Self Employed Income Support Grant November 2020, Millions Of Self Employed To Benefit From Second Stage Of Support Scheme Gov Uk

Self employed income support grant november 2020 Indeed recently has been hunted by consumers around us, perhaps one of you. People are now accustomed to using the internet in gadgets to view image and video information for inspiration, and according to the title of the article I will talk about about Self Employed Income Support Grant November 2020.

- Qa1a Xg6kzo7dm

- How Does Hong Kong S Employment Support Scheme Work

- Self Employed Warned A Third Of Government Grant May Be Clawed Back Your Money

- 6tjs891l9n4txm

- Http Www Cumbria Gov Uk Elibrary Content Internet 537 6379 6441 17992 4410614549 Pdf

- Uldbc7ho8ilydm

Find, Read, And Discover Self Employed Income Support Grant November 2020, Such Us:

- Empnh8uxj4swem

- Phu2zntczvmd M

- Coronavirus Self Employment Income Support Scheme Seiss Low Incomes Tax Reform Group

- 9a Ifrlkwzdqm

- Self Employment Income Support And The Second National Lockdown Institute For Fiscal Studies Ifs

If you re searching for Indian Government Office Interior you've come to the ideal location. We ve got 100 images about indian government office interior including pictures, photos, photographs, wallpapers, and much more. In these page, we also provide variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

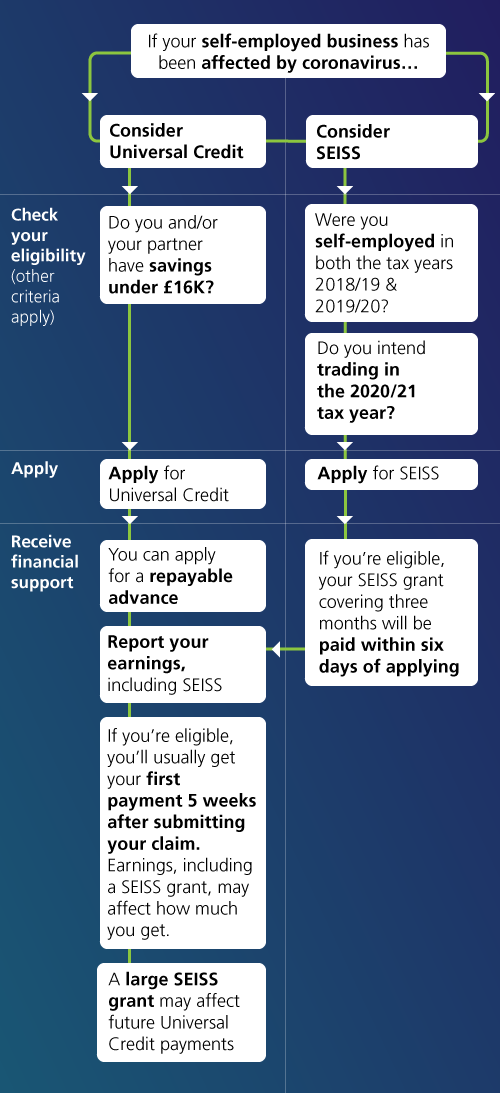

The government said this is a potential 31bn of support to the self employed through november to january with a further grant to follow covering february to april.

Indian government office interior. It is possible that the fourth grant will be taxable in 202122 that has yet to be decided. The third self employed income support scheme seiss grant covering november to january will now be 80 of average trading profits up to a maximum of 7500 the chancellor rishi sunak has announced. The third self employed income support scheme seiss grant will increase to 80 for november during the winter lockdown in england.

Yes the grants are subject to income tax and self employment national insurance contributions in the 202021 tax year. We have updated the policy paper in line with the announcement from the chancellor today. On 2 november prime minister boris johnson announced further support for self employed workers during the forthcoming winter lockdown in england from 5 november to 2 december.

The self employment income support scheme grant extension provides critical support to the self employed in the form of 2 further grants each available for 3 month periods covering november 2020 to january 2021 and february 2021 to april 2021. In line with the extension of the furlough scheme for one month the government has confirmed that the self employment grant will increase to 80 of profits for november. The self employment income support scheme grant extension provides critical support to the self employed in the form of 2 further grants each available for 3 month periods covering november 2020.

This could provide some additional support for self employed childminders who have experienced a decrease in income as a result of the covid 19 pandemic. Previously the third seiss grant for lost earnings was meant to cover up to 80 of average profits in november then up to 40 of average profits in december and january up to a maximum of. Update 2 november 2020.

Hmrc will provide a specific section in the 202021 self assessment tax return for the reporting of seiss grants. The third seiss grant for lost earnings between november 2020 and january 2021 will. Guidance about the self employment income support scheme grant extension.

Here is the latest update to the the self employment income support scheme grant extension as outlined by the government covering november 2020 april 2021.

More From Indian Government Office Interior

- Government Guaranteed Bonds Malaysia

- Self Employed Simple Invoice Template Free

- Government Revenue On Supply And Demand Graph

- Government Hospital Definition

- Furlough Extension Uk Aviation

Incoming Search Terms:

- Self Employed Grant When Can I Claim The Third Installment And How Much Will I Get Furlough Extension Uk Aviation,

- Seiss Grant When Can You Claim The Third Grant For The Self Employed Capitalcitystealth Com Furlough Extension Uk Aviation,

- Third Self Employed Grant To Rise To 7 500 Which News Furlough Extension Uk Aviation,

- Coronavirus Covid 19 Sme Policy Responses Furlough Extension Uk Aviation,

- Self Employment Income Support Scheme Grant Extension Gov Uk Furlough Extension Uk Aviation,

- Coronavirus Support For Small Businesses The Self Employed Furlough Extension Uk Aviation,