligible self employed folks to deduct up to 100 of health dental and long term care insurance premiums for themselves and for their spouses dependents and non dependent children under age 27.

Theres a full phase out so that no qbi deduction can be claimed. Drive for uber full time have a business profit profit business income business expenses. And that will help to keep you healthyand happyin 2020 and beyond.

The deduction that allows self employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. You may be able to deduct the amount you paid for health insurance for yourself your spouse and your dependents. With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost.

Self employed individuals calculating your own retirement plan contribution and deduction accessed dec. The self employed health insurance deduction is an adjustment to income also known as an above the line deduction because you dont need to itemize to benefit from it. Self employed health insurance deduction.

Use irs form 1040 to deduct home office insurance travel internet phone and other qualifying expenses that you incur operating your business. If you qualify the deduction for self employed health insurance premiums is a valuable tax break. Or are normal in the start up phase of your type of business.

Deducting health insurance premiums if youre self employed accessed dec. For the self employed health insurance premiums became 100 percent deductible in 2003. Self employed health insurance deduction worksheet.

The self employed health insurance deduction has been around for a whilesince 1987 to be exact. What is my qbi if my business isnt profitable. Its available if you.

2019 you took out a 100000 discounted loan and received 98500 in proceeds. Running a business can be expensive especially when taxes decrease your bottom line. The loan will mature on january 1 2029 a 10 year term and the 100000.

If you qualify for the deduction claiming it will reduce your adjusted gross income or agi. If you have an s corp you should be aware of a 2015 notice regarding reimbursement for health premiums. A child includes your son daughter stepchild adopted child or.

Self Employed Health Insurance Deduction What To Know Credit Karma Tax Self Employed Vs Employed National Insurance

More From Self Employed Vs Employed National Insurance

- Government Job Vacancies In Sri Lanka 2020 My Tutor

- What Is Furlough Mean

- Government Debt Definition

- Government Of India Act 1919 Was Based On

- Self Employed Furlough Scheme Government

Incoming Search Terms:

- Instructions For Form 8995 2019 Internal Revenue Service Self Employed Furlough Scheme Government,

- Sweden Taxing Wages 2020 Oecd Ilibrary Self Employed Furlough Scheme Government,

- Cares Act Of 2020 Summary Shakespeare Wealth Management Self Employed Furlough Scheme Government,

- Staying On Top Of Changes To The 20 Qbi Deduction 199a One Year Later Wffa Cpas Self Employed Furlough Scheme Government,

- Section 199a Deduction Qbi And Retirement Accounts White Coat Investor Self Employed Furlough Scheme Government,

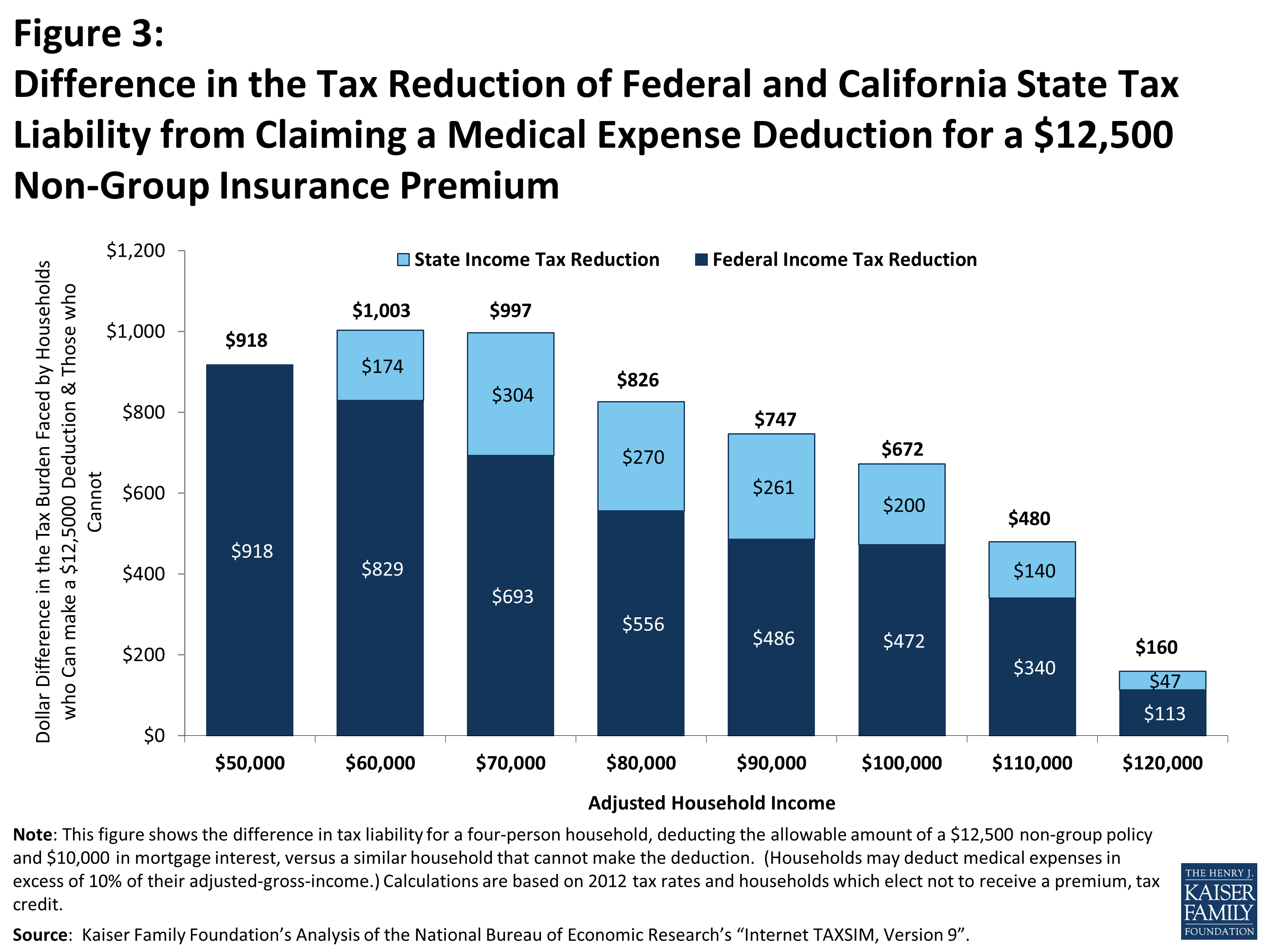

- Tax Subsidies For Private Health Insurance Iii Special Tax Deduction For Health Insurance Premiums For The Self Employed 7779 02 Kff Self Employed Furlough Scheme Government,